Build A Info About Is Depreciation On The Balance Sheet

Balance sheets provide the basis for.

Is depreciation on the balance sheet. Here is an example of the journal entries required to record depreciation of a laptop with an anticipated service life of five years. The accumulated depreciation reduces the value of the asset on the balance sheet. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year.

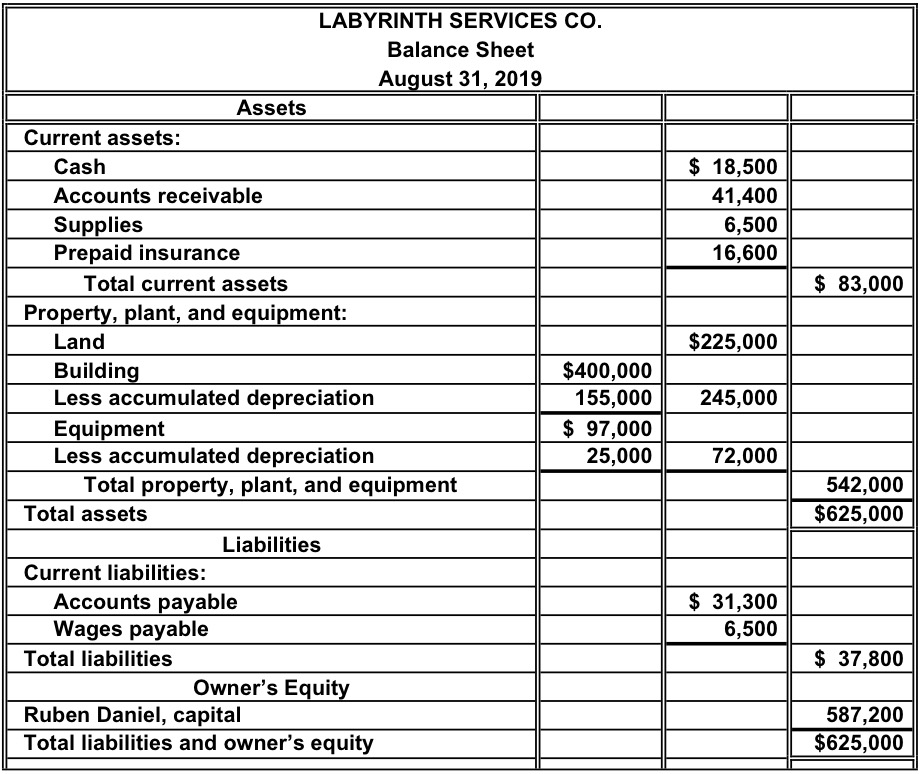

Depreciation represents how much of the asset's value has been used up in. It is not a process for valuing the asset. However, it also affects the balance sheet by decreasing the value of assets over time.

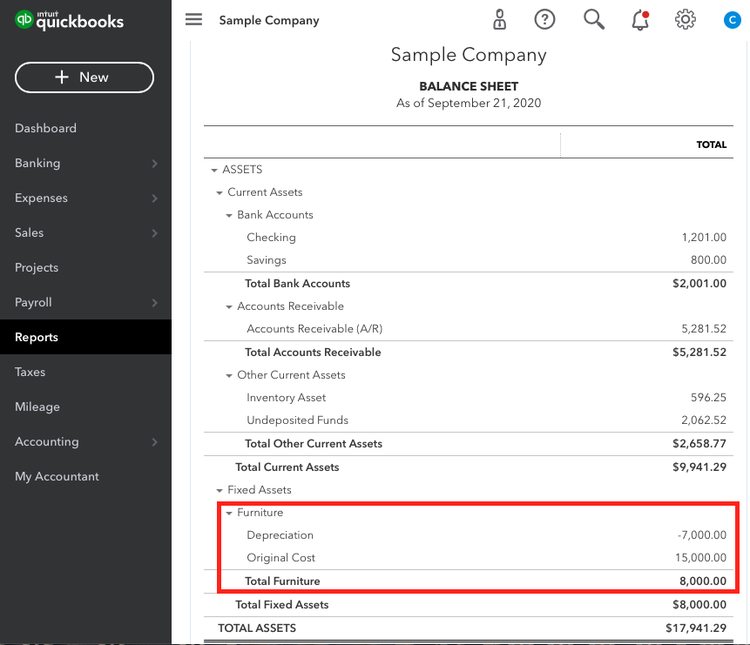

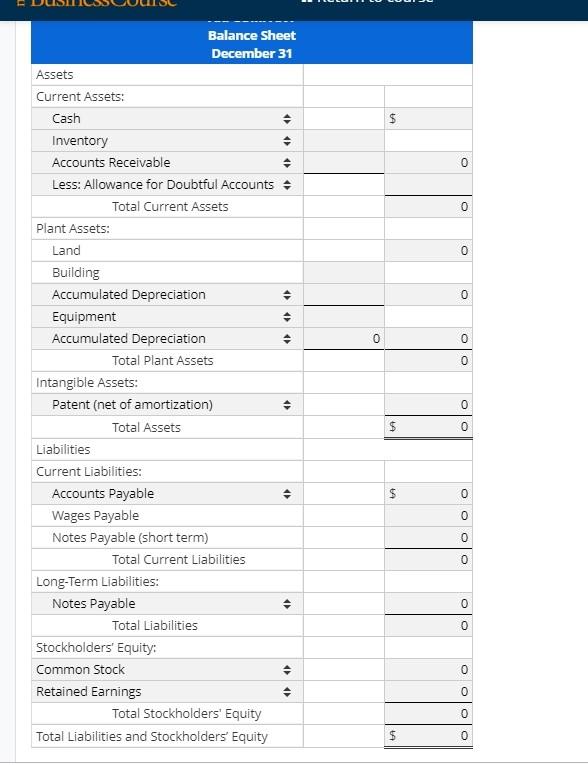

It subtracts a fixed percentage from the asset’s remaining book value every year. Most businesses list assets, including depreciation, in one line on their balance sheet labeled property, plant, and equipment—net. why it's important It accounts for depreciation charged to expense for the income reporting period.

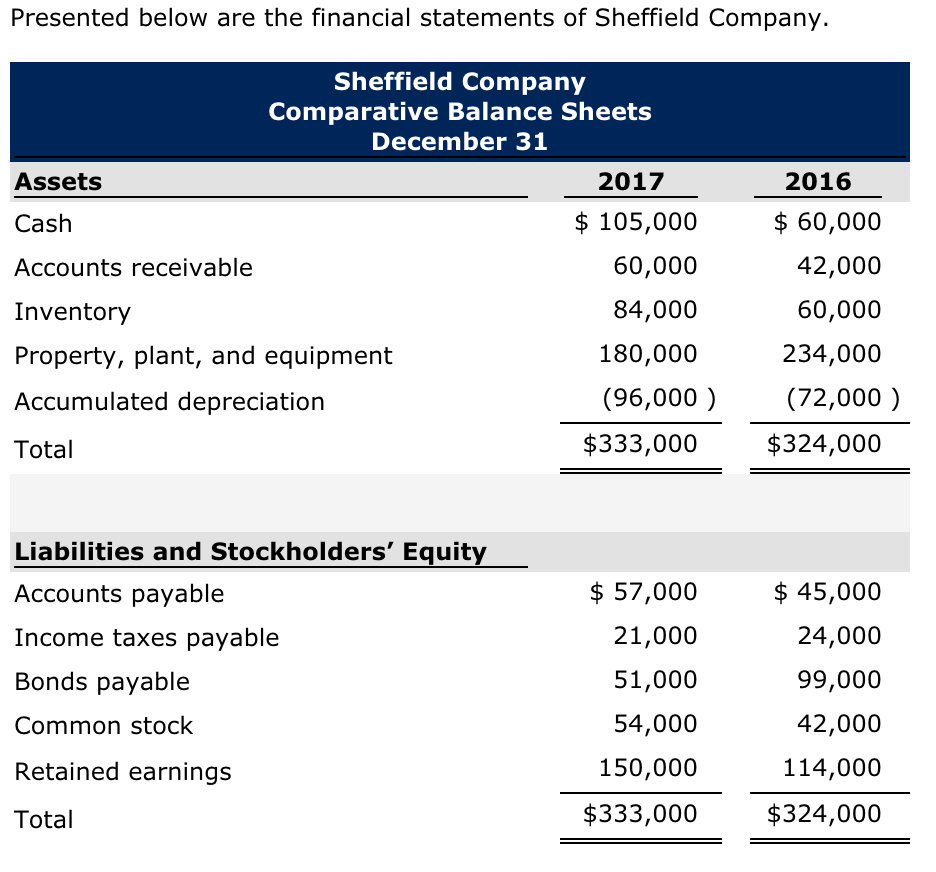

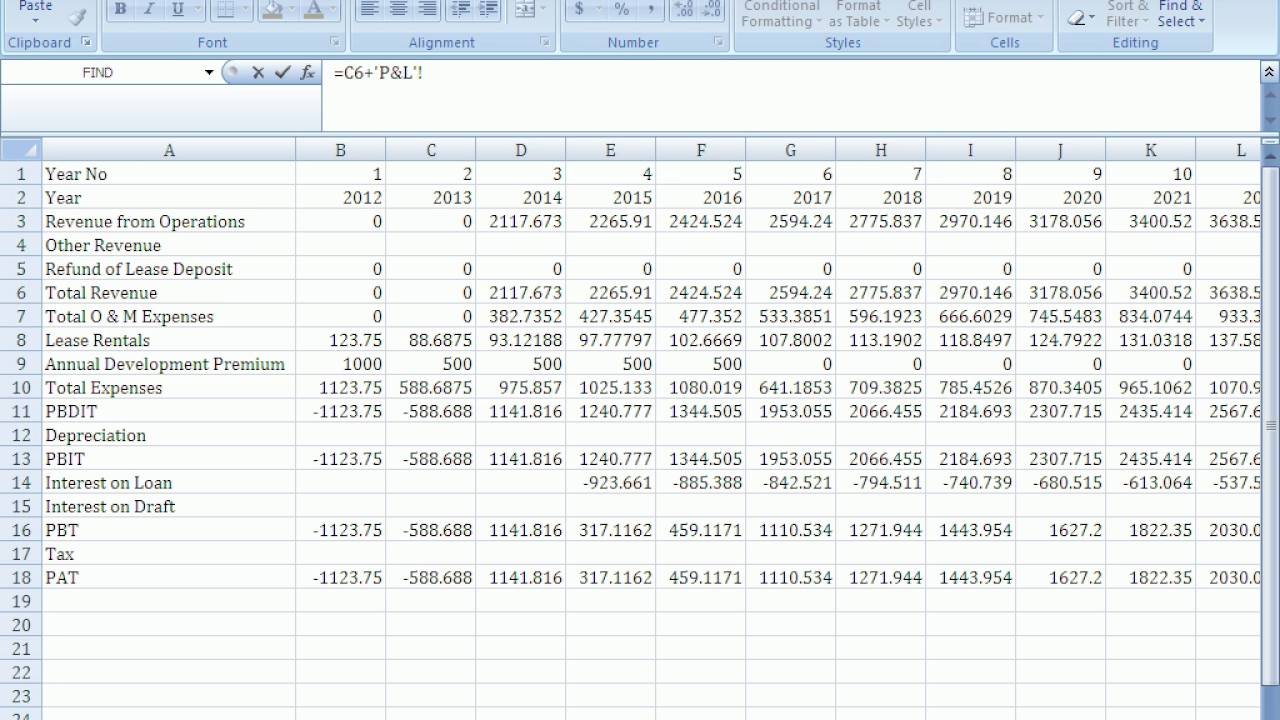

Depreciation is found on the income statement, balance sheet, and cash flow statement. Depreciation, or the decrease in value of a company asset, is reported on financial statements. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

Depreciation expense is reported on which of the following financial statements? Explore its impact, how it affects businesses, and its relevance in accounting practices. The balance sheet is based on the fundamental equation:

Depreciation is typically tracked one of two places: On an income statement or balance sheet. It can also be referred to as a statement of net worth or a statement of financial position.

After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000. Accumulated depreciation is presented on the balance sheet just. The reason for this is that depreciation reflects the reduction in value of an asset over time due to wear and tear.

On the balance sheet, it is subtracted from the cost of the asset to determine its net book value. The question of when to record depreciation expense on the balance sheet can often cause confusion. Balance sheet depreciation is a way of calculating the decrease in value of an asset over its useful life.

For income statements, depreciation is listed as an expense. To record the cash purchase of a laptop: Depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life.

Defining the declining balance method. The depreciation term is found on both the income statement and the balance sheet. This means an asset loses more value in its early years.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)