Underrated Ideas Of Tips About Commission Payable In Balance Sheet

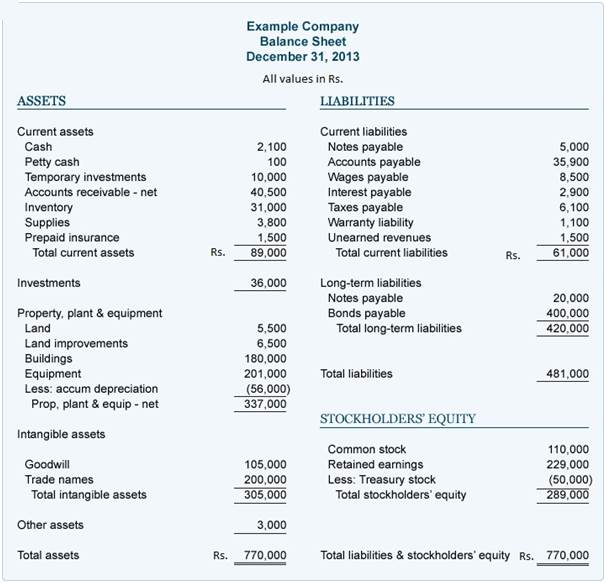

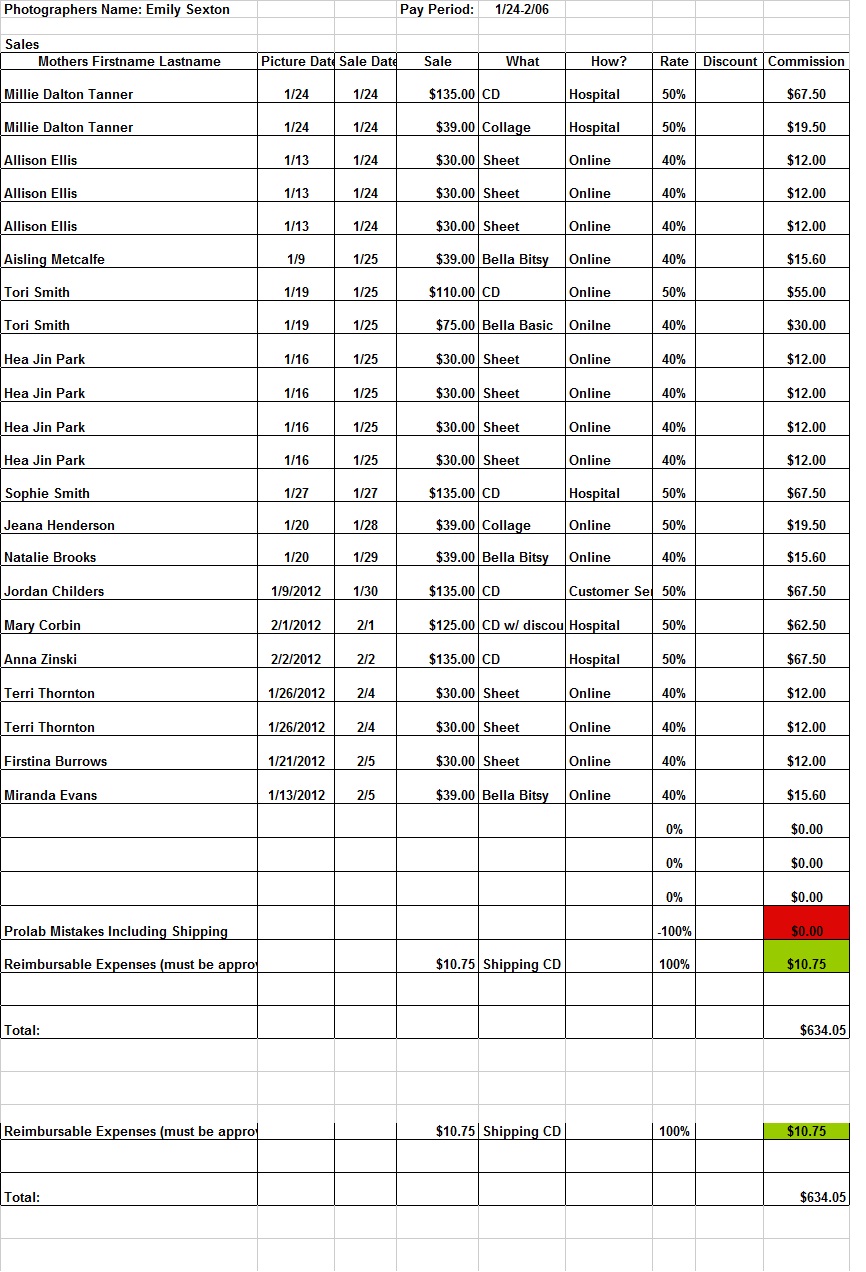

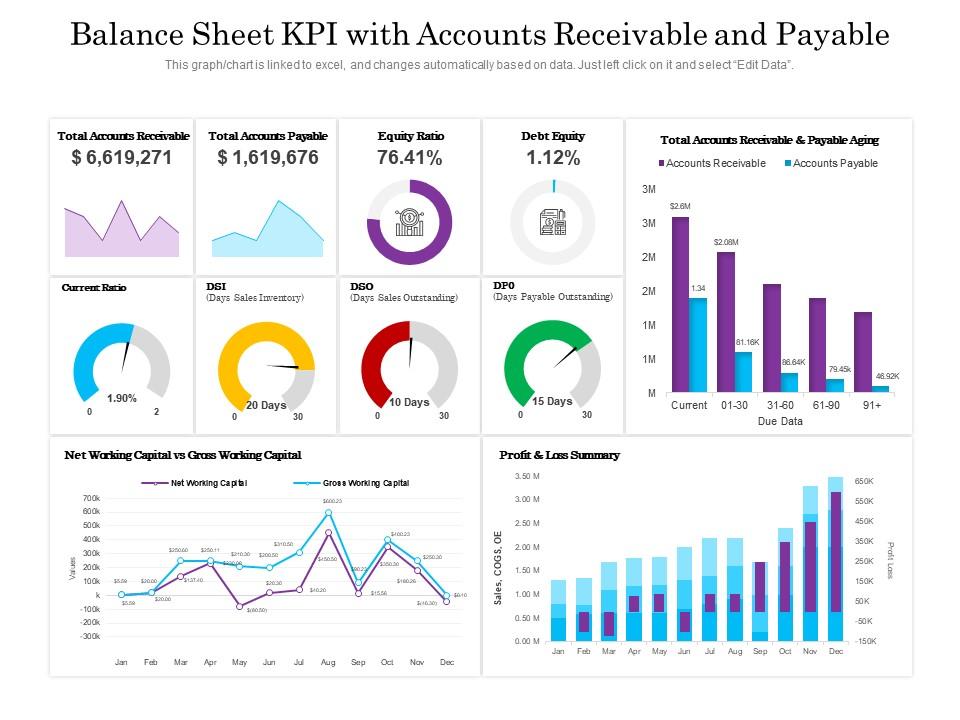

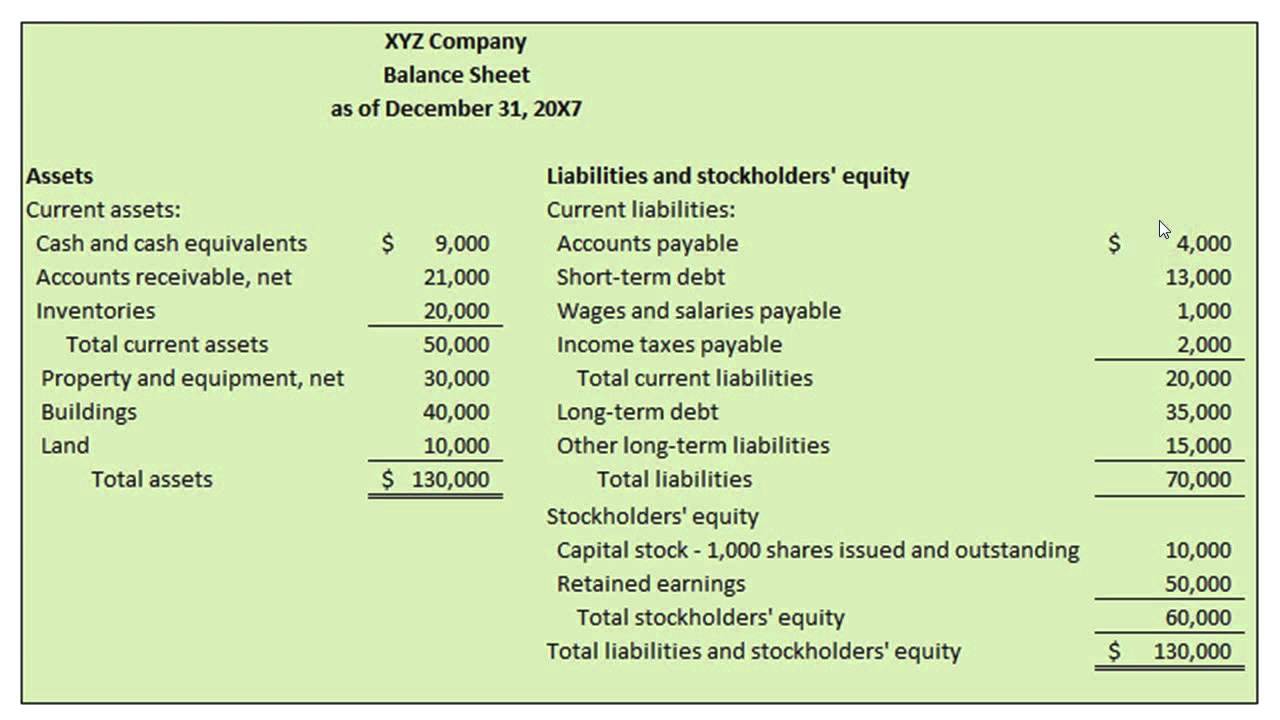

Write “sales commissions payable” and the amount you owe your employees as a line item in the current liabilities section of your balance sheet.

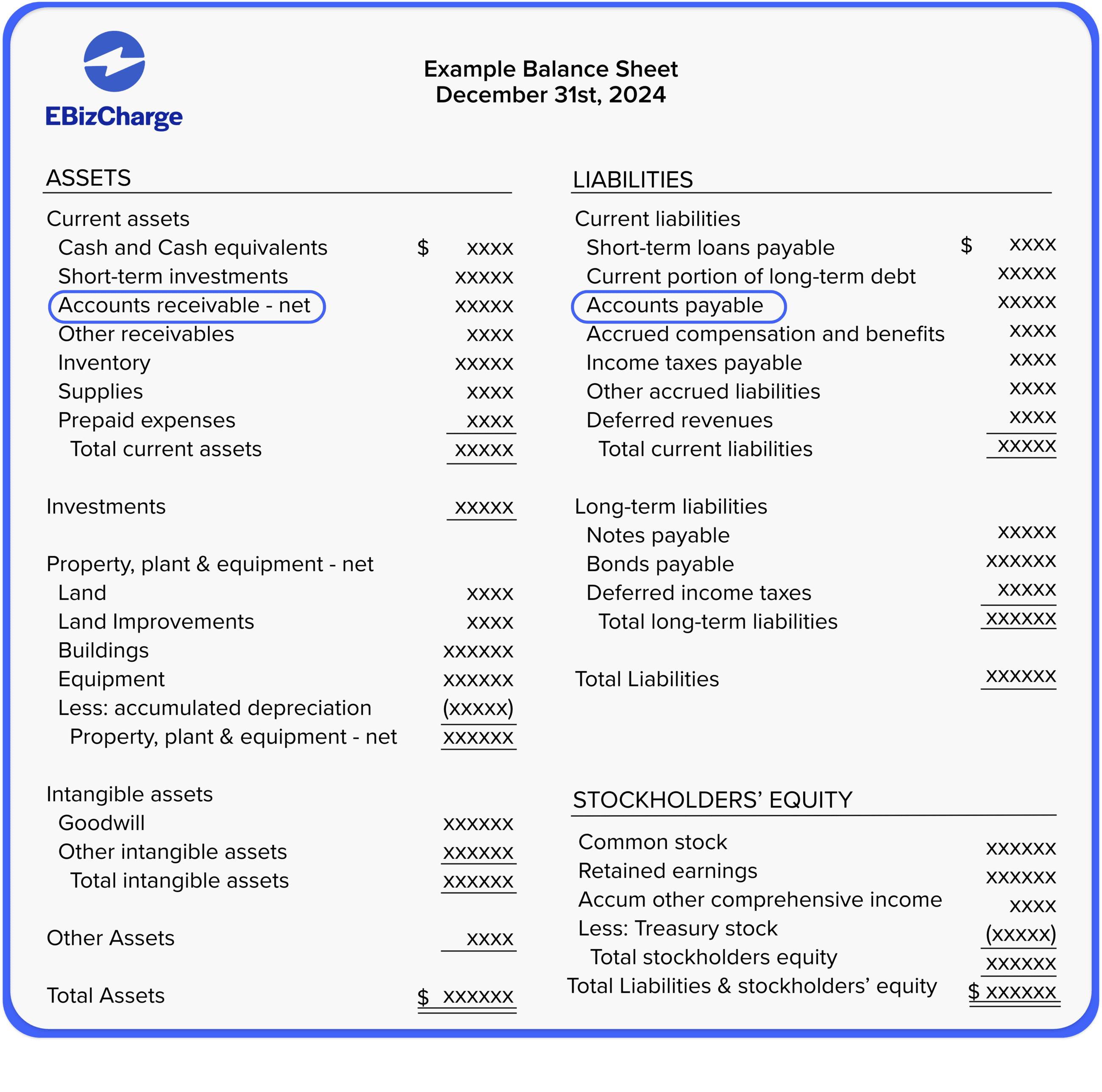

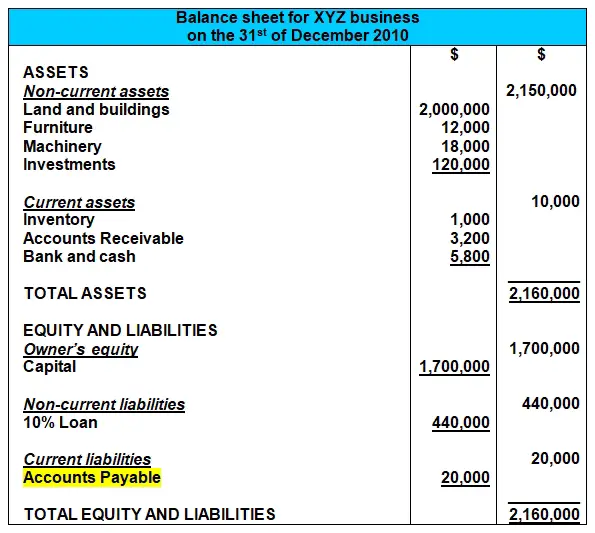

Commission payable in balance sheet. Accounts payable is a credit balance classified as a current liability in the liability section of a balance sheet. Revenues and expenses are not listed on a balance sheet but. Outstanding commission payable journal entry should be.

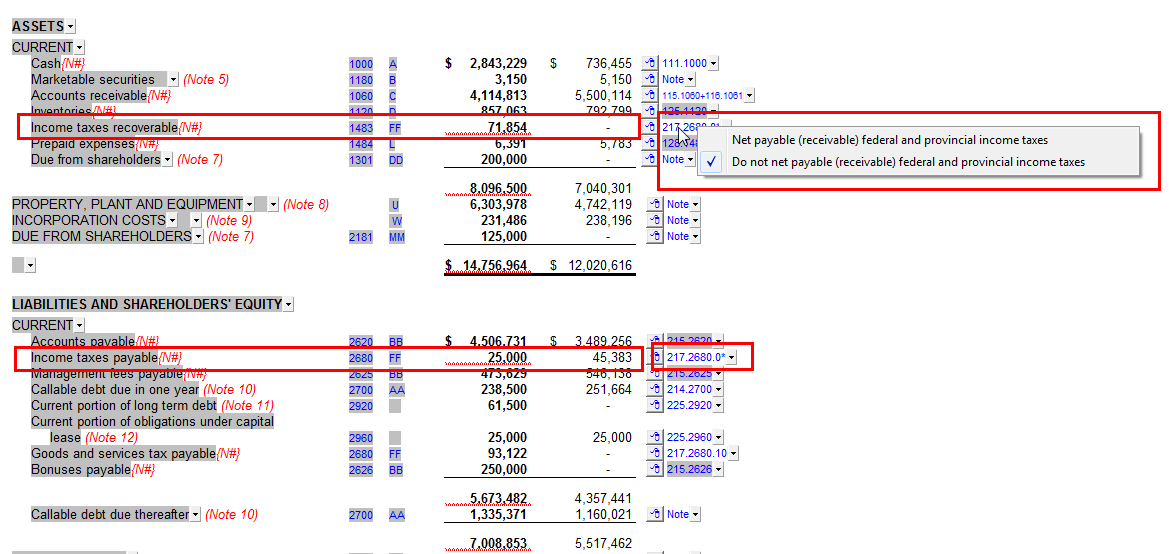

If the tax payable for a period has. In the balance sheet, the provision for taxation should contain only those accounts in respect of which assessment has not been made. The company receiving the commission should credit commission revenues and debit commissions receivable provided there is certainty that the commissions will be.

Accounts payable is a liability since it is money owed to creditors and is listed under current liabilities on the balance sheet. Therefore, commission payable is a. The lease commission is usually paid base on the percentage of the rental fees.

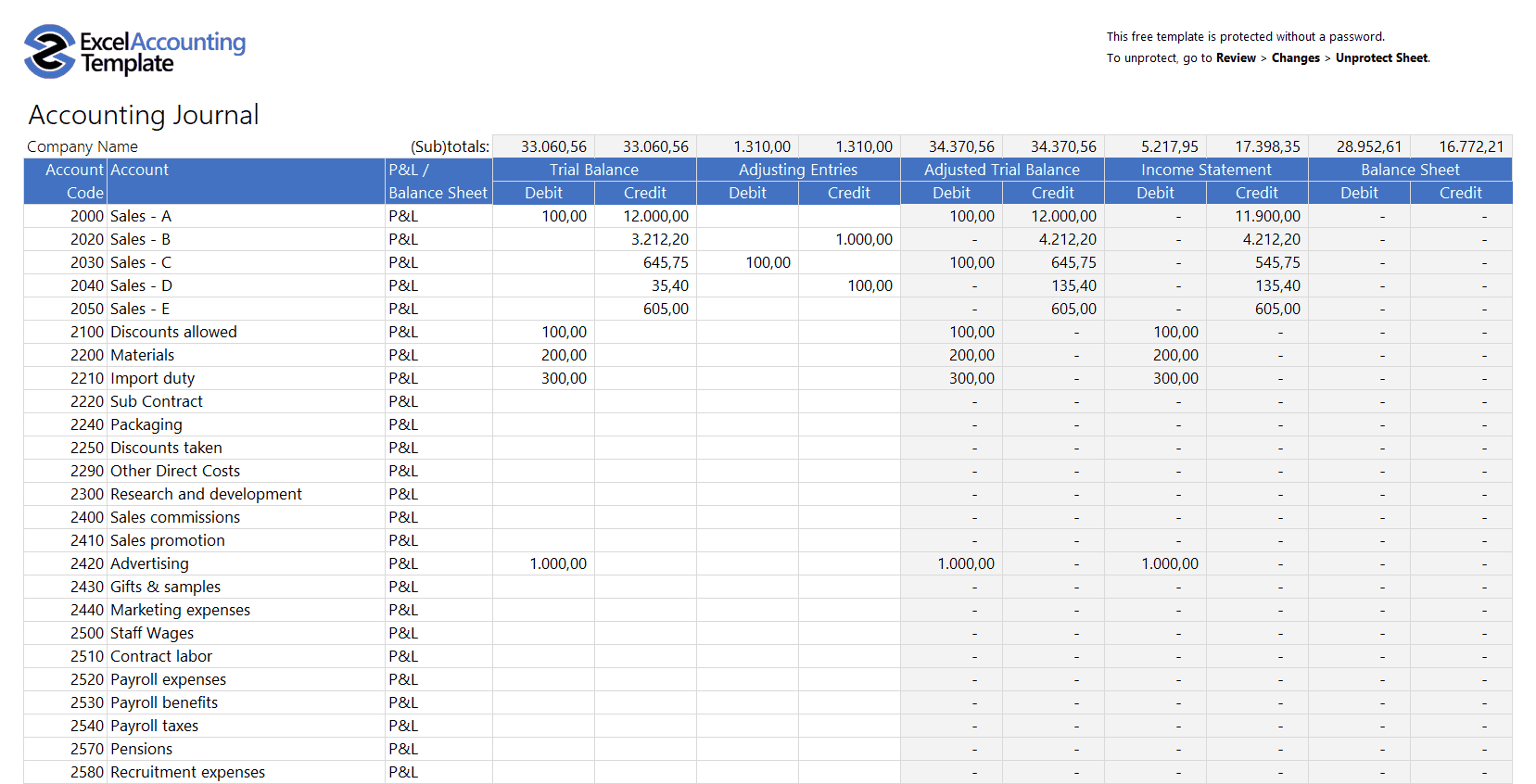

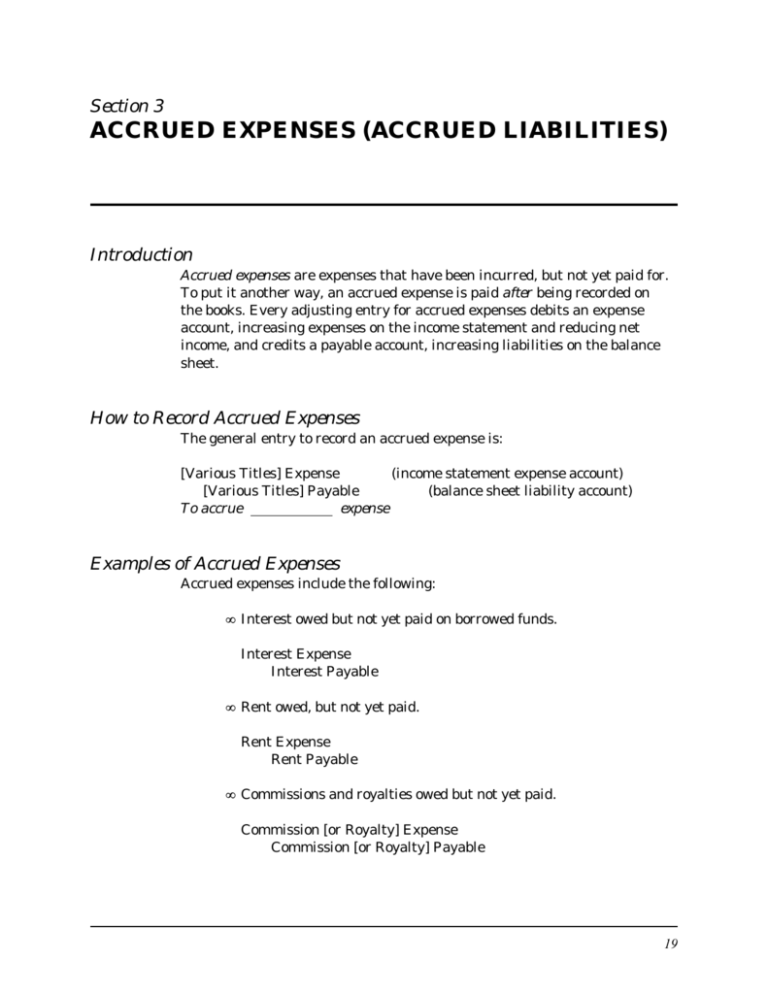

Under the accrual basis of accounting, you should record an expense and an offsetting liability for a commission in the same period as you record the sale generated by the salesperson, and when you can calculate the. Manager’s commission payable after charging the commission adjustment of interest on capital adjustment of goods distributed among staff members for staff welfare. The balance sheet is one of the three core financial.

The balance sheet is comprised of three. A commission is a revenue or an expense, depending on whether it is incoming or outgoing. 11.3 accounts and notes payable.

Your annual salary is $40,000. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Ifrs 15 outlines the accounting for the incremental costs of obtaining a contract, as well as the costs incurred to fulfil a contract.

Accounts payable (ap) is a liability that appears on a company’s balance sheet. Features of manager’s commission. Accounts payable are found on a firm's balance sheet, and since they represent funds owed to others they are booked as a current liability.

Any time you hear of payable, you should understand this represents a liability of a debt. In accounting perspective, lease commission is considered as the initial direct cost which. Combines a guaranteed income with variable earnings for performance.

The outstanding commission is a current liability like any other outstanding expense, hence it is shown on the liability side in the balance. It represents the amount of money owed by the business to its vendors for goods. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

In this example, write “sale. As fixed assets age, they begin to lose their value. Accounting for a commission.