Perfect Tips About Cash Flow Forecast For Startup Business

A cash flow forecast provides the answer.

Cash flow forecast for startup business. Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less than 10 months, according to. When you look at the bank statement of any business, you soon realise that cash flow is a dynamic and often unpredictable part of business life. Why is a cash flow forecast important to startup businesses?

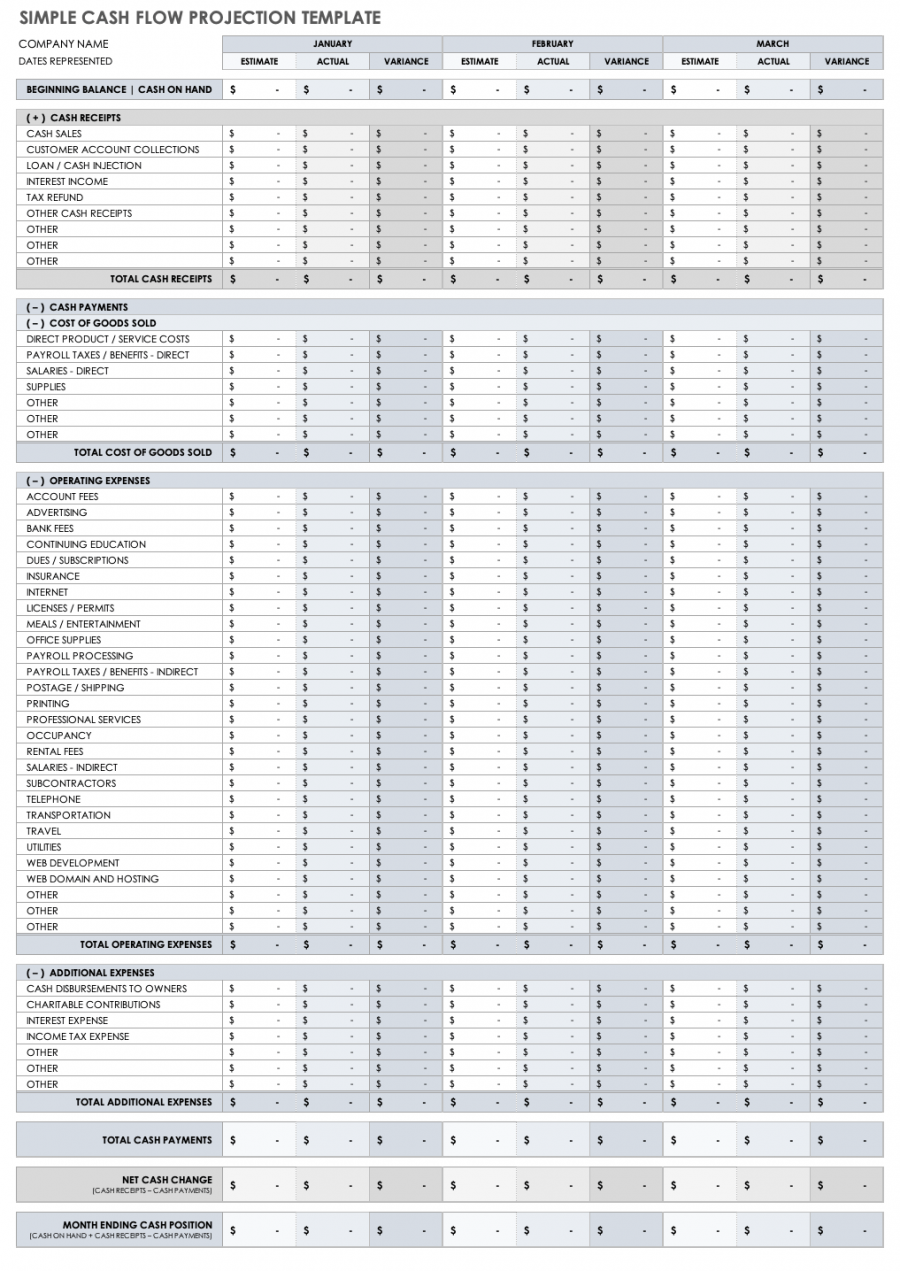

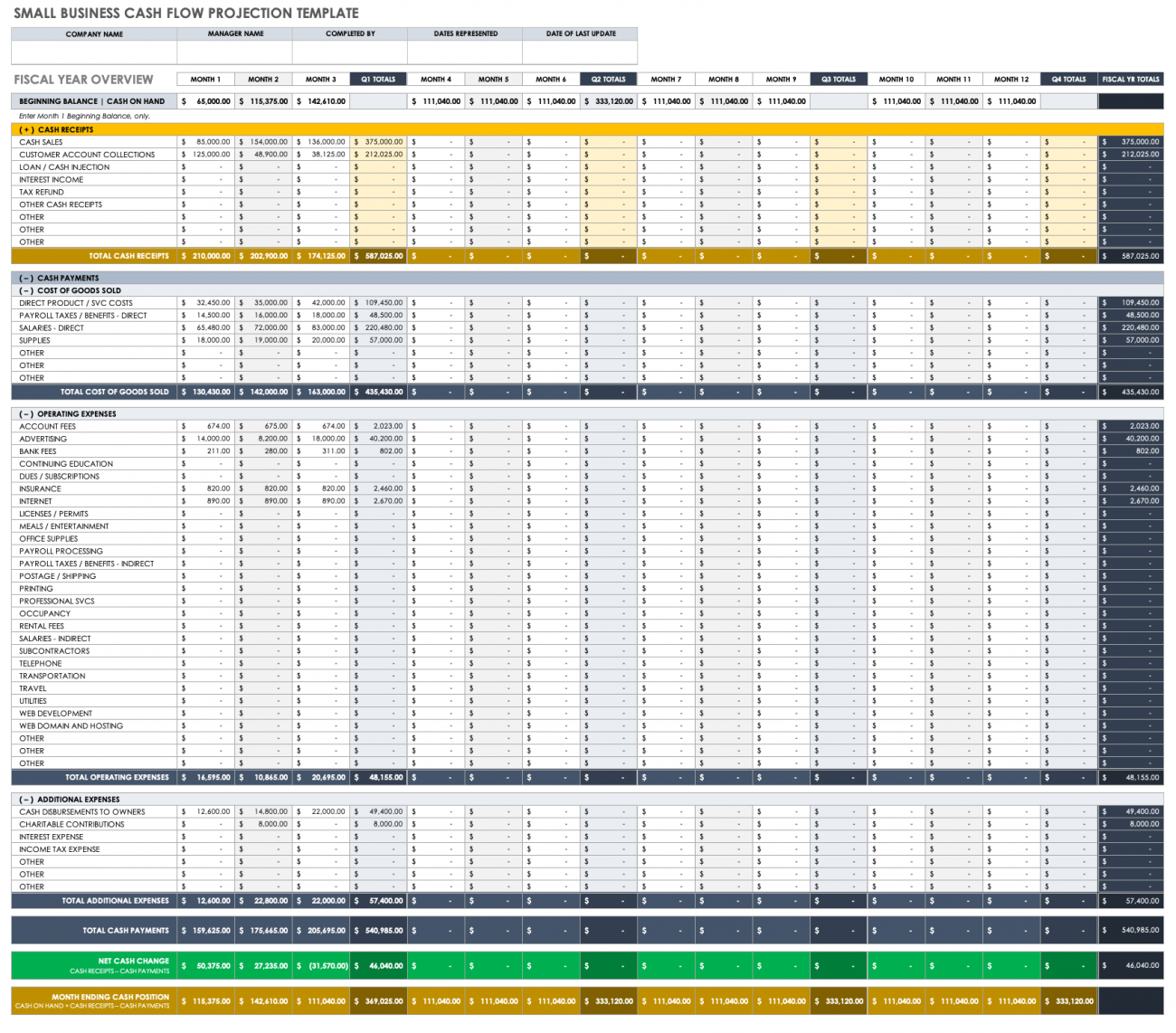

Free cash flow forecast template a good cash flow forecast might be the most important single piece of a business plan. How to create a cash flow forecast (and why your business needs one) step 1: Plan for future cash shortcomings meet your tax obligations plan asset purchases plan for growth or expansion make an informed decision on whether borrowing is right for you test different strategic scenarios

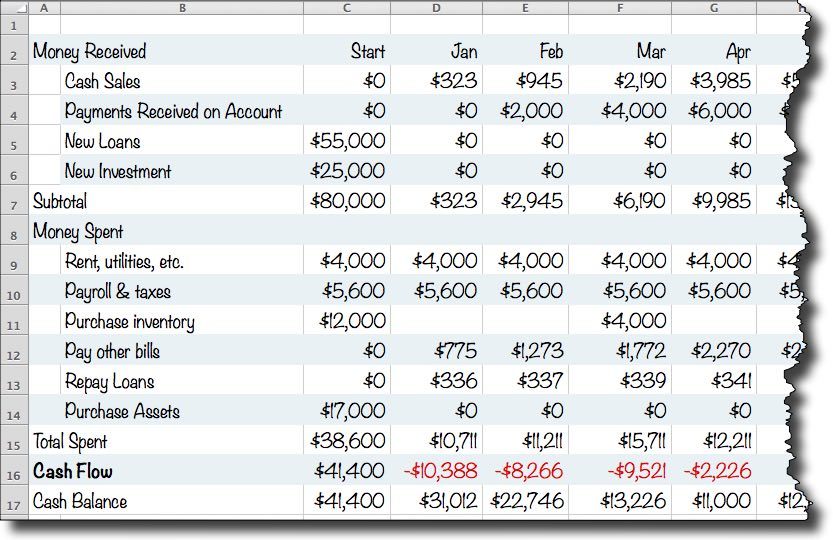

Cash flow forecasts are an important tool for all stages of contracting, being a sole trader or in business. The challenge for sophie and jack is to ensure that customers pay on time. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out based on past business performance.

Every startup should consider the likely future cash flows of the enterprise in the first few weeks and months of trading. A startup’s cash flow is integral to the sustainability and growth of the business. The accounting period can be any length but is usually a month or a year.

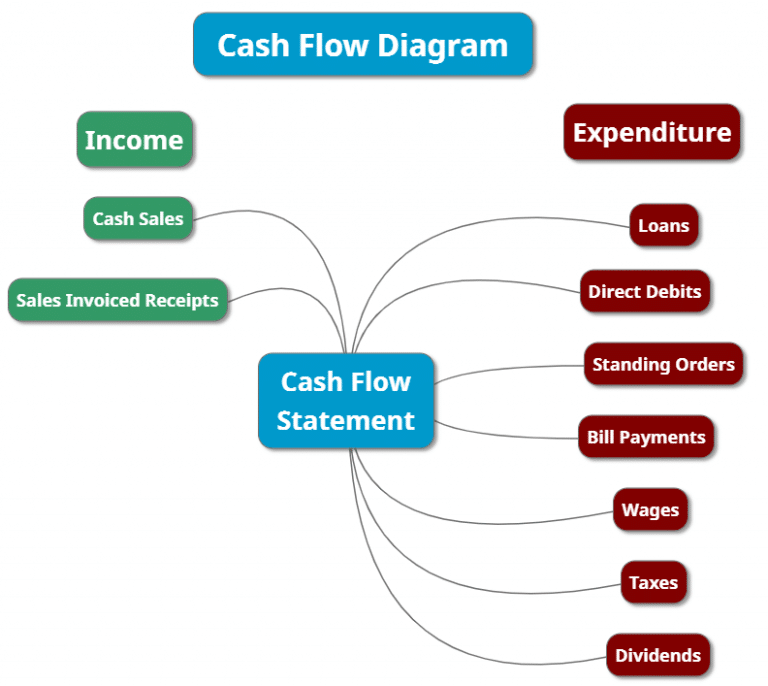

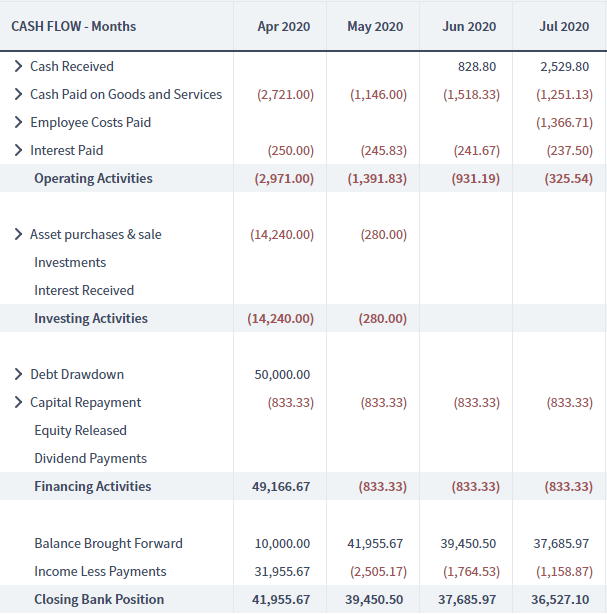

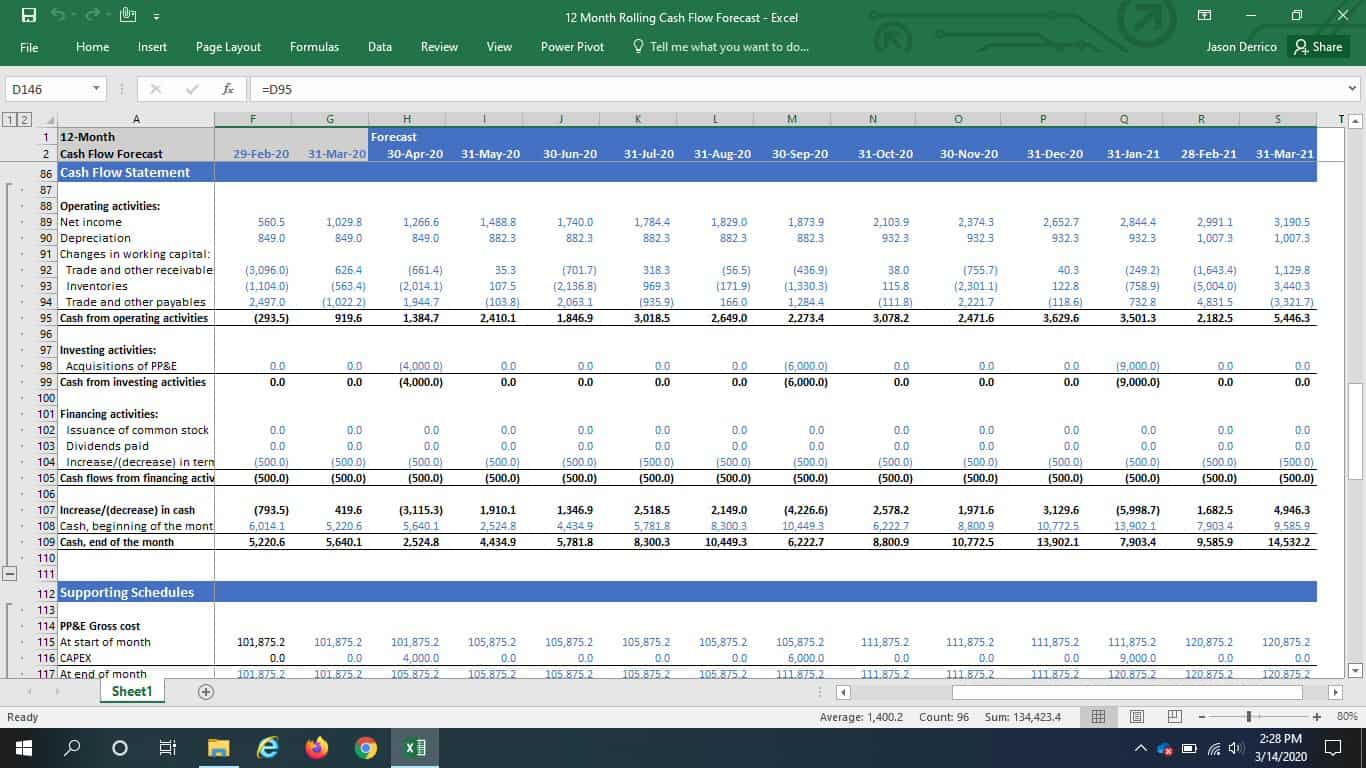

Introduction what is cash flow? Cash flow forecasting follows a repeatable process. Most cash flow forecasts aim to project out to a year from the current date.

Funding startups create financial projections in the form of a pro forma income statement — which simply means a financial forecast. Updated october 27, 2023 download now: It’s not uncommon for a business to experience a cash shortage, even when sales are good.

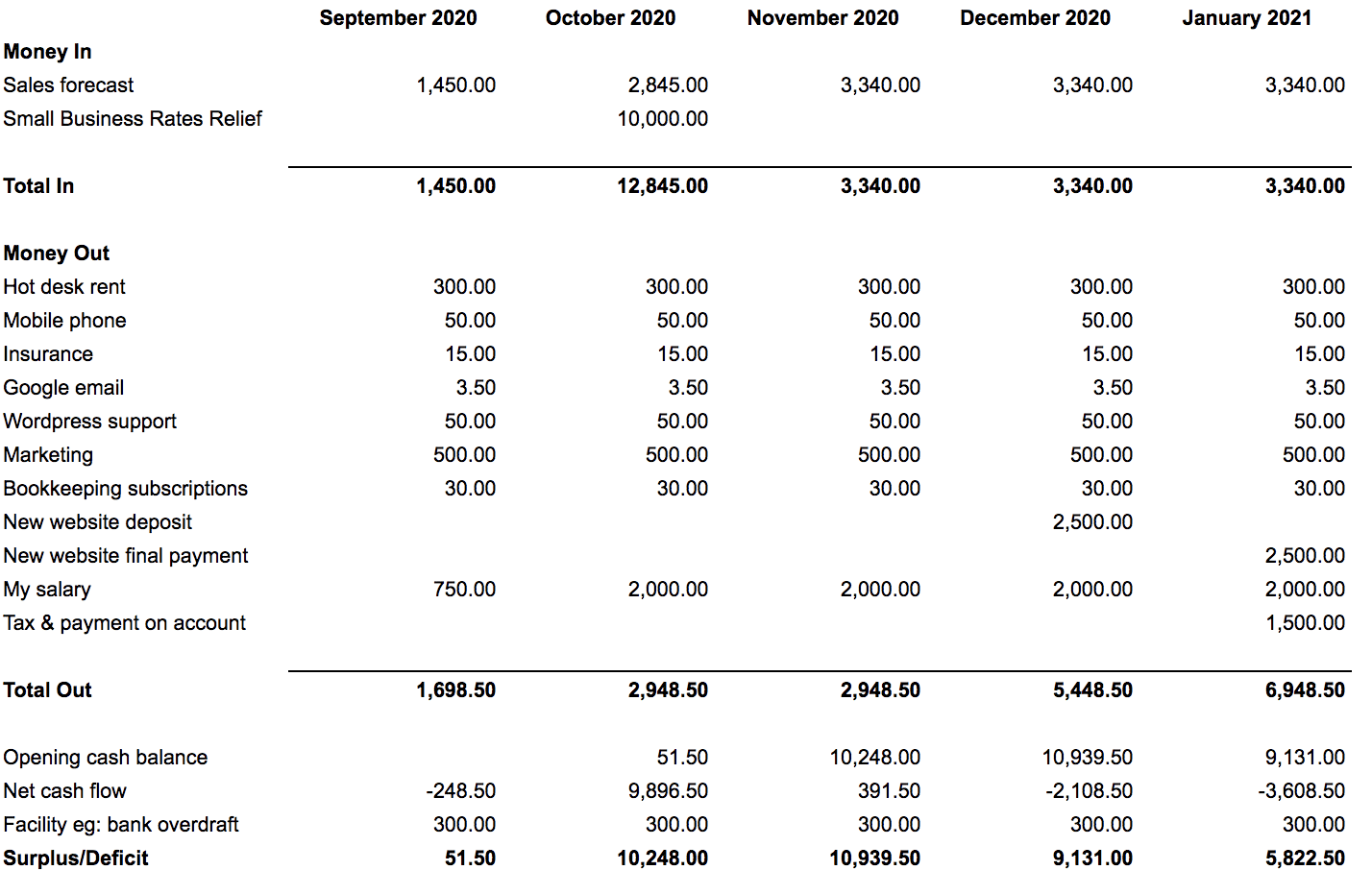

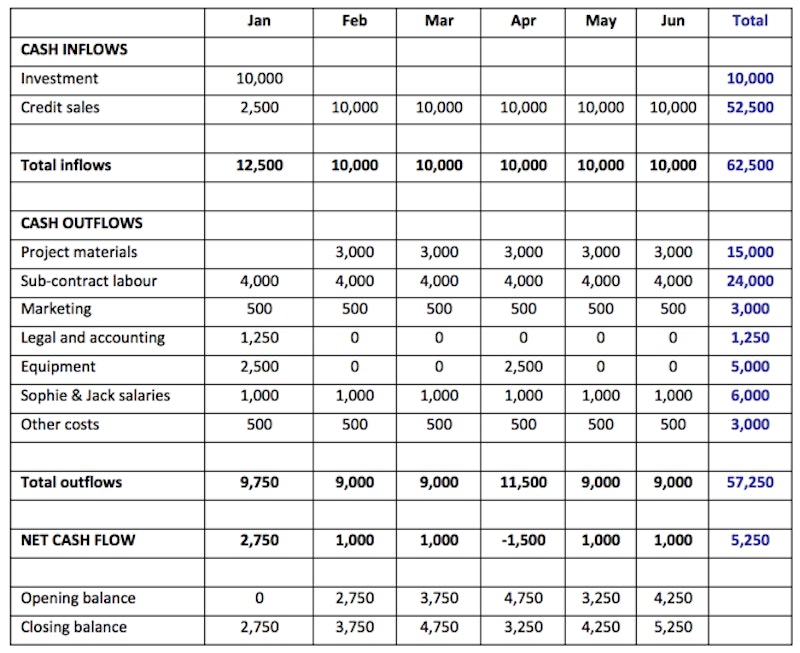

Start by outlining all anticipated expenses and revenues for a specific period, typically monthly or quarterly. In the forecast above, the monthly cash inflows are around £10,000 p/m and total £62,500 for the first six months of trading. October 5th, 2022 | by:

Aqa, edexcel, ocr, ib. First, calculate net cash flow by subtracting outflows from inflows. 17th march 2021 starting a new business is an exciting time.

The primary purpose of a cash flow forecast is to highlight potential cash shortages. Start with your sales, adding them to the appropriate week or month. Type of cash flow operating cash flow (ocf) investing cash flow (icf) financing cash flow (fcf) managing a startup cash flow 1.) create a cash flow forecast 2.) prioritize your expenses 3.) delay payments when possible 4.) collect.

A cash flow forecast can also be used to determine the viability of new business ventures. You need your profit and loss forecast to create your cash flow forecast. Without a positive cash flow operations cease.