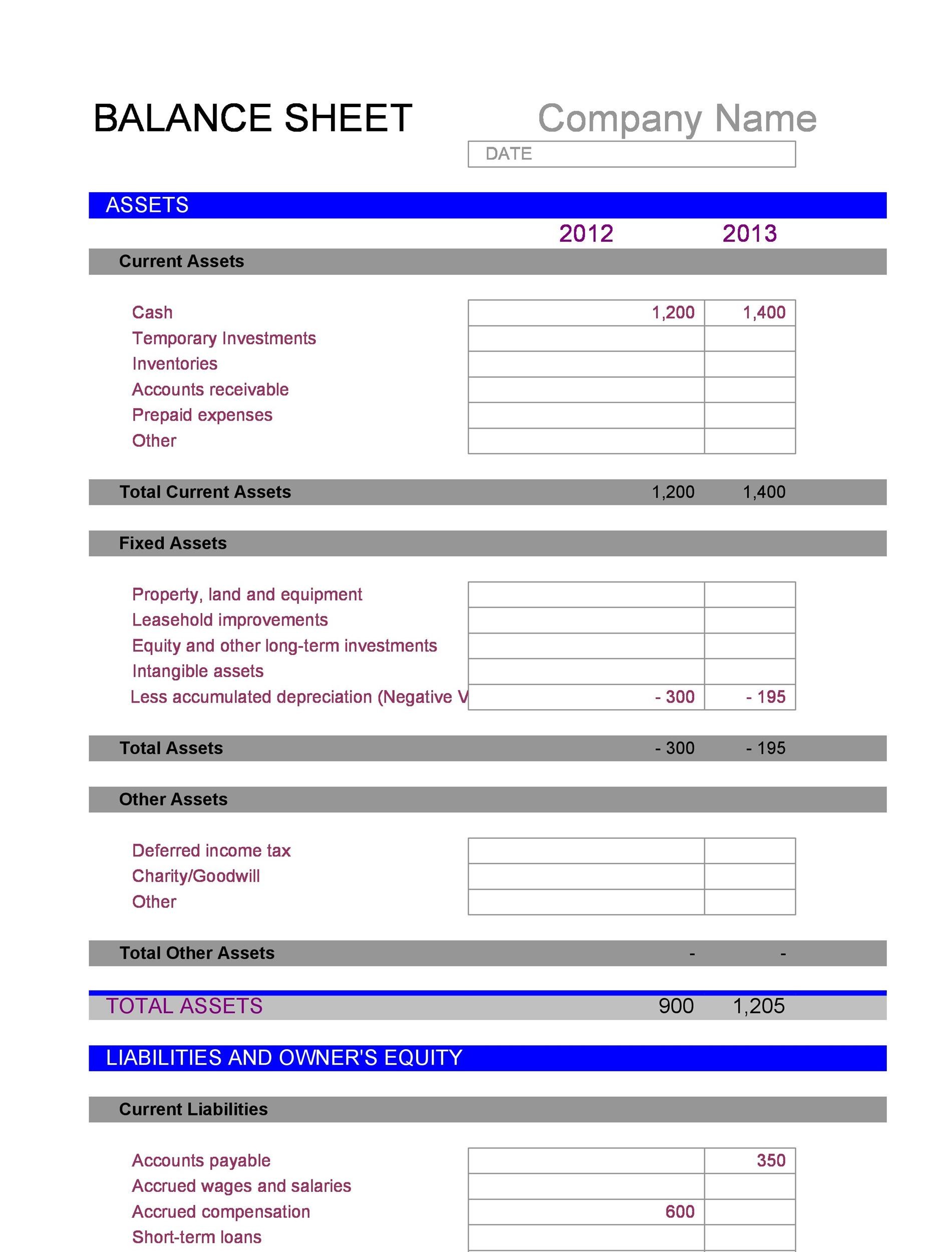

Heartwarming Info About Proper Balance Sheet

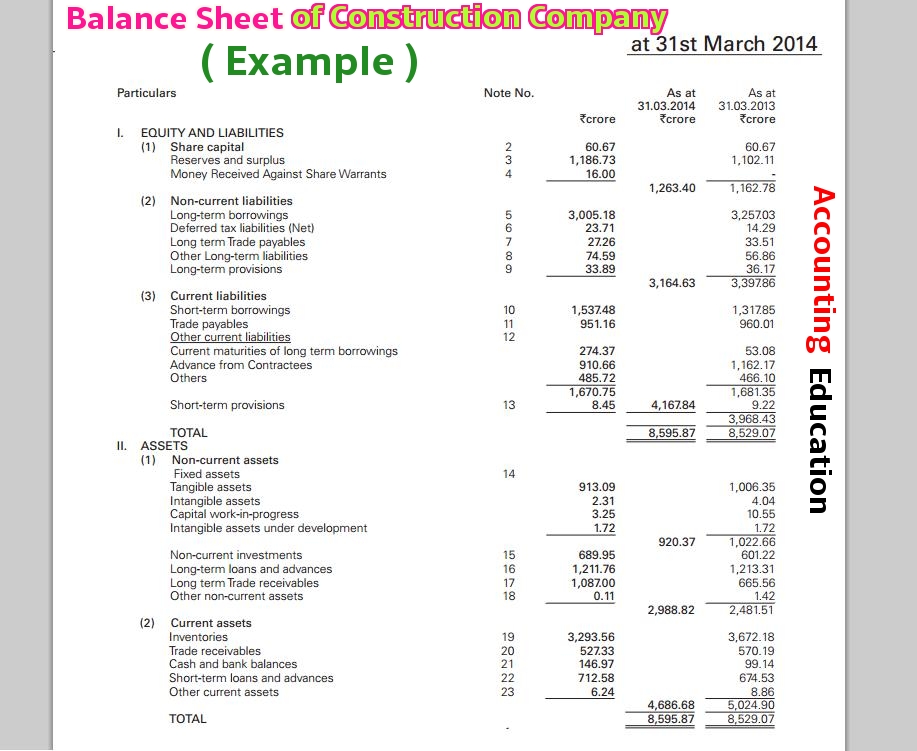

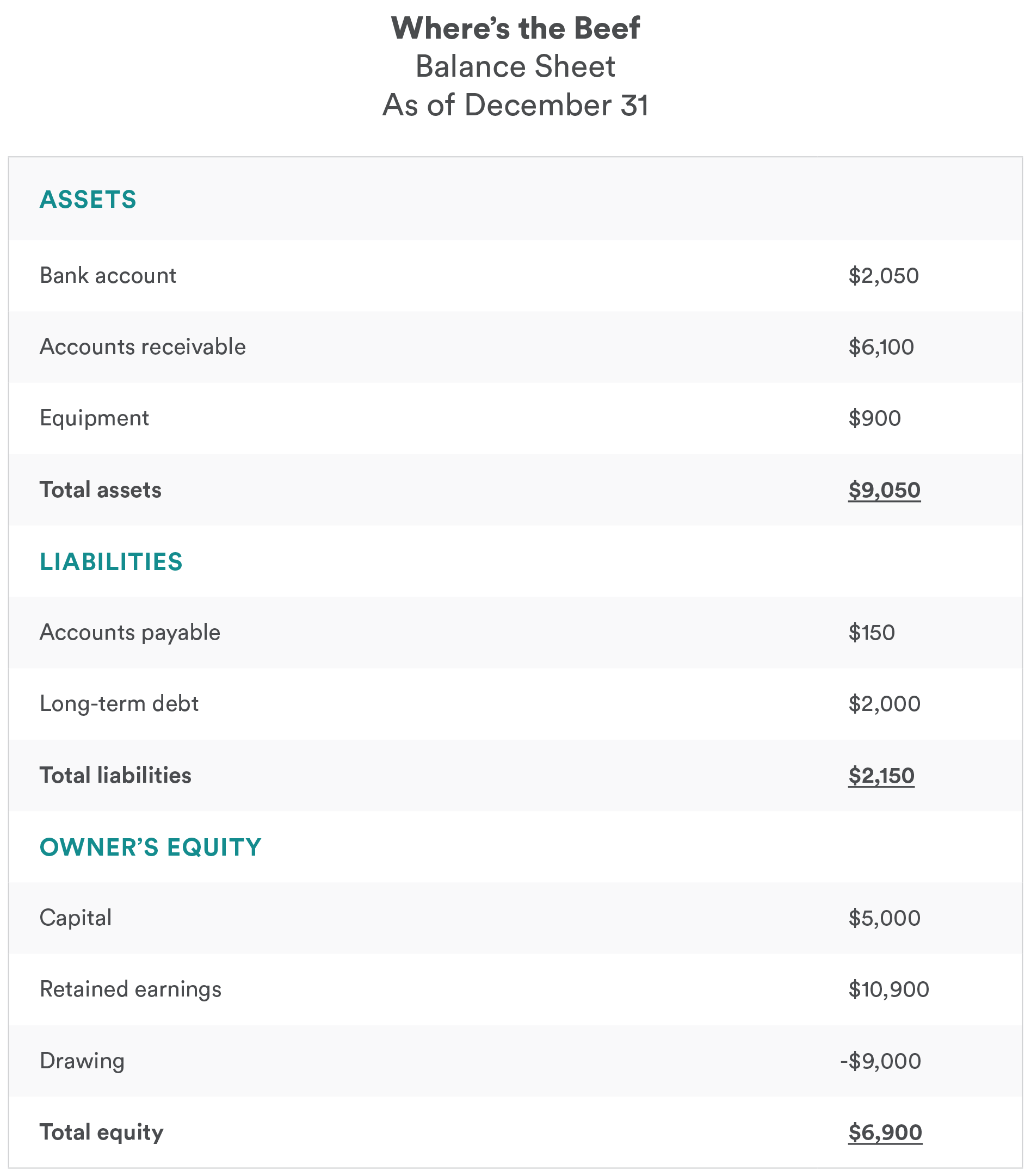

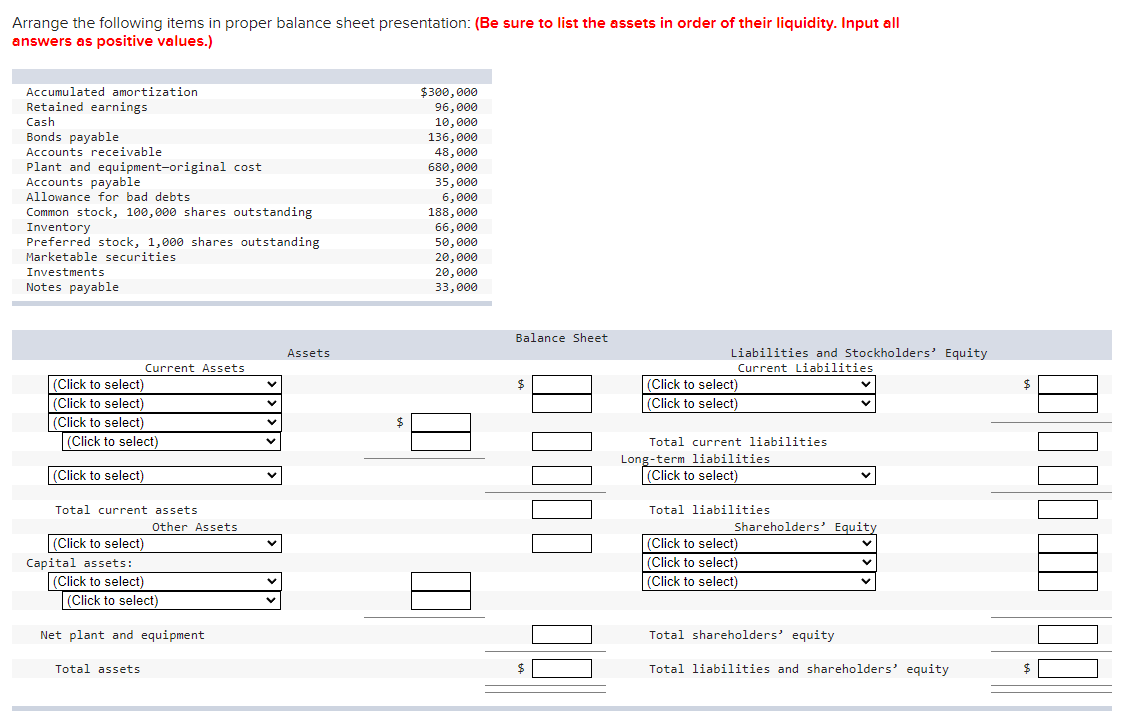

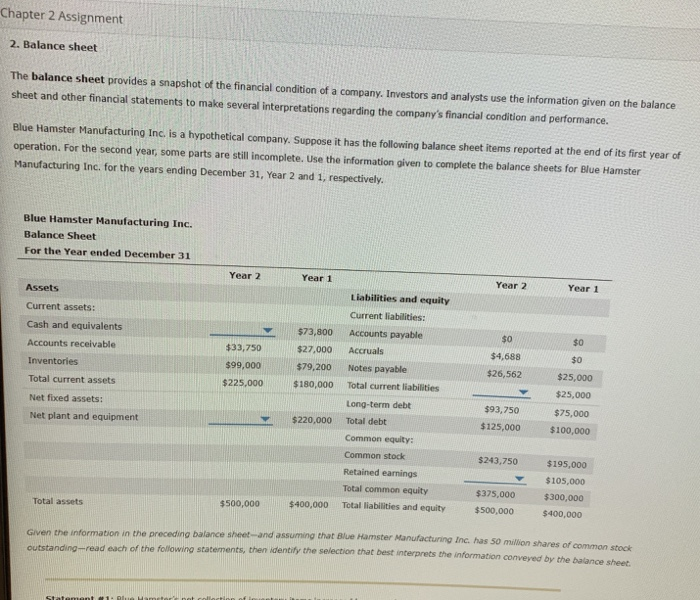

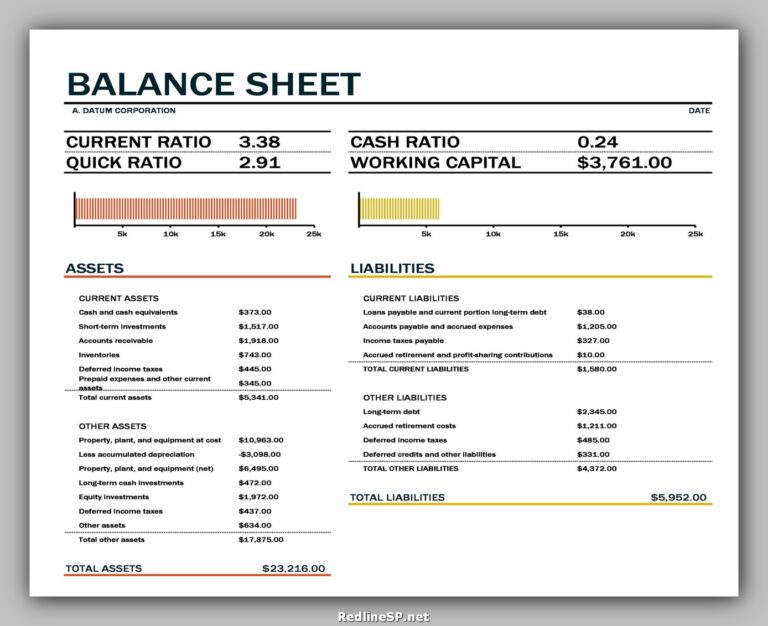

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Proper balance sheet. Lenders typically look at liabilities to ensure a. The balance sheet presents an account of where a company has obtained its funds and where it has invested them. Fed minutes suggest officials are seeking smallest balance sheet possible.

Minerals resources boss chris ellison has hit back at his critics. The annual accounts of all the eurosystem national central banks will be finalised by the end of may 2024, and the final annual consolidated balance sheet of the eurosystem will be published thereafter. What is a balance sheet?

Balance sheets provide the basis for. It is allowing up to $95 billion in treasury and mortgage bonds to. The balance sheet is a key financial statement that provides a snapshot of a company's finances.

Obtain credit/debt from a lender. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. You may find this information on the company's general ledger, which shows all financial transactions recorded during a.

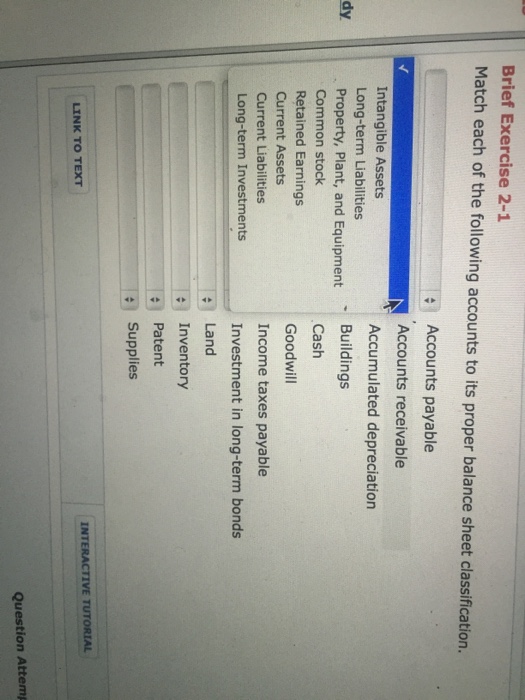

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Heidelberg materials will buy back more shares after its debt declined significantly, it said on thursday.

And capital represents the portion left for the owners of the business after all liabilities are paid. A balance sheet summarizes the assets, liabilities, and capital of a company. It can also be referred to as a statement of net worth or a statement of financial position.

Like any other financial statement, a balance sheet will have minor variations in structure depending on the organization. Liabilities are obligations to creditors, lenders, etc. Assets have declined by about $1.3 trillion since june 2022.

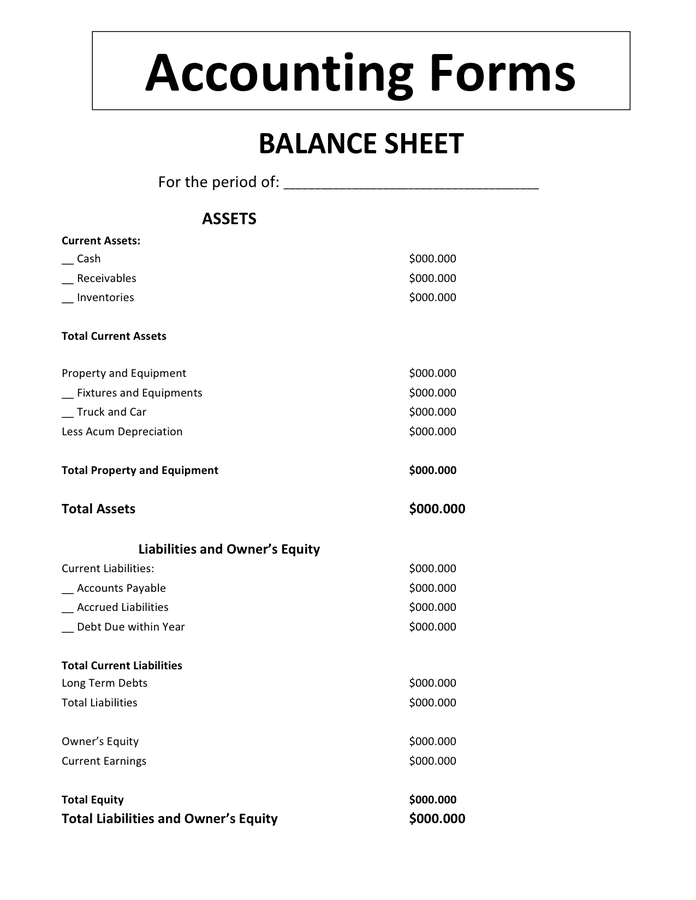

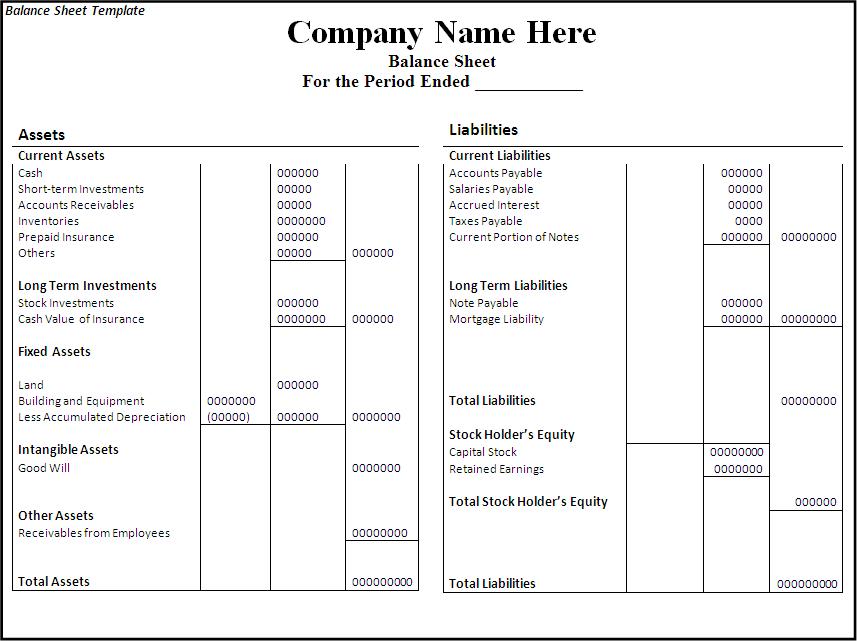

This financial statement details your assets, liabilities and equity, as of a particular date. The balance sheet, income statement, and cash flow statement make up the three main financial statements that businesses use. Title the sum “total liabilities and owner's equity. the balance sheet has been correctly prepared if “total assets” and “total liabilities and owner's equity” are equal.

The balance sheet is split into two columns, with each column balancing out the other to net to. Balance sheets may be produced on a monthly, quarterly, or annual basis, depending on your needs. Assets = liabilities + equity.

The current size of the fed's balance sheet is $7.7 trillion. Assets = liabilities + shareholders’ equity A business has primarily two sources of funds which are shareholders and lenders.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)