Best Of The Best Info About Nonbusiness Bad Debt Statement Example

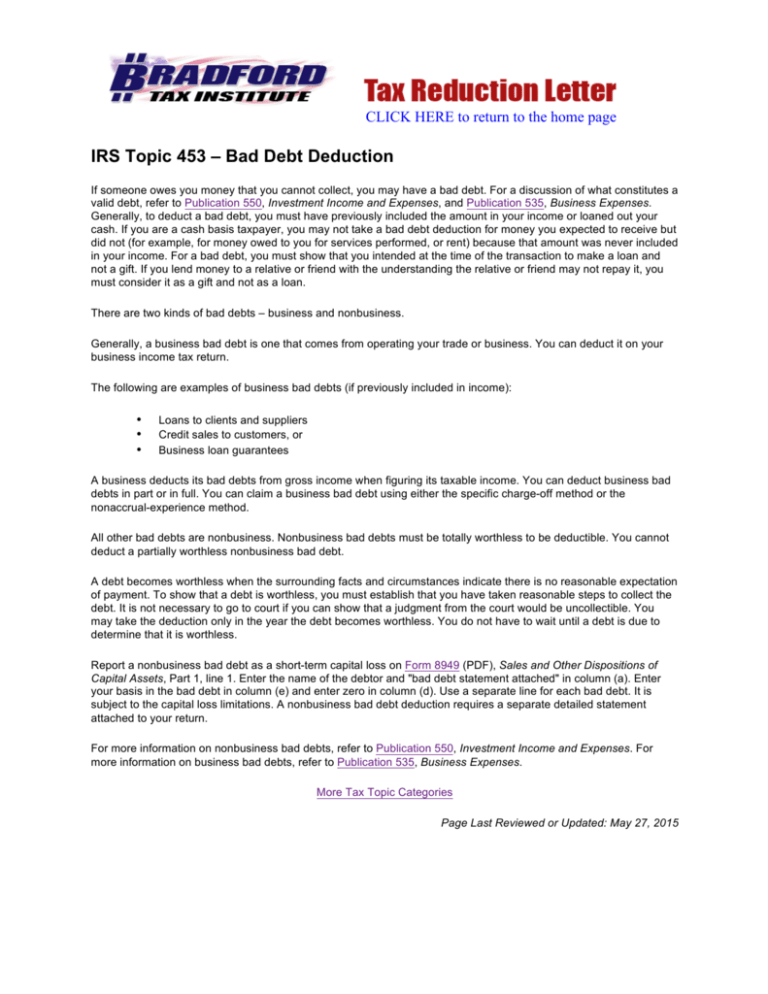

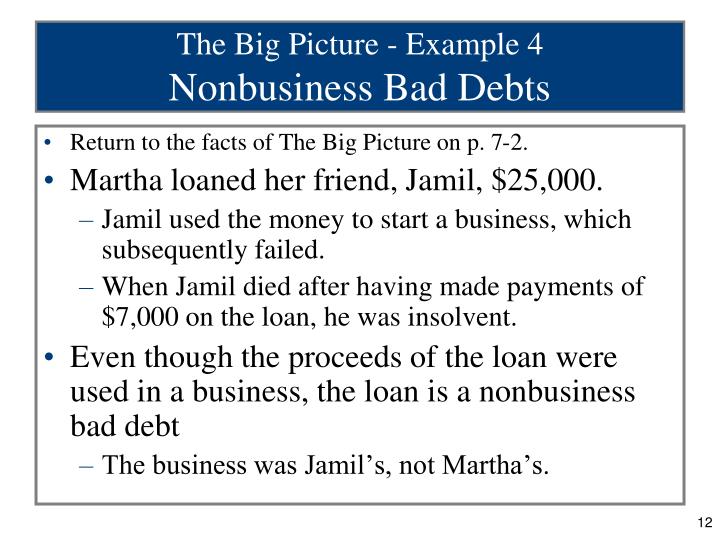

Loans to clients and suppliers credit sales to customers, or business loan.

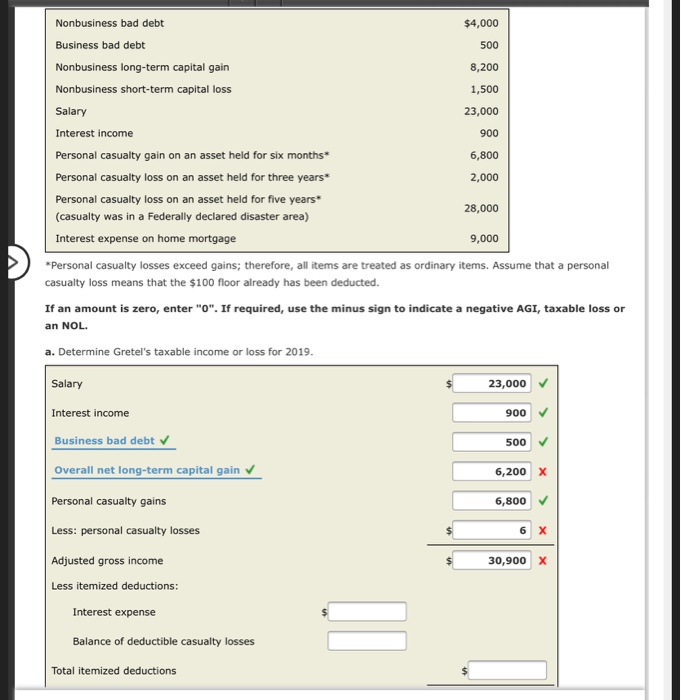

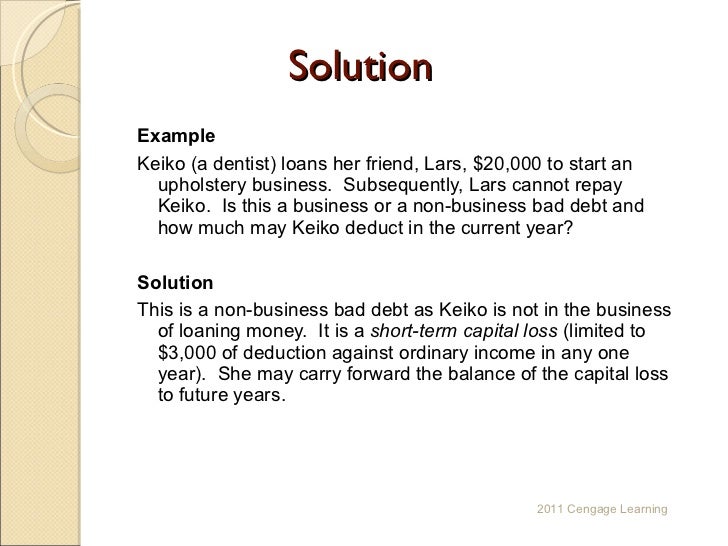

Nonbusiness bad debt statement example. This year's proseries form 1040 includes, under schedule d, bad debt. Westlaw conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology. Eligibility to claim a bad debt deduction on your income taxes requires that the debt is already worthless—it is no longer collectible.

(2) what documentation is required to. This is a term used a lot in business, but you can recoup some of a personal. How to add a nonbusiness bad debt?

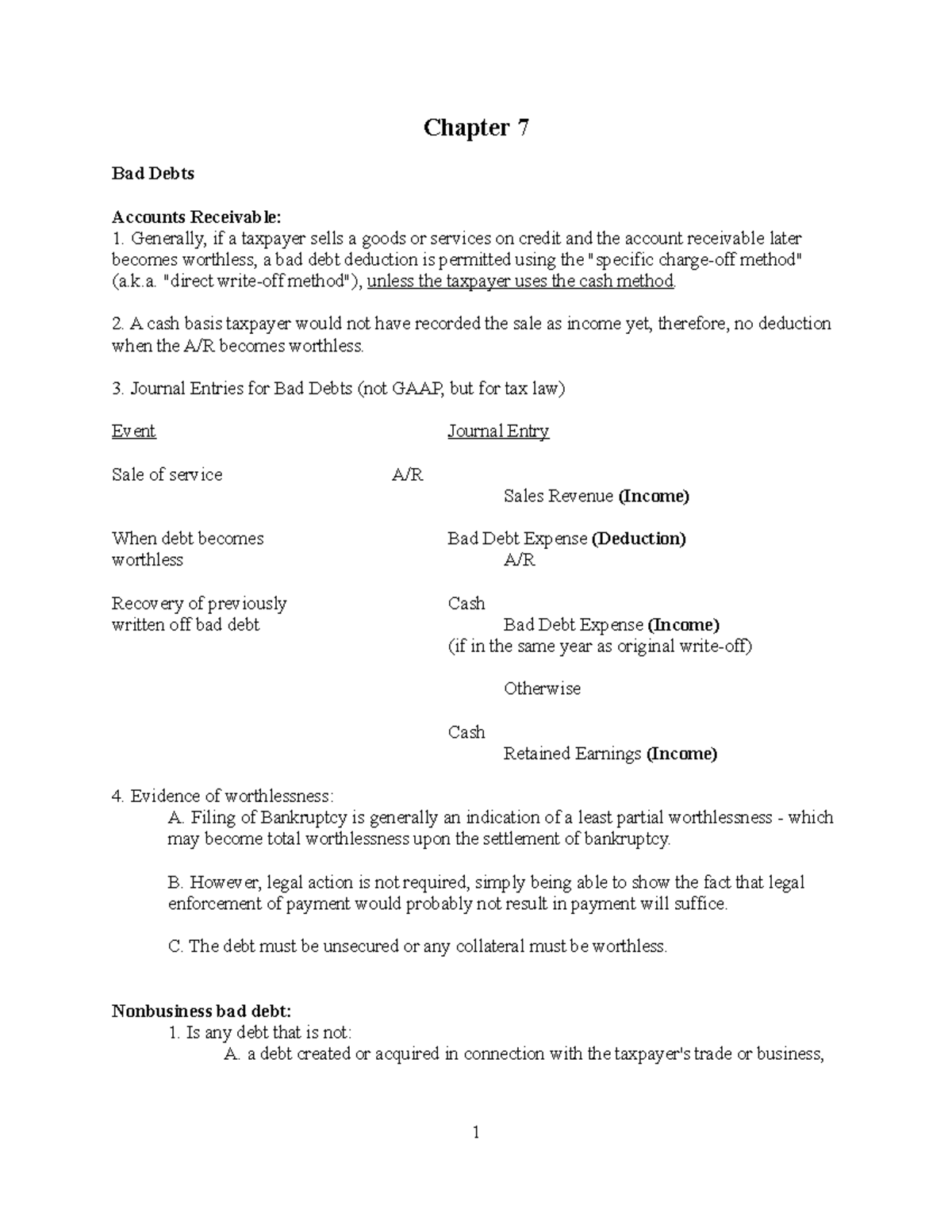

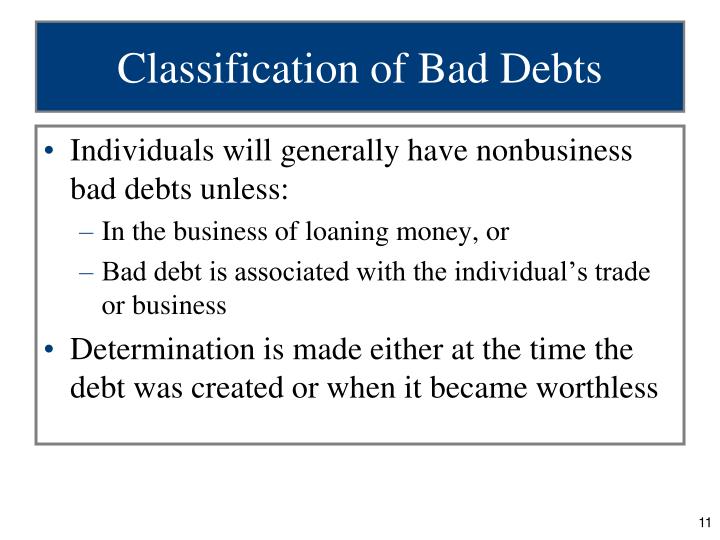

Generally, you can't take a deduction for a bad debt from your regular income, at least not right away. A description of the debt (including the amount and the date it became due), the name of the debtor (and any business or family relationship between. Business bad debts may be deducted in part or in full.

550 for what qualifies as a nonbusiness bad debt and how to enter it on part i of form 8949. What is proof of worthlessness? These include nonbusiness and business bad debt.

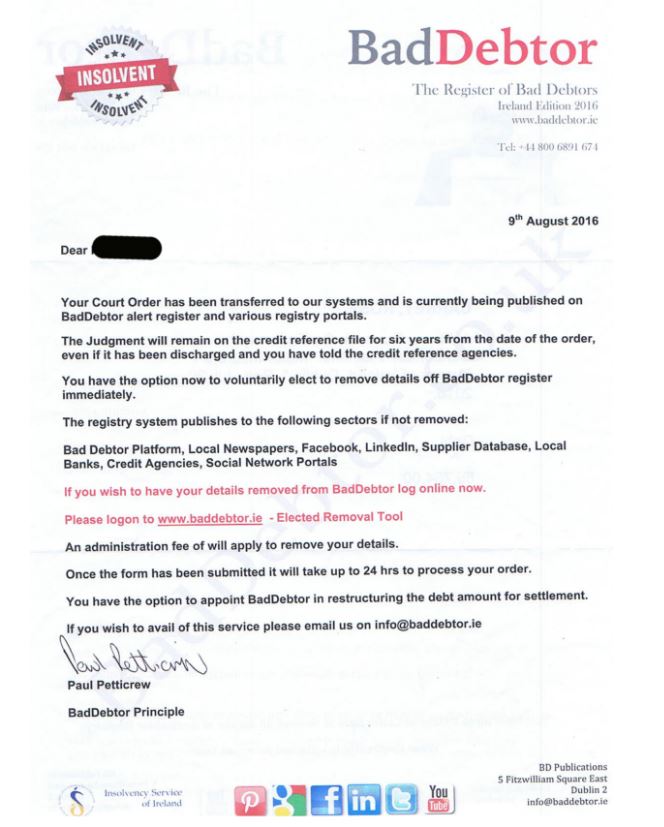

On the first line of the first part, write the. The highlighted terms are very important. A bad debt occurs when someone owes you money and your efforts to get paid have failed.

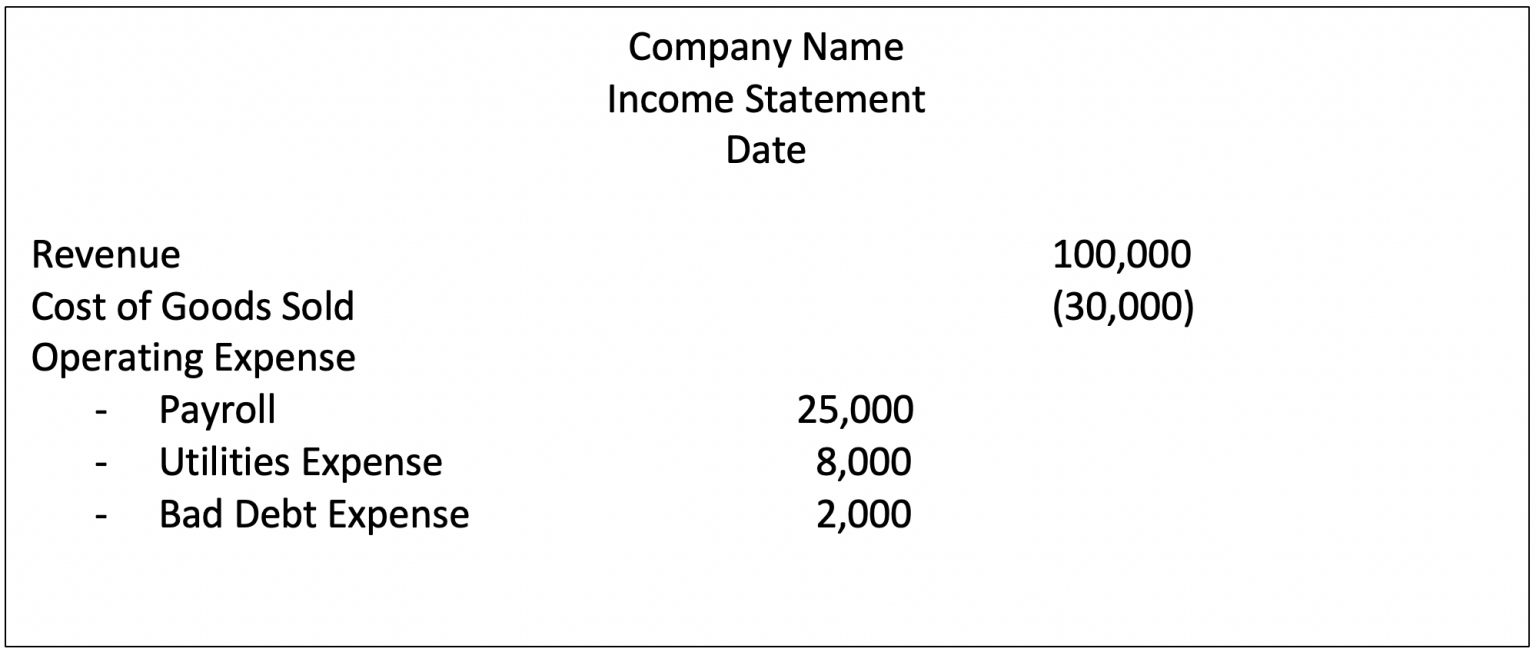

Basis in bad debt required. A business deducts its bad debts from gross income when figuring its taxable income. Unfortunately, the form is not constructed to include cases where the taxpayer is paying.

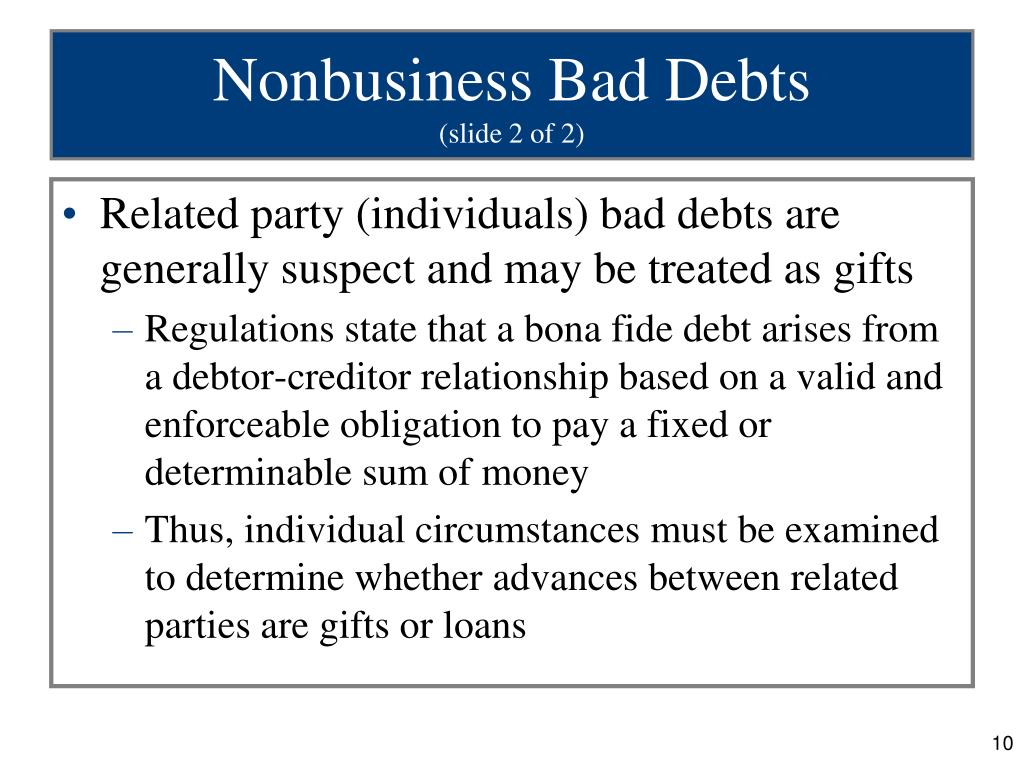

A nonbusiness bad debt is any debt that is not a business bad debt — either a personal debt or a debt related to investments. To write off a nonbusiness bad debt, fill out form 8949. Bad debts come in two kinds.

A partial loss of a business bad debt can be. The irs states that “a nonbusiness bad debt deduction requires a separate detailed statement attached to your return. (1) what documentation is required to establish a nonbusiness bad debt?

Asked three questions concerning nonbusiness bad debts:

![[Get 20+] Sample Letter To Write Off Bad Debts](https://efinancemanagement.com/wp-content/uploads/2018/11/Bad-Debts.png)