Great Tips About Cash Flows Statements Explain In Detail

Get a cash flow statement template and more in this guide.

Cash flows statements explain in detail. Explain the need for management to control cash flows. What is a cash flow statement? It is important for the company to determine if too much of its cash is lying idle, or if there’s a shortage or excess of funds.

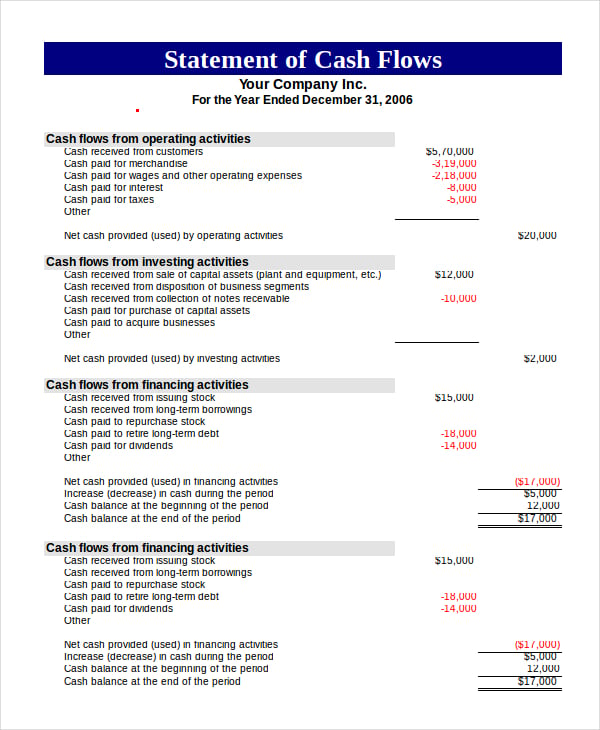

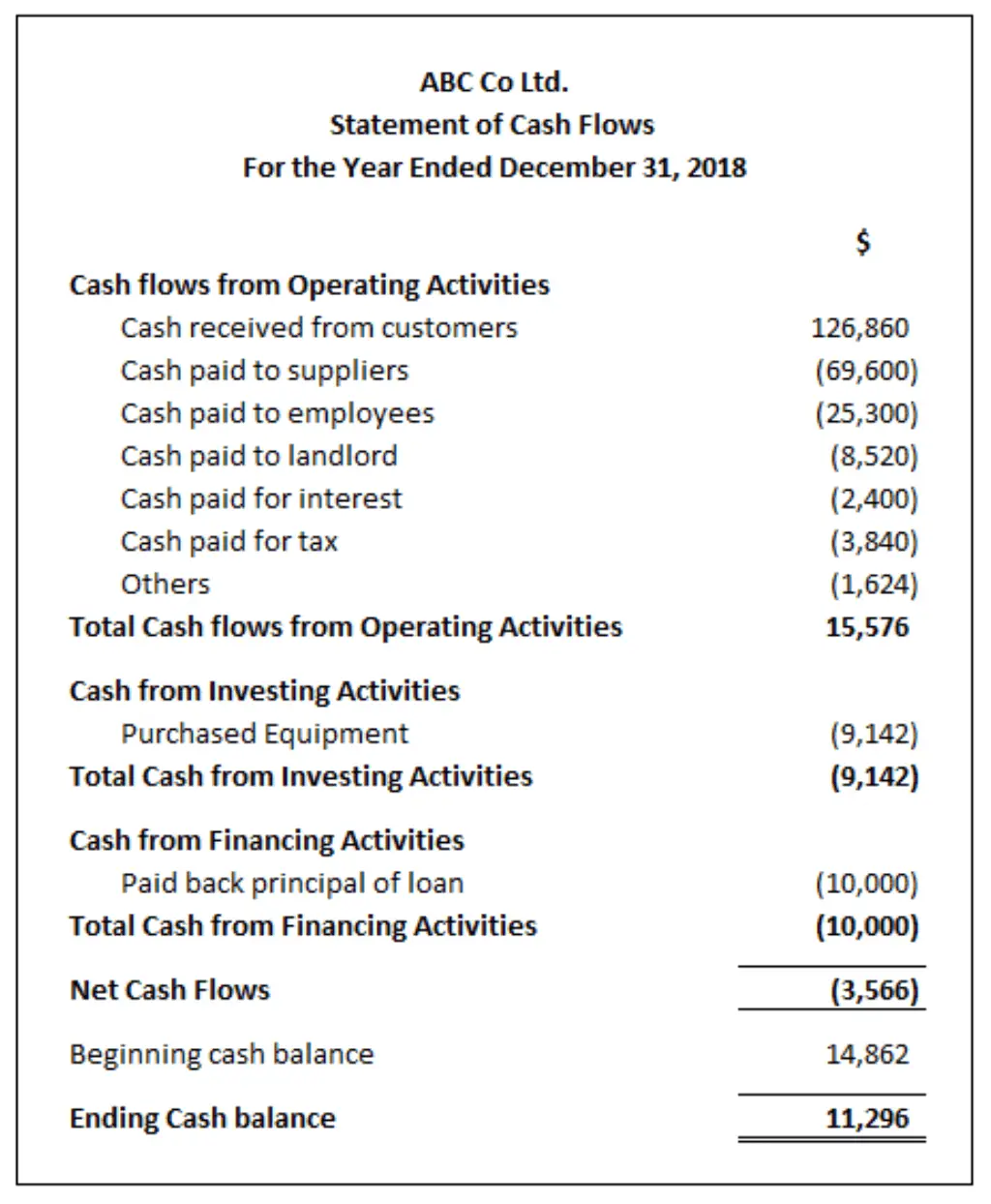

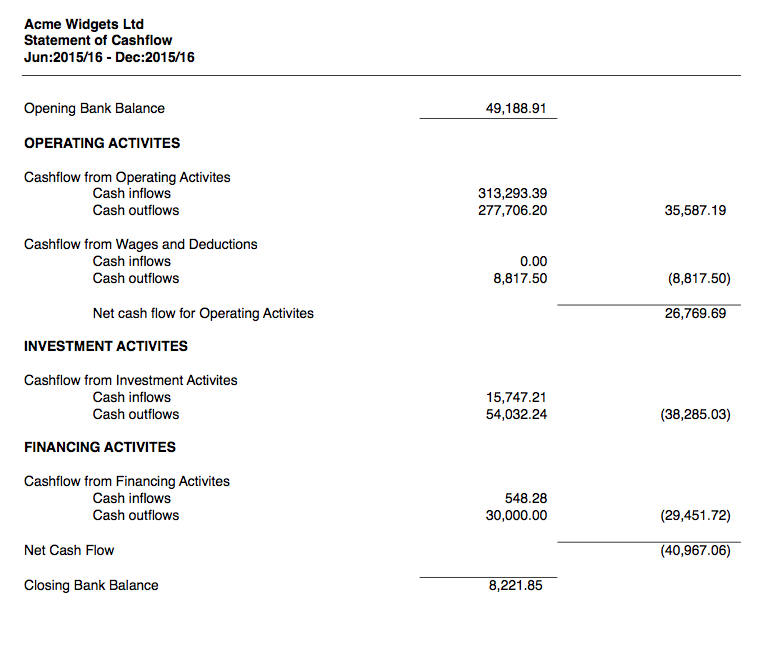

By kaleigh moore nov 28, 2023 on this page what is a cash flow statement? Cash from operating activities, cash from investing activities and cash from financing activities. The cfs highlights a company's cash management, including how well it generates.

The cash flow statement is required for a complete set of financial statements. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

Your company’s cash flow statement provides a detailed look at how your business’s cash has moved during this period, which could be monthly, quarterly, or. The statement of cash flows enables users of the financial statements to determine how well a company’s income generates cash and to predict the potential of a company to generate cash in the future. A cash flow statement is a financial statement that presents total data.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). This includes all money your company makes and spends. Cash flow statements are financial accounting statements that provide a detailed picture of the movement of money through a company — both what comes in and what goes out — during a certain.

Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time. The statement of cash flows identifies the sources of cash as well as the uses of cash, for the period being reported, which leads the user of the financial statement to the period’s net cash flows, which is a method used to determine profitability by measuring the difference between an entity’s cash inflows and cash outflows.

Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally. A cash flow statement is essentially a snapshot of a business’s cash flow during a set time frame. The direct method determines changes in cash receipts and payments.

Explain the need for management to control cash flows; Record adjusted ebitda margin fourth. Explain the differences between profit and cash flows;

The cash flow statement is typically broken into three sections: Explain the value of a statement of cash flows to users of financial statements; A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities.