Outrageous Tips About Internal Income Statement

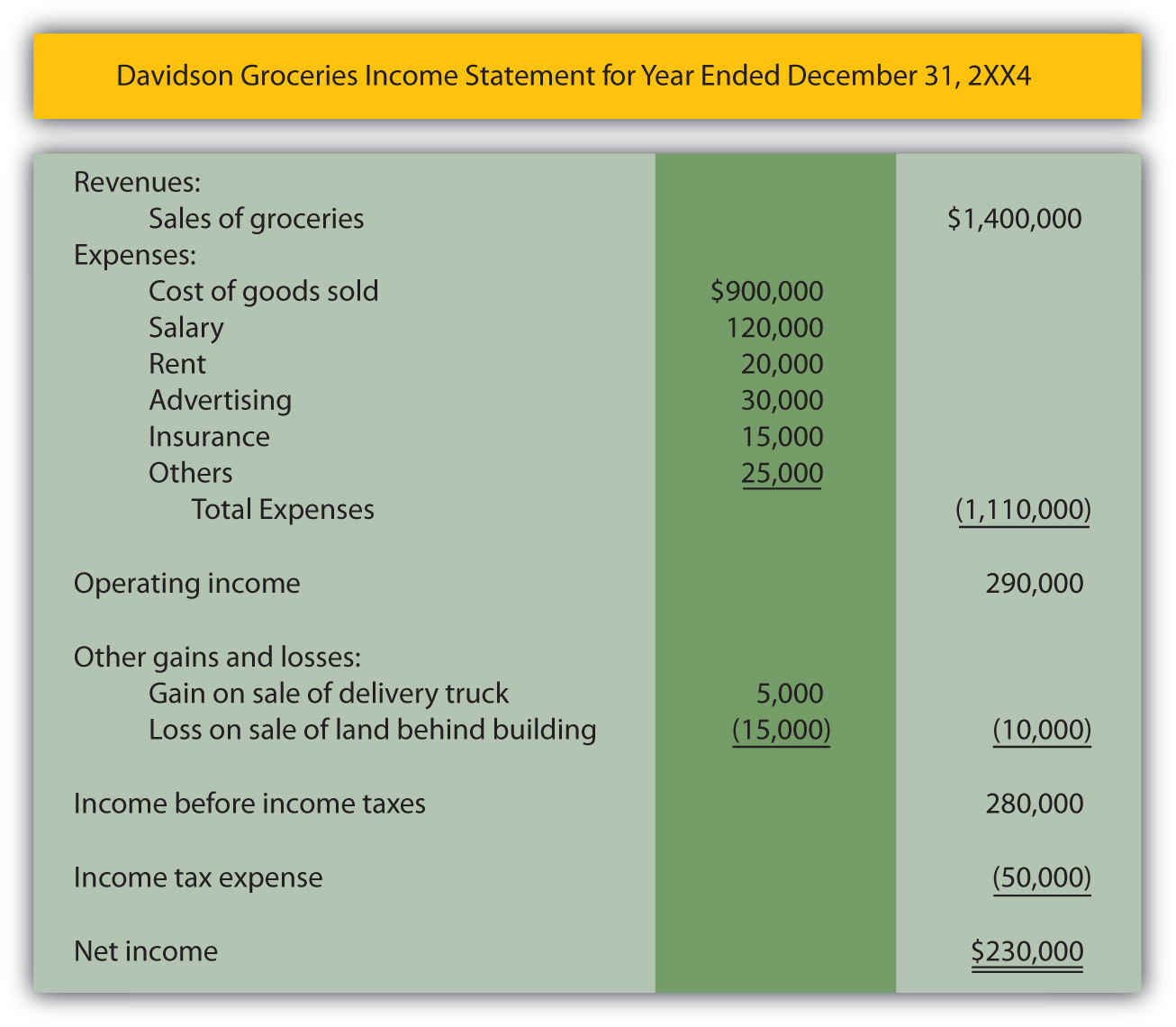

Statement of revenues and expenses.

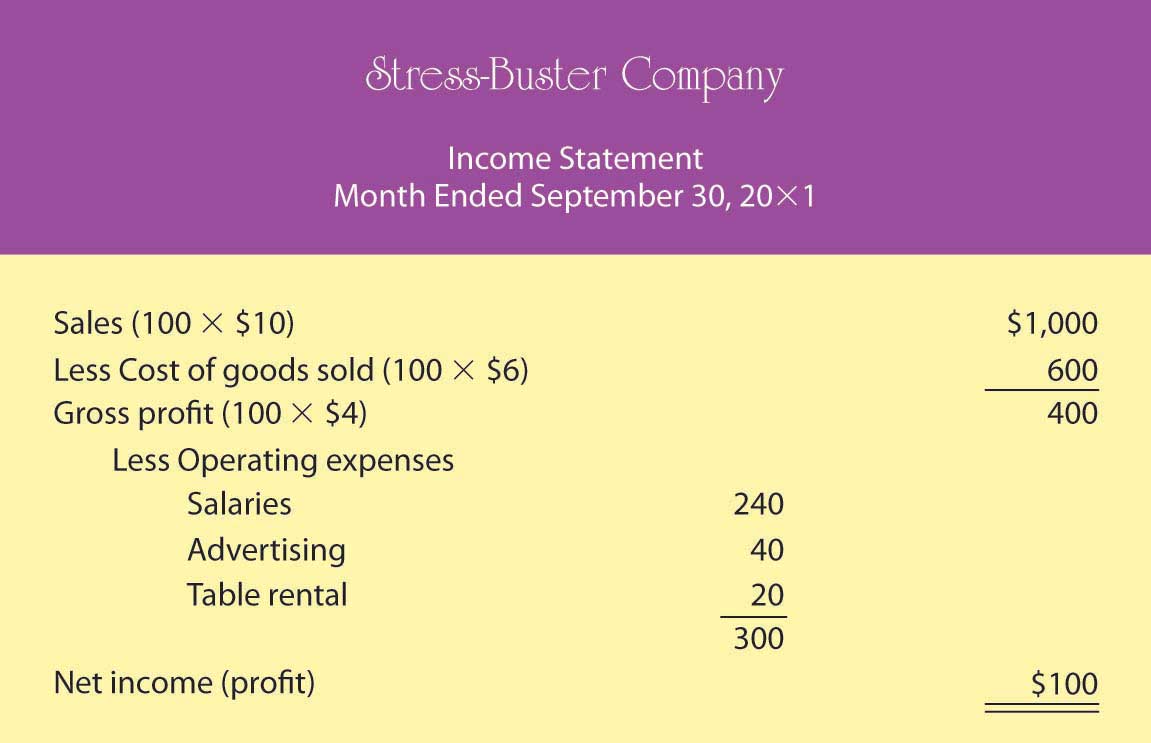

Internal income statement. Net income is shown in the bottom line. Here are a few of the most common: (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

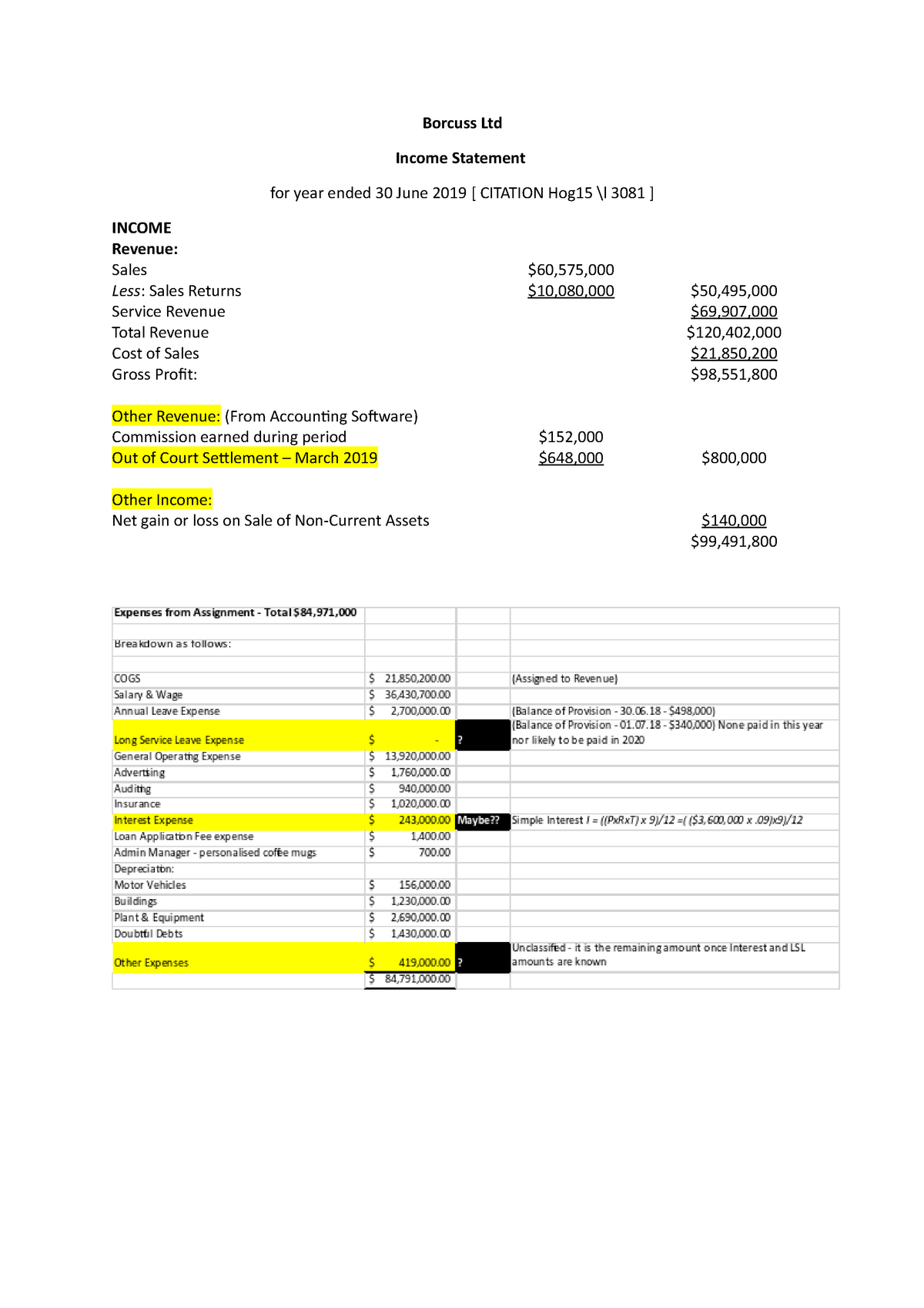

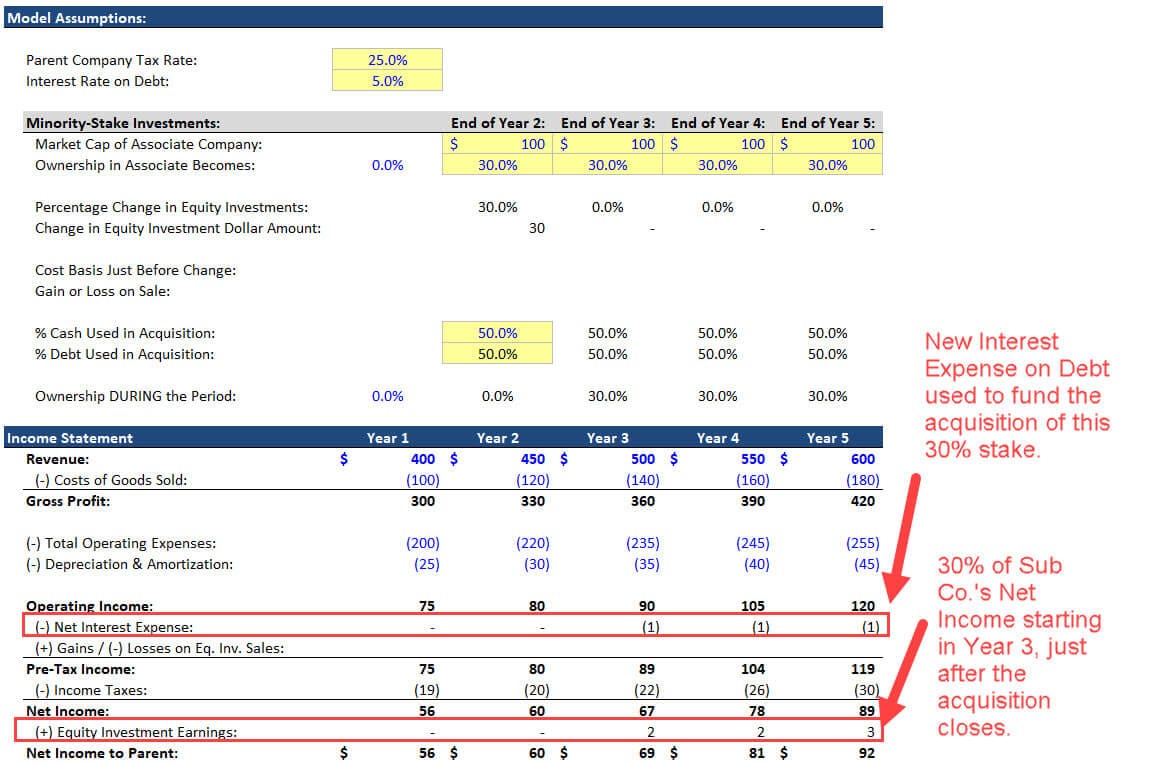

And that extra complication behind income statements is what we’re here to clear up. The more detailed breakdown of expenses can provide a better understanding of how business activities are affecting your bottom line. Statement of operations and operating expenses.

This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. You get the point—beyond the basic concept behind an income statement, things can get a little more complicated than just the difference between your total revenue and your total expenses. Uses of internal financial reports 1.

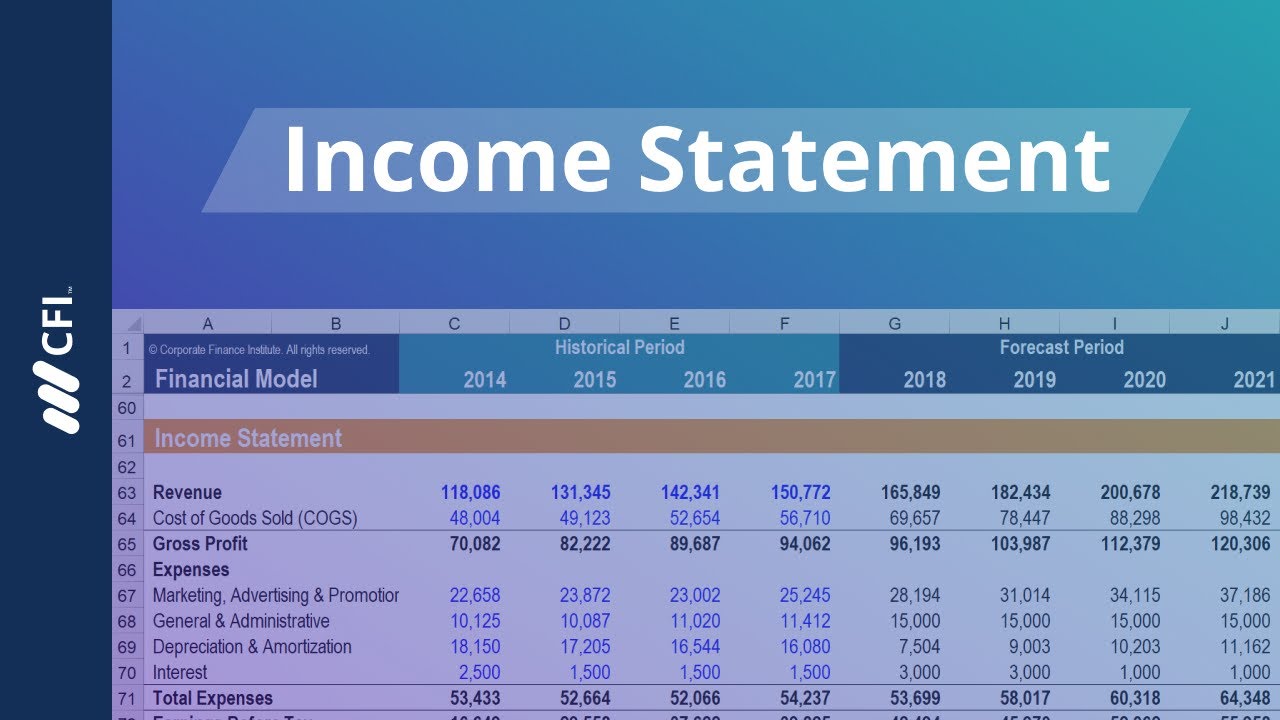

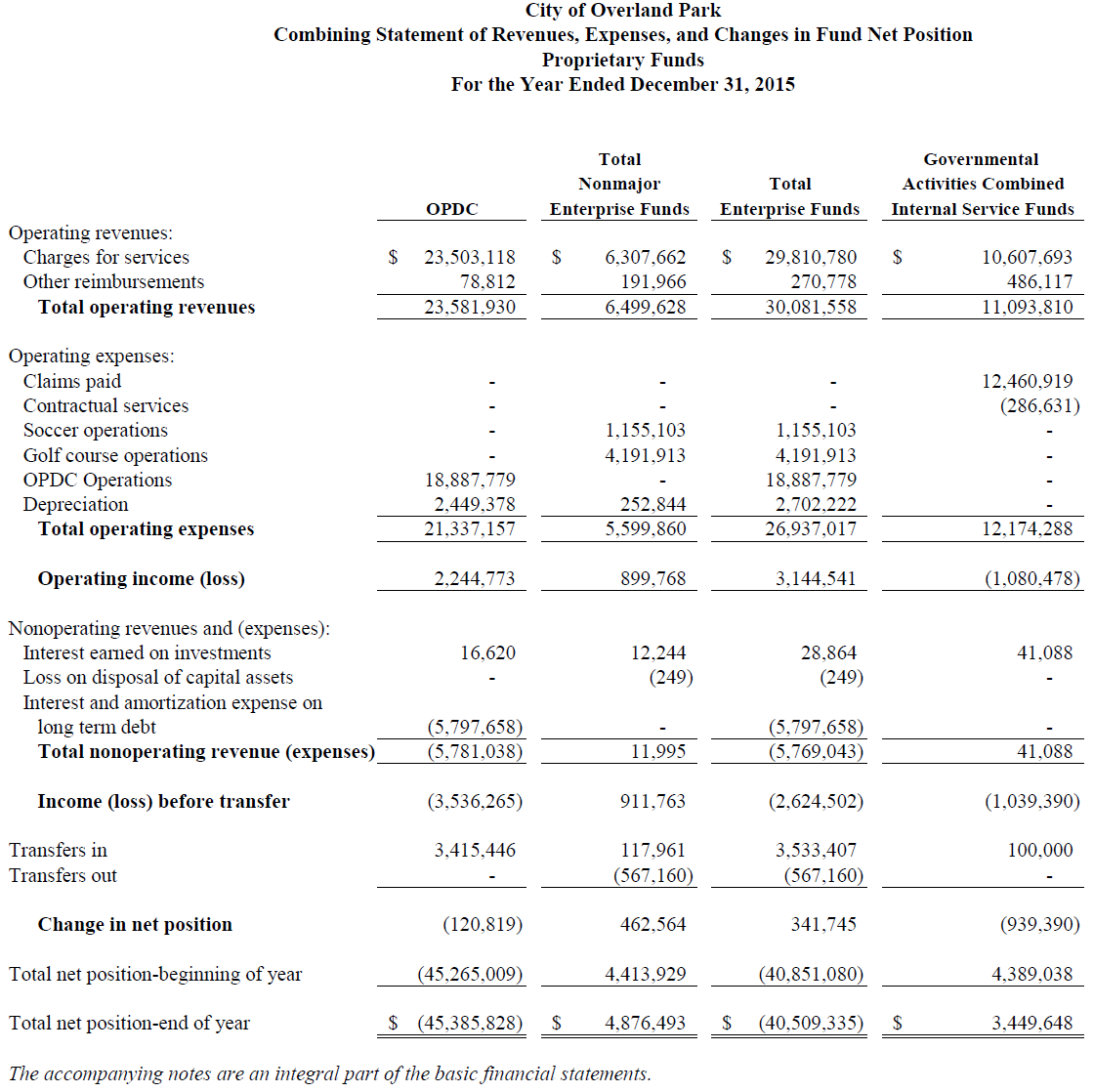

Income from operations of $652 million; Who uses an income statement? There are two different groups of people who use this financial statement:

Each of the financial statements provides important financial information for both internal and external stakeholders of a company. What is the income statement? An internal income statement is an accounting document measuring any financial aspect of a business that its leadership chooses.

There are two main groups of people who use this financial statement: For instance, the expensing of building with an actual historical cost of $400,000 and a useful life of 40 years will mean that the annual depreciation expense will. This year, the process of filing an income tax and benefit return may feel particularly daunting.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20. Once expenses are subtracted from revenues, the statement produces a company's profit. An income statement is a financial statement that shows you how profitable your business was over a given reporting period.

Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company. The income statement focuses on four key items: Written by jeff schmidt reviewed by scott powell what are the three financial statements?

The historical cost principle means that most of the expenses reported on the income statement are the actual costs from past transactions. I have seen internal income statements titled several different ways. Fueling global growth in tight markets

An internal income statement, also referred to as a profit and loss statement, reports revenues and expenses that occur over a specified period, which is usually a year. It shows your revenue, minus your expenses and losses. In such a stressful economic environment, the last thing anyone.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)