Real Info About Current Ratio Decrease Interpretation

It might be required to raise extra finance or extend the time it takes to pay creditors.

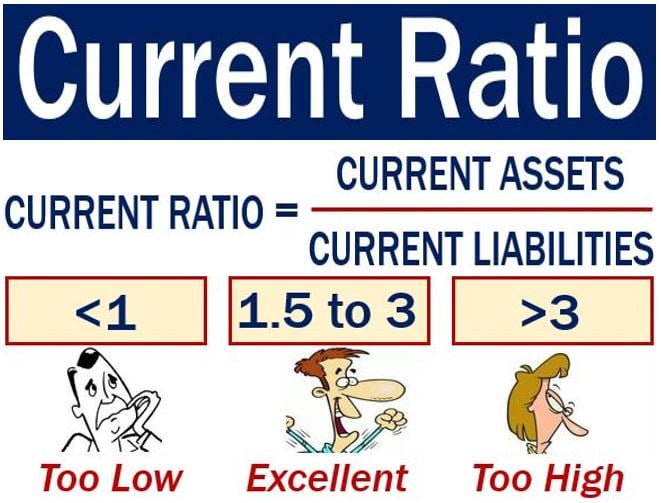

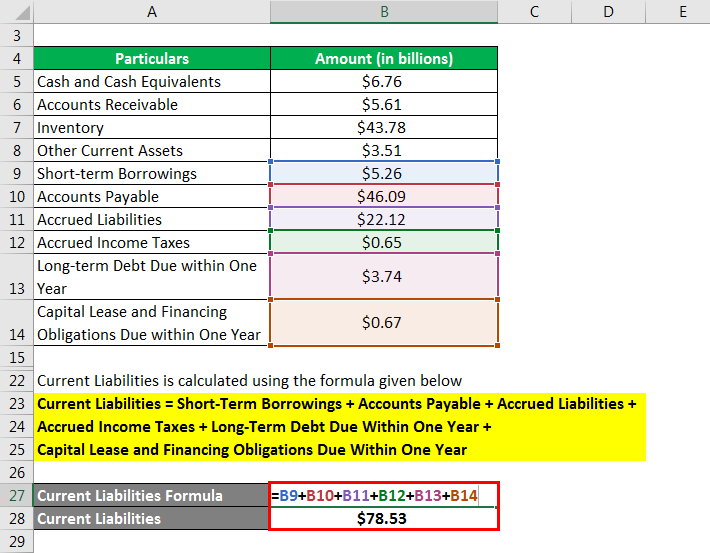

Current ratio decrease interpretation. If a company’s current ratio falls below 1, the company likely won’t have enough liquid assets to pay off its liabilities. · current ratio = 1 this happens when a company’s assets and liabilities are equal. But large businesses in financial trouble face.

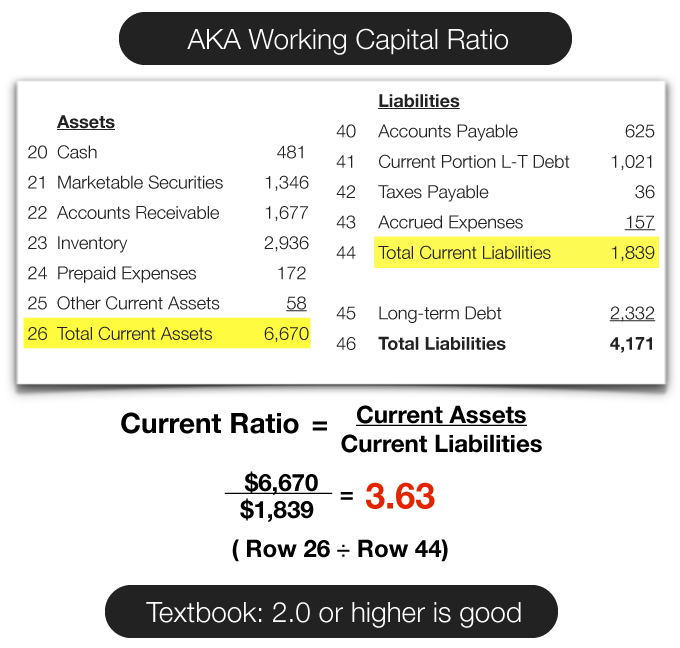

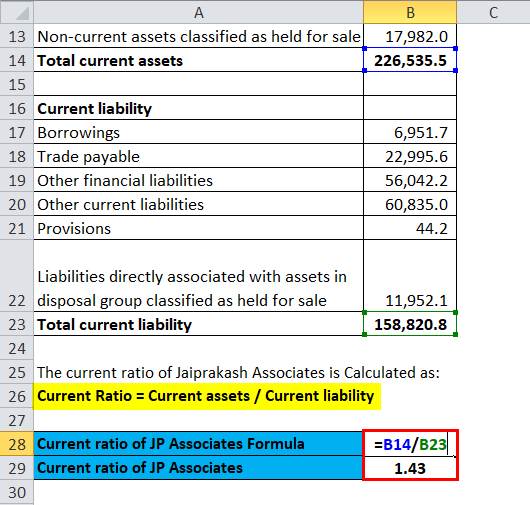

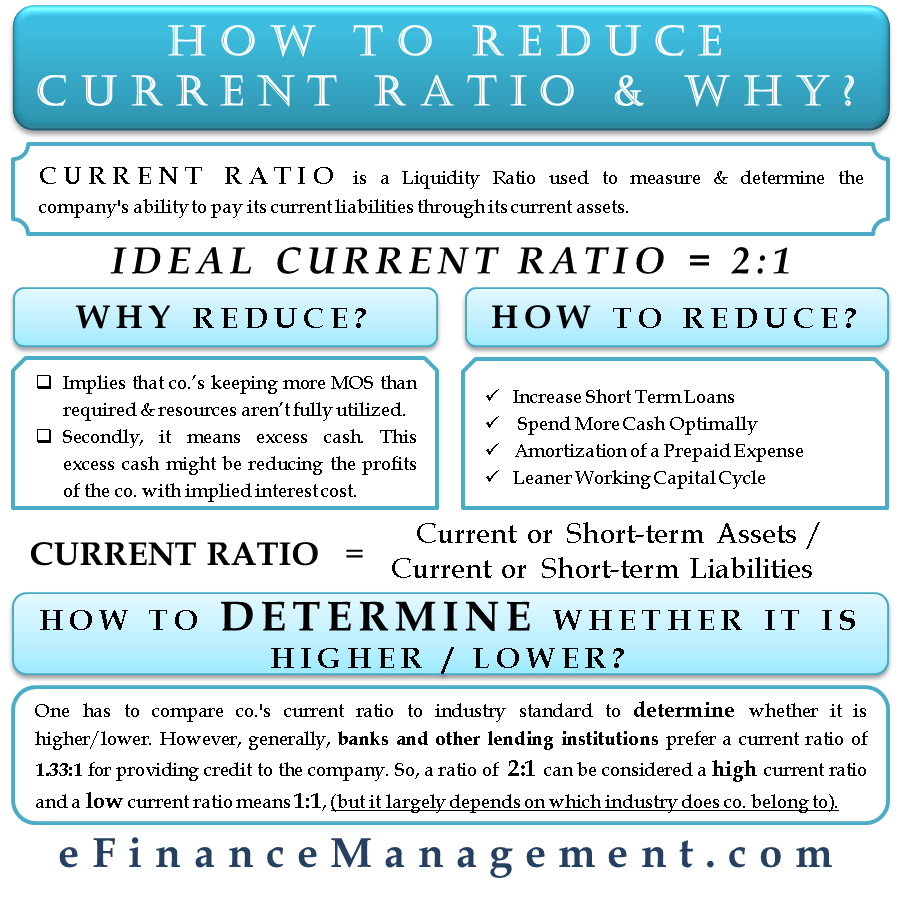

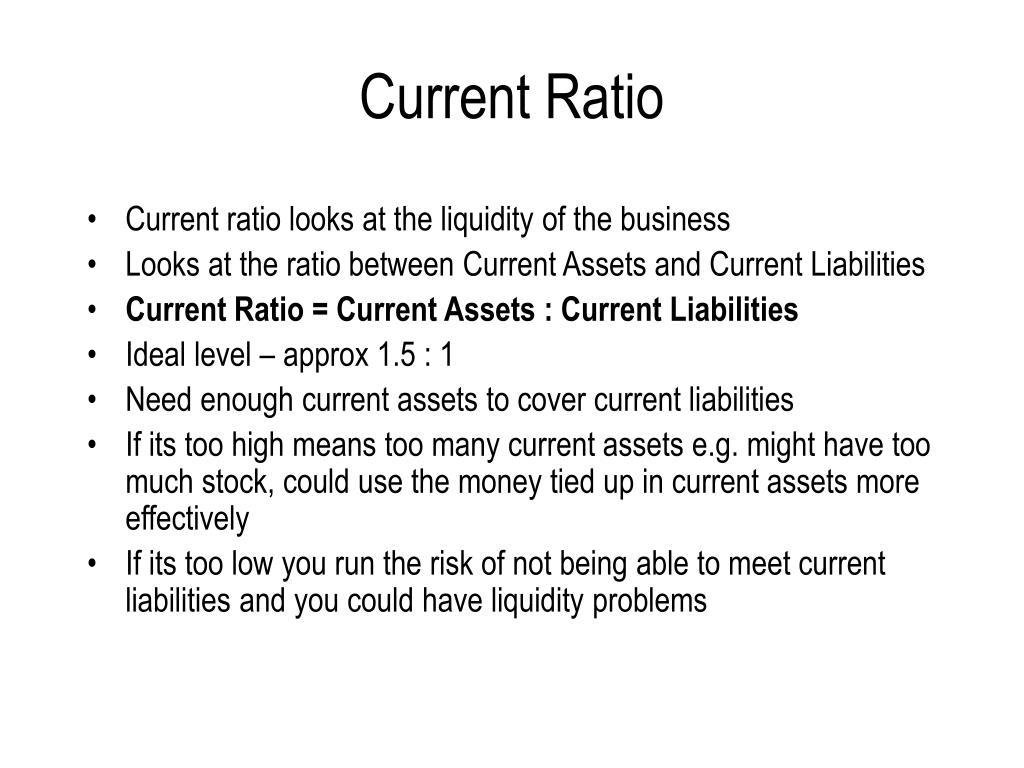

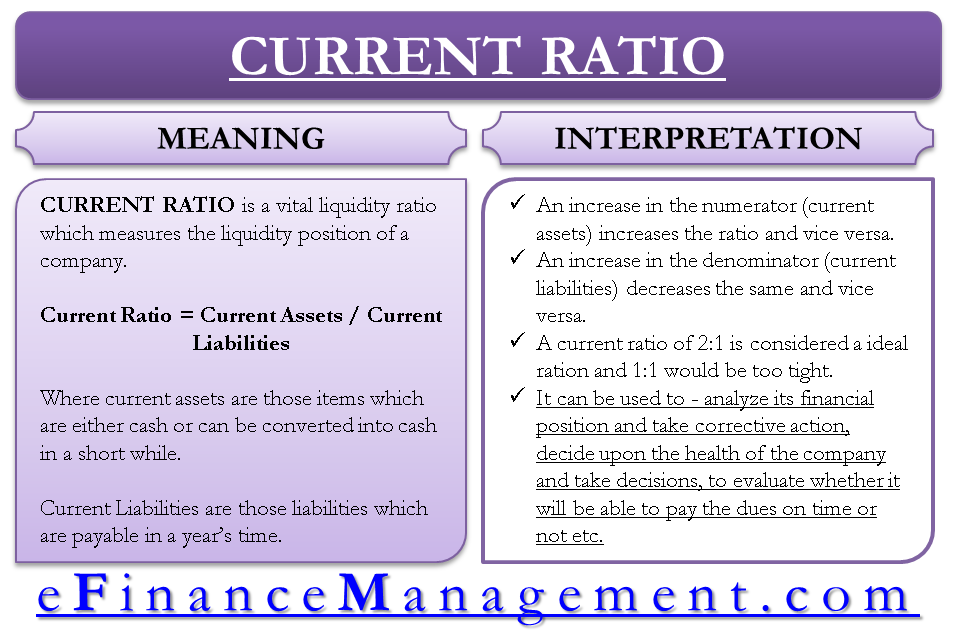

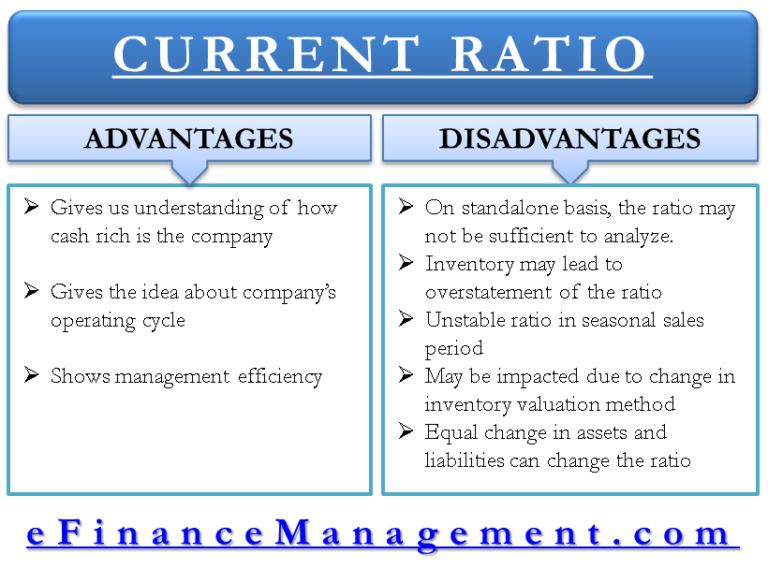

Generally, a decrease in current ratio means that there are problems with inventory management, ineffective or lax standards for collecting receivables, or an excessive cash burn rate. The current ratio should be looked at in the light of what isnormal for the business. Key takeaways the current ratio is a very common financial ratio to measure liquidity.

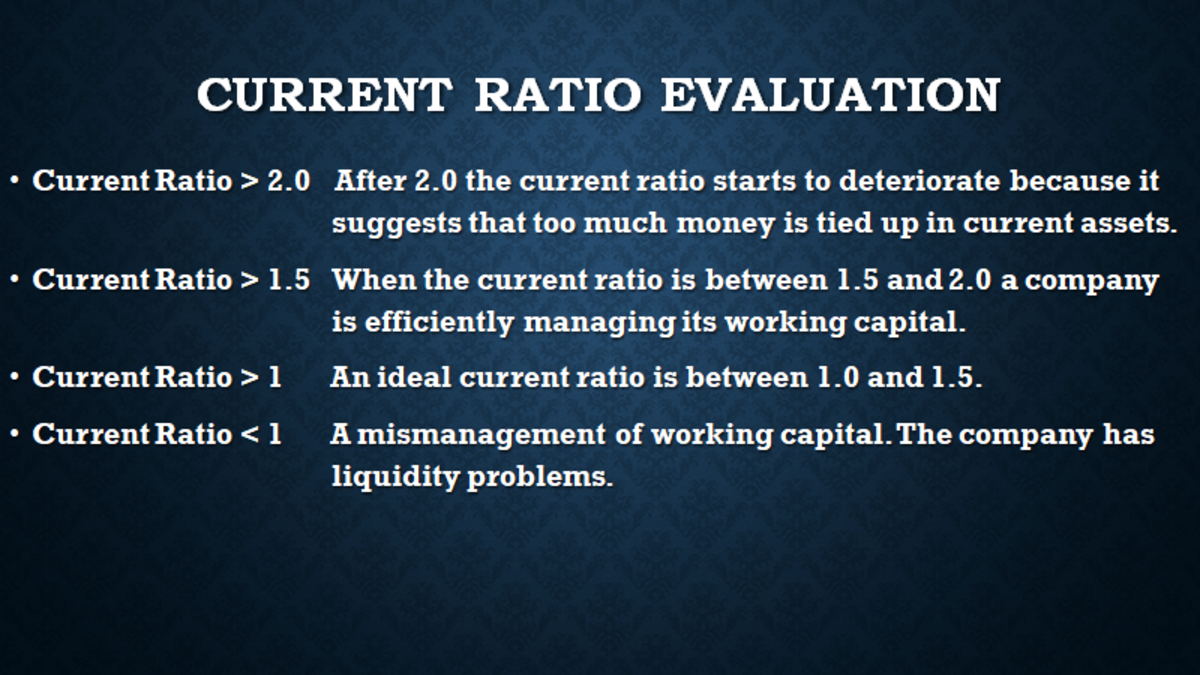

However,more recently a figure of 1.5:1 is regarded as the norm. This ratio can also be presented as 2.5:1. Liquidity concerns are typically indicated by ratios less than one, while working capital management issues are characterized by ratios more than three.

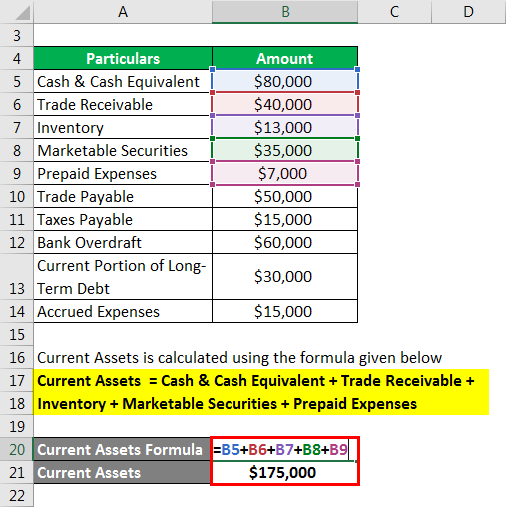

Regardless of the reasons, a decline in this ratio means a reduced ability to generate cash. Hence it is recommended to invest in companies with a current ratio more than one. Current ratio = rs 2, 50,000/rs 1, 00,000.

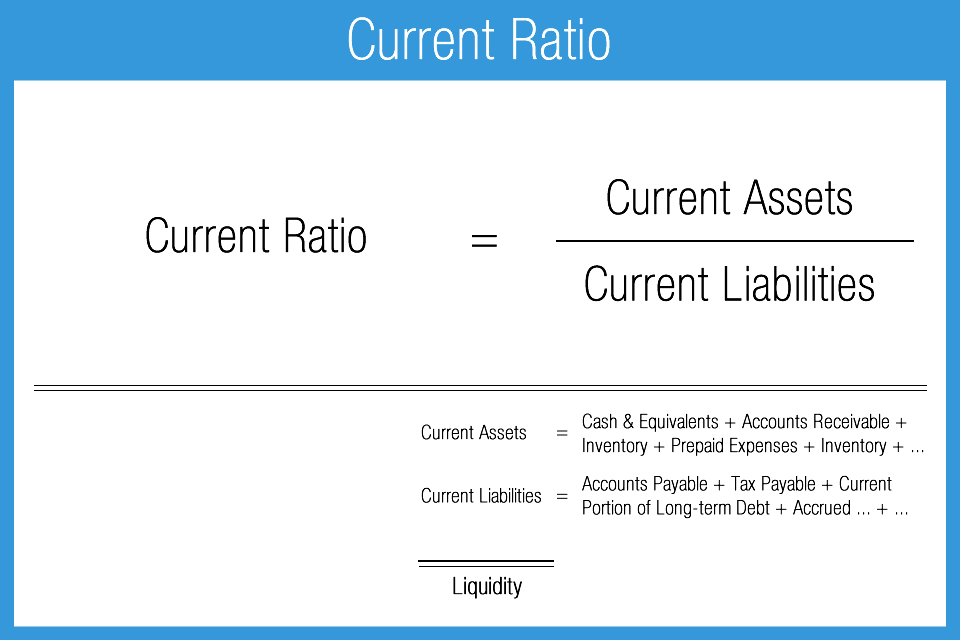

It expresses the proportion of a company's current assets to its current liabilities. A low current ratio of less than 1.0 might suggest that the business is not well placed to pay its debts. It would decrease the level of current liabilities and, therefore, improve the current ratio.

However, it struggles with its comparison with different industry groups. A current ratio of 2:1 is considered a lenient liquidity position, and 1:1 would be too tight. It is also known as working capital ratio.

It helps investors gauge a company’s ability to meet their financial obligations and compare financial soundness with other competitors or stocks. In current ratio, current liabilities are taken as 1 and current assets are given in comparison to it. Written by tim vipond what is the current ratio?

It can also be used to decide whether a business should be shut down. A ratio greater than 1 means that the company has sufficient current assets to. A current ratio of one or more is preferred by investors.

Current ratio can be easily manipulated by equal increase or equal decrease in current assets and current liabilities numbers. Generally, a high current ratio is ideal. But even a small decrease in cash flow can lead to credit defaults.

A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations. An increase in the numerator (current assets) increases the ratio in the current ratio and vice versa. This range suggests that a company has sufficient current assets to cover its current liabilities comfortably.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)