Have A Tips About Deferred Tax Expense On Income Statement

Total income tax expense or benefit for the year generally equals the sum of total income tax currently payable or refundable (i.e., the amount calculated in the.

Deferred tax expense on income statement. It is the opposite of a deferred tax liability,. This future deferred income tax. Accounting for income taxes.

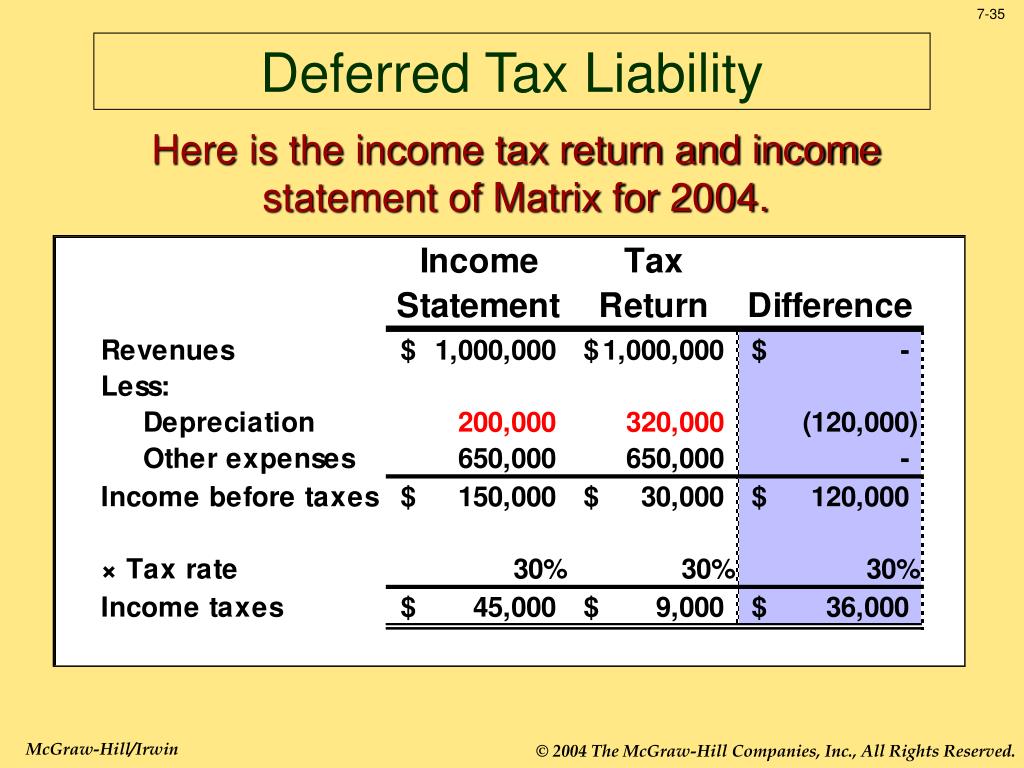

Deferred income tax expense (benefit) represents the anticipated future tax expense (benefit) from activity in past or current periods. Total tax expense = current income tax obligation + deferred tax expense. A deferred tax liability is recorded.

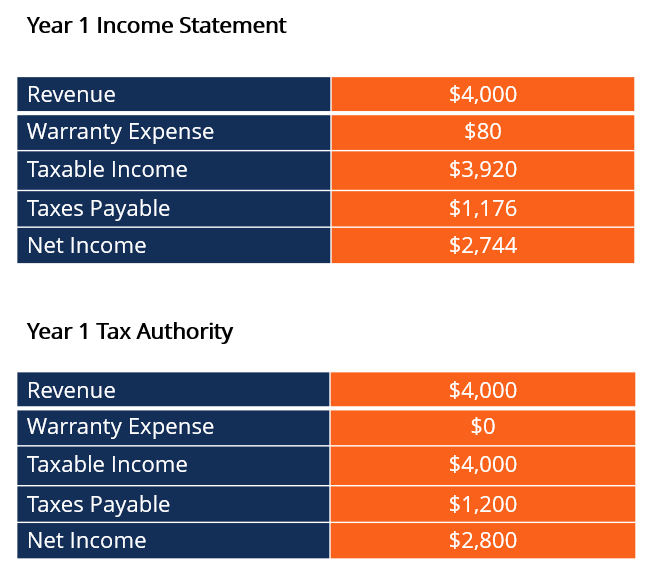

Where deferred tax expense is negative for a period, current tax expense is lower than. Deferred tax is the application of the accruals concept. Now we understand the concept of deferred tax assets and deferred tax liabilities.

The next thing is deferred tax expense. A deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. In the income statement, the provision for income taxes includes the impact of deferred income tax, which helps show how the deferred tax affects the company’s.

Deferred tax expense relating to the origination and reversal of temporary differences: It is important to note that references to ‘income tax’ here are to tax on company profits or losses rather. Current tax expense.

Deferred tax is accounted for in accordance with ias ® 12, income taxes. The following formula can be used in the calculation of deferred. Net operating losses definition:

The following chart illustrates when an accounting asset or liability (excluding income tax accounts) generates a corresponding deferred tax asset or liability: Definition definition items on the balance sheet that are created when the tax paid is less than the tax considered on the income statement. Like deferred revenues, deferred expenses are not reported on the income statement.

The dynamic on the income statement is more complex. The total tax expense in the ifrs income statement is composed of deferred income tax and current income tax. Deferred income taxes are taxes that a company will eventually pay.

A deferred tax liability, or “dtl”, is created when the income tax expense recorded on a company’s income statement prepared under gaap accounting. A deferred tax liability (dtl) or deferred tax asset (dta) is created when there are temporary differences between book (ifrs, gaap) tax and actual income tax. The deferred tax income amounts in 2022 and 2023 represent a negative expense, or a recovery of the expense that was previously charged in 2021.

As deferred tax primarily arises due to timing differences between the accounting and taxation treatment.

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)