Peerless Tips About Bank Balance Sheet Meaning

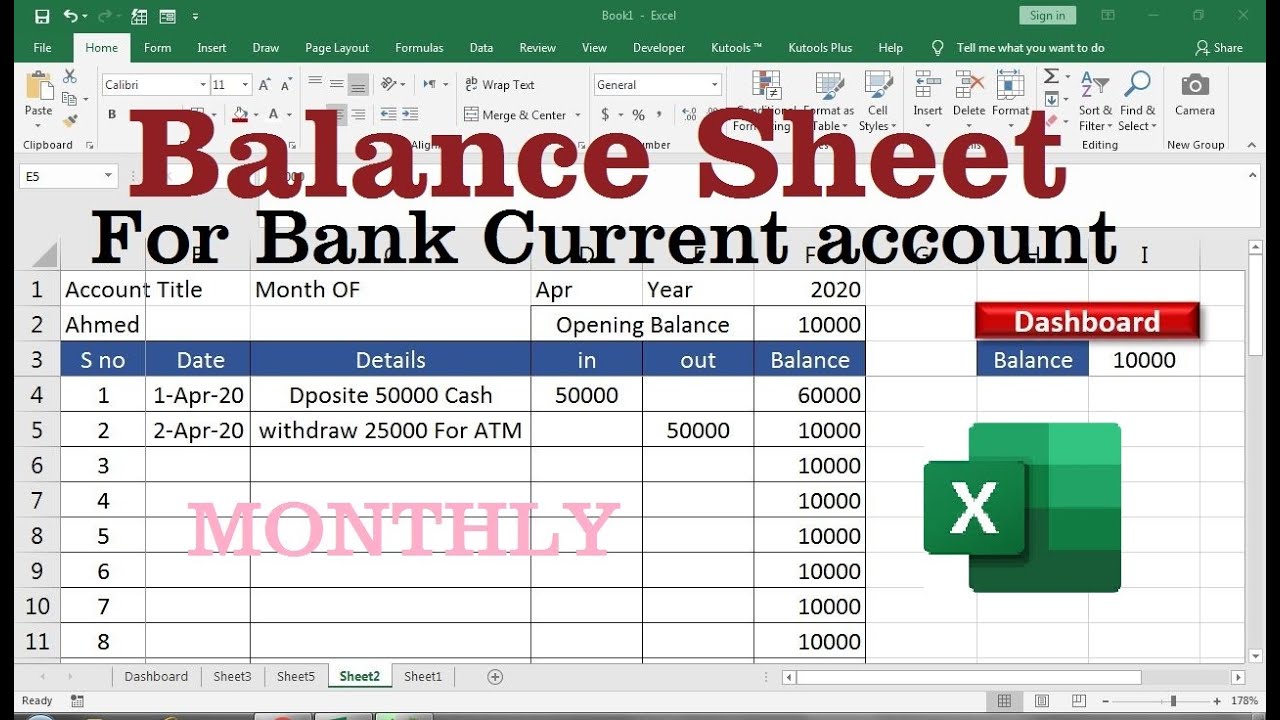

A bank balance sheet is a summary of the bank’s financial situation at a given point in time.

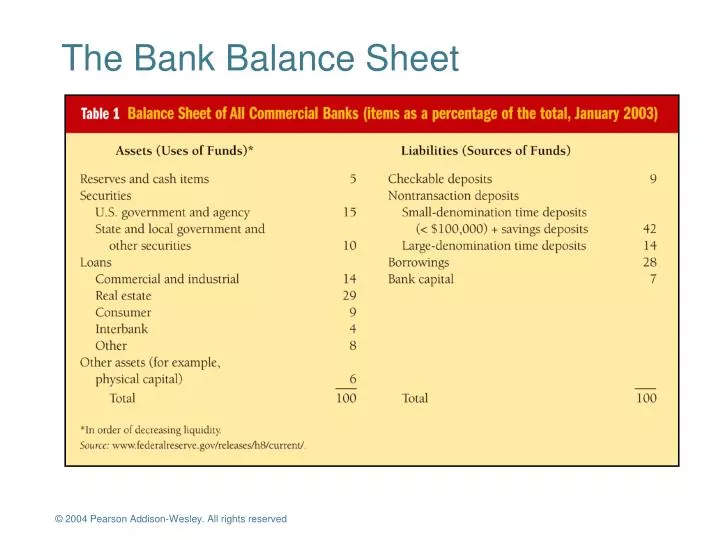

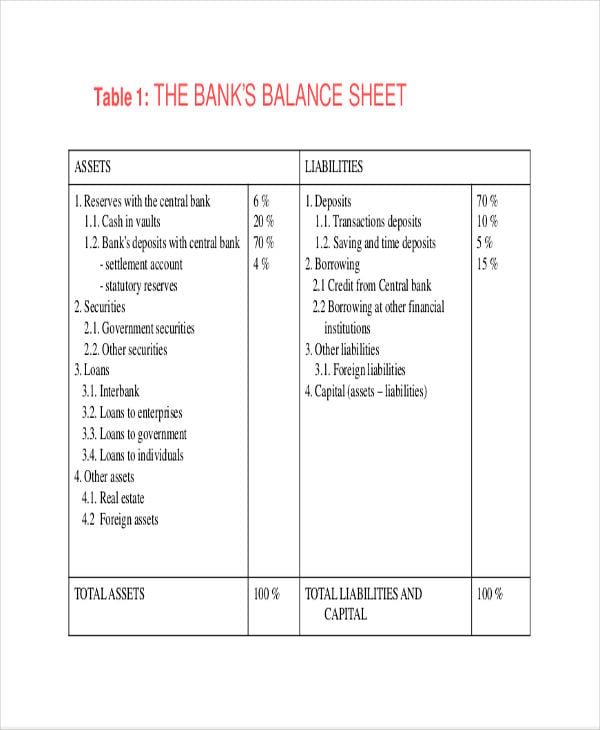

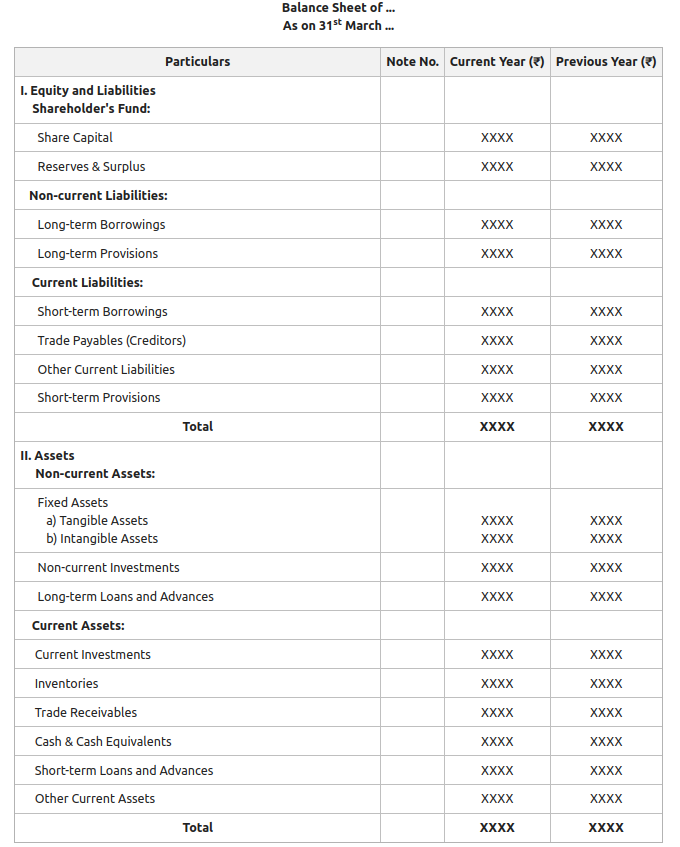

Bank balance sheet meaning. Balance sheets examine risk. Bank balance sheets report the assets, liabilities, and bank capital for an individual bank. A balance sheet (aka statement of condition, statement of financial position) is a financial report that shows the value of a company's assets, liabilities, and owner's equity on a.

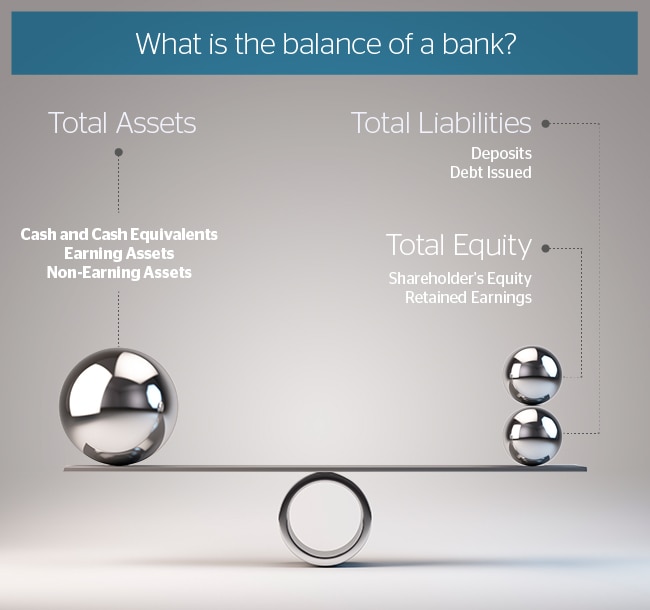

A balance sheet is one of the final financial statements prepared by a business. Assets = liabilities + capital. A bank’s balance sheet can be defined as a part of a bank’s financial statements, which represent the financial position, i.e., the.

Definition of banks balance sheet. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s regulatory authority. What is a balance sheet?

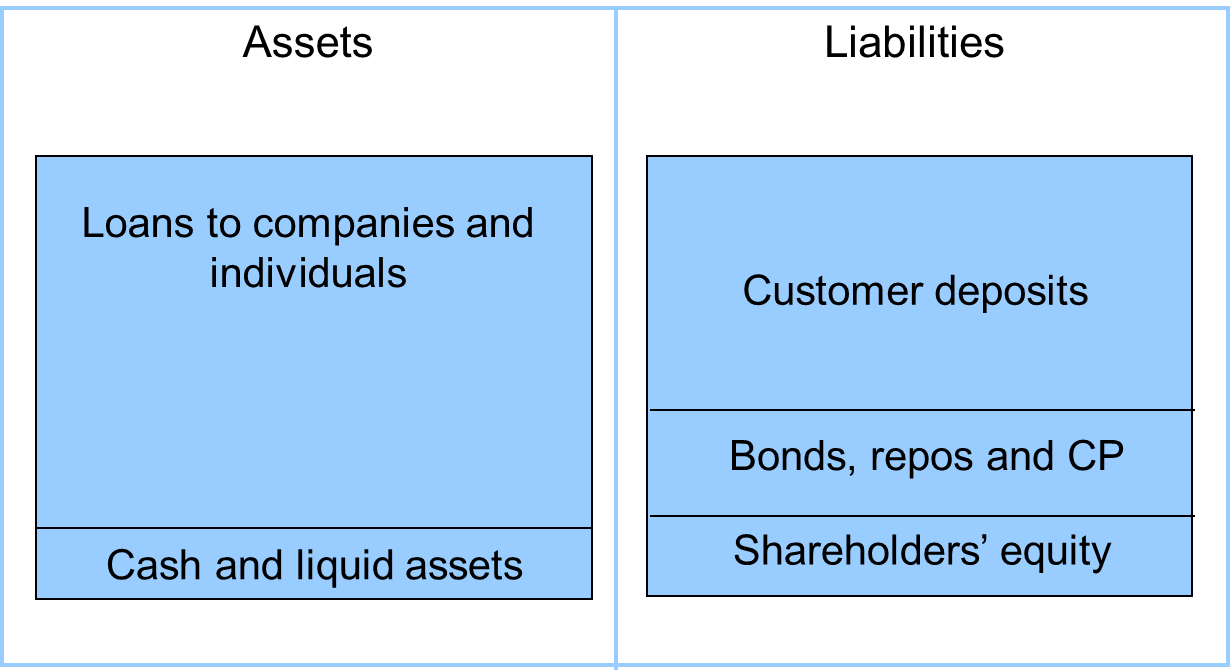

It shows what the bank owns (assets) and what it owes (liabilities) to others. The volume of business of a bank is. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top.

Assets = liabilities + owner’s equity. The balance sheet may also be called the statement of financial position or statement of financial condition because it. The balance sheet is a statement that shows the financial position of the business.

It includes important information about the. It records the assets and liabilities of the business at the end of the accounting period after. Typical balance sheet a typical balance sheet consists of the core accounting equation, assets equal liabilities plus equity.

The balance sheet identity is: From a balance sheet standpoint, we do think that there is an ability to flex and to sometimes even unbundle their balance sheet. The balance sheet, in simple terms, can be defined as a document or a statement that highlights the financial state of a company at any given date.

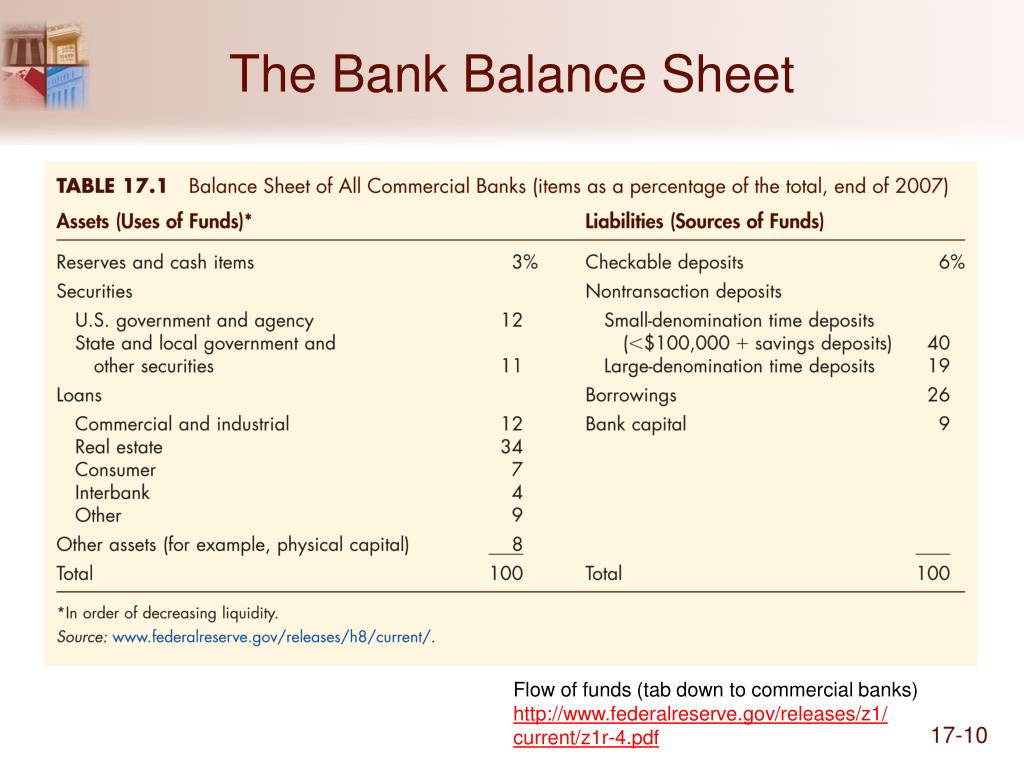

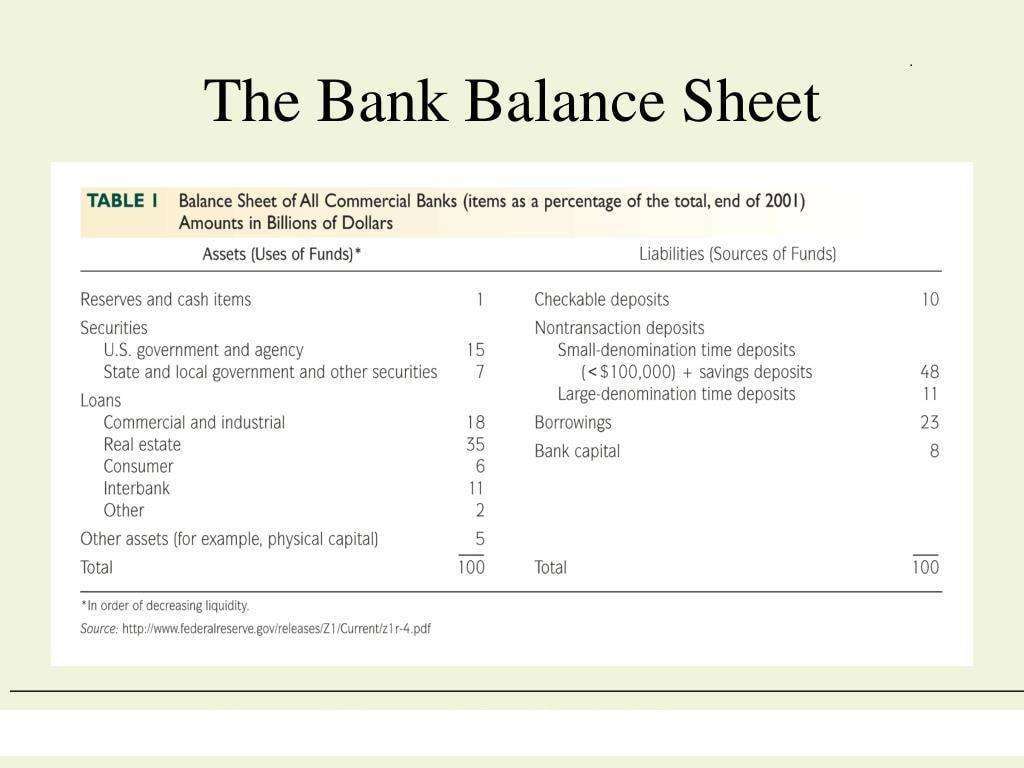

The assets in the financial statement for banks are the lending resources available with the banks, while the liabilities in these balance sheets indicate the deposits that customers make along with other financial. Assets go on one side, liabilities plus equity go on the other. The assets are items that.

The result must be the same as the total assets. The balance sheet is just a matter of adding liabilities plus equity. Banks balance sheet reflects the capacity of the banking institutions to lend money to customers.

With this information, a company can quickly assess whether it. The fed discloses it weekly in table 5 of its h.4.1. The balance sheet of the federal reserve bank like any balance sheet, the fed's shows its assets and liabilities.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)

![[Economics] What is Understanding Balance sheet of a Commercial Bank](https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/d41d2102-4f84-4785-90c3-817a96d6ad2b/balance-sheet-of-a-company-vs-balance-sheet-of-bank---teachoo.jpg)