Lessons I Learned From Info About Non Going Concern Financial Statements

What is going concern?

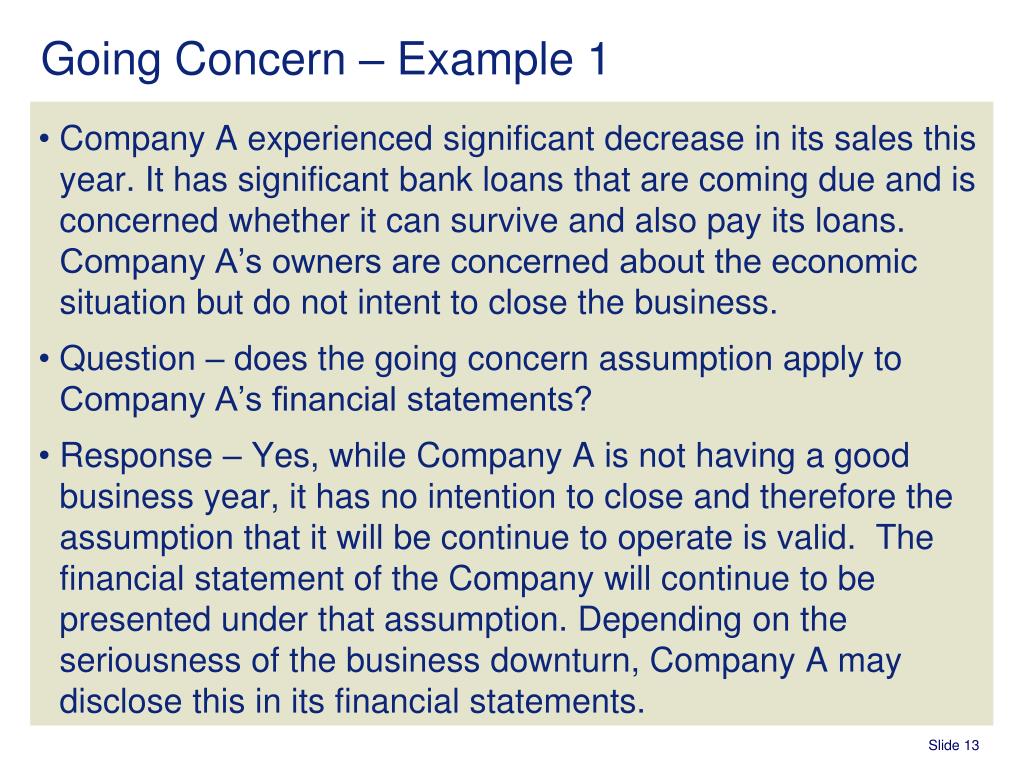

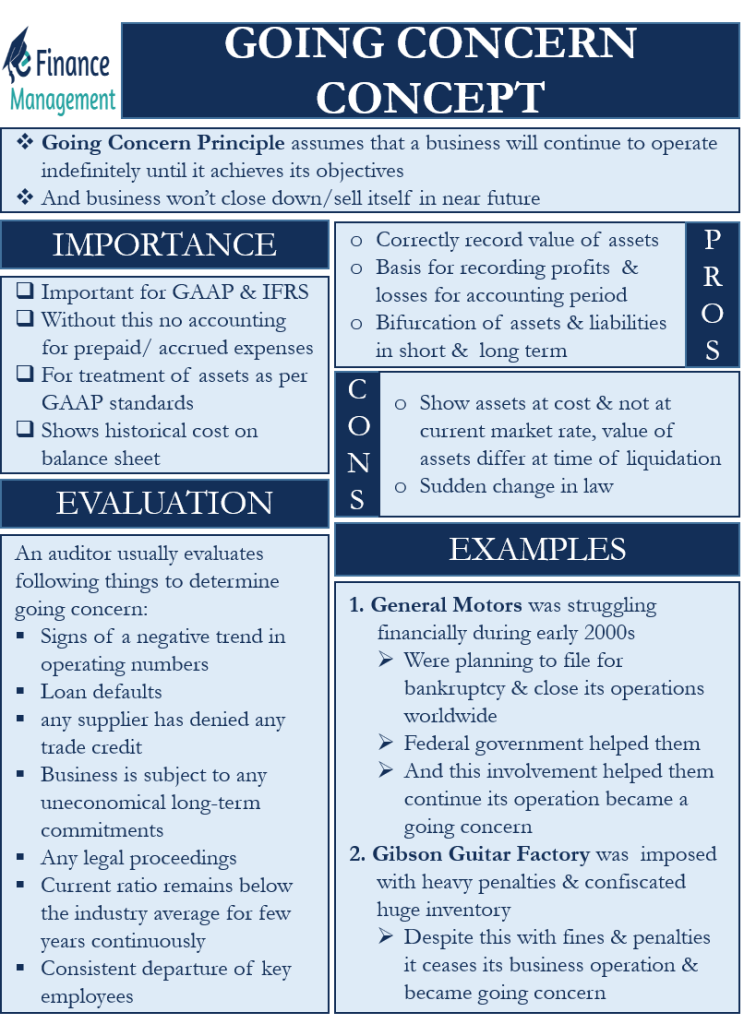

Non going concern financial statements. Mfrs 101 “presentation of financial statements” permits an entity that is no longer a going concern to prepare financial statements on a different basis but still in accordance with mfrs. Documents shown during trial ranged from spreadsheets to signed financial statements. It says that all entities have to prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so.

In one example, the attorney general's legal team showed that trump's triplex in his eponymously named. At its june 2021 meeting, the ifrs interpretations committee decided to finalise the agenda decision. The disclosures that an entity should give about the date when the financial statements were authorised for issue and about events after the reporting period.

It is one of the basic assumptions described in ias 1 presentation of financial statements. The submission asked whether an entity that is no longer a going concern: Not only does this present.

They did not identify any entity restating comparative information to. Ind as 1, presentation of financial statements, requires while preparing financial statements, management shall make an assessment of an entity’s ability to continue as a going concern. The staff of the australian accounting standards board (aasb) has published 'going concern disclosures:

When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern” (ias 1.25). Paragraph 14 of ias 10 states that ‘an entity shall not prepare its financial statements on a going concern basis if management determines after the reporting period either that it intends to liquidate the entity or to cease trading, or that it. When an entity should adjust its financial statements for events after the reporting period;

The objective of this standard is to prescribe: When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern' (ias 1.25). When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern” (ias 1.25).

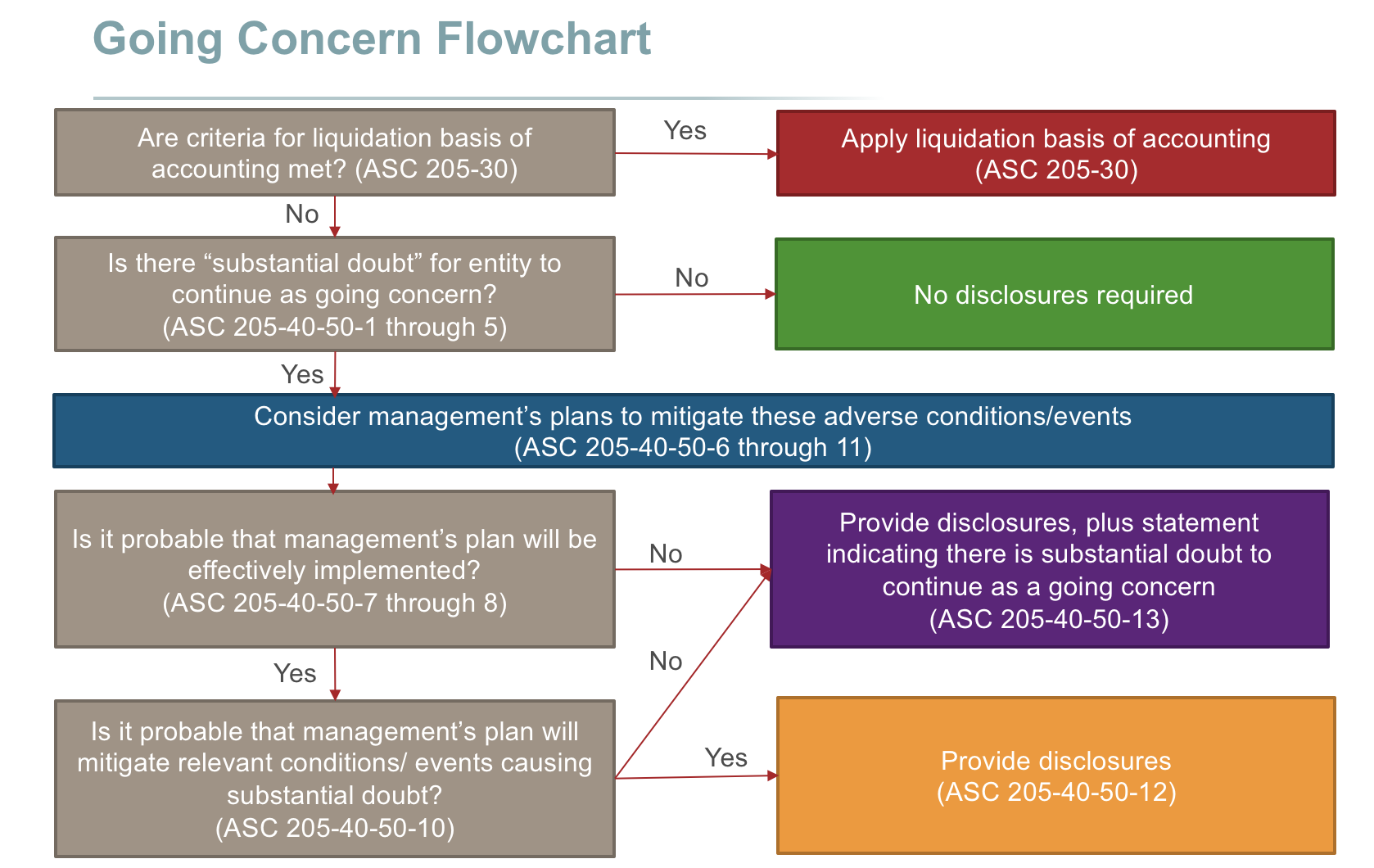

Preparing financial statements when the going concern basis is not appropriate. 24.5.1 assessing going concern financial reporting under us gaap assumes that a reporting entity will continue to operate as a going concern until its liquidation becomes imminent. Both ias 1 ‘presentation of financial statements’ and ias 10 ‘events after the reporting period’ suggest that a departure from the going concern basis is required when specified circumstances exist.

Paragraph 25 of ias 1 requires the entity to disclose the fact that the financial statements have not been prepared on a going concern basis and the reasons why the entity is not regarded as a going concern, as well as disclosing the basis on which the financial statements have been prepared. Can prepare financial statements for prior periods on a going concern basis if it was a going concern in those periods and has not previously prepared financial statements for those periods (question i); On 12 february 2021, the ifrs interpretation committee (“ifric”) issued a tentative agenda decision on the issue relating to the preparation of financial statements when an entity is no longer a going concern.

When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern' (ias 1.25). In accordance with paragraph 8.7 of the ifrs foundation’s due process handbook the board, at its june 2021. However the standards state that when a company does not prepare financial statements on a going concern basis, it should disclose that fact, together with the basis on which it prepared the financial statements and the reason why the company is not regarded as a going concern.

An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)