Best Of The Best Info About Consolidated Retained Earnings Formula

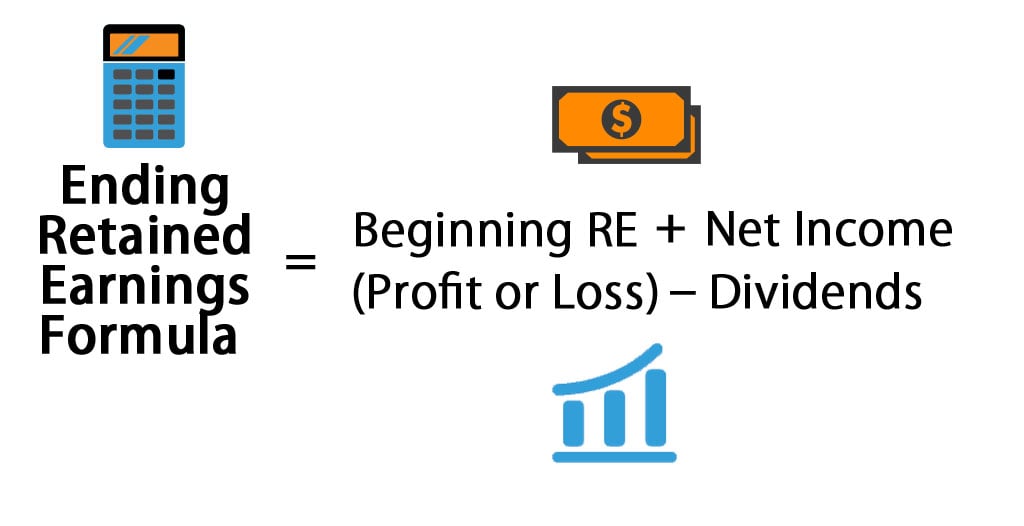

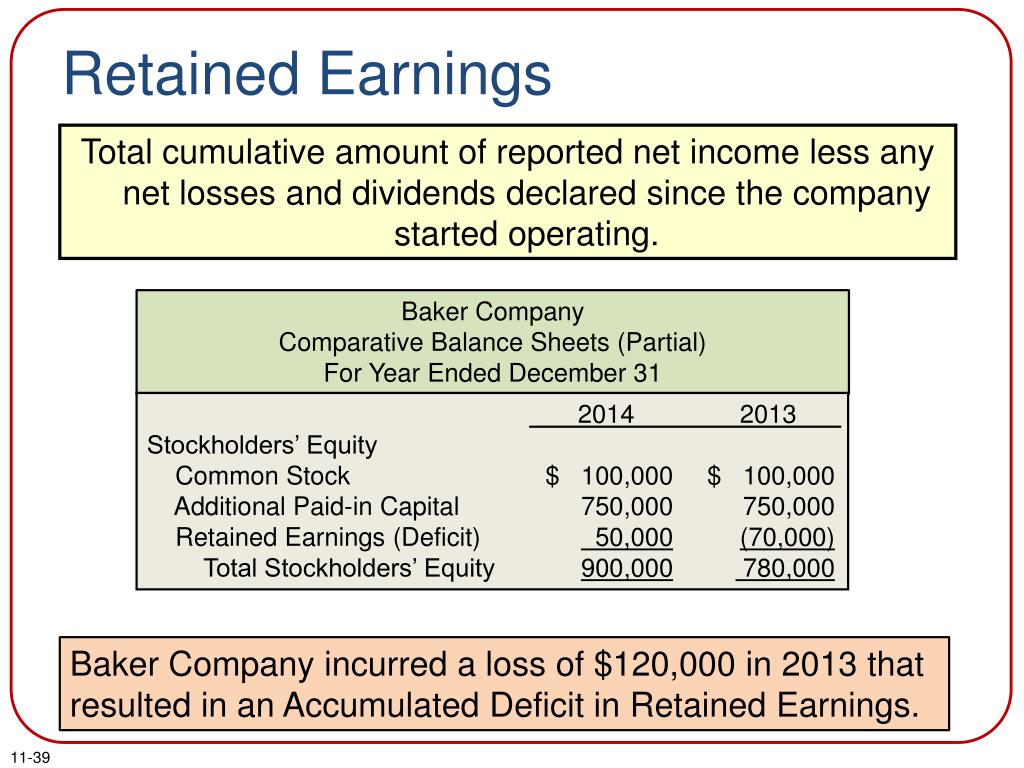

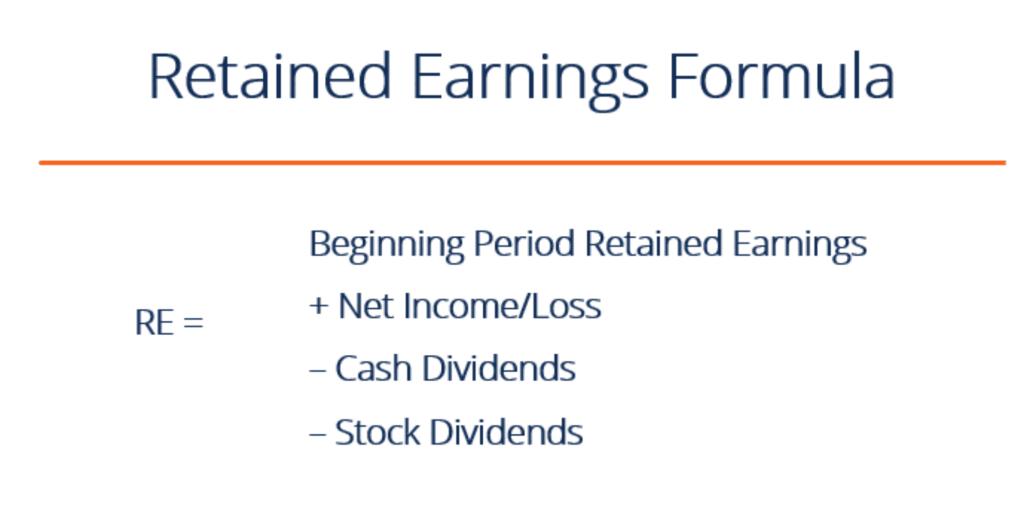

Retained earnings are calculated by subtracting distributions to shareholders from net income.

Consolidated retained earnings formula. Retained earnings formula and calculation. Determine which entities the parent company controls based on ownership percentage and voting. All the paragraphs have equal authority but retain the.

The following formula can be used to work out consolidated retained earnings: The key steps are: 12, the day before reports about deal talks.

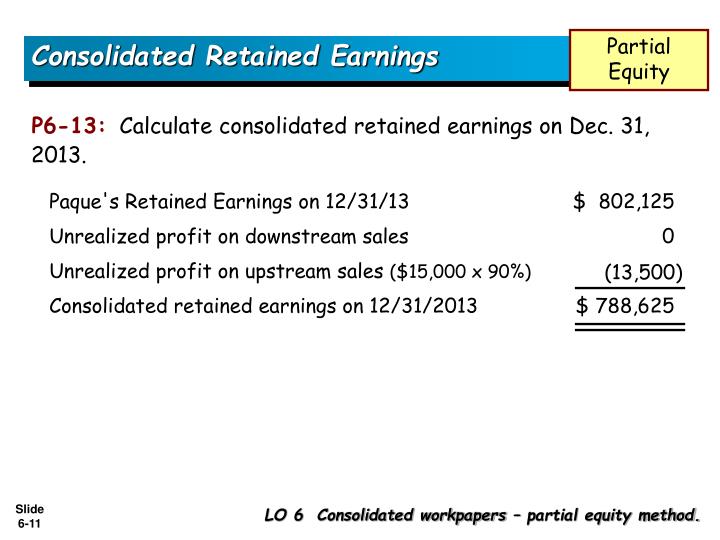

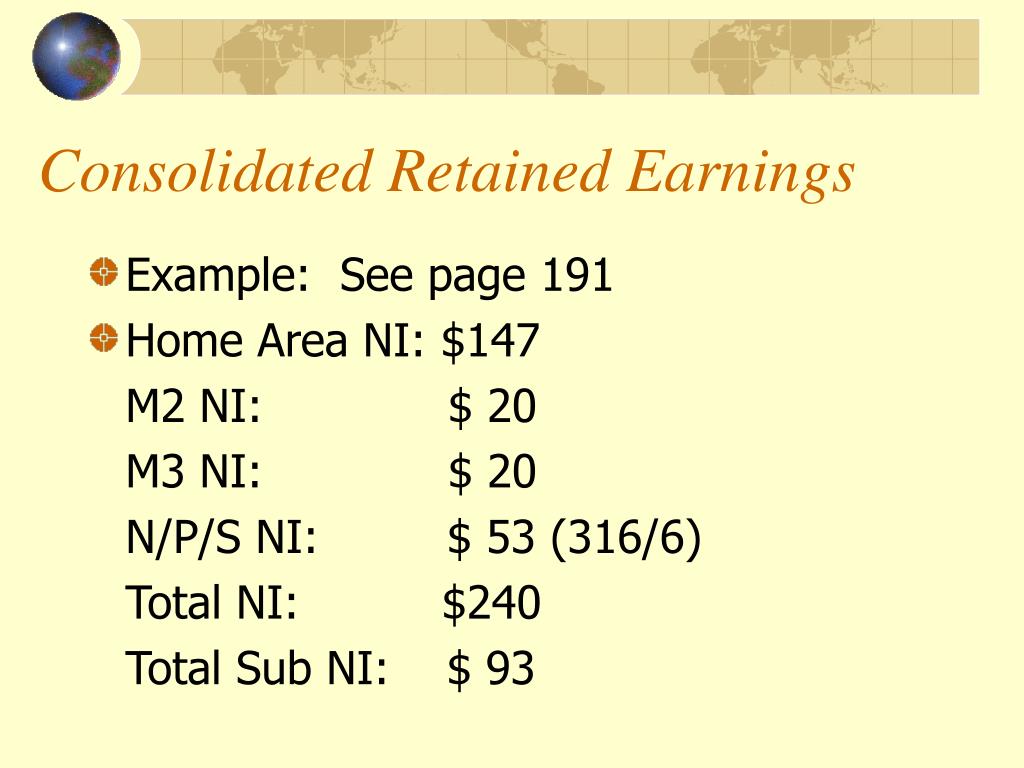

Retained earnings is very important as it reports how the company is growing with respect to its profit. The fiscal year targets include the impact of an extra week in. Consolidated net income is the sum of net income of the parent company excluding any income from subsidiaries recognized in its individual financial statements.

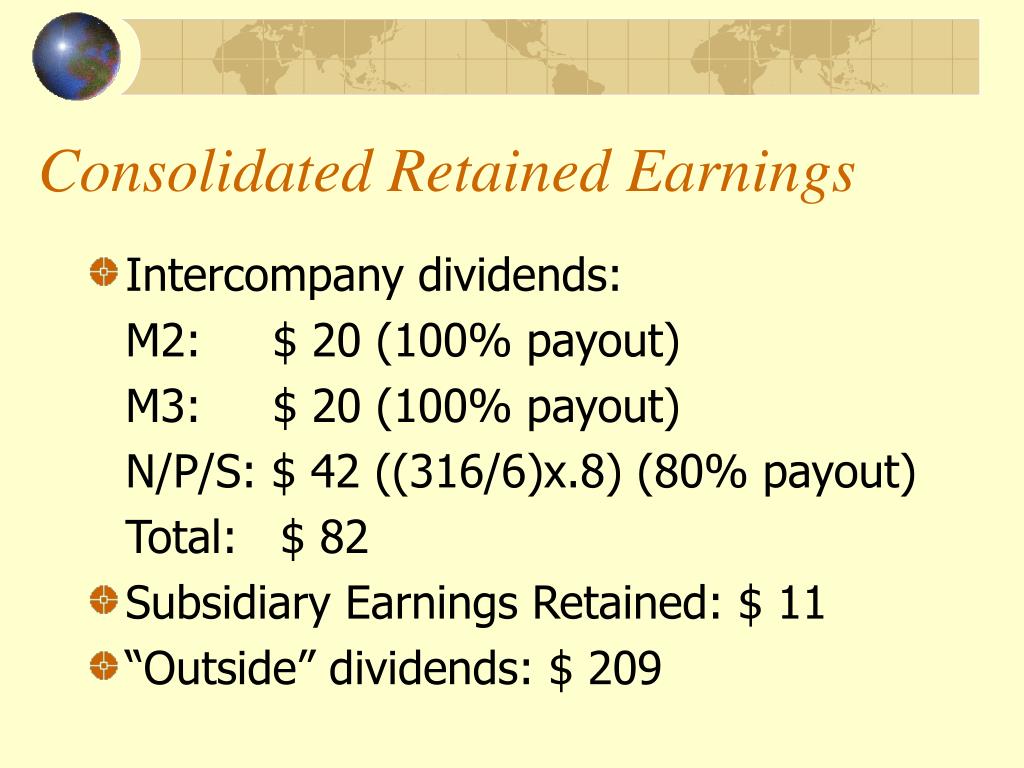

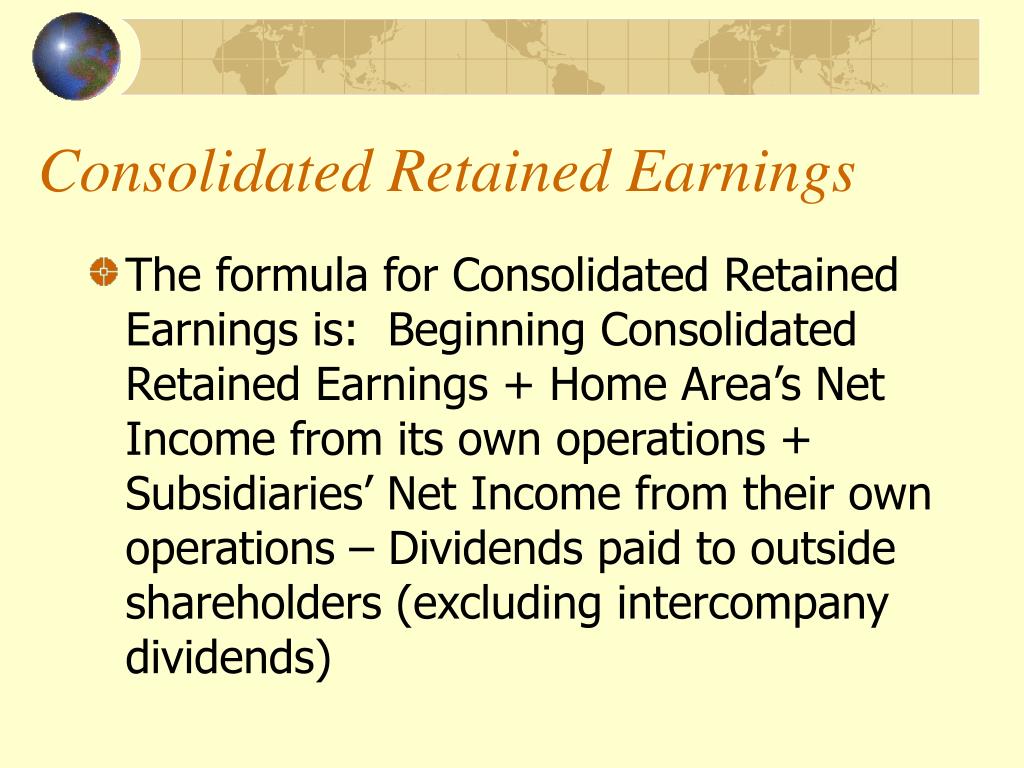

Consolidated retained earnings • consolidated retained earnings is that portion of the undistributed earnings of the consolidated enterprise accruing to the shareholders of. Synopsys also provided its consolidated financial targets for the second quarter and full fiscal year 2024. Beginning retained earnings → the ending retained earnings.

The retained earnings formula provides a way to calculate a company's retained earnings at the end of a specific period: Retained earnings formula explained. Discover the items recorded as retained earnings and.

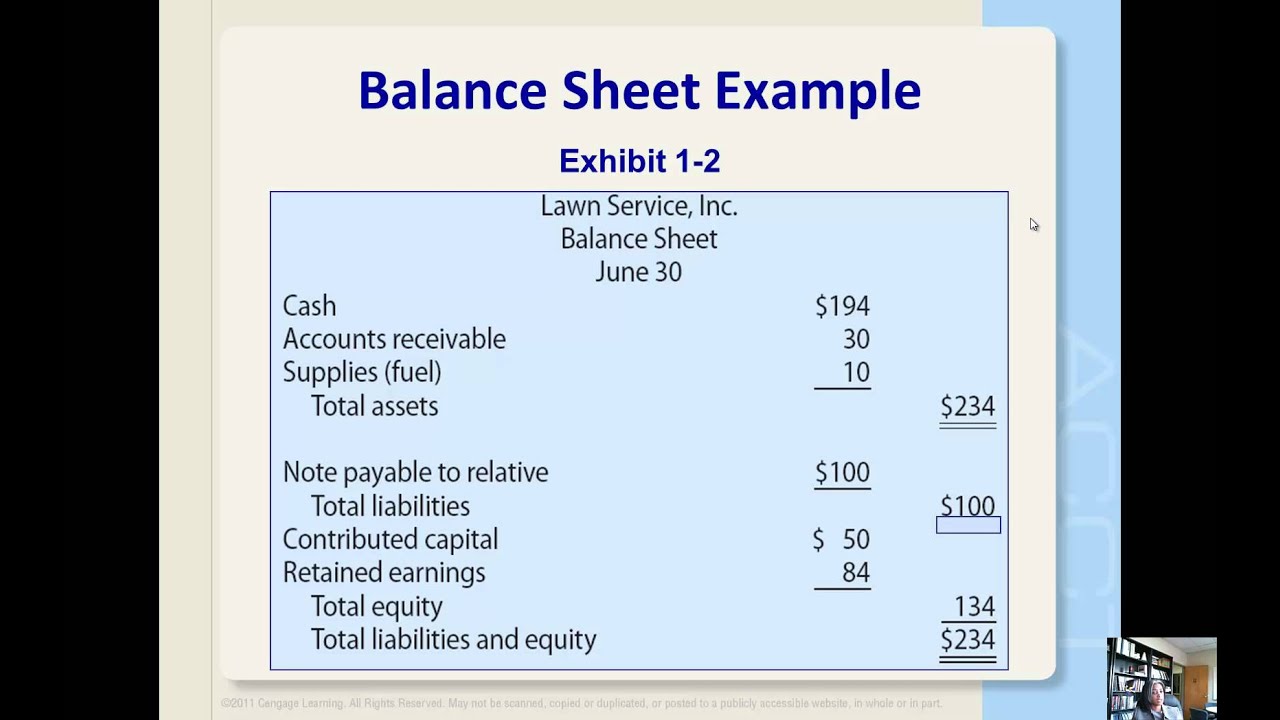

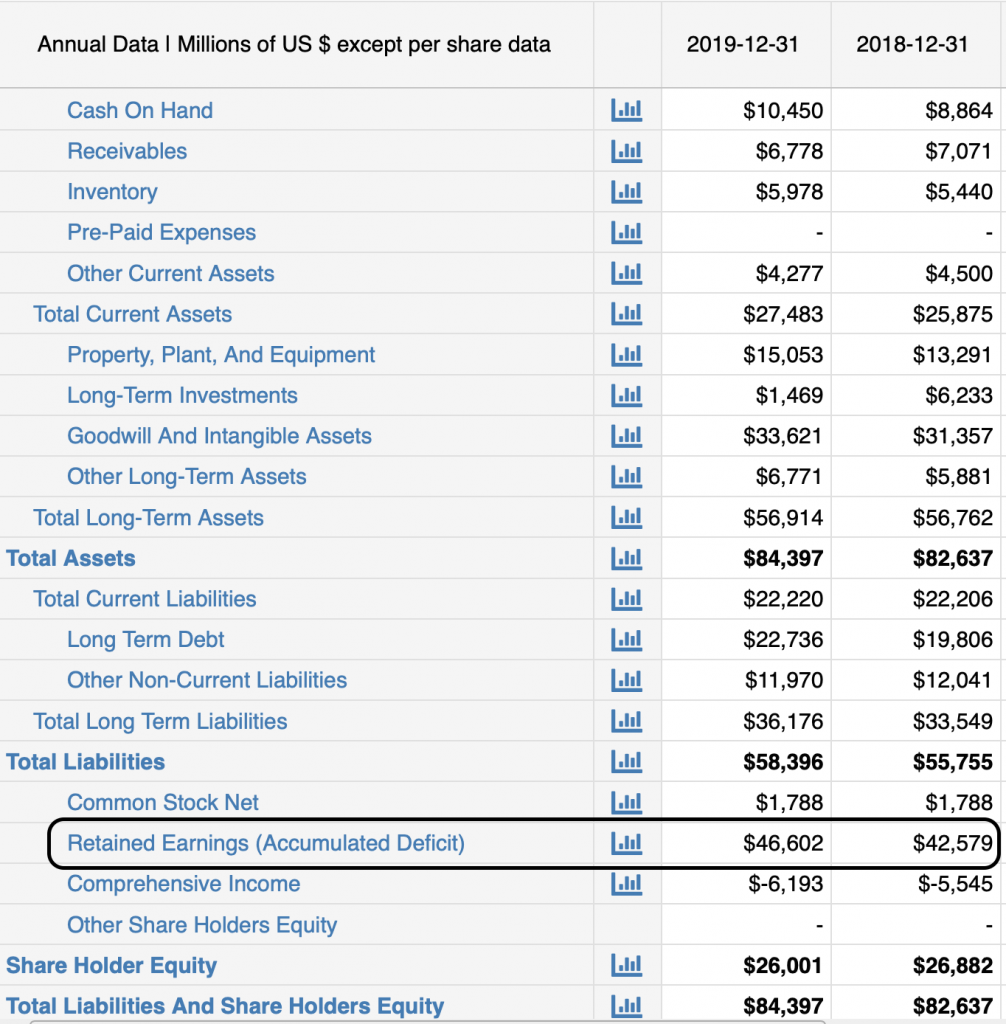

What makes up retained earnings. Its retained earnings calculation is: For purposes of presenting consolidated financial statements, the reporting entity should reflect its retained earnings balance, which includes its proportionate share of the.

An investor can make an idea. Total designated retained earnings $ 252 $ 221 total retained earnings $ 12,533 $ 11,810 following the spring meetings in april 2018, a financing package was endorsed. Identify the entities to consolidate:

Walmart proposed to buy vizio for $11.50 per share, a premium of 47% to the company's closing price of $7.82 as of feb. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity,. It is calculated by taking the company's net income or earnings minus any preferred stock dividends, and then divided by the total number of outstanding common.

Chapter 11 / lesson 7 6.3k earnings retained by a company are used to fund growth, pay off debt, or add to cash reserves. To calculate retained earnings, the beginning retained earnings balance is added to the net income or loss and then dividend payouts are subtracted.