Spectacular Tips About Net Cash Flow From Operating Activities Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

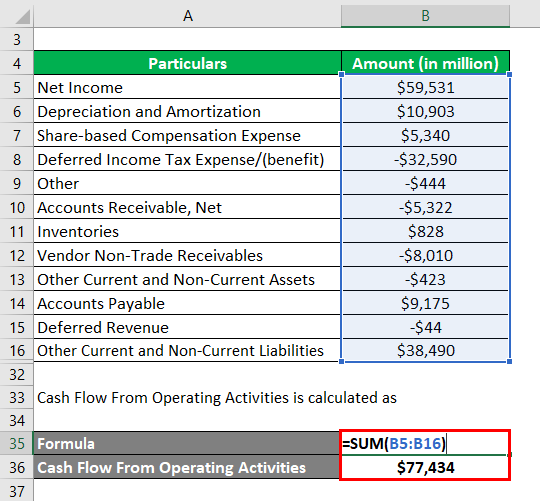

Cash flow from operating activities (cfo) shows the amount of cash generated from the regular operations of an enterprise to maintain its operational.

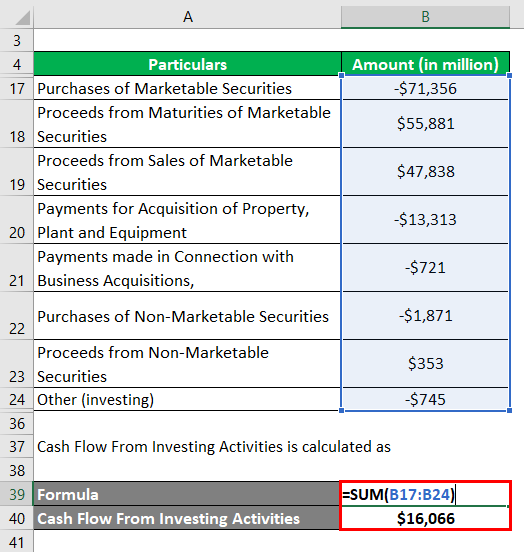

Net cash flow from operating activities formula. Cash flow from investing activities would be £150,000. Using the indirect method, operating net cash flow is calculated as follows: Determine net cash flows from operating activities.

Accounting march 29, 2023 the net cash flow formula helps reveal if a business is performing well or in danger of going bankrupt. Begin with net income from the. Cash flow from operations can be found on a company’s statement of cash flows.

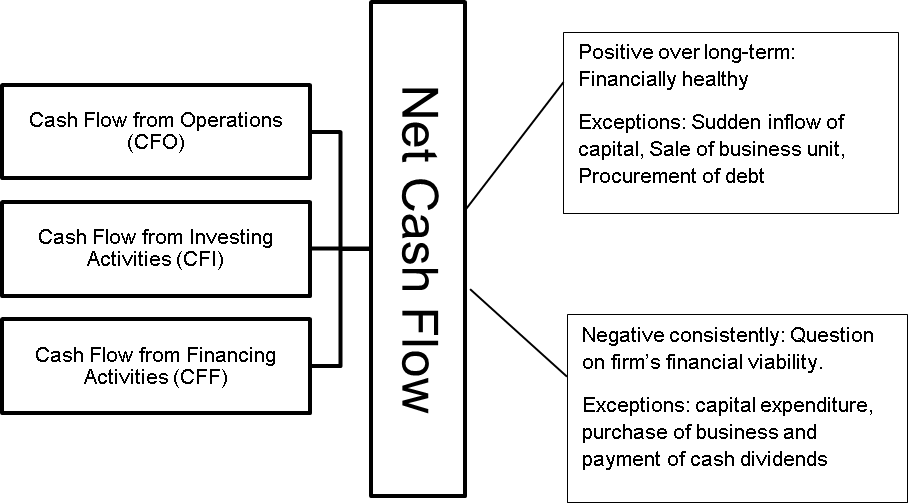

The formula for net cash flow calculates cash inflows minus cash outflows: Key takeaways net income is a key metric of profitability and is a major driver of stock prices and bond valuations. Net cash flow from operating activities is a financial metric that indicates the amount of money a company brings in from its ongoing, regular business activities,.

Repeated periods of positive net cash. The formula for calculating the operating cash flow ratio is as follows: The operating cash flow formula signifies the cash flow generated from the core operating activities of the business after deducting the operating expenses.

Determining cash flow from operating activities here, we will show you how to determine the value of cash flow from operating activities using the. Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service to customers. Cash flows from operating activities makes.

Purchase/sale of property and equipment (£50,000) + purchase/sale of other businesses (£75,000) +. Net cash flow = cash flow from operations + cash flow from investing + cash flow from financing relevance and use of net cash flow formula it is. Essentially, you want to adjust for things like depreciation, increases in accounts receivable, and other non.

The operating cash flow ratio is calculated by dividing operating cash flow by current liabilities.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)