Inspirating Tips About Projected Balance Sheet Method

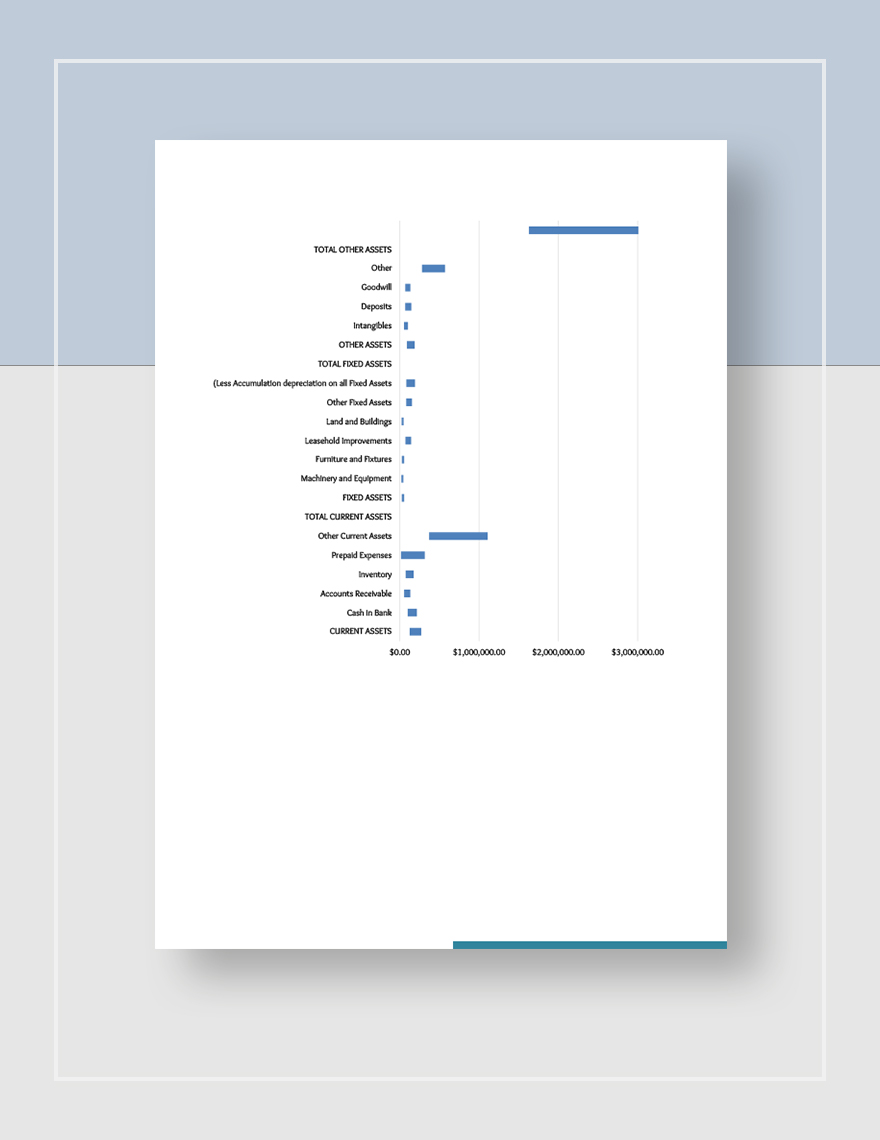

Electronic spreadsheets like ms excel are used to analyze and process historical and future data.

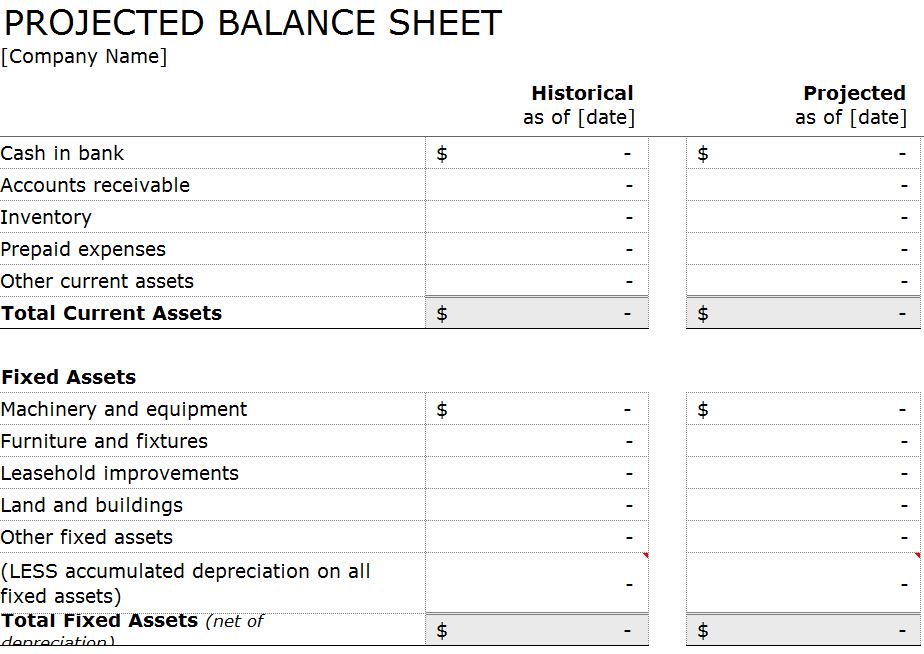

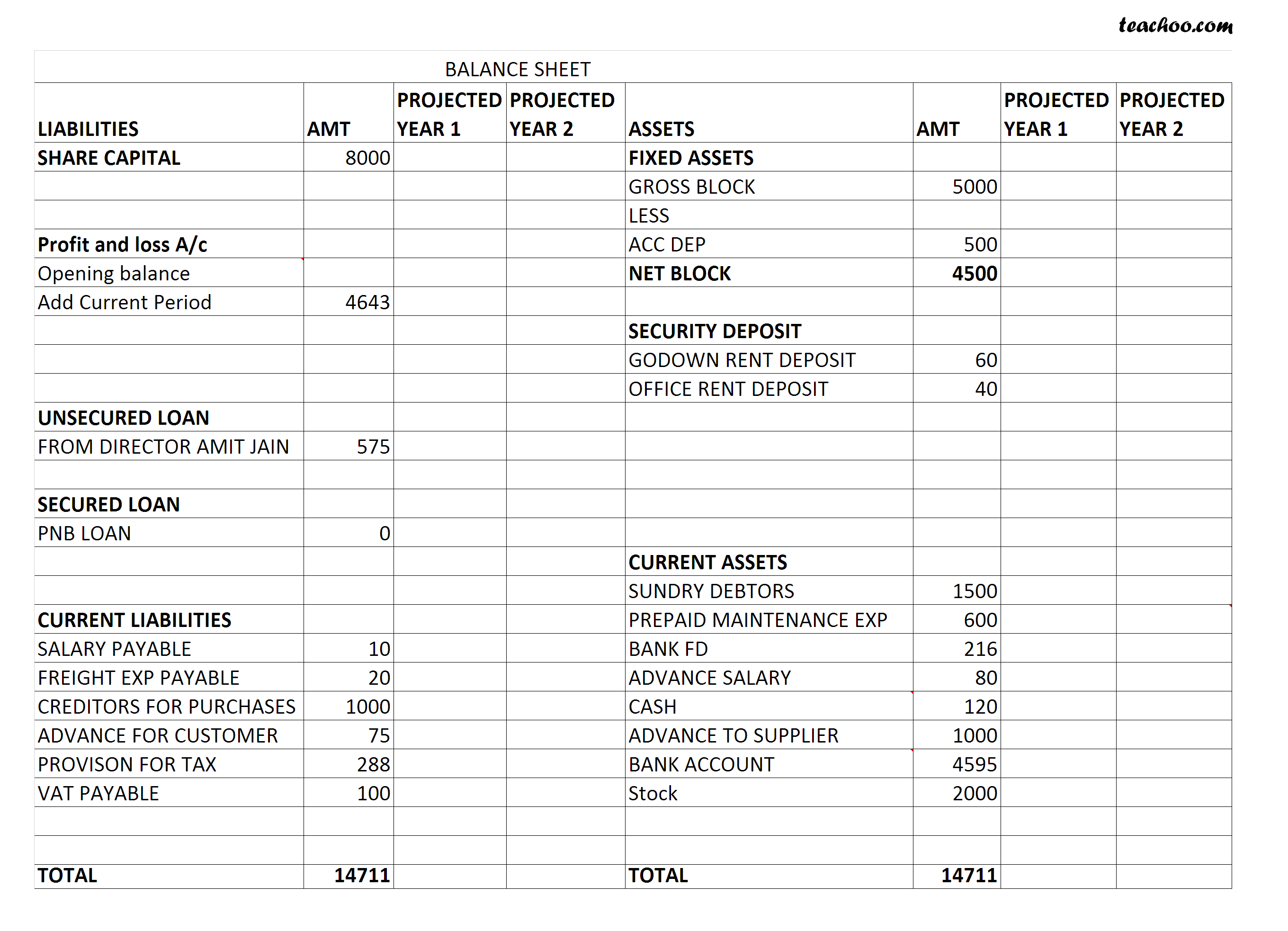

Projected balance sheet method. Estimating working capital requirement using operating cycle method problem x ltd co. Net working capital is the total of your current assets and liabilities. Balance sheet forecast for a 70+ types of startups;

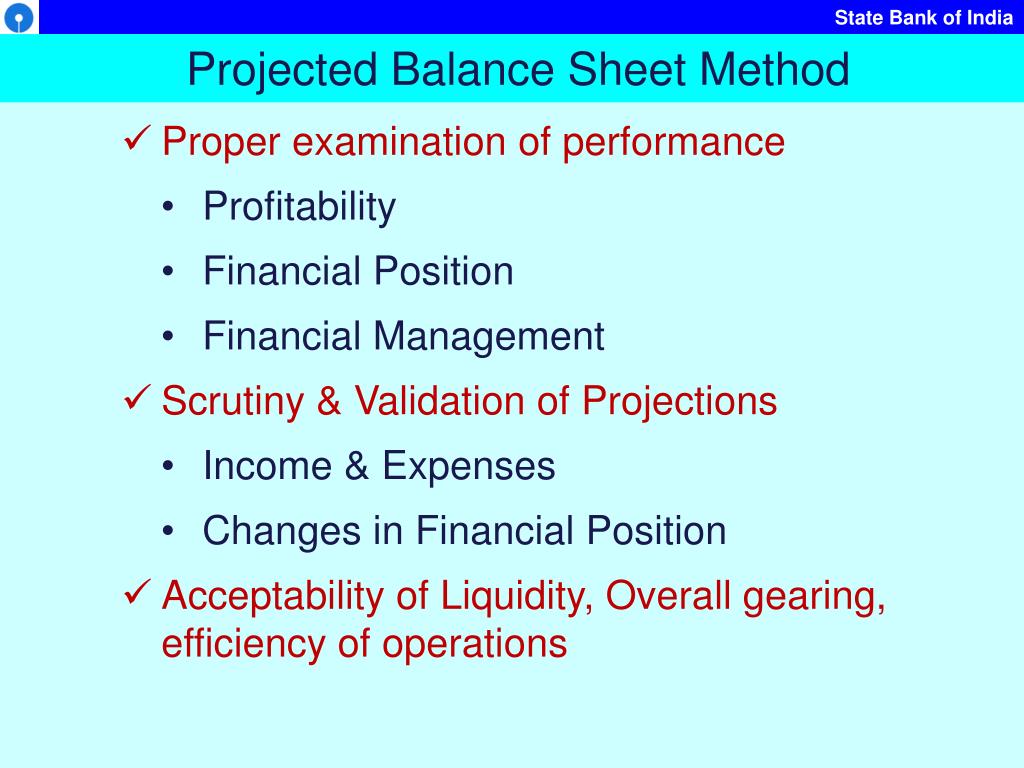

Projected balance sheet method. The various items in the balance sheet are also to be projected by either of above two methods but both the methods are to be used in combination. A projected balance sheet and income statement will come in handy when it's time to make decisions about how to grow your company.

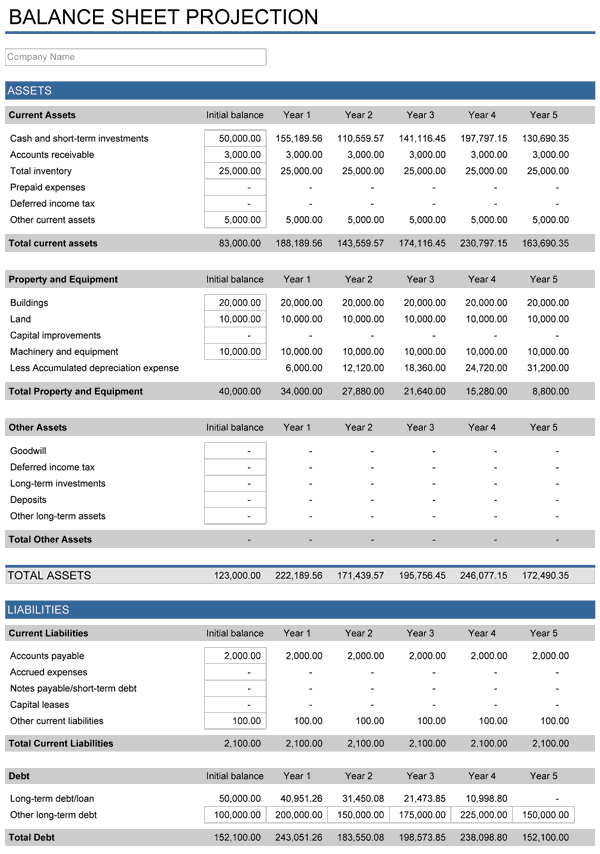

Using projected financial statements. Our templates will help you produce a full pro forma financial model which will include a 5 year projected balance sheet as well. What is a projected balance sheet?

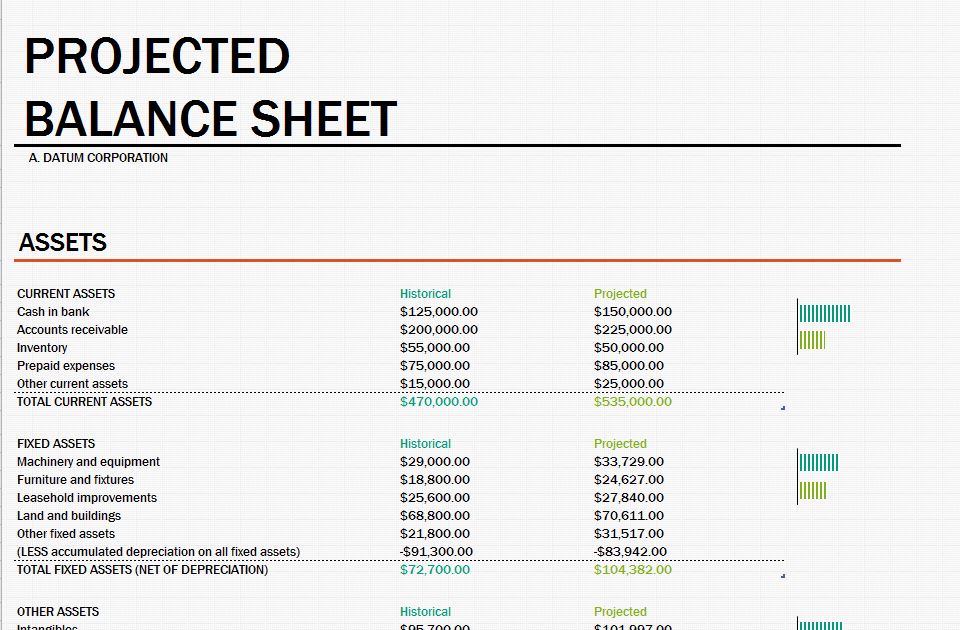

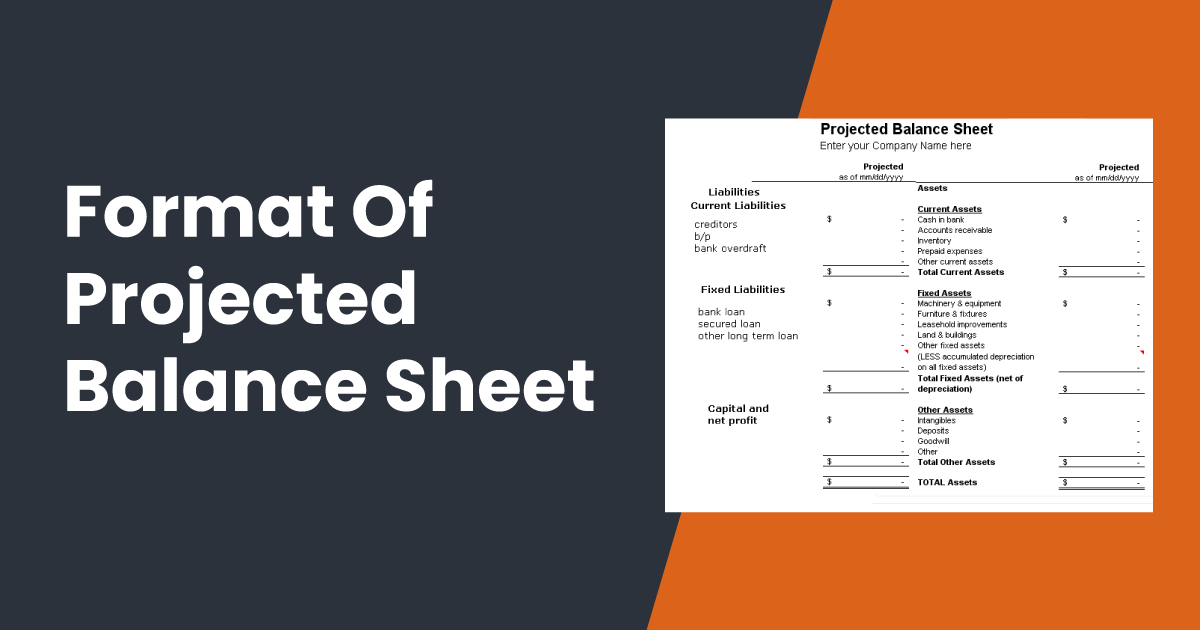

Unless you're a startup without previous financial statements, gather any. How to forecast the balance sheet? A projected balance sheet contains all the financial information (such as assets, liabilities and owner’s equity) of an organization.

A balance sheet projection (also called a balance sheet forecast) is a guide to a business’s financial situation in the future. Cash flow, solvency, and liquidity. Total assets = total liabilities + total equity in the equation,

It is also called the pro forma balance sheet. Projected balance sheet for an acquisition; A projected balance sheet always satisfies the following equation:

Analyze historical data to accurately forecast your company’s profits or losses, you’ll first need to understand its past performance and use that data to predict future financial outcomes. A projected balance sheet also known as a pro forma balance sheet, shows the estimation of the total assets and total liabilities of any business. A projected balance sheet, also referred to as pro forma balance sheet, lists specific account balances on a business' assets, liabilities and equity for a specified future time.

Normally you would need a projected balance sheet to have an idea of how your organization will operate in the future. As a result, it will help your business manage your assets now for better results in the future. Estimated sales 20,000 units @ $5 p.u.

Projectionhub has tools that can help you produce a projected balance sheet for both situations: Make sure you’re using comparable data. It has some integral components, whose inclusion is a must in order to make a projected balance sheet.

To make a powerful and useful cash flow projection, you need to summarize and aggregate the rows of the balance sheet. The above screenshot is from cfi’s financial modeling course. The closing balances of all accounts are arrived other than cash and bank balances.