Real Tips About Financial Performance Format

Australian accounting standard aas 1 “statement of financial performance”, as issued in.

Financial performance format. Dividend of € 1.80 per share; Financial statements are often audited by. Figure 4.1 the average nim of s elected private banks in the year 2009.

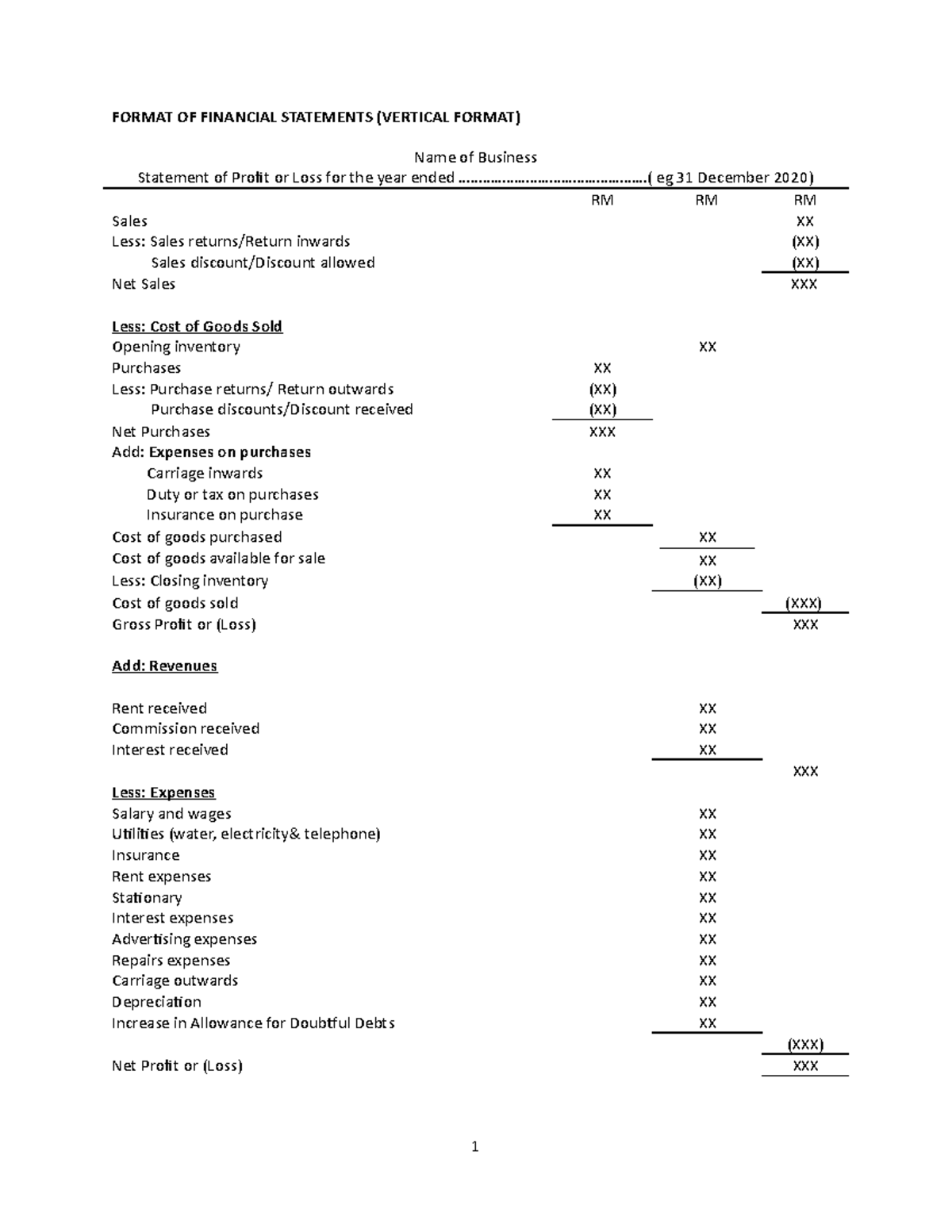

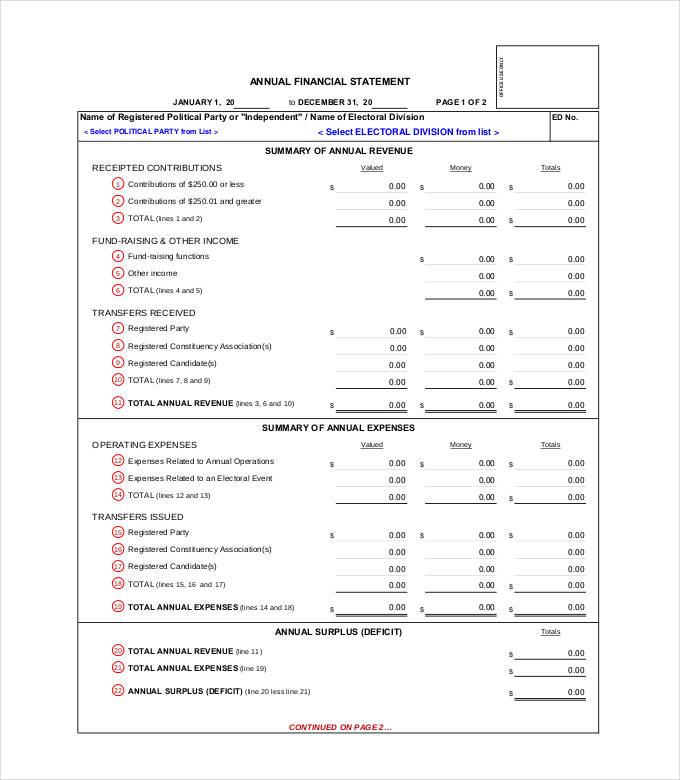

Special dividend of € 1.00 per share. By analyzing financial data and presenting it in a clear and concise format, these reports enable stakeholders to gain insights into the company’s financial standing and make informed decisions. Financial statements are written records that convey the financial activities of a company.

Financial key performance indicators (kpis) are select metrics that help managers and financial specialists analyze the business and measure progress toward strategic goals. Free cash flow before m&a and customer financing € 4.4 billion; Where as, a company with a december.

Cash flow statement cash flow statementa statement of cash flow is an accounting document. 2.3 when applied or operative, this standard supersedes: Example of bist information companies

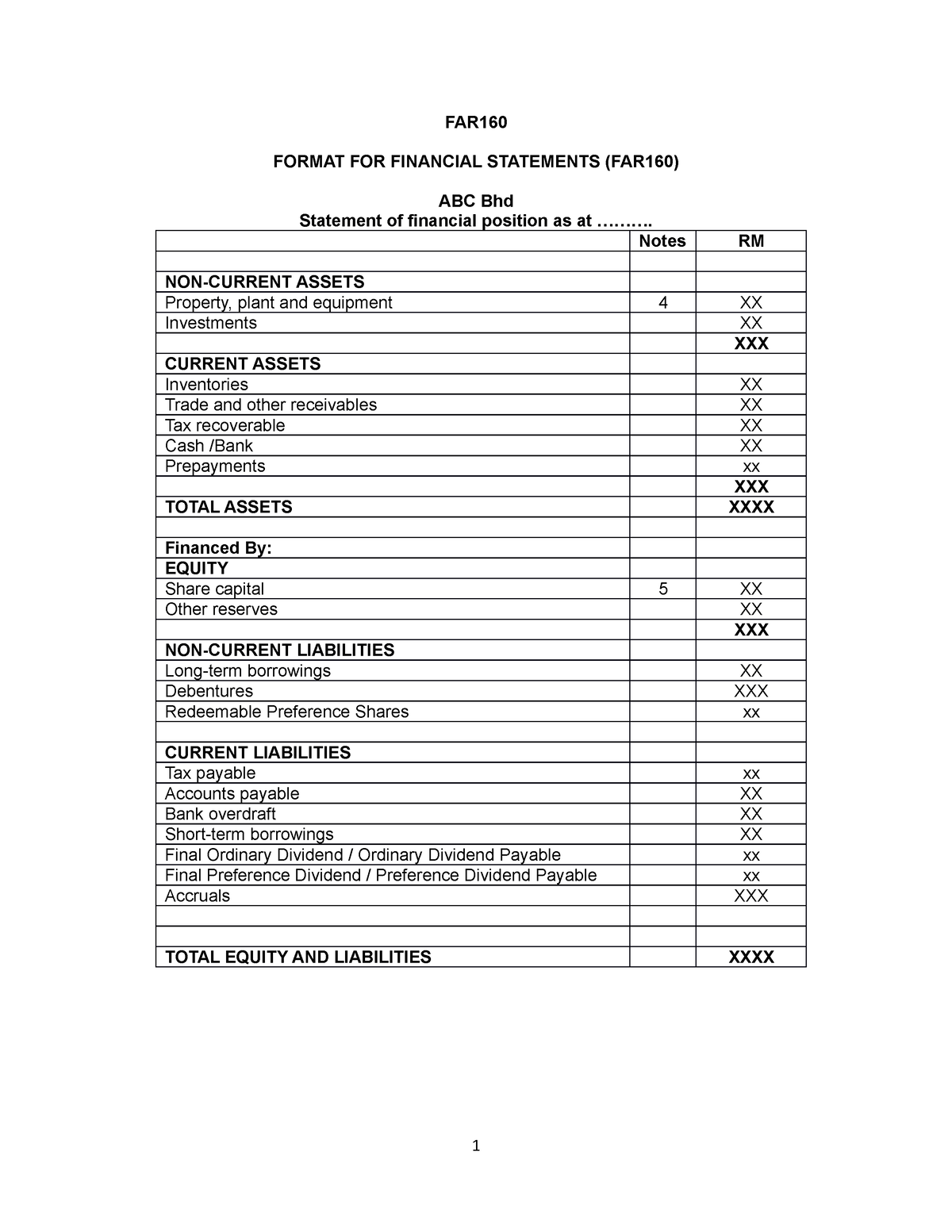

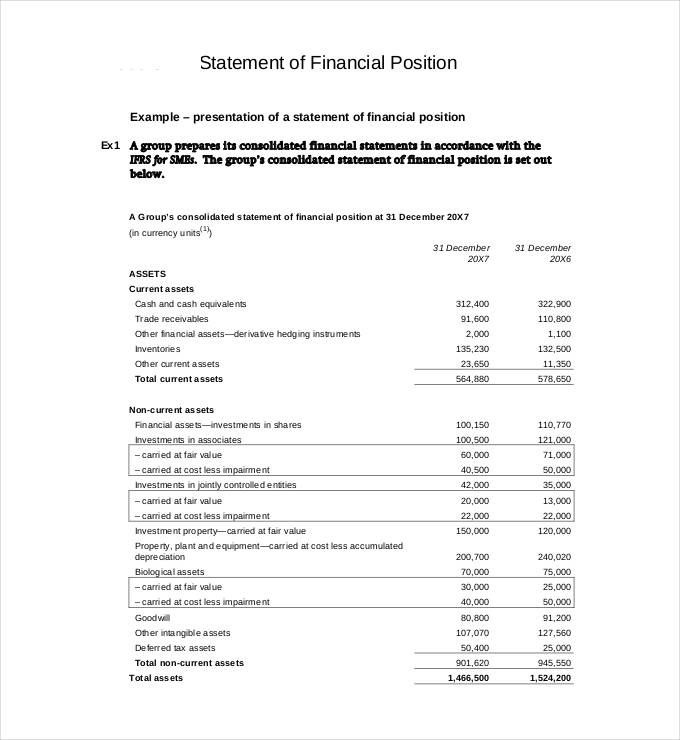

Ias 1 ‘presentation of financial statements’ acknowledges an entity may present, outside the financial statements, a financial review that describes and explains the main features of the organisation’s financial performance (including cashflows) and financial position, both locally and internationally. More so, financial performance is a way to satisfy farm owners and can be represented by profitability, growth, and market value.

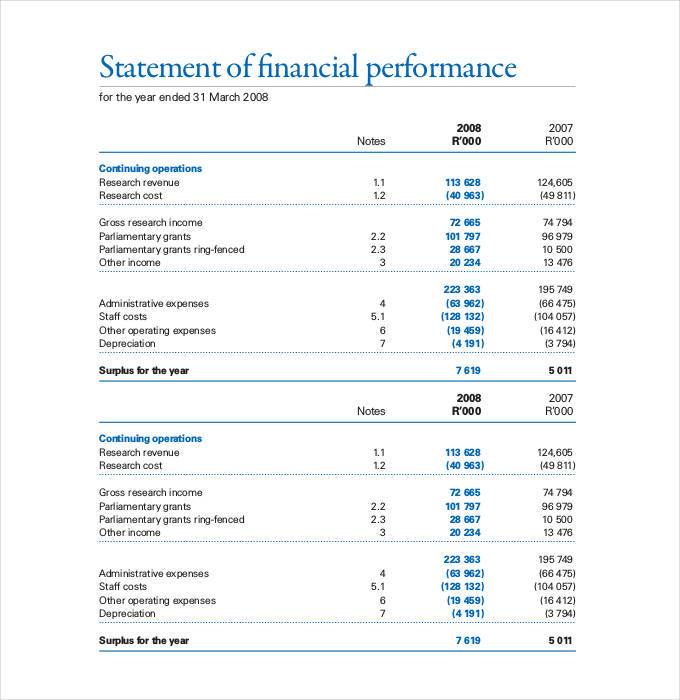

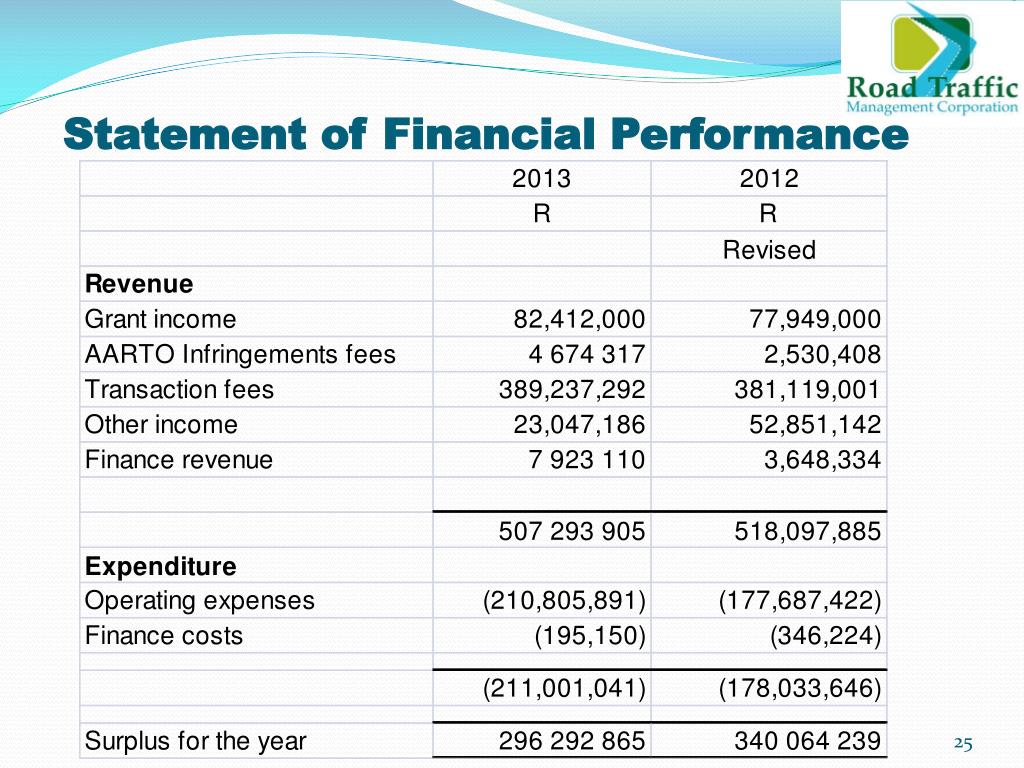

It is the process of measuring the results of a firm's policies and operations in monetary terms. First, identify potential places of waste or inefficiency. Corporate financial performance is an overview of the company's financial status report over a period of time to figure out how successful and profitable a company is in producing revenue.

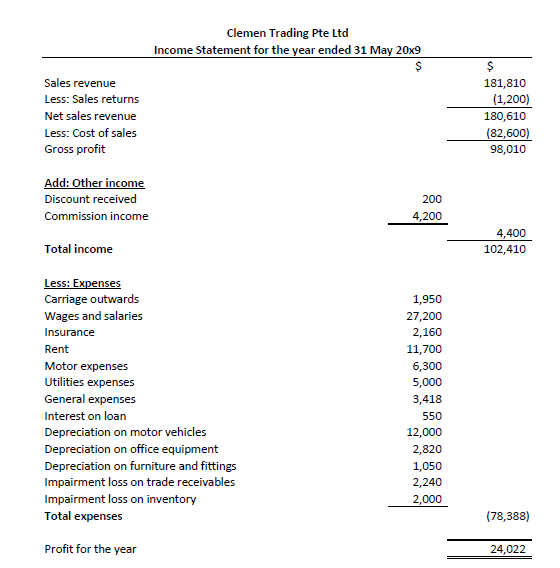

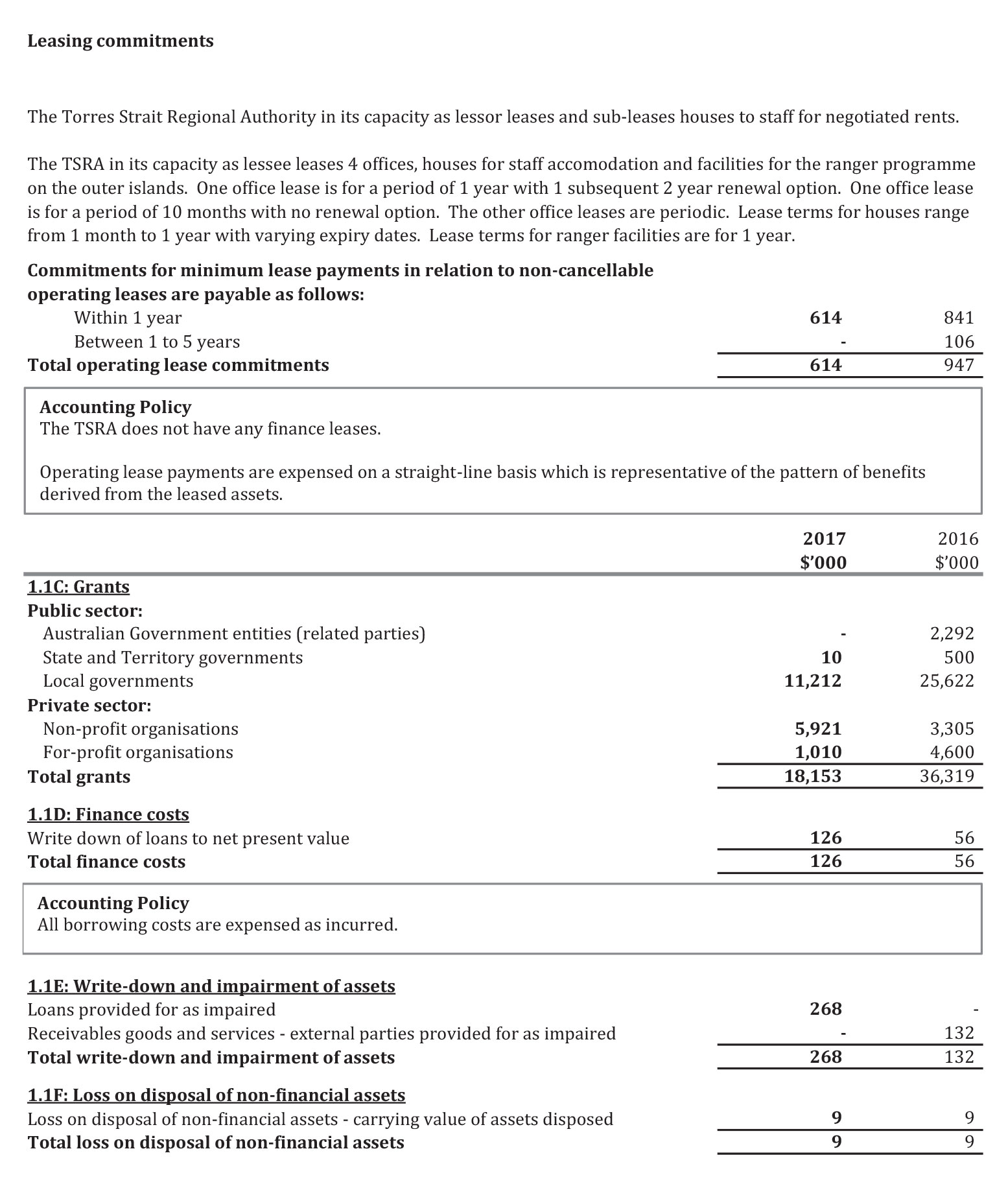

One straightforward way to improve financial performance is to cut costs. The standard does not require the presentation of the following line items from the face of the statement of financial performance: It is evaluated based on a firm’s assets, liabilities, revenue, expenses, equity, and profitability.

[23] supported this argument by emphasizing that. Four main areas to look at include people, energy, transportation and travel. A financial report or financial statement is a management tool used to communicate the performance of key financial activities efficiently.

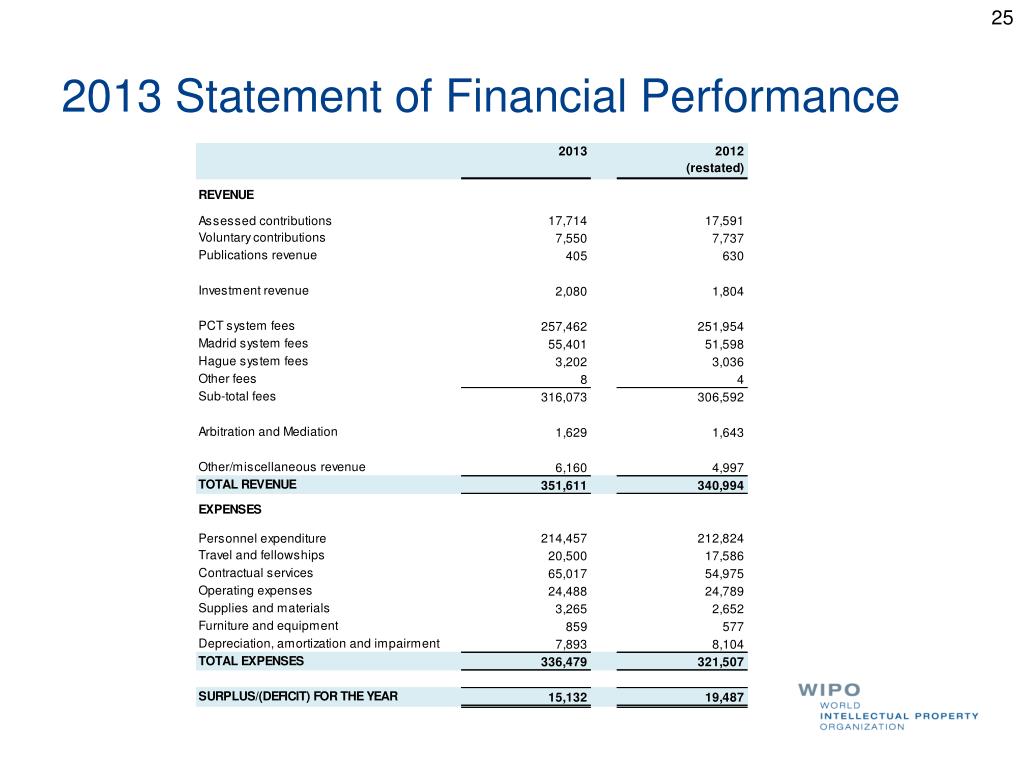

These requirements were previously included in ipsas 3. Financial performance can take many forms but tends to show quarterly or yearly metrics and how they’ve changed. Figure 4.2 banks mean nim in t year 2009.

Financial ratios serve as crucial indicators. Financial performance is a mirror that reflects the job that a company’s management is doing. Ipsas 1 specifies minimum line items to be presented on the face of the statement of financial position, statement of financial performance, and statement of changes in net assets/equity, and includes guidance for identifying additional line.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)