Beautiful Info About Patents And Trademarks On Balance Sheet

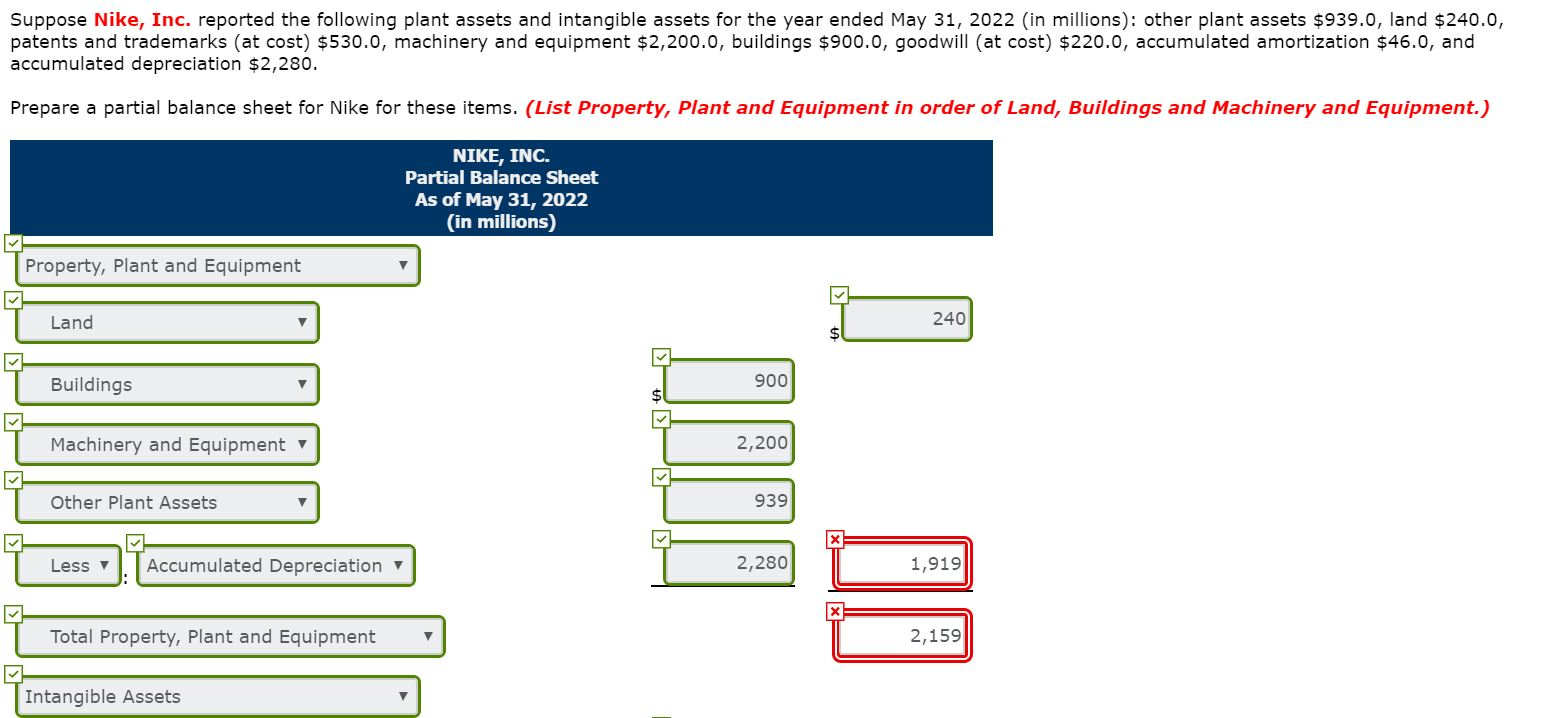

Realize that the use of historical cost means that a company’s intangible assets such as patents and trademarks can be worth much more than is shown on the.

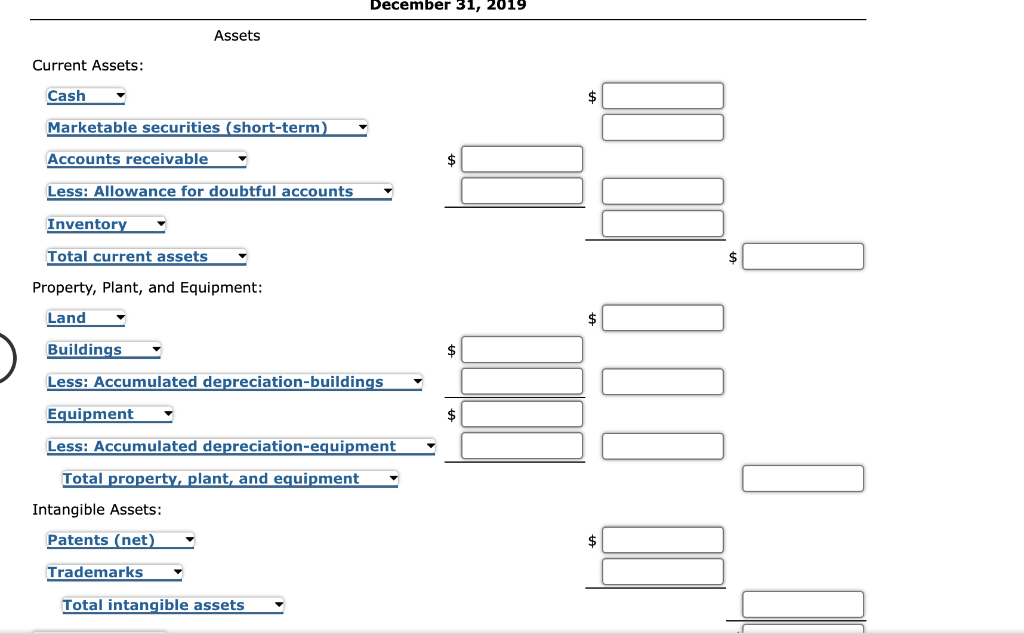

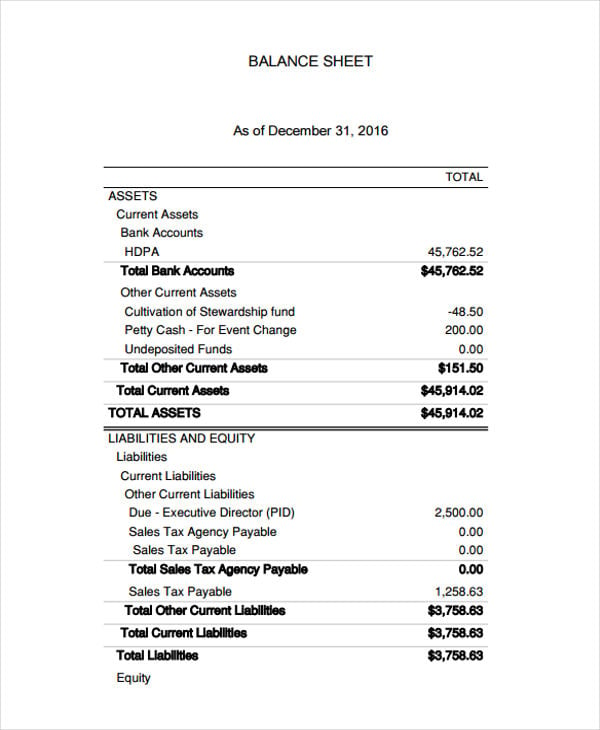

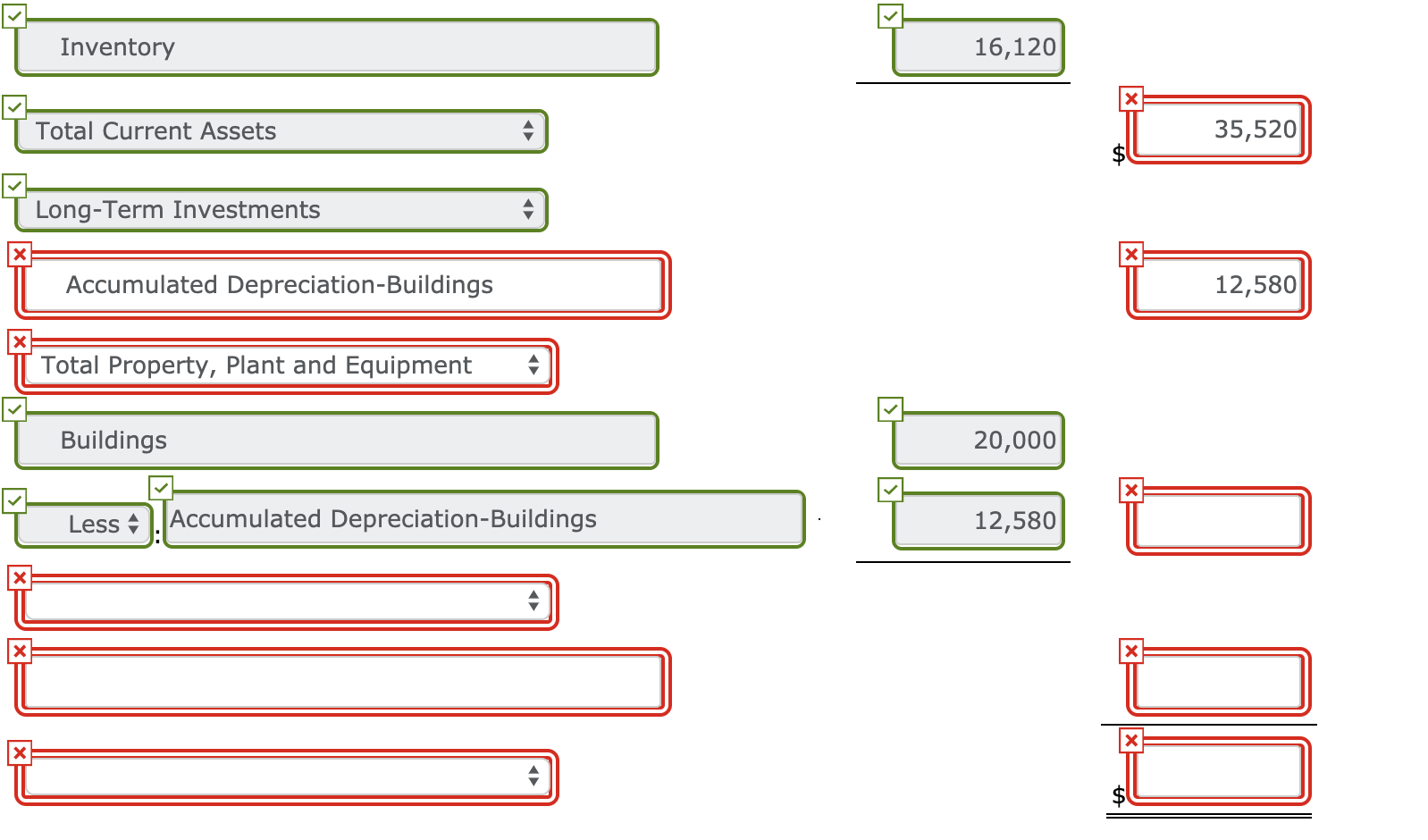

Patents and trademarks on balance sheet. Reported figures for intangible assets such as trademarks may indeed be vastly understated on a company’s balance sheet when compared to their fair values. These must be amortized over the. Note 3 to the balance sheet format states that:

Patents, trademarks, and copyrights generally have associated costs and are capitalized as assets on the balance sheet. An intangible asset cannot be seen or touched but still hold value.

Goodwill, brand recognition and intellectual property, such as patents, trademarks and copyrights, are all intangible assets. This can include patents, trademarks, research and development,. Many intangible assets (such as trademarks and copyrights) are reported on the balance sheet of their creator at a value significantly below actual worth.

A trademark could be a word, phrase, logo, etc. Patents can be valued using a variety of. Separable assets can be sold, transferred, licensed, etc.

Valuing a patent the value of a patent that a company would record on its books. The things of interest concerning patents, copyrights and trademarks are their nature, how much they are worth when they are acquired, whether or not they may increase in value. Calculate the value of a patent on the balance sheet using its development costs or purchase price.

When to record an intangible asset. Patents, trademarks, licensing, and copyrights are all examples of intangible. If a company purchases a trademark from another company, the.

They do not have a physical presence. A patent is classified as an intangible asset and is listed on a company's balance sheet. Intellectual property is considered an alternative asset class on a balance sheet and is often overlooked by businesses.

Intangible assets are distinguishable from. On a balance sheet goodwill and intangible assets are each separate line items. Total the development costs for the patent, including research.

Intangible assets that are internally generated can usually not be included on an organization or company's balance sheet. Being intangible, patents are difficult to value properly, but they still must be accounted for on a firm's balance sheet. Patents go in the intangible assets subsection of the classified balance sheet.

Such an asset is identifiable when it is separable, or when it arises from contractual or other legal rights.