Best Info About Need Of Trial Balance

Preparation of trial balance is the third step in the accounting process.

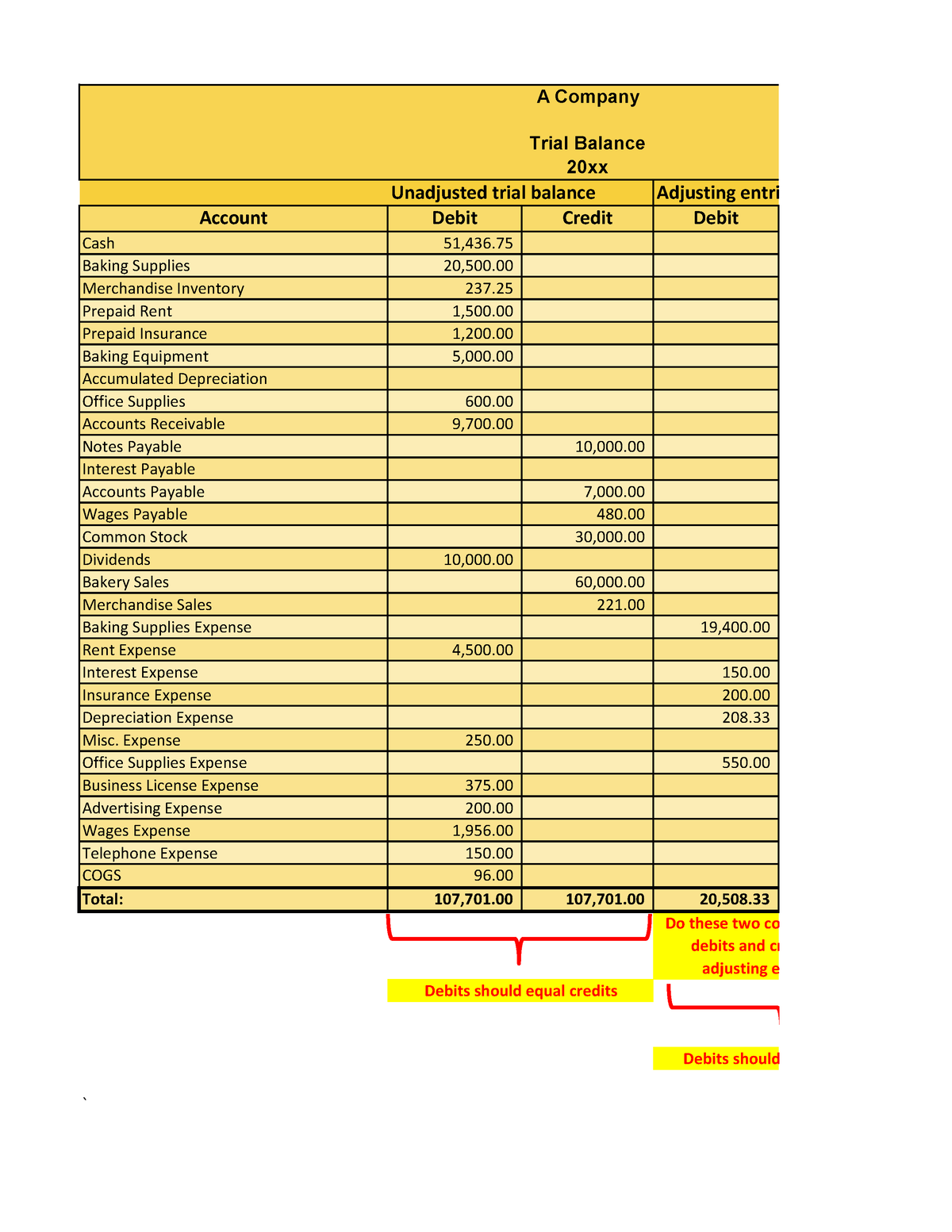

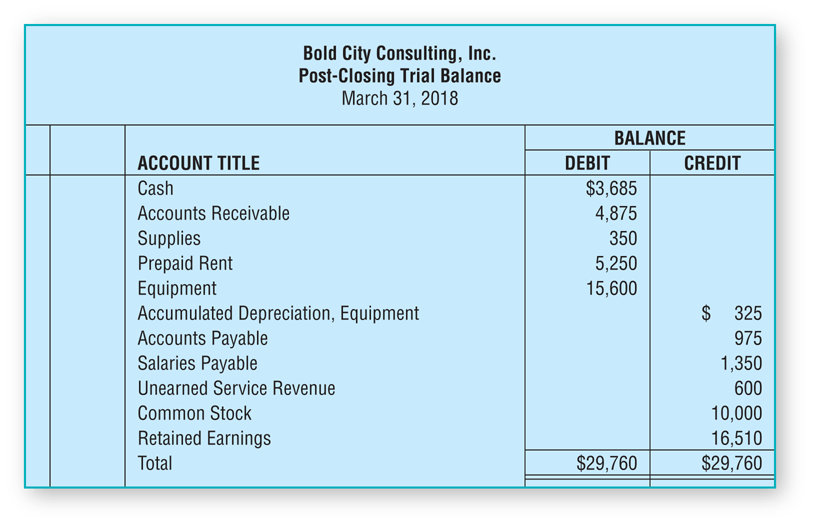

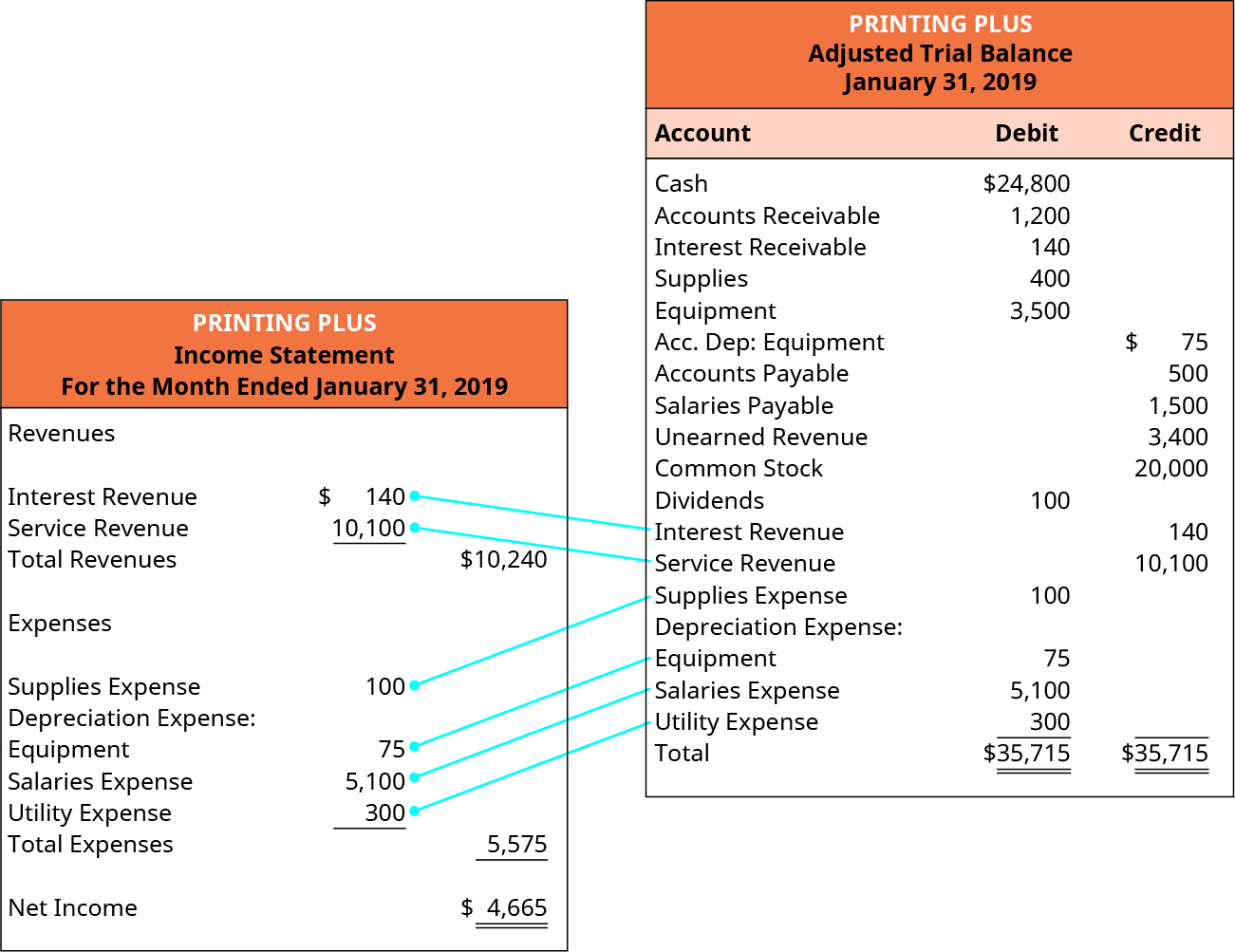

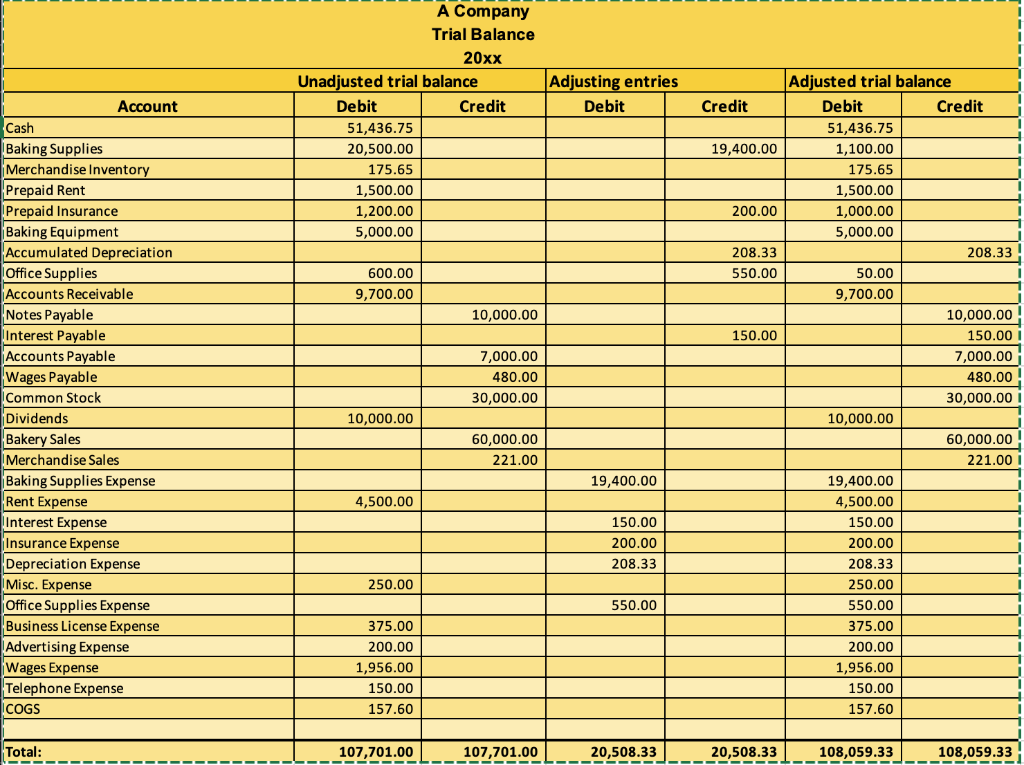

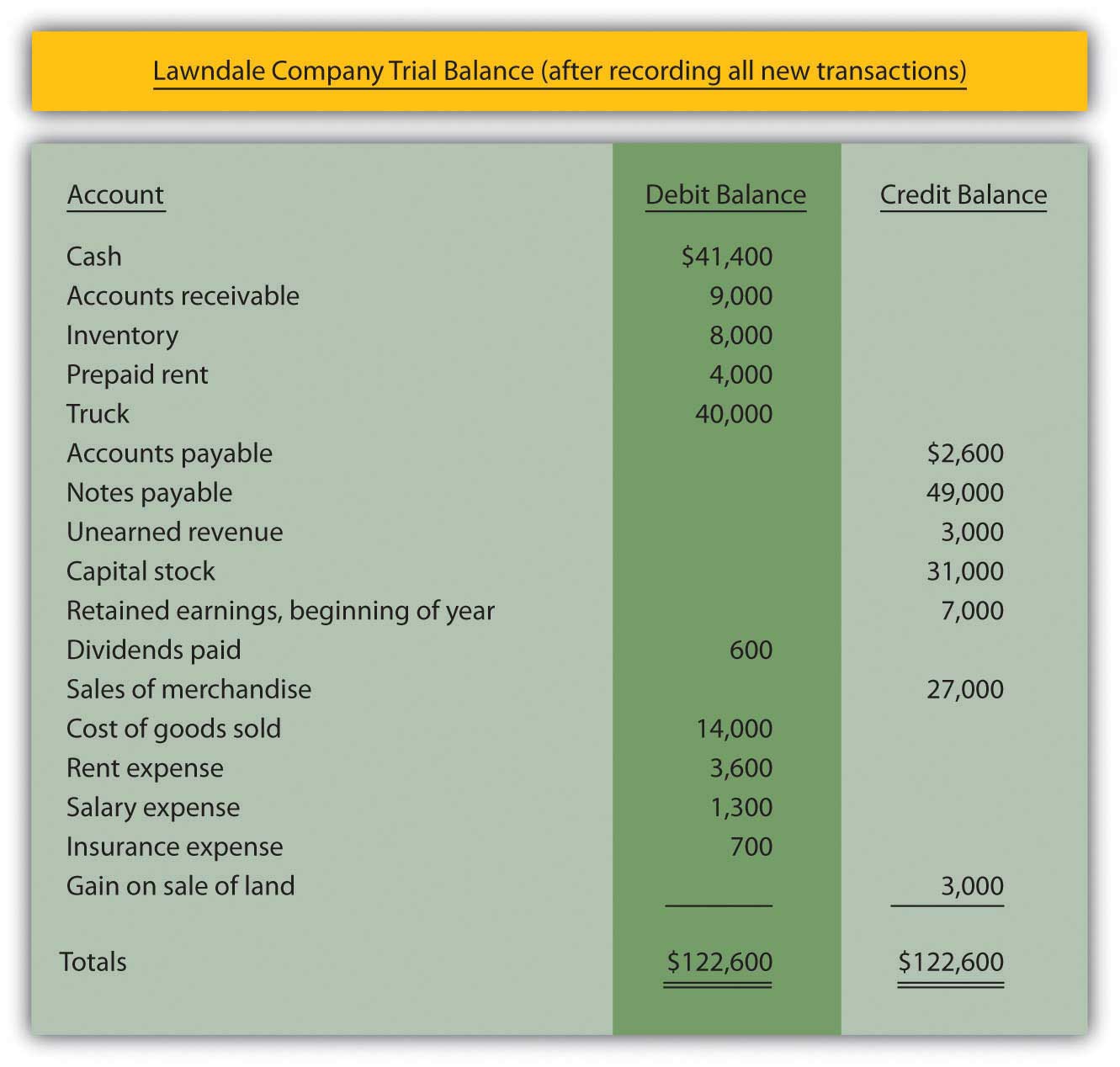

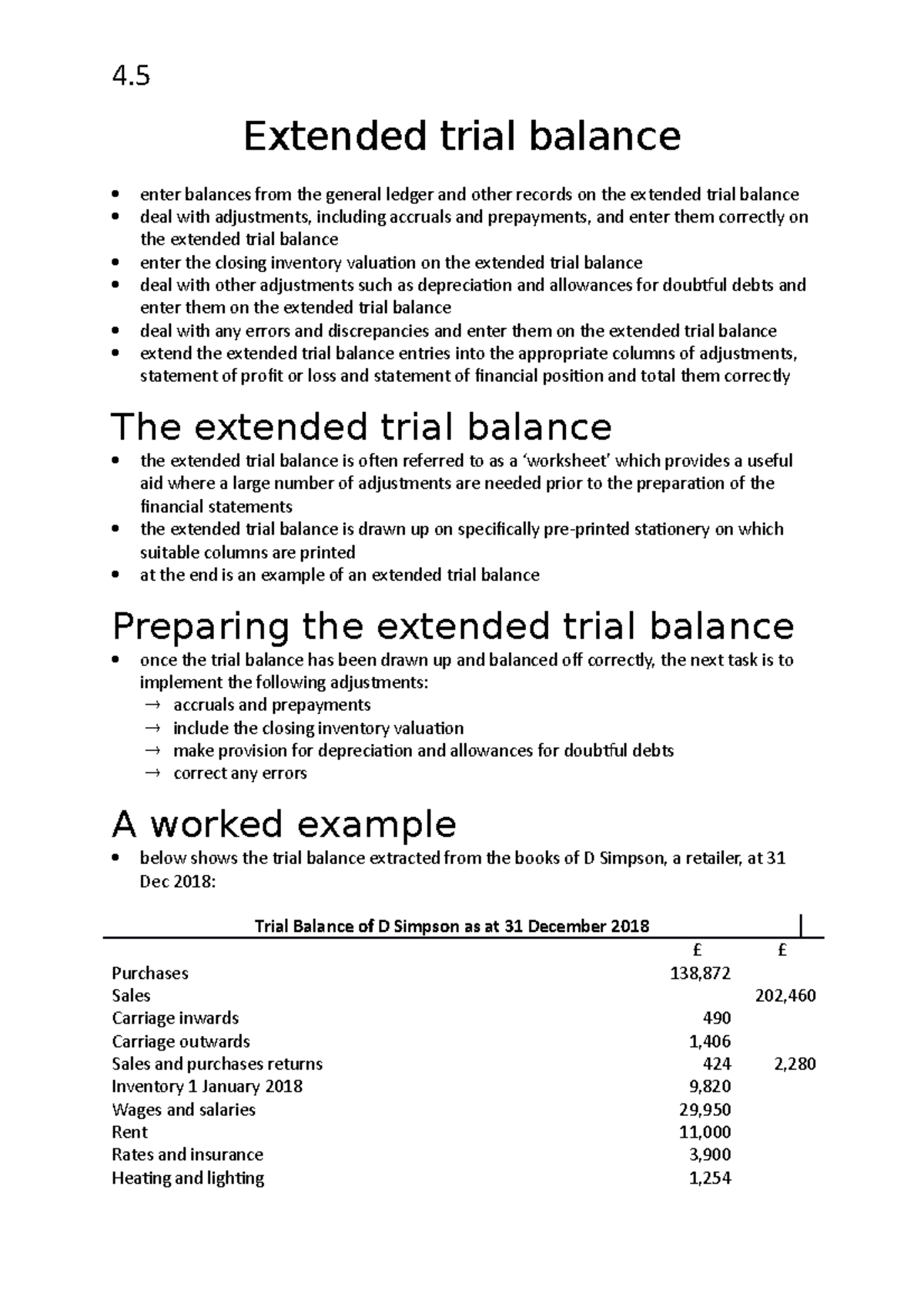

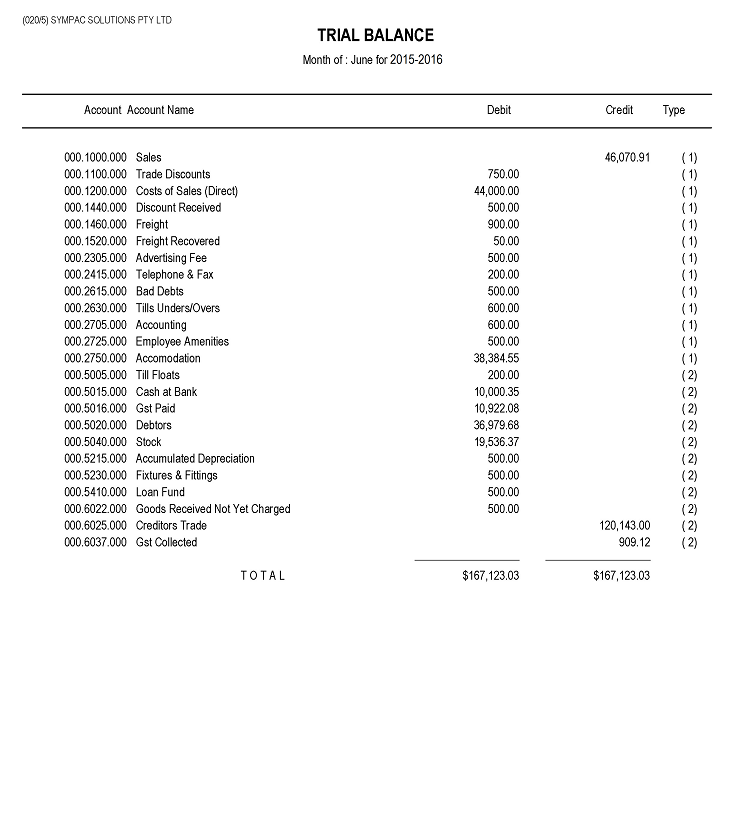

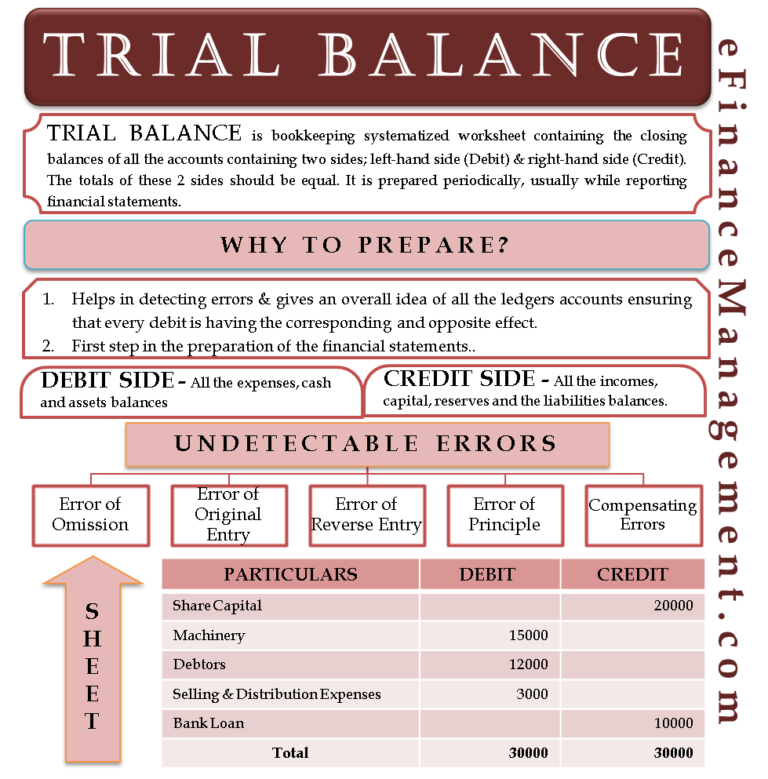

Need of trial balance. Trial balance is a statement summarizing the closing balance of all the ledger accounts, prepared with the view to verify the arithmetical accuracy of ledger posting. Rerun the trial balance after making adjusting entries. A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements.

The goal is to confirm that the sum of all debits equals the sum of all credits and identify whether any entries have been recorded in the wrong account. A trial balance can help a company detect some types of errors and make adjustments to the trial balance and accounting ledgers before the books are closed for the accounting period and financial statements are prepared. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order.

Although a trial balance may equal the debits and credits, it does not mean the figures are correct. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown with the total of all.

Then we prepare a trial balance to verify that the debit totals equal to the credit totals. Moreover, pay attention to account names and codes to ensure consistency. Next, verify the balances of each account listed in the trial balance.

This systematic review was performed to investigate the effect of exercise therapy on bdnf levels and clinical outcomes in human pd and to discuss mechanisms proposed by. A new drug for the treatment of parkinson's disease is being trialled to establish if it is safe. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

The main objectives of a trial balance are as follows: Engoron attends the trump organization civil fraud trial in new york in november 2023. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new.

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. First, we record the transactions in the journal. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

The next step is the creation of a worksheet having three columns which are having account name, debit (dr.) and credit (cr.) details. It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct. Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal.

Definition a trial balance is a statement or report generated at the end of an accounting period, listing all the accounts and their balances. Trial balance helps a professional accountant to balance or check both debit and credit items of income, expenses, assets, and liabilities. Preparation of trial balance.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. You will do the same process for all accounts.