Recommendation Info About Is An Income Statement The Same As Profit And Loss

An income statement is another name for a profit and loss statement (p&l).

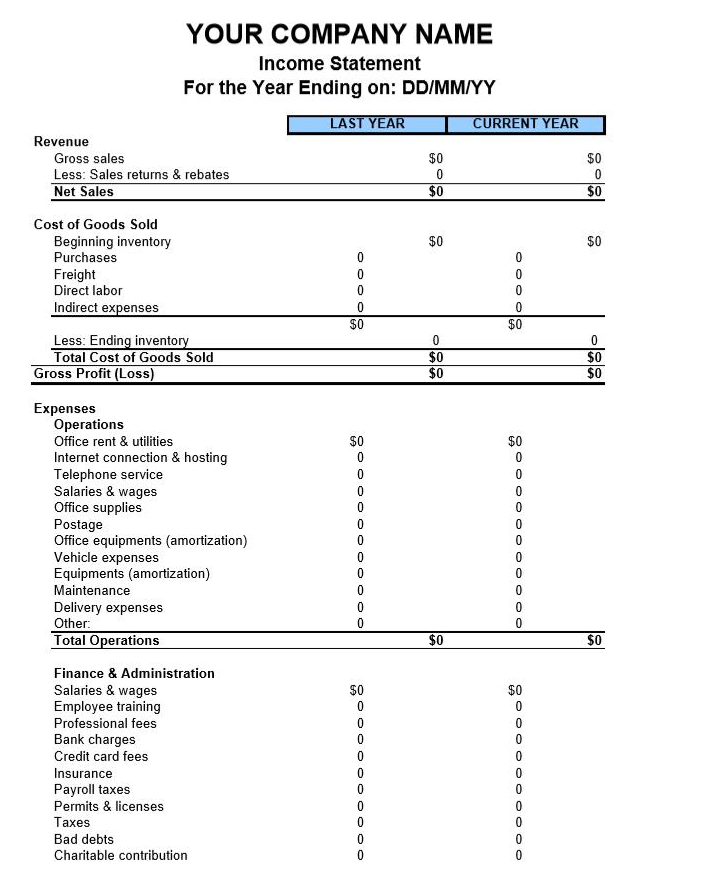

Is an income statement the same as profit and loss. In basic accounting, the p&l statement is always one of the first financial statements to be prepared. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions in penalties and new restrictions on. It’s a financial document that includes the revenues and expenses of a company.

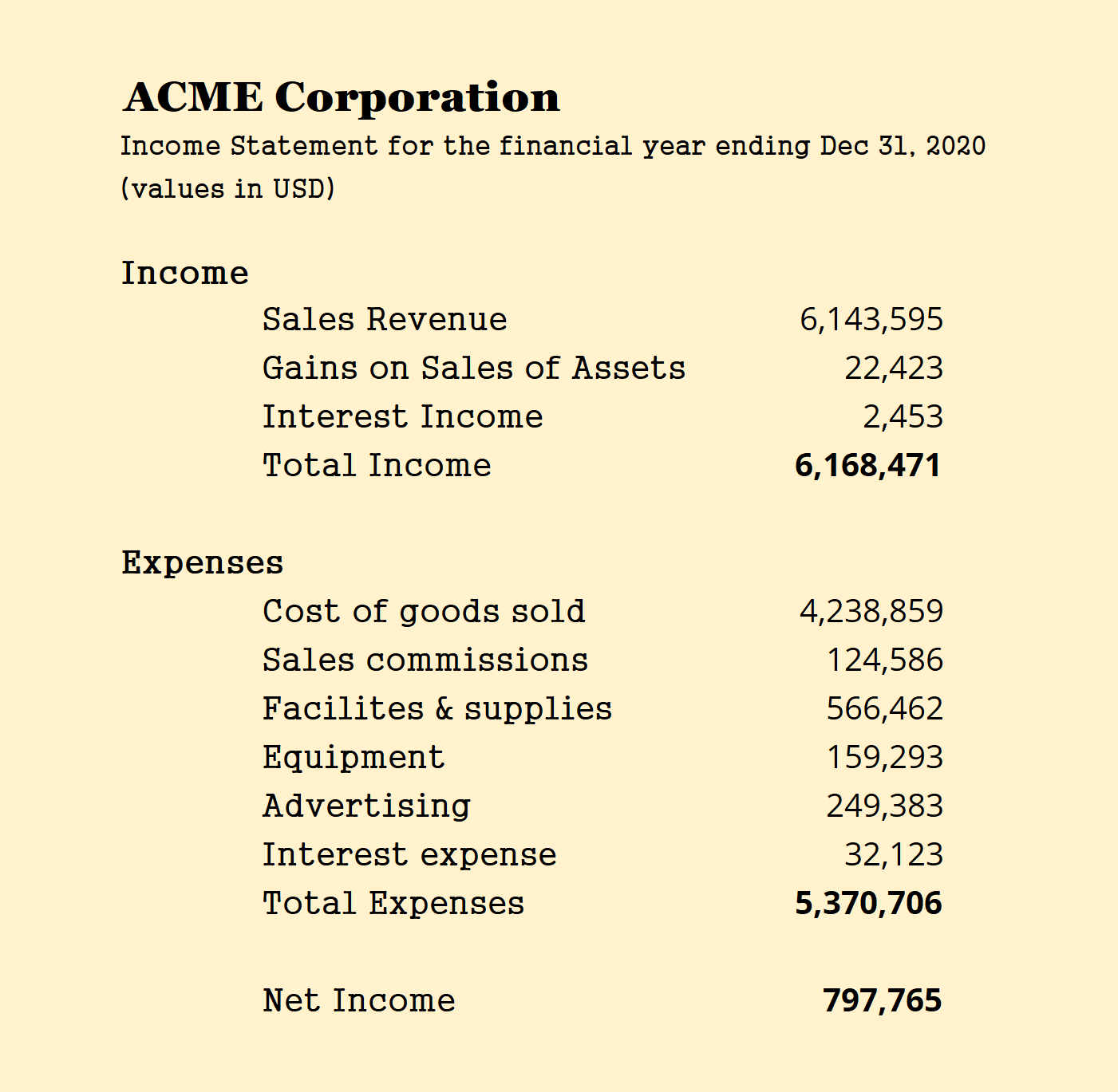

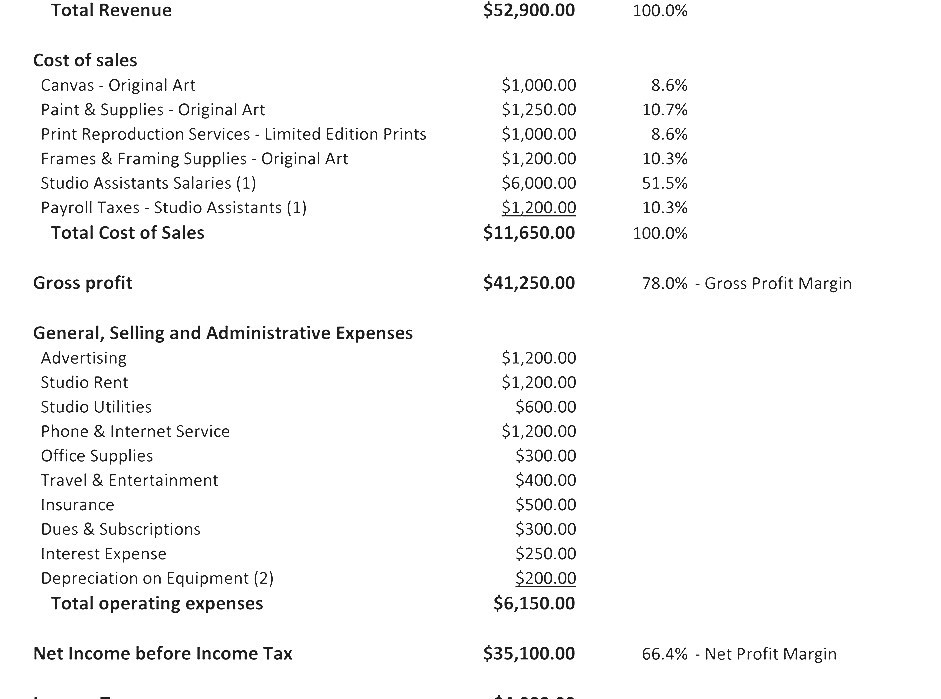

The income statement can be summarized by the formula: They are similar since both provide information about your income, expenses, profits, and losses. Business owners use the p&l to assess the company's profitability—how much money a company makes.

Revenue, expenses, gains, and losses. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. When a new york judge delivers a final ruling in donald j.

The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. The main components of income statements are revenue, expenses and net profit or loss. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. The income statement is a statement (a report) which forms part of all the financial reports, called the financial statements. However, companies and businesses have been using the terms profit and loss more frequently recently.

Sales on credit) or cash. The profit and loss (p&l) statement (also known as an income statement) is one of the four basic financial statements that presents the revenues, expenses, and net income of a business. You can look at an income.

Then, it subtracts the costs of making those goods or providing those services, like. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Net income is the profit that remains after all expenses and costs, such as taxes.

When it comes to deciding whether to use a profit and loss statement or an income statement, there are a few factors that you should consider. On the bottom of the income statement is the net profit or loss. It’s essentially a snapshot of how much money the company made (or lost) during that time frame.

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The income statement focuses on four key items: Revenue is money a business generates through its primary activities, such as selling products.

In this article, we define income statement vs. Expenses are outgoings, such as the cost of buying products. P&l is short for profit and loss statement.

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)