Out Of This World Info About Short Note On Trial Balance

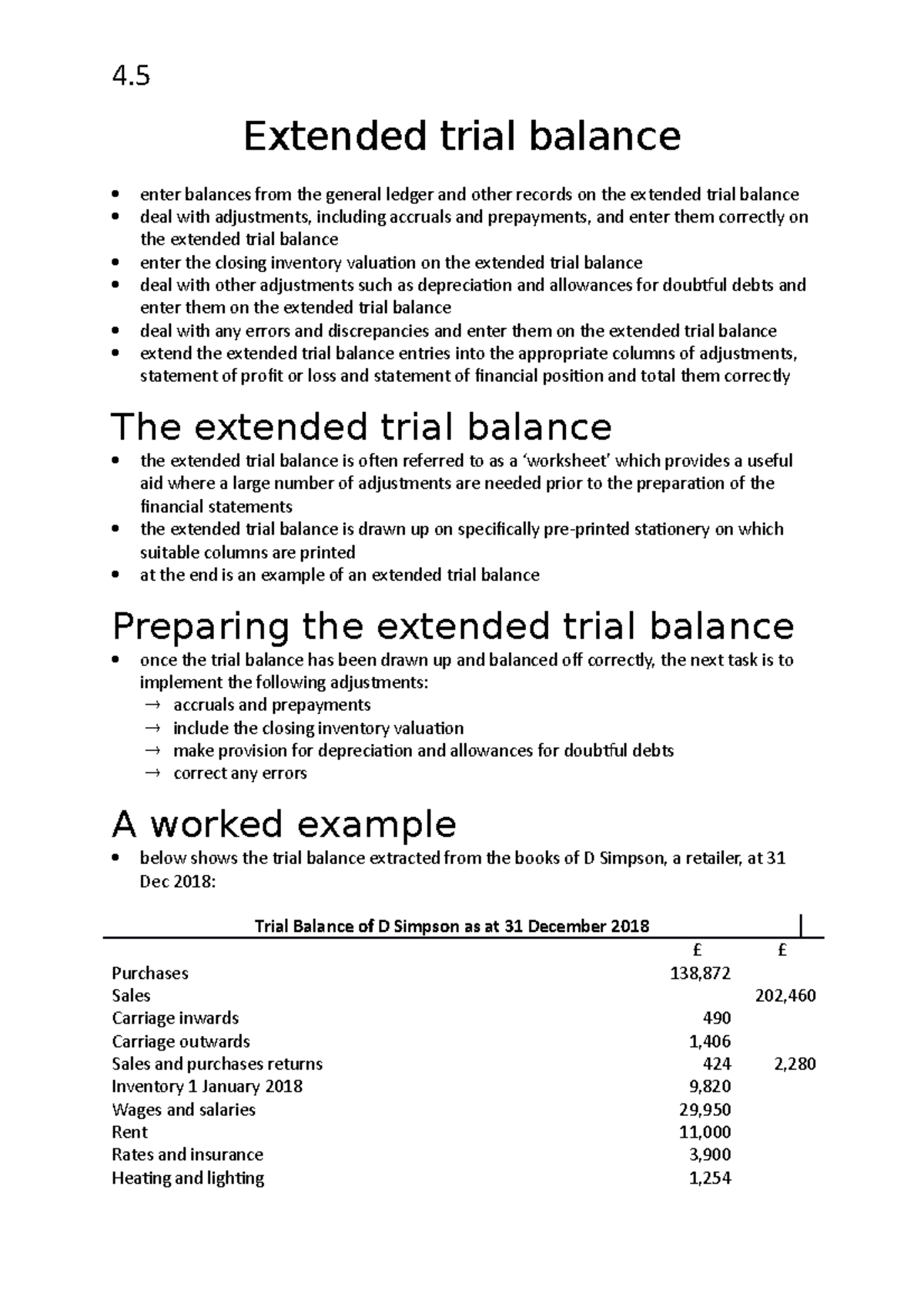

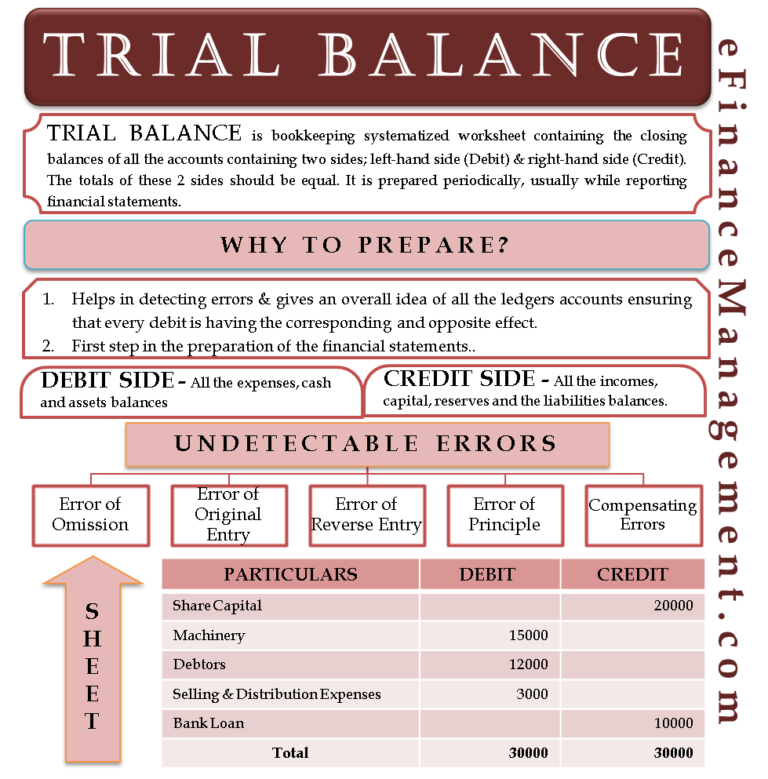

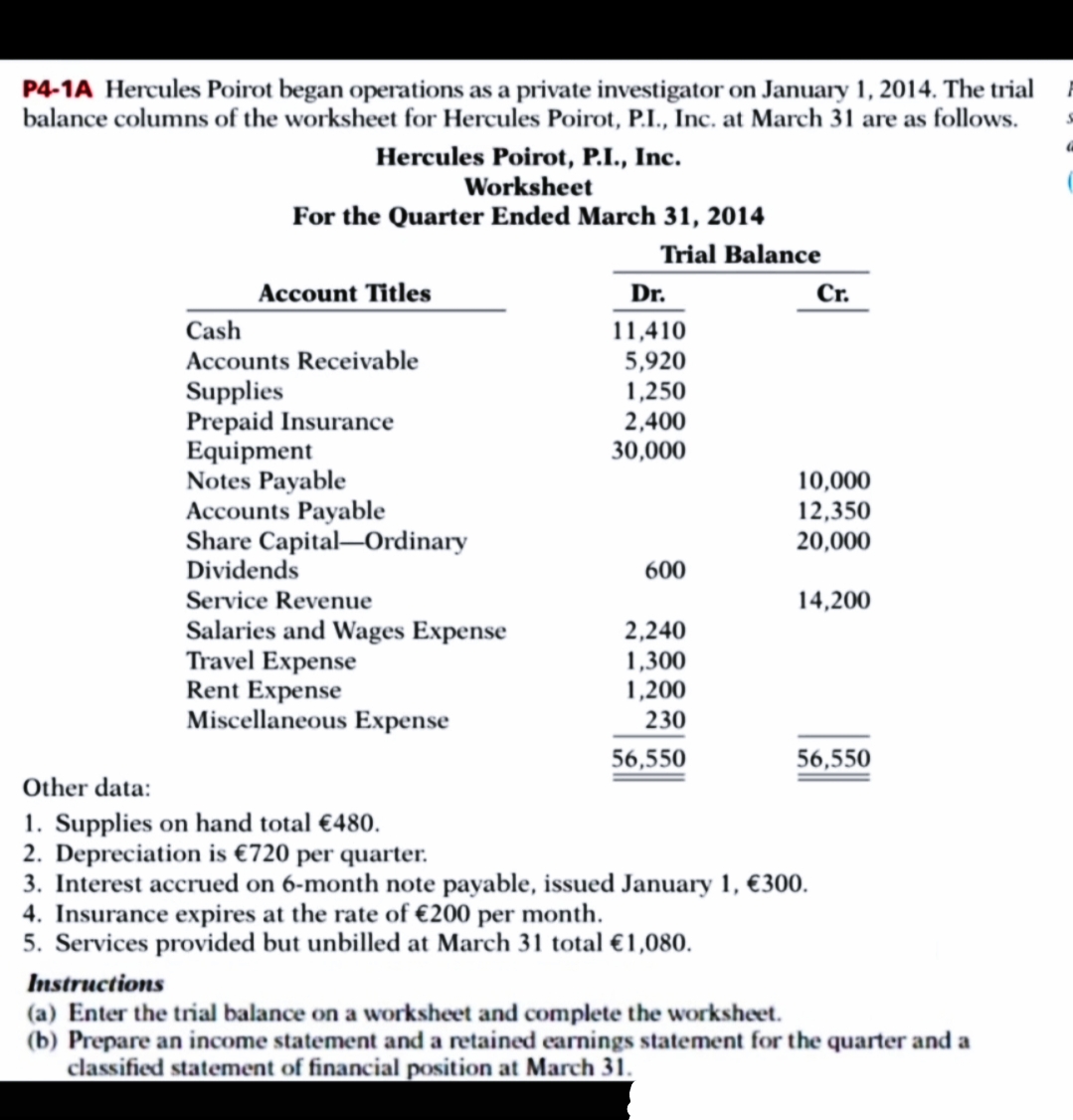

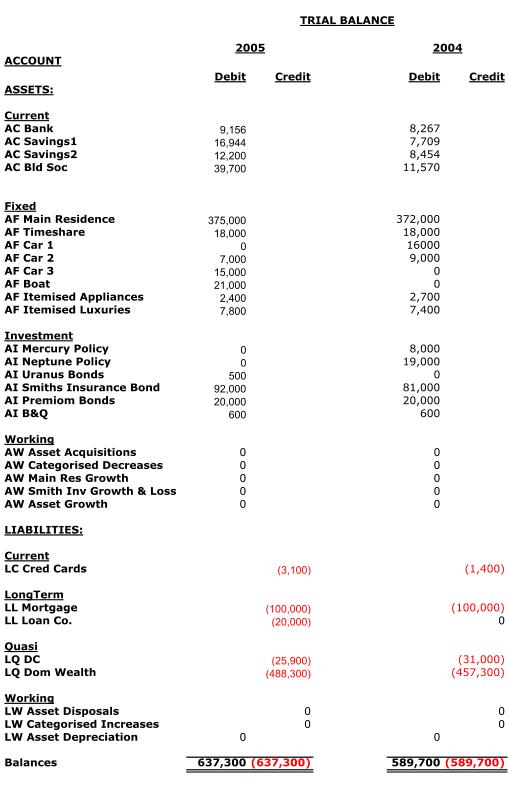

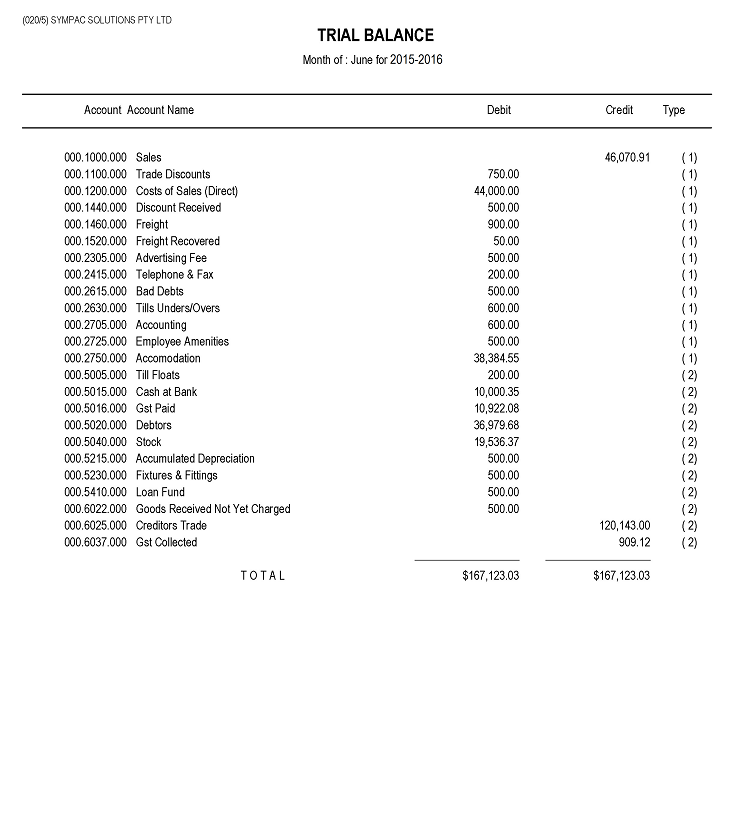

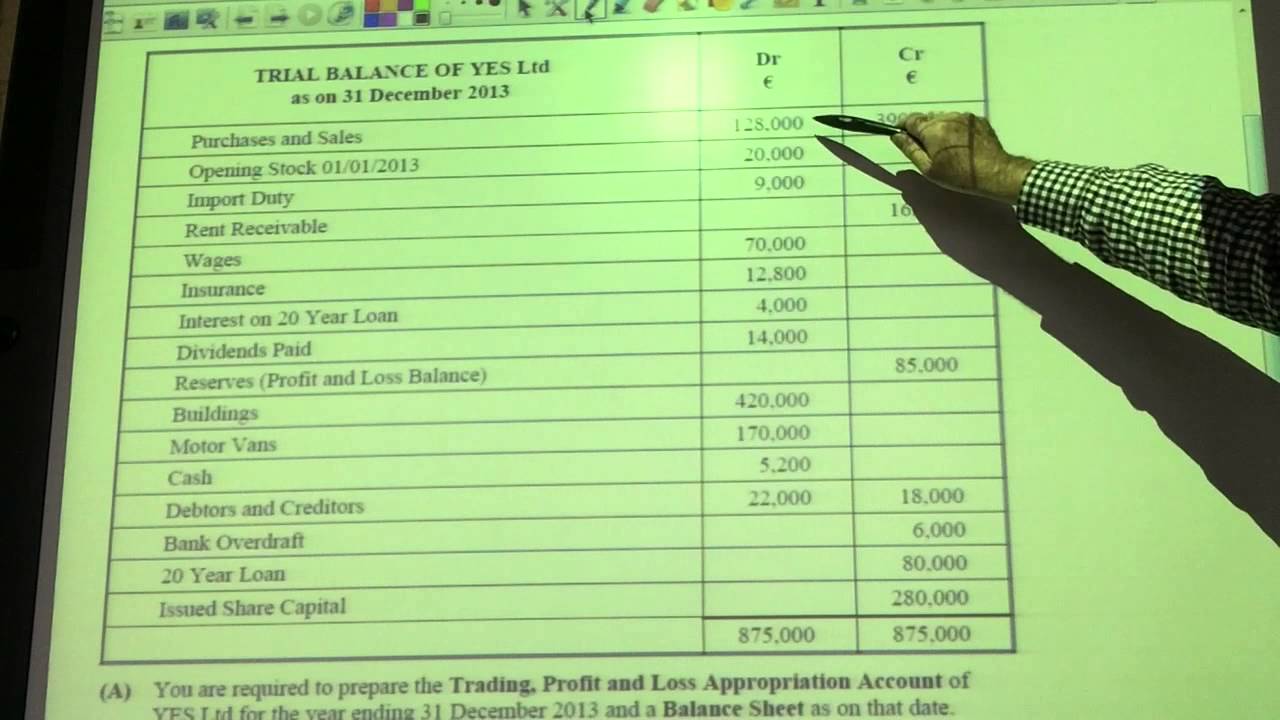

This statement comprises two columns:.

Short note on trial balance. This is done to determine that debits. This means that it states the total for each asset, liability, equity,. Meaning of ipo, definition of trial balance on the economic times.

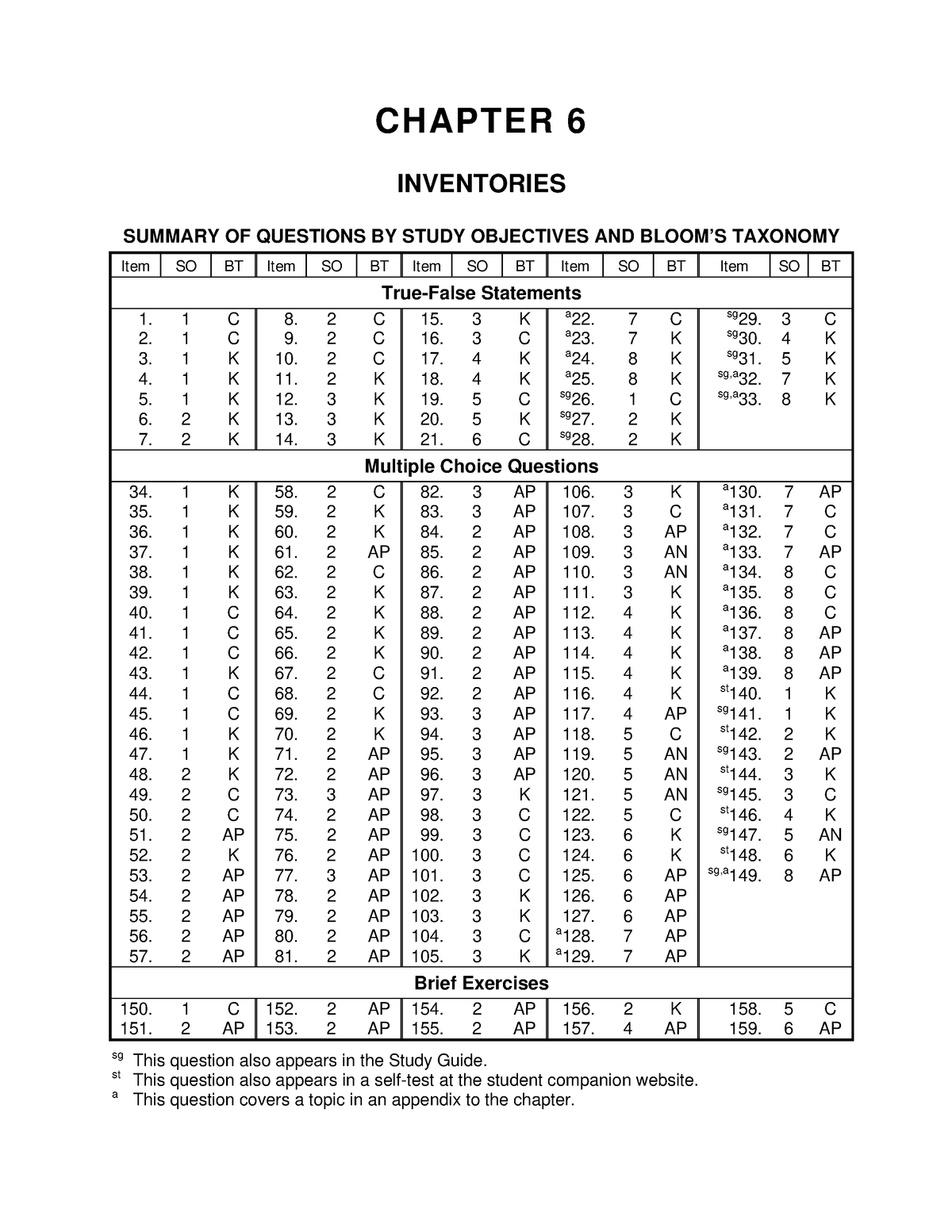

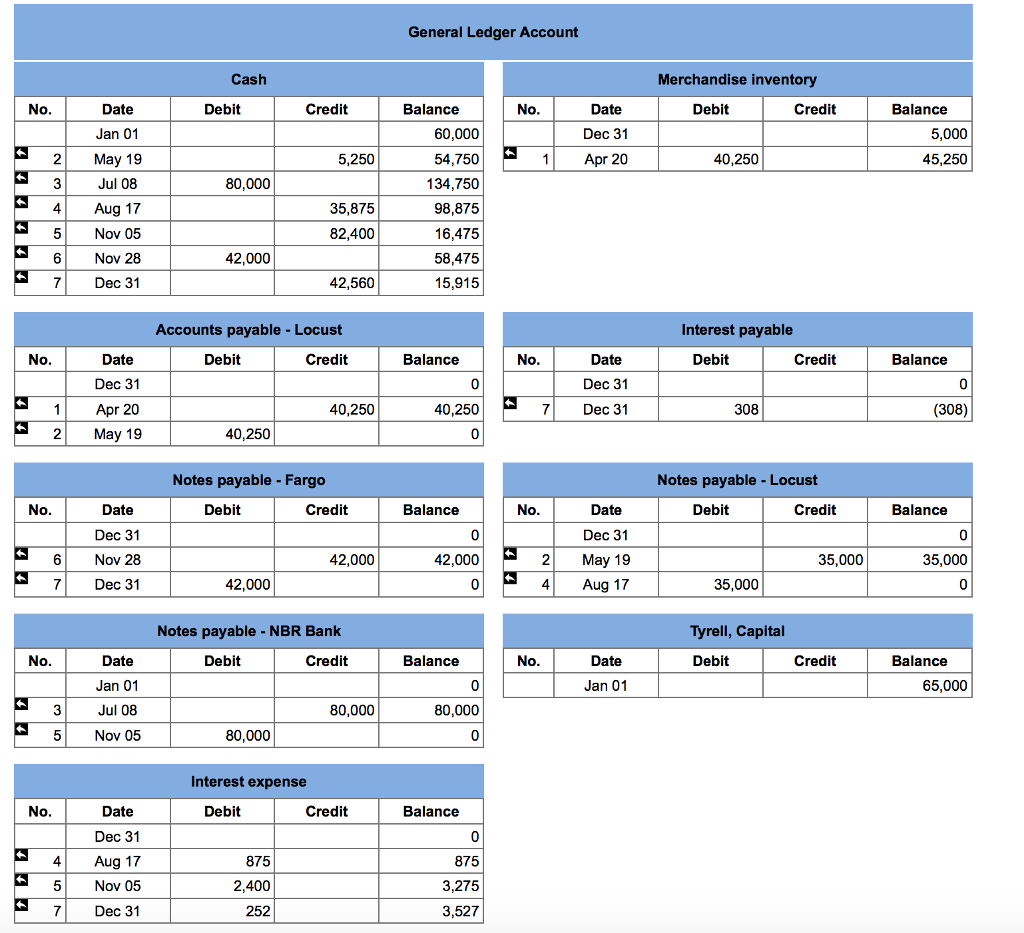

The important idea is that companies use some numbering system. Williams, m., & bettner, h. Trial balance is the third step of the accounting process, wherein once the accounts are posted in the ledger, a statement is prepared to show the debit and credit balances.

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. To prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. Trial balance is a initial summary for books of account.

Batliboi, a trial balance may be defined as a statement of debit and credit balances extracted from the ledger with a view to testing the arithmetical accuracy of the. There are three ways in which a trial balance can be prepared. A trial balance is a statement that keeps a record of the final ledger balance of all accounts in a business.

The primary purpose of a trial balance is to identify errors and ensure the equality of debits and credits. This is used as a first check by auditors to ensure there are. A trial balance is a listing of all accounts (in this order:

A trial balance is an important step in the accounting process, because it helps identify. A trial balance is a financial report showing the closing balances of all accounts in the general ledger at a point in time. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

Creating a trial balance is the first step in closing the. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet.

Asset, liability, equity, revenue, expense) with the.