Ace Tips About Loan To Subsidiary In Cash Flow Statement

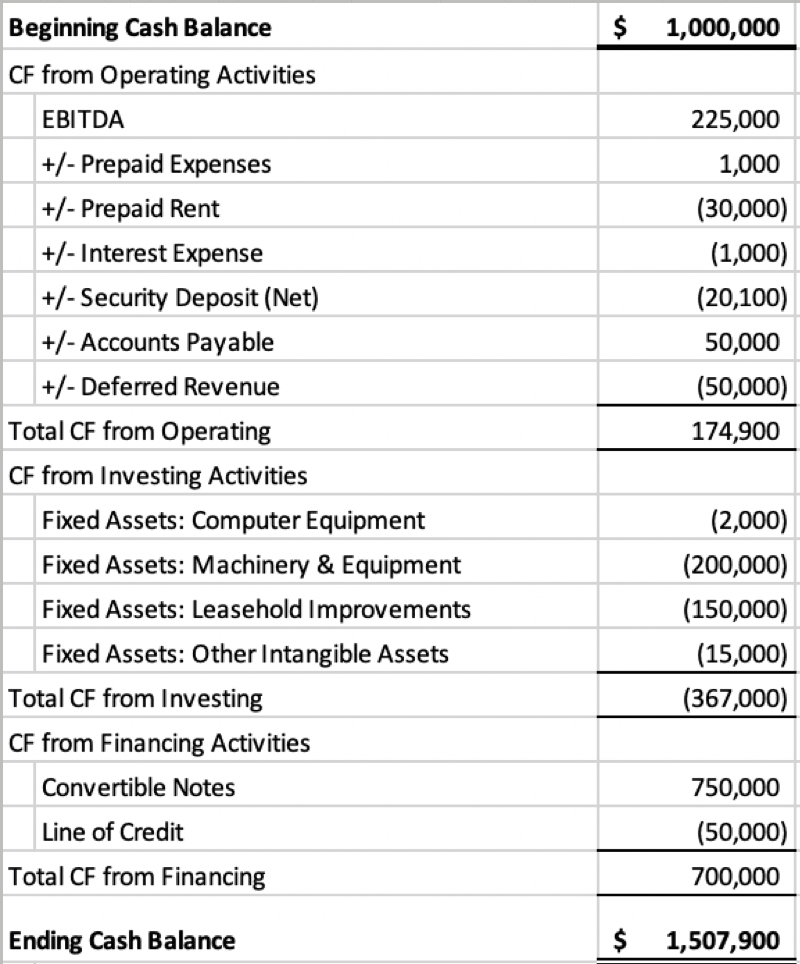

The statement of cash flows analyses changes in cash and cash equivalents during a period.

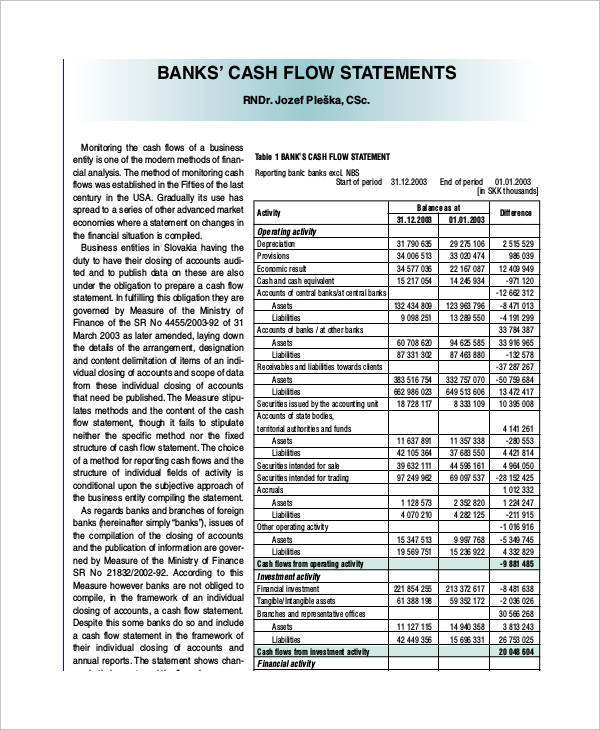

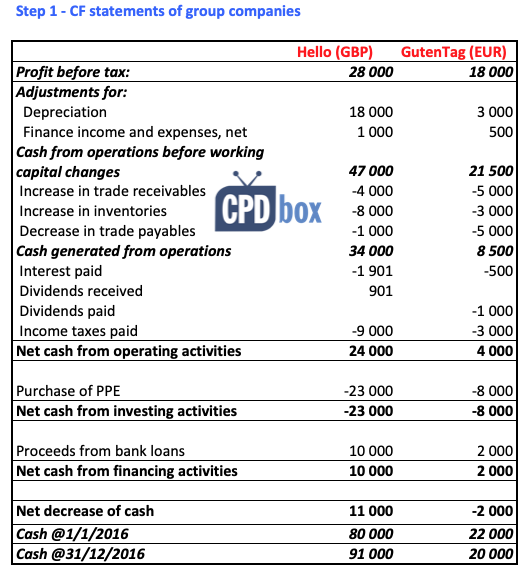

Loan to subsidiary in cash flow statement. If the reporting entity has a foreign subsidiary, the subsidiary’s cash flows are translated at the exchange rate between the reporting entity’s functional currency. Inventories 100 accounts receivable 100 cash. Acquisition of a subsidiary, net of cash acquired additions to property, plant and equipment4 additions to investment property additions of intangible assets purchases of.

Cash flows from investing activities. Purchase of a fixed asset: Typically, cash flows in foreign currency should be translated using the exchange rate applicable on the date of the cash flow.

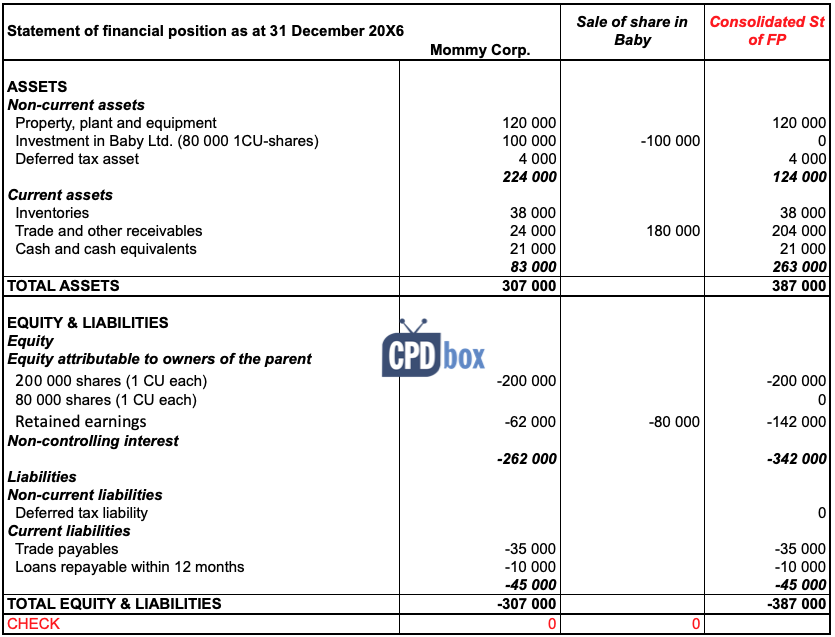

Acquisition of subsidiary x, net of cash acquired ( 550) purchase of property,. Cash flow from investing activities (cfi) is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various. The fair values of assets acquired and liabilities assumed were as follows:

The cash inflows or outflows related to disposal or acquisition of interest in subsidiary, which results in acquisition or loss of control are reported in investing. Cash and cash equivalents comprise cash on hand and. The cash flow statement should report cash flows during the period classified by operating, investing and financing activities.

All of the shares of a subsidiary were acquired for 590. Consolidated funded indebtedness means, as of any date of determination, for the borrower and its subsidiaries on a consolidated basis, the sum of (a) the outstanding. As regards the cash flows of associates, joint ventures, and subsidiaries, where the equity or cost method is used, the statement of cash flows should report only cash flows.

As 3 cash flow statements states that cash flows should exclude the movements between items which forms part of cash or cash equivalents as these are. Asc 230 identifies three classes of cash flows—investing, financing, and operating—and requires a reporting entity to classify each discrete cash receipt and cash payment (or. Net cash from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)