Stunning Info About Investment Shown In Balance Sheet

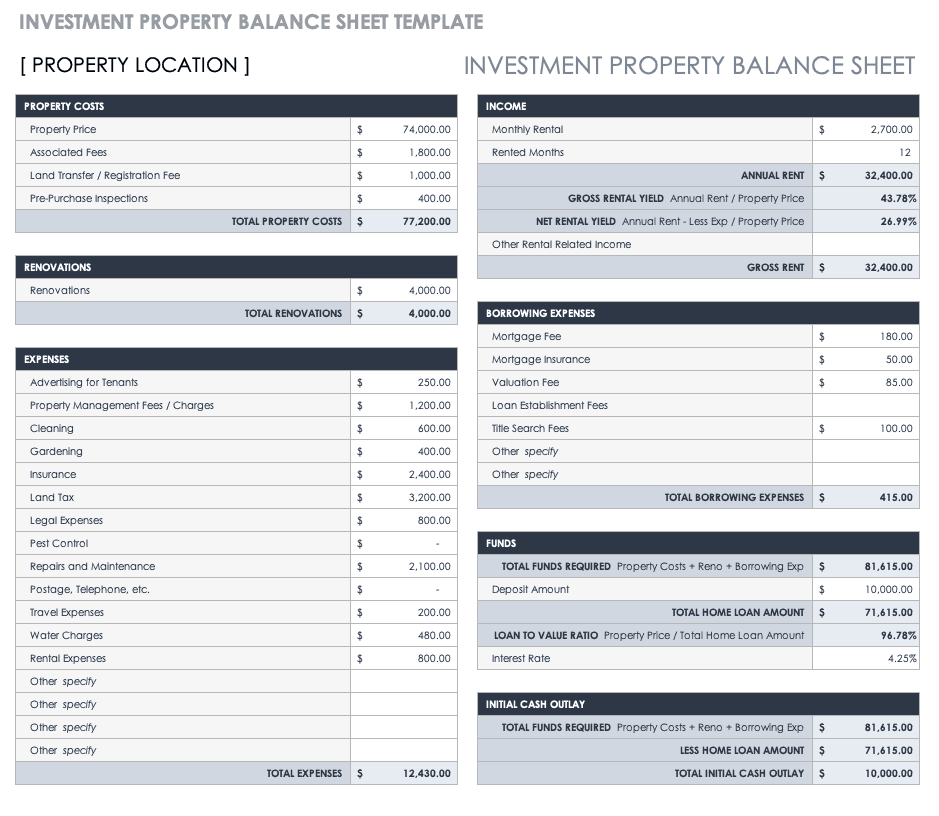

Capital investment refers to money you put into your business for the long haul, such as buying buildings or company cars.

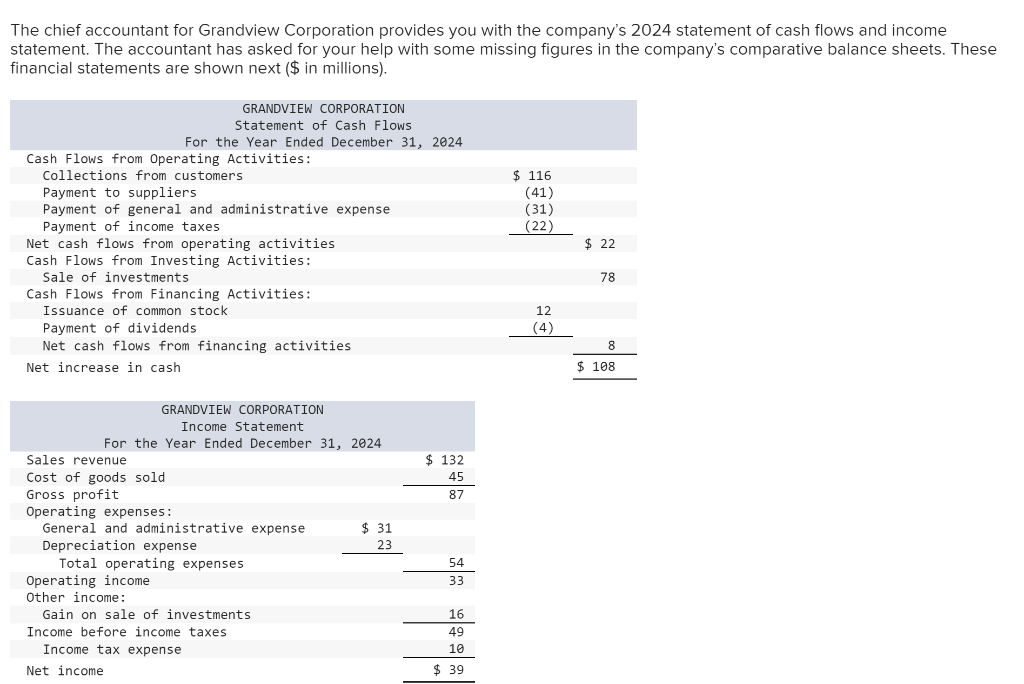

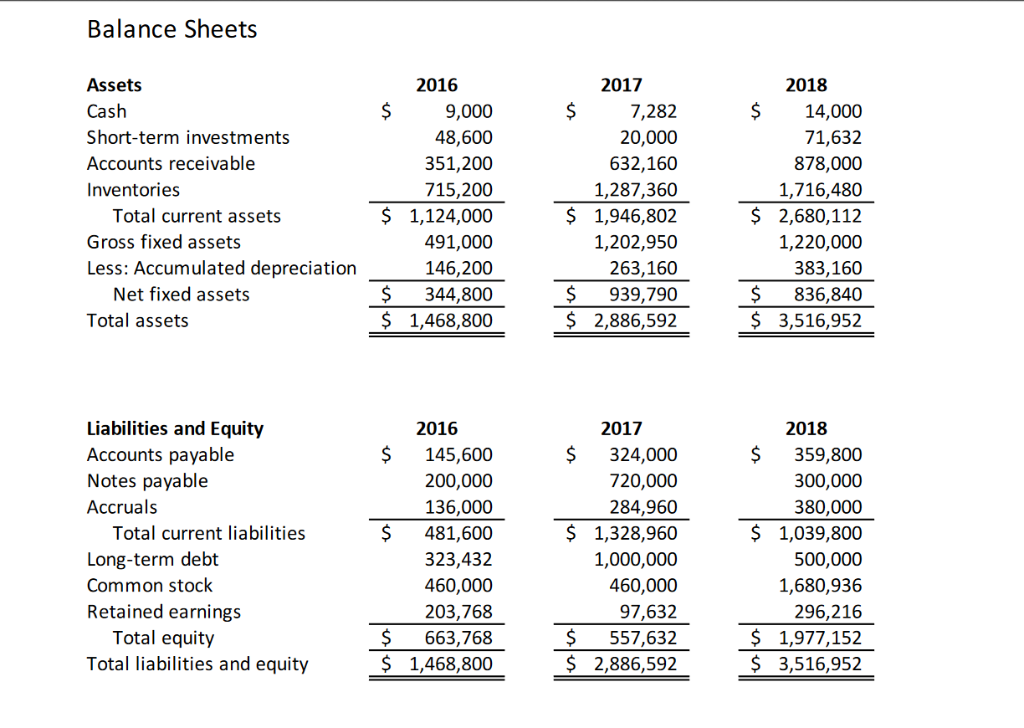

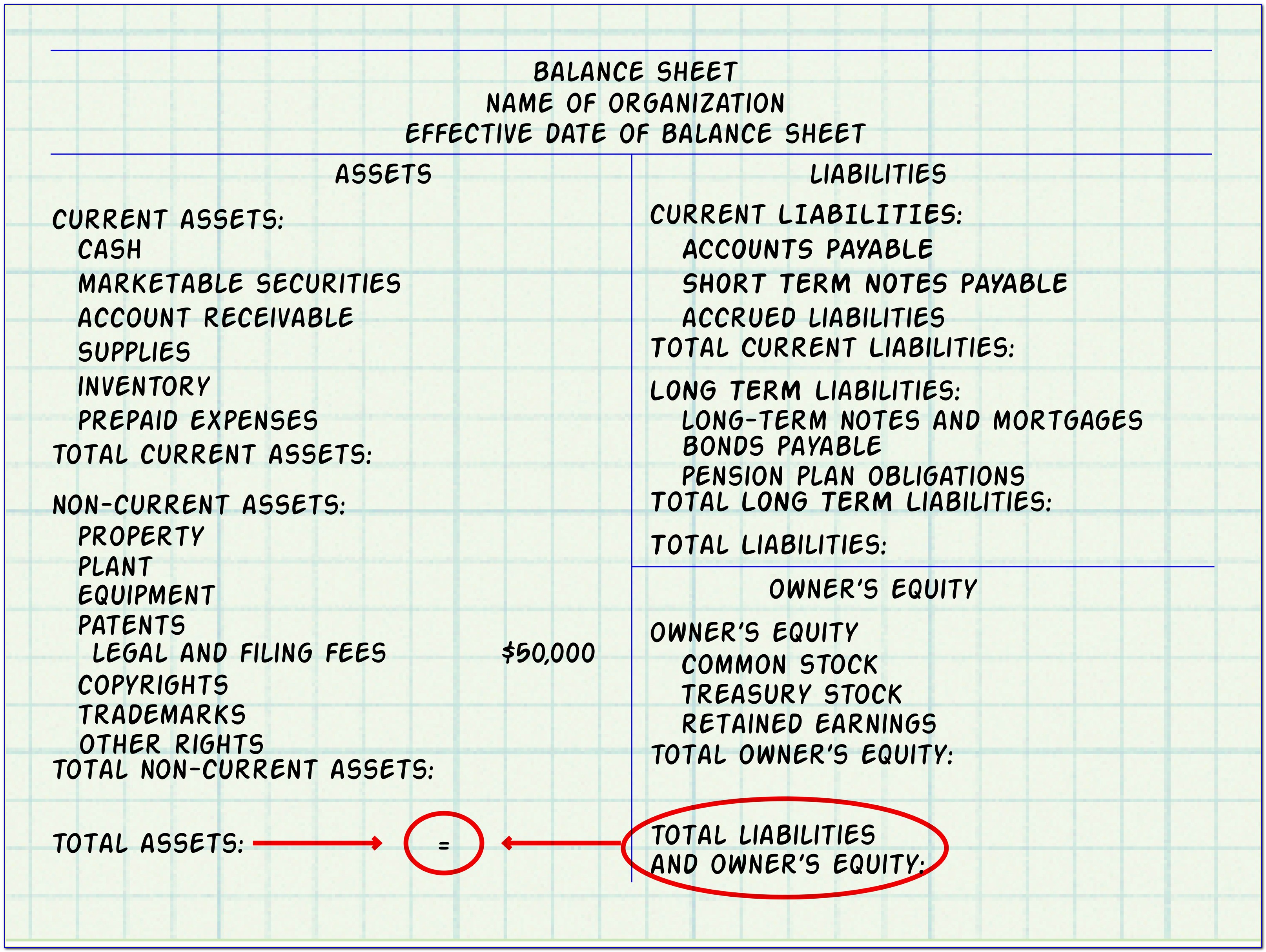

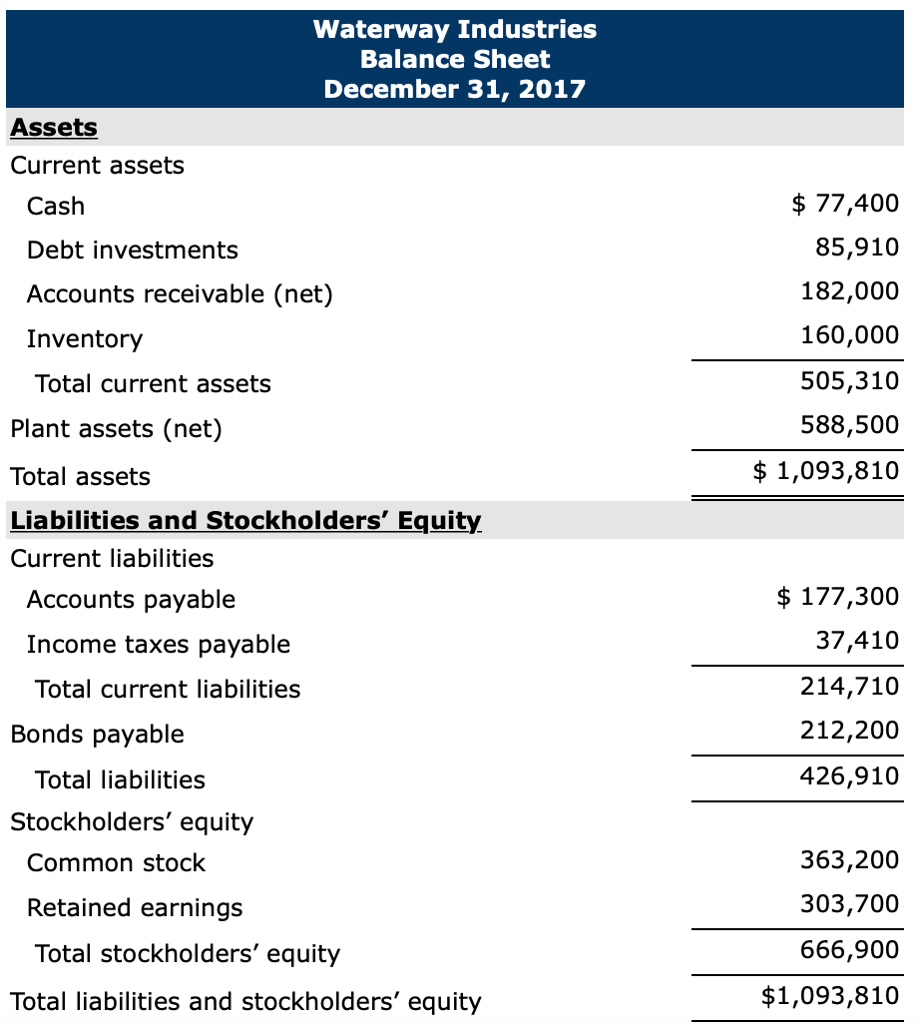

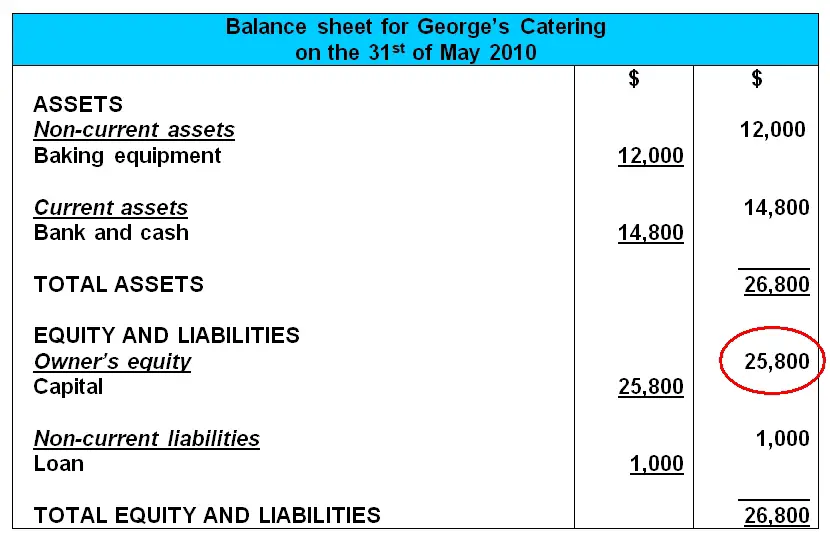

Investment shown in balance sheet. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. The balance sheet is split into two columns, with each column balancing out the other to net to. You don't enter it as a separate item on the balance sheet.

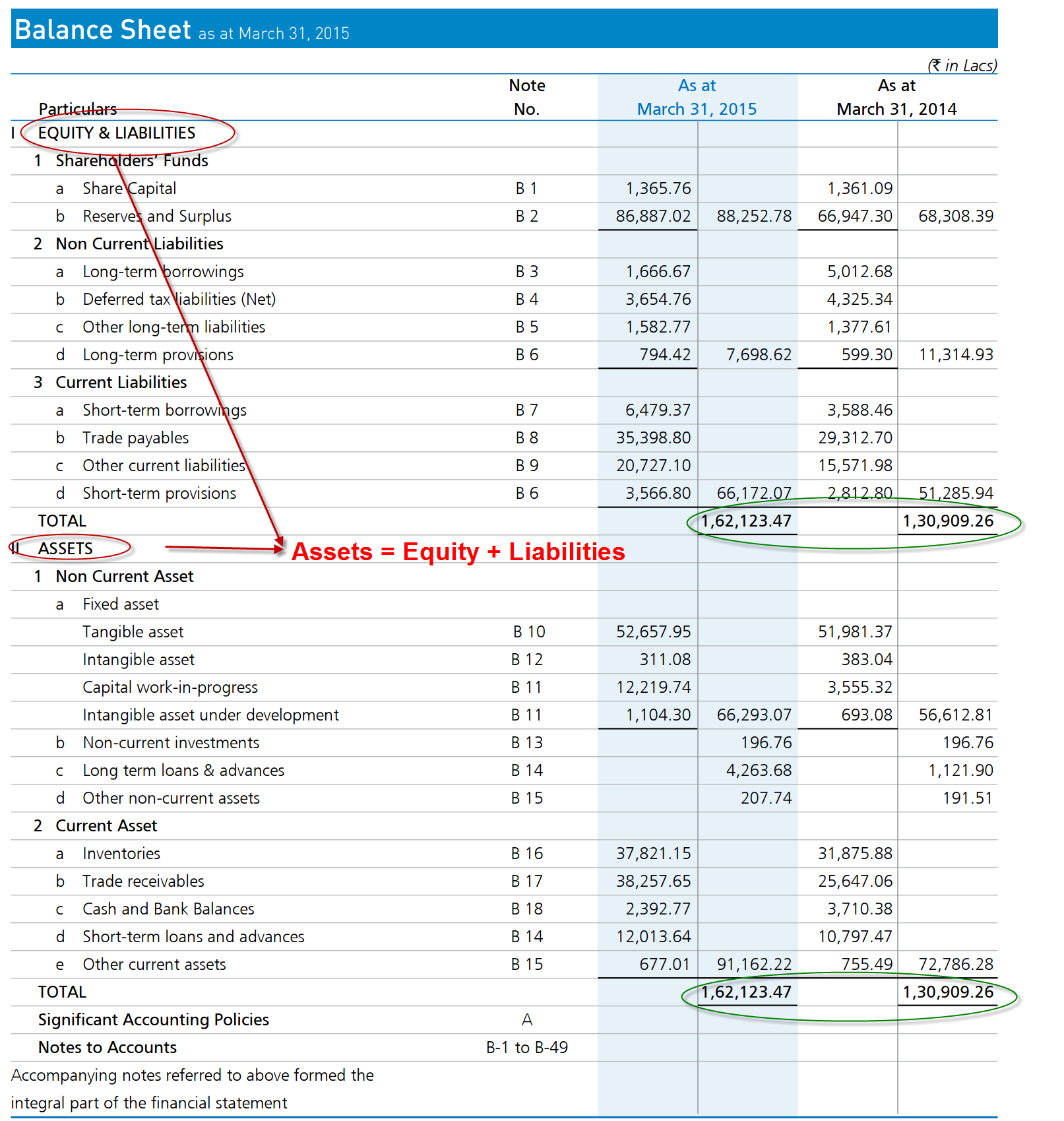

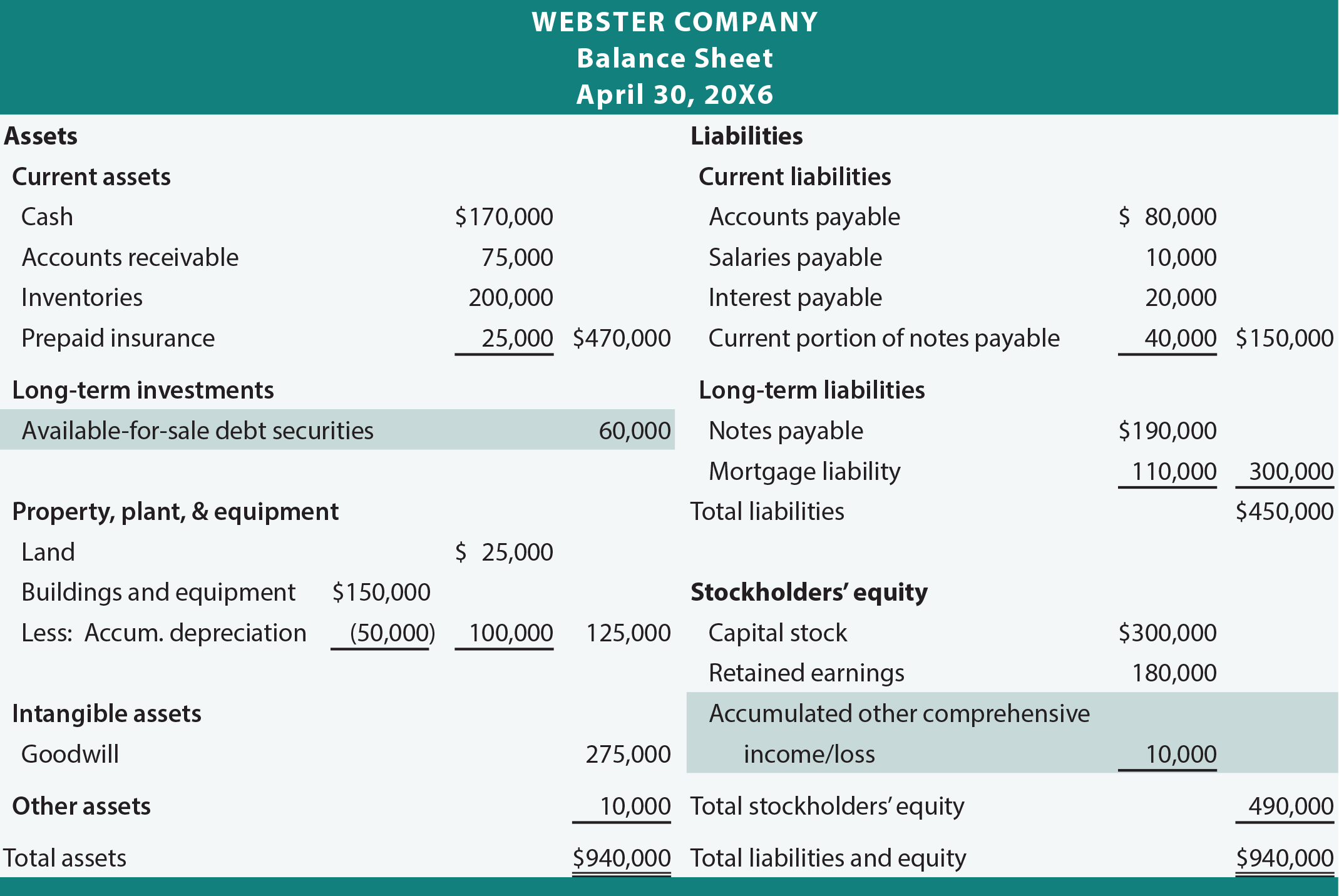

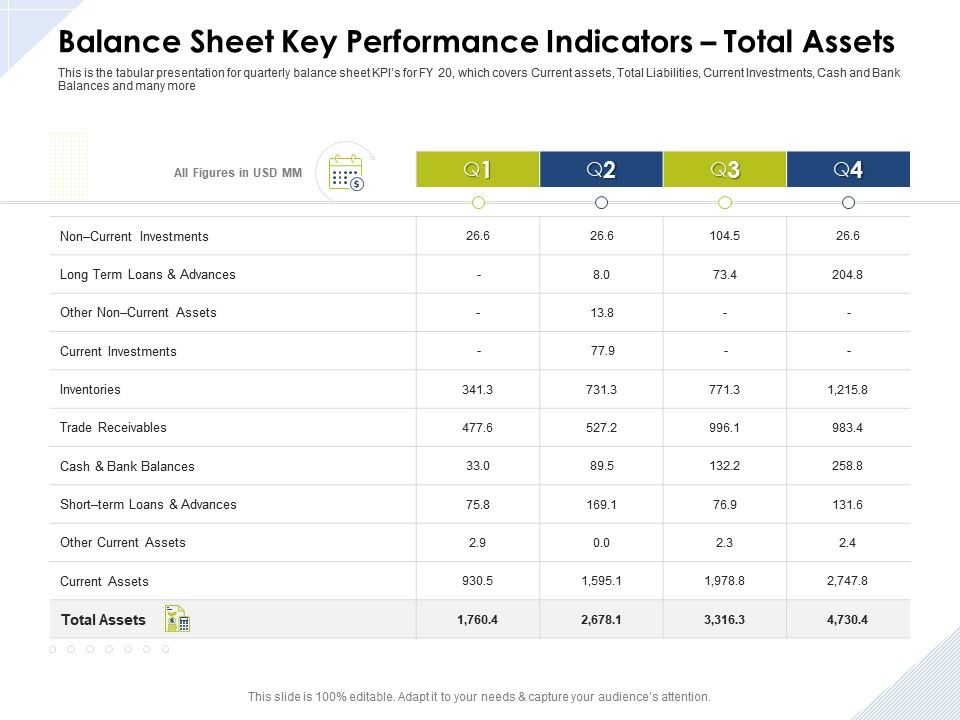

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Investments might include stock, stock funds, or bonds. The balance sheet displays the company’s assets, liabilities, and shareholders’ equity at a point in time.

The balance sheet is based on the fundamental equation: Assets must equal liabilities plus equity. The entry to record the valuation adjustment is:

We will now understand the 2 nd half of the balance sheet, i.e. A company's financial statements — balance sheet, income, and cash flow statements —are a key source of data for analyzing the investment value of its stock. The asset side shows us all the company’s assets (in different forms) right from its inception.

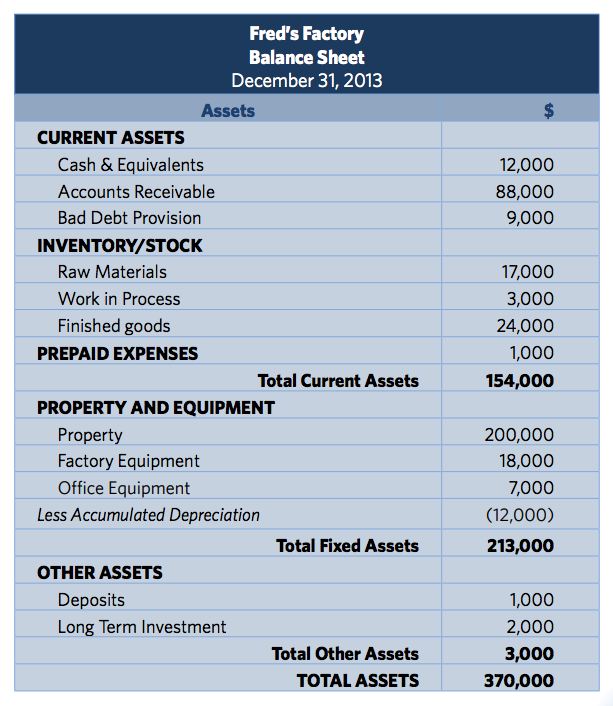

Reading a balance sheet is important in determining the financial health of a company. The asset side of the balance sheet. Current investments are those that can be readily converted into cash and are not intended to be held for more than one year.

Investment is a crucial item in the balance sheet of the business. Assets in simple terms are the resources held by a company, which help in generating the revenues. It summarizes a company’s financial position at a point in time.

The balance sheet is one of the three core financial statements that are used to. There are several approaches to valuing these assets. For example, if company a acquires a 5% stake in company b by buying 1,000,000 equity shares @ us$ 5 each, then the investment cost of us$ 5,000,000 is recorded as an investment in company a’s balance sheet.

We need to show the investments separately in the balance sheet. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. The two sides of the balance sheet must balance:

In the balance sheet the market value of short‐term available‐for‐sale securities is classified as short‐term investments, also known as marketable securities, and the unrealized gain (loss) account balance of $15,000 is considered a stockholders' equity account and is part of. Us loans & investments guide reporting entities that present a classified balance sheet should see fsp 2.3.4 and fsp 9.4.1 for information on the presentation of loans, receivables, and investments as current and noncurrent. It can also be referred to as a statement of net worth or a statement of financial position.

A balance sheet is a financial document that a company releases to show its assets, liabilities and overall shareholder equity. The debit entry increases the balance sheet carrying value of the investment by the share of net income. Here is the snapshot of the assets side of the.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)