Supreme Info About Outstanding Salary In Balance Sheet

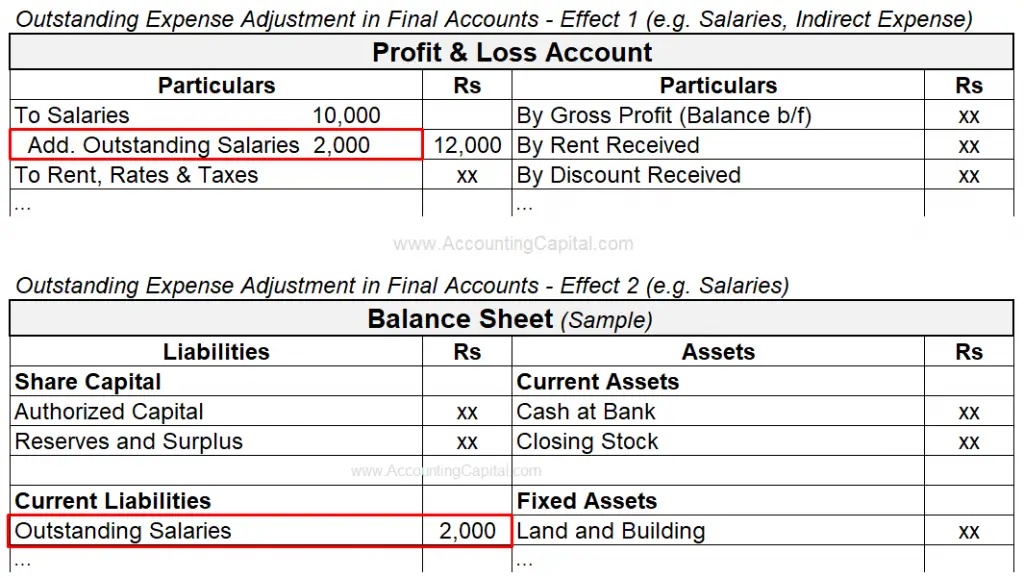

The correct answer is salaries paid are shown on the debit side of the profit and loss account but outstanding salaries (when given in additional information) is.

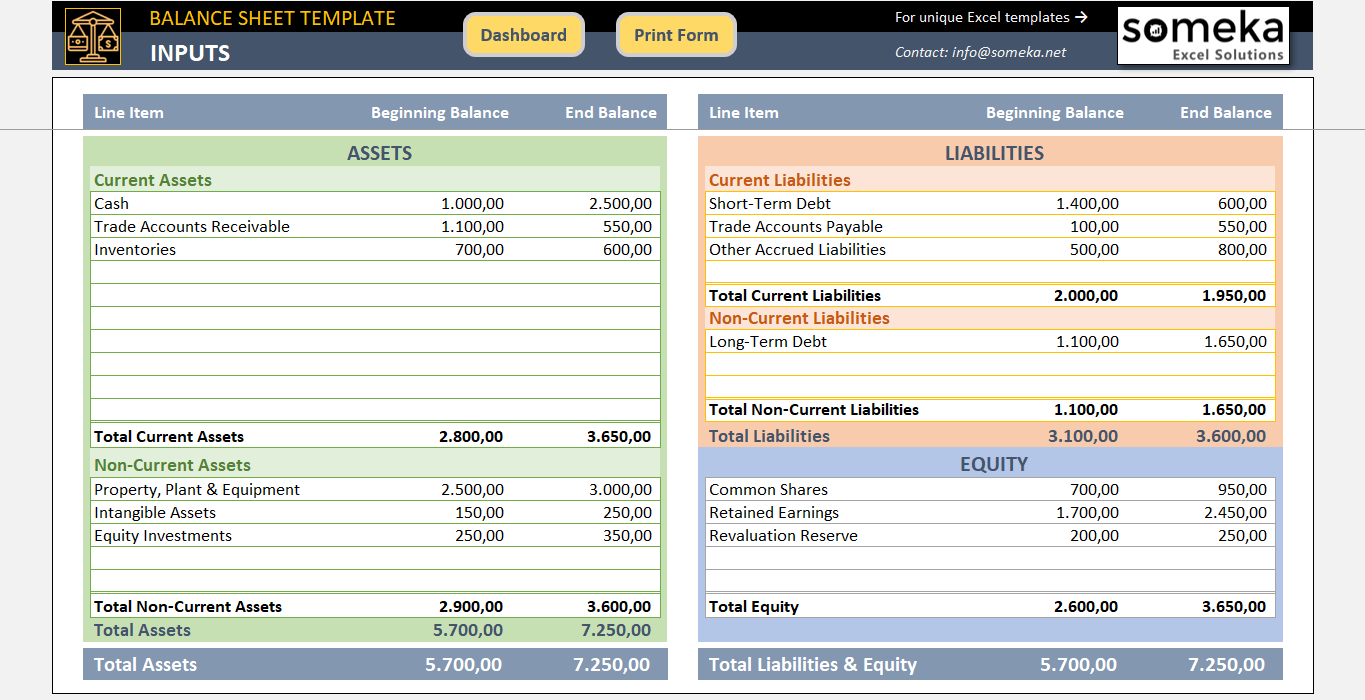

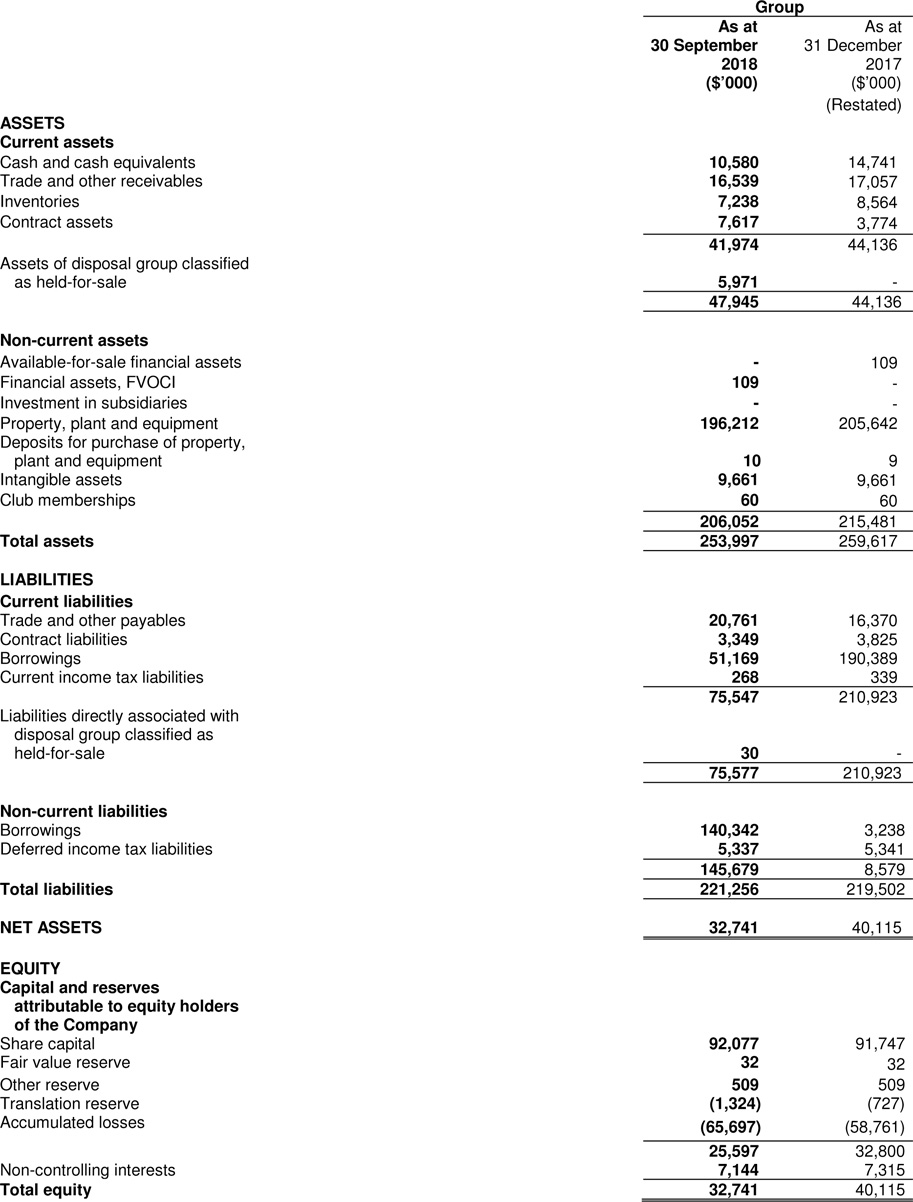

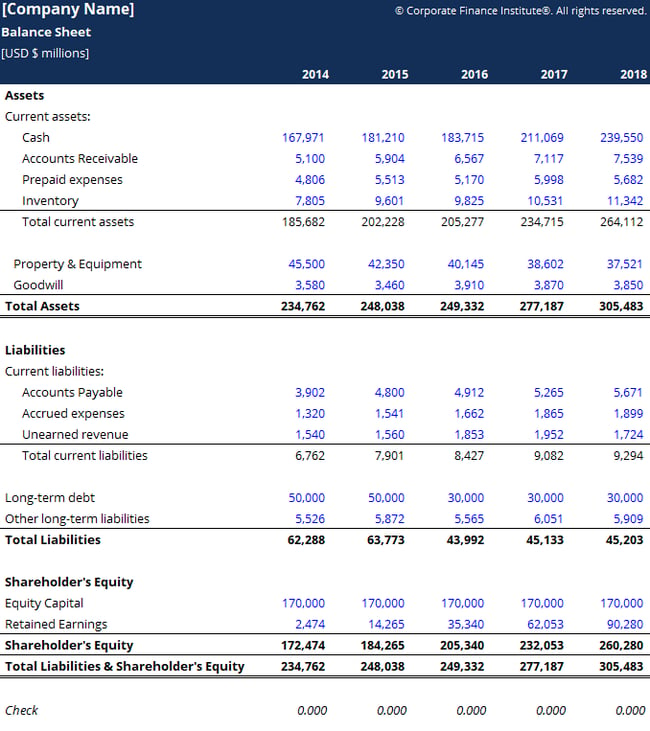

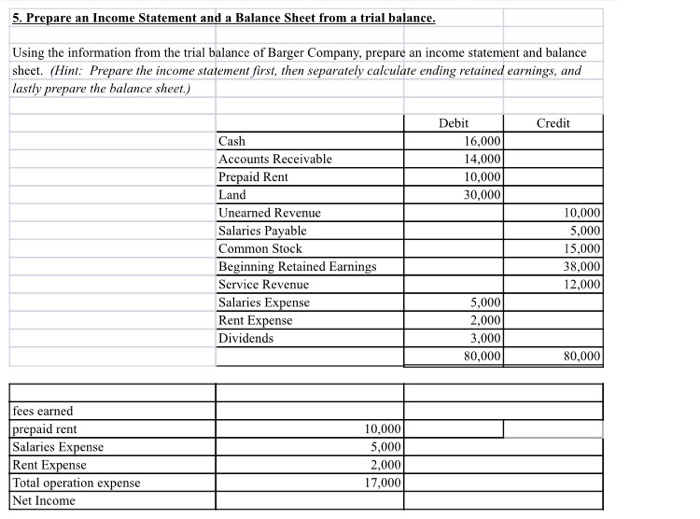

Outstanding salary in balance sheet. The accounting term “accrued wages” describes the unpaid compensation not yet paid by a company to employees for the services they have already provided. (ii) paid rent in advance ₹ 500. An accrued salary expense is likely to affect both the income statement and the company’s balance sheet.

Salary expense is recorded in the books of accounts with a journal entry for salary paid. Outstanding salary is a liability and shown in balance sheet. (i) commenced business with cash ₹ 60,000.

Outstanding wages amounting to ₹500. The following journal entry can be passed in case of outstanding expenses. Outstanding salary is added to the salary and shown on the debit side of profit and loss account.

Pass outstanding salary journal entry in the books of unreal corp. Also prepare a balance sheet. The outstanding expense is represented on the liability side of the balance sheet of a business.

(for recording the expense of the current year. Outstanding salary of rs 1,000 is added to salary account and is debited to profit and loss account. Solution verified by toppr correct option is d) outstanding expense are those expenses which are due but not paid.

This is because an accrued salary expense affects both the expense. (iii) purchased goods for cash ₹ 30,000 and credit ₹. Wages expenses will be the first entry.

Journal entry for outstanding salary at. The salary outstanding is considered as the liability on the balance sheet while the expense is recorded on the income statement. Wages that have occurred but have not yet been paid by the employer are referred to as outstanding wages.

To perform accounting with accuracy, these expenses are required. These are expenses like salary for the month of march is not. Salary paid in advance amounting to ₹5,000.

Using the below trial balance and supplementary information provided along with it. Amount of closing stock on 31st march 2022 was ₹15,000. Outstanding salary is a personal representative account.

Outstanding expenses are recorded in books of finance at the. It is further shown under the head current liabilities in the balance sheet. Company b had to pay salaries of ₹1,00,000 to its employees on.