Can’t-Miss Takeaways Of Tips About Public Accounting Audit

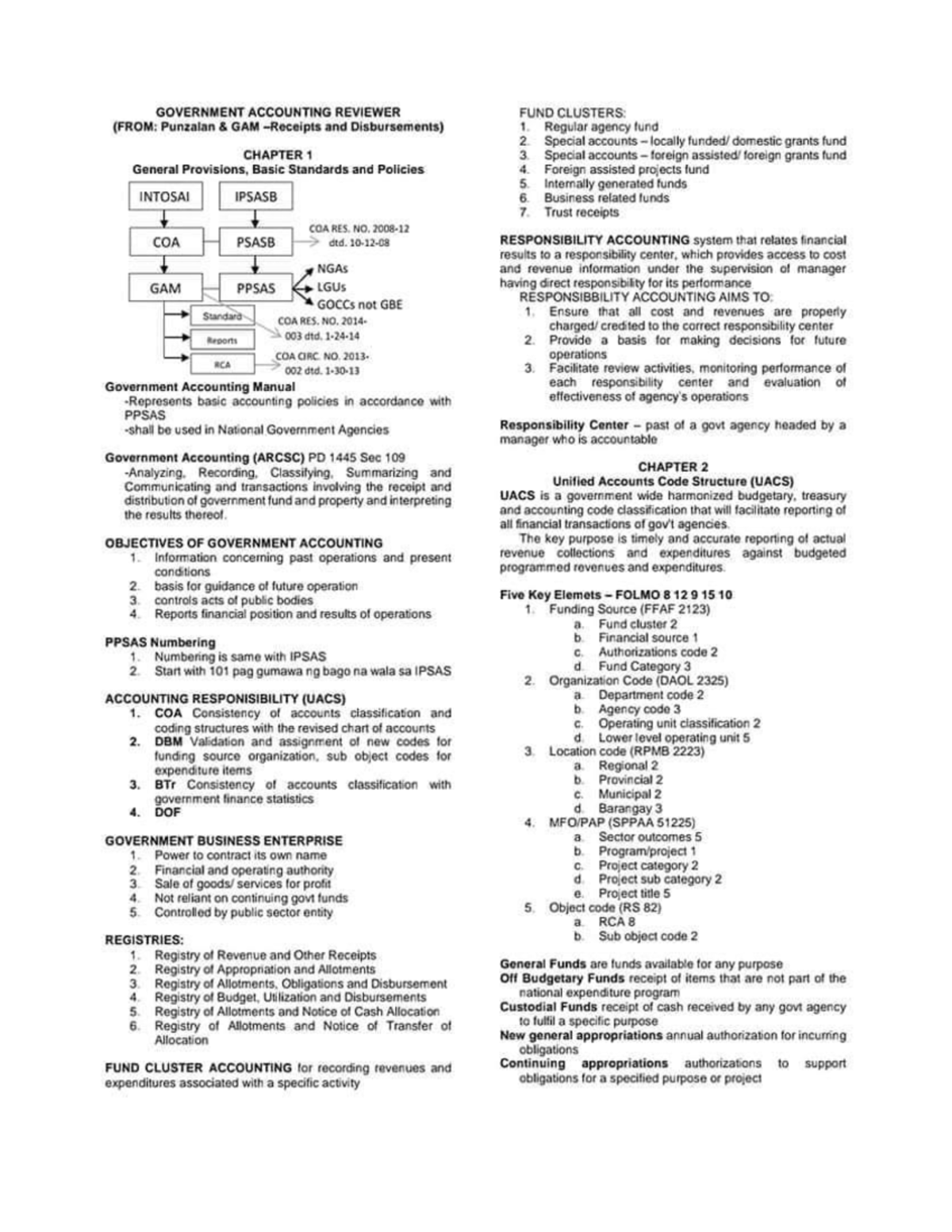

Finance or public courts of auditors in each country, to get an overview of the accounting and auditing arrangements in place.

Public accounting audit. Public accounting refers to the practice of providing accounting, taxation, audit, and consultancy services to different clients. In a recent move, the pcaob has penalized four audit firms for breaches related to communication standards with audit committees. The average annual net price of the universities in this ranking amounts to about $17,500.

Public accounting refers to a business that provides accounting services to other firms. Having a master’s degree in accounting or an mba is valuable for those looking into careers in treasury, investor relations, fp&a (financial. Audit is fundamental to accountability.

Companies hire public accounting firms for internal and external audits because only a third party can conduct an authentic audit. Public accountants provide accounting expertise, auditing, and tax services to their clients. Cost of an online accounting degree.

Auditing is a specialized branch of public accounting practice. Certified public accountant duties. Private audit underpins accountability of corporations to uphold trust in capitalism (mueller et al., 2015 ), while public audit.

Peraturan menteri keuangan nomor 192/pmk.03/2007 tentang tata c ara penetapan w ajib p ajak dengan kriteria. Internal audit leaders can be agile by embracing change and adapting quickly in uncertain times, but shifting to an agile mindset requires an environment safe for learning. These services usually fall into one.

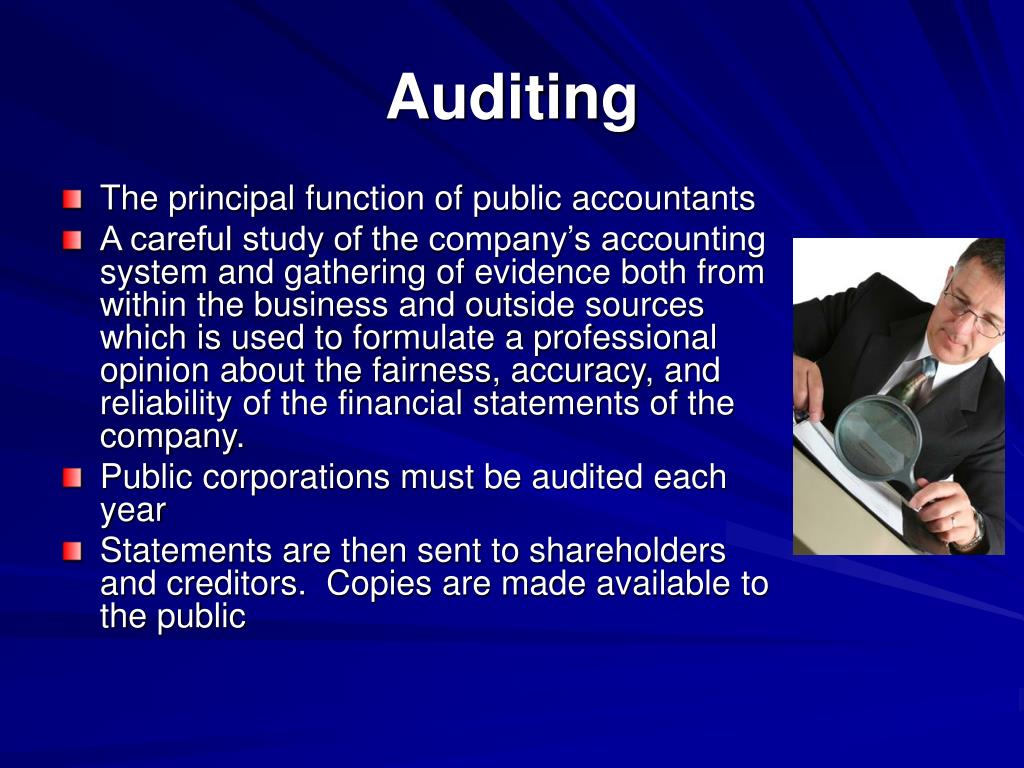

Auditing lies at the very heart of public accounting. China and the united states reached a landmark agreement that allowed the us public company accounting oversight board to inspect auditors’ work involving. Audit quality is an important thing that public accounting firms must consider.

Accounting and business, 8 (1), hal. Auditing and the chapter1 public accounting profession the evolution of auditing practices & the traditional conformance role of auditing. Cpas analyze financial records to prepare tax returns, create budget reports, and conduct.

What is public accounting? It is the process through which public accountants examine and. Actively teach subjects for introduction of accounting, auditing, public sector accounting, forensic accounting and investigative auditing and management.

Public accounting browse by positions in public accounting in public accounting, the cpa serves many clients as an objective outsider or in an advisory capacity. In the dynamic realm of modern business, where technological strides occur at breakneck speeds, certified public accountant (cpa) firms in the philippines are faced. What is public accounting?

The national center for education.