Fine Beautiful Info About Salary Expense Financial Statement

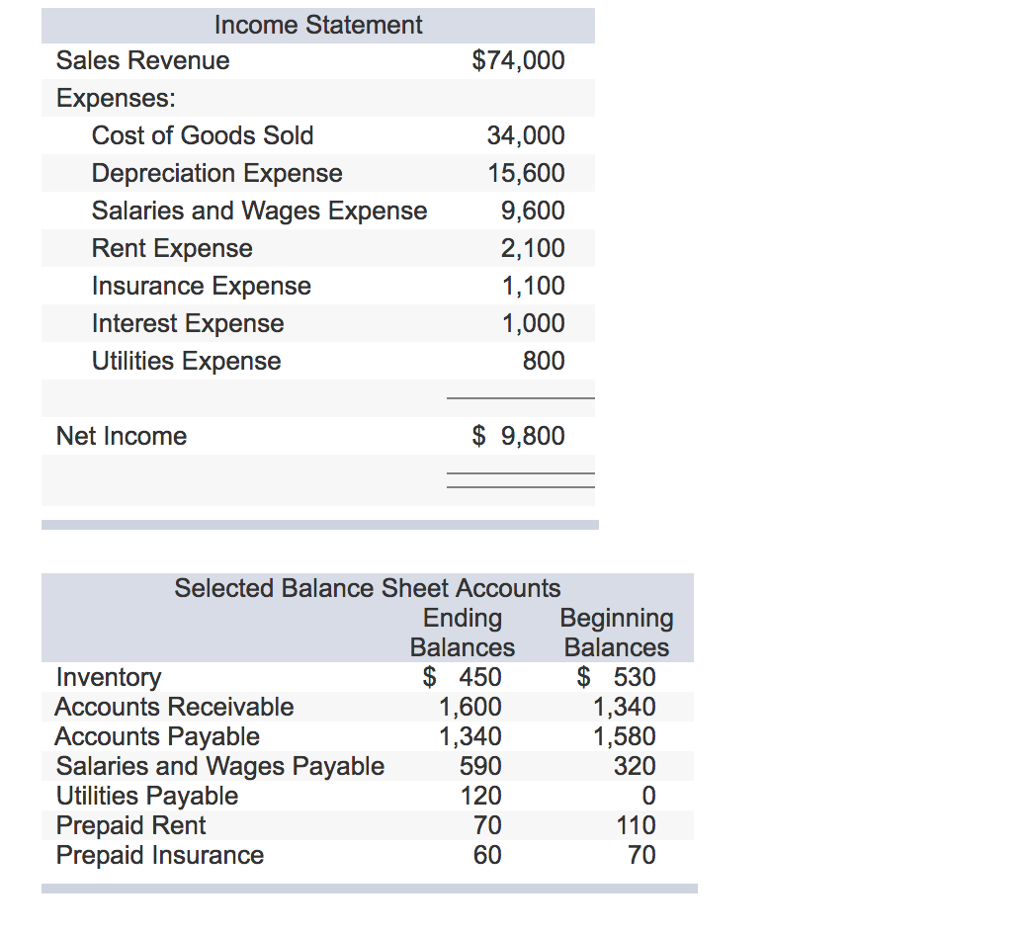

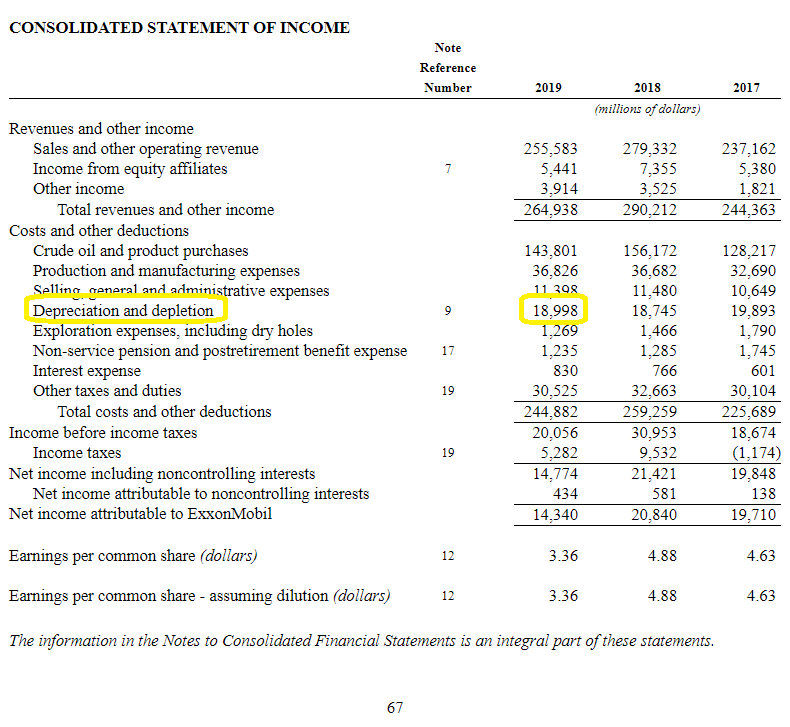

An income statement provides a detailed look at how much profit a business makes in an accounting period.

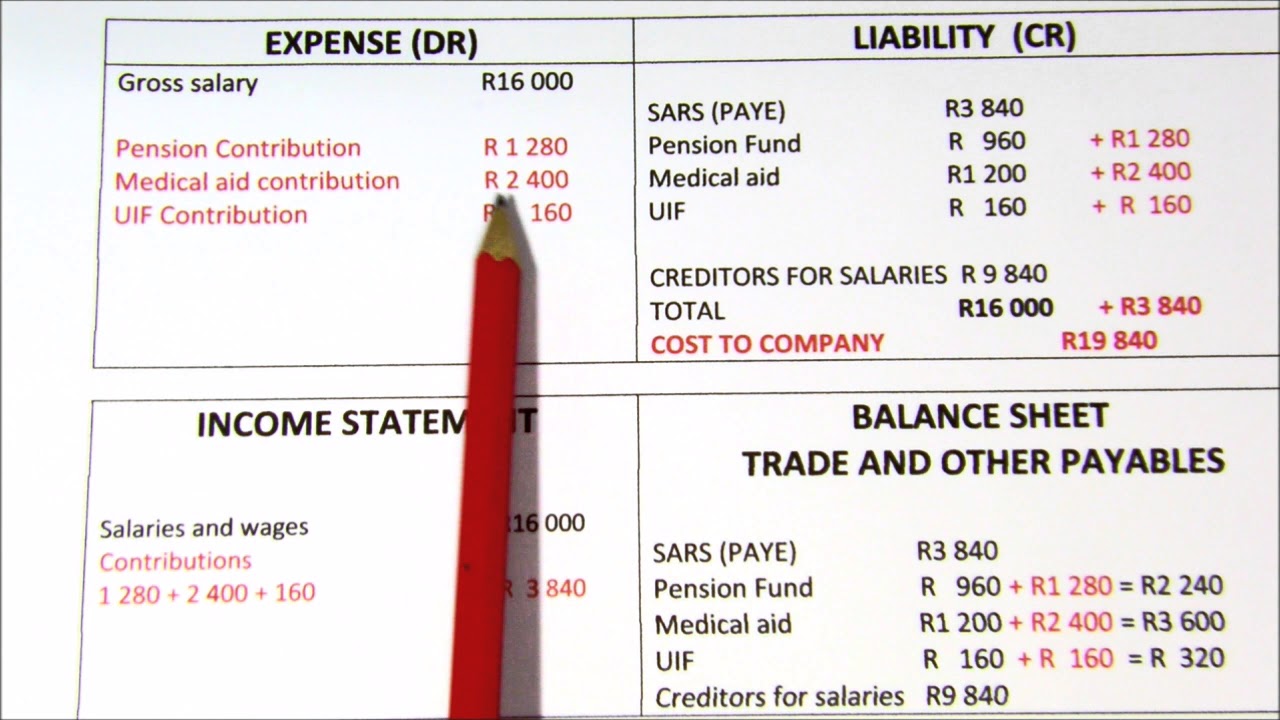

Salary expense financial statement. An income statement summarizes a company's financial performance. If the enterprise is a corporation, the owner's gross compensation should be debited to a salary expense account. Salaries expense is the fixed pay earned by employees.

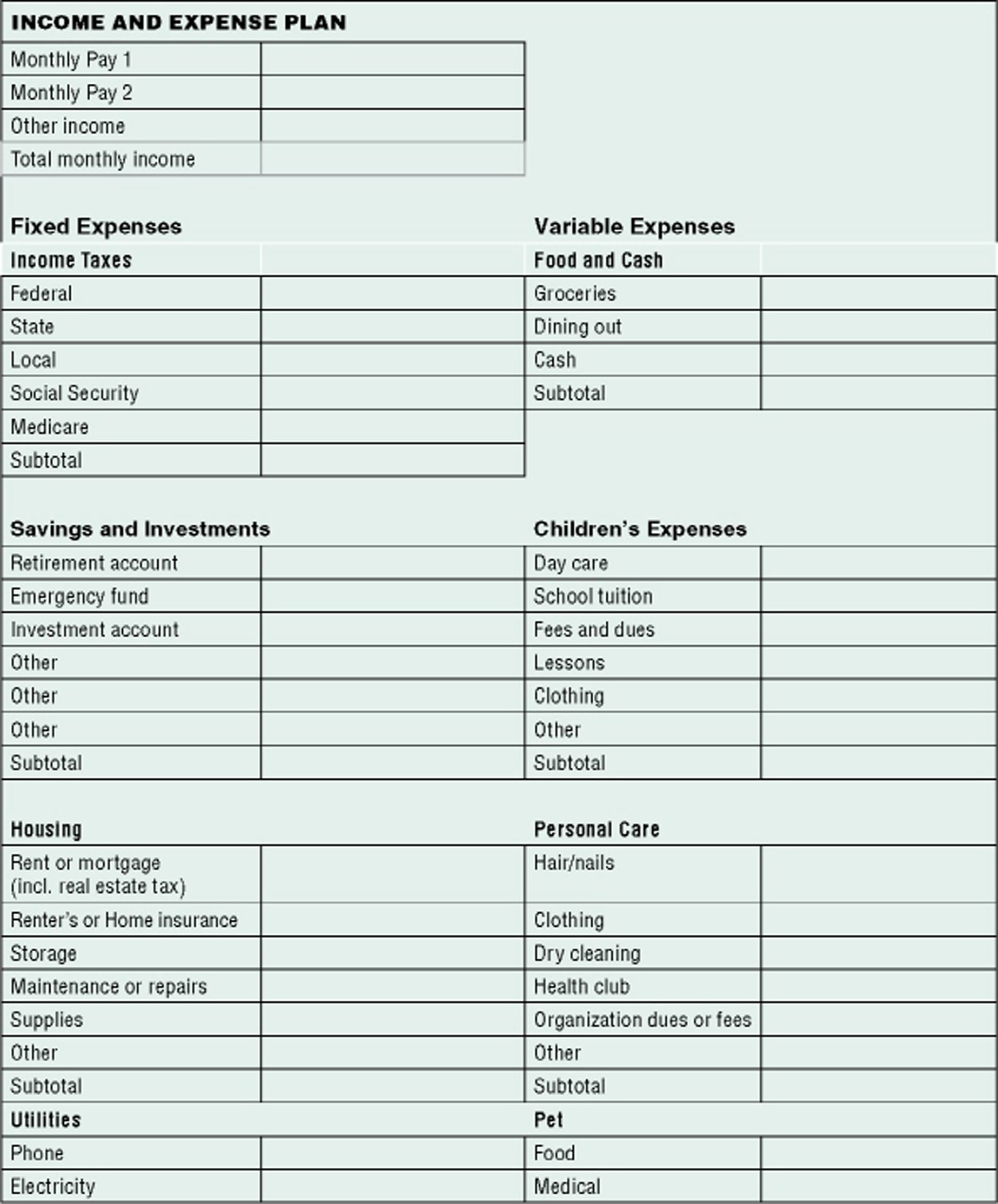

Salaries payable is a liability account and will increase total liabilities and equity by $1,500 on the balance sheet. The income statement primarily focuses on a company's revenues and expenses during a particular period. For example, if you itemize,.

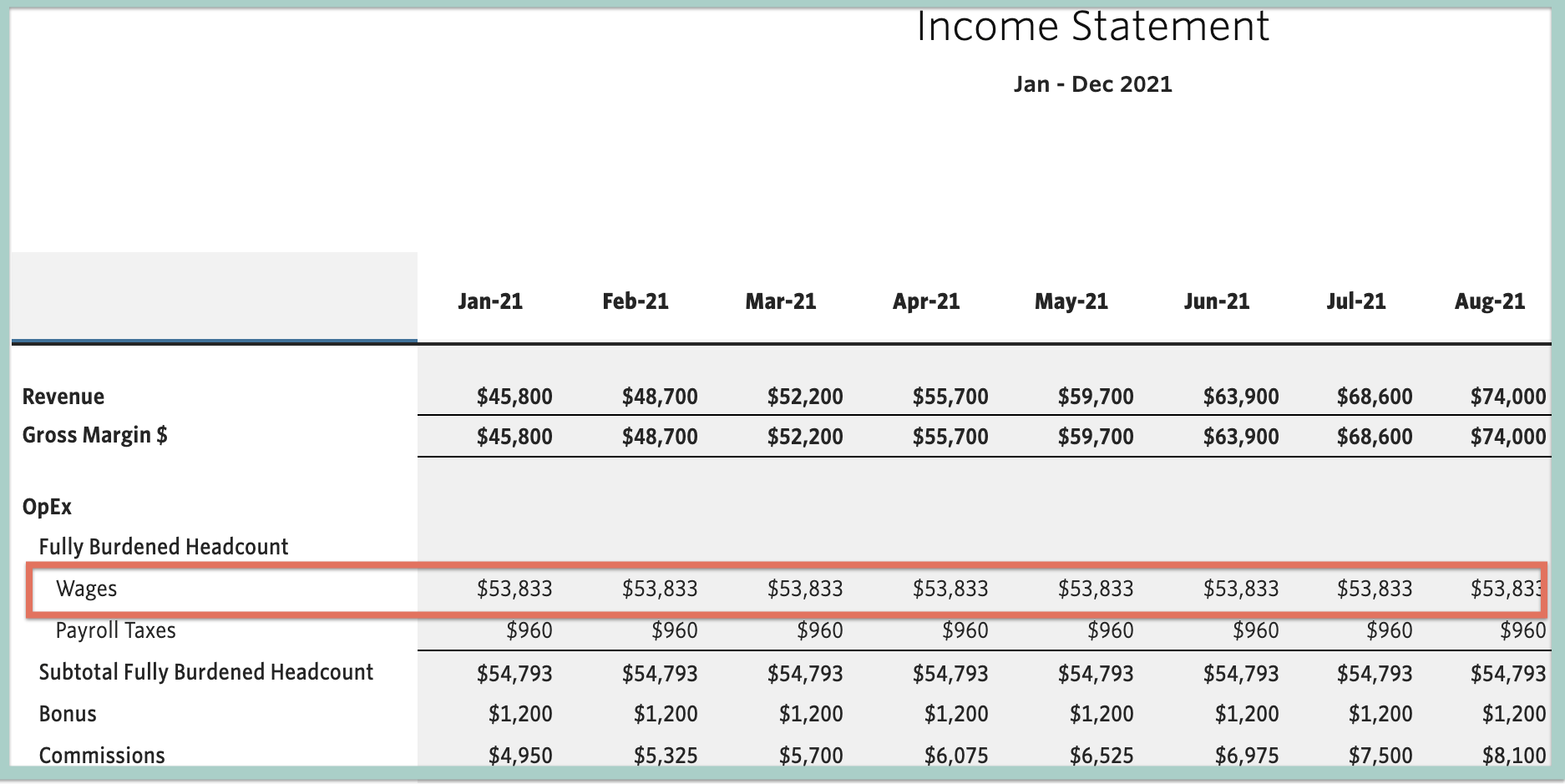

For example, wages for work done in the month of december are paid on the first day of. Below, we illustrate the journal entries for wage expense. Salaries are paid to on the 26th of every month and the last salaries paid were on dec.

But there is a floor. Salaries expense definition. Company a pays its employees on the first day of the next month.

Salaries and wages as expenses on income statement. You can learn about the health of a business—up and down,.

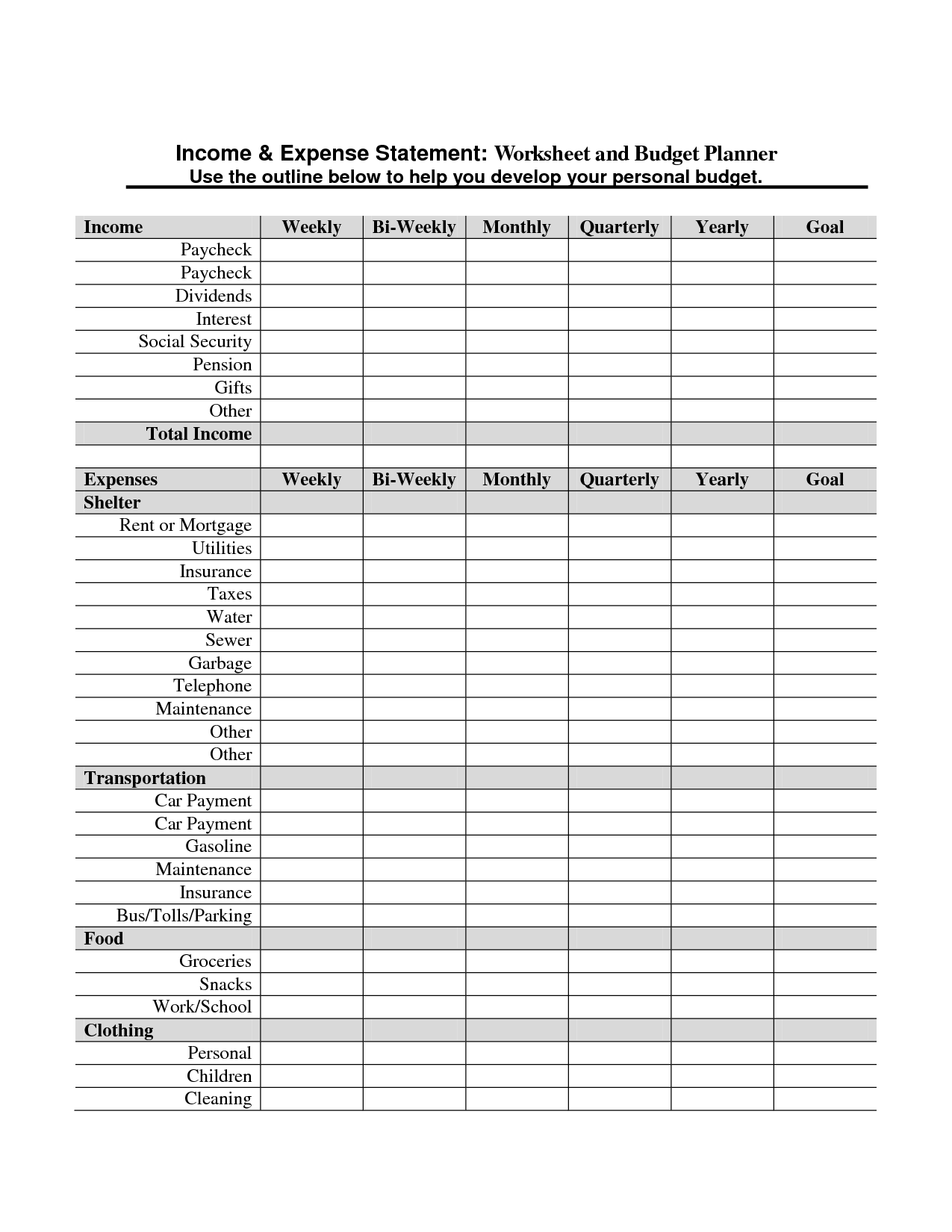

Once expenses are subtracted from revenues, the. Lawn mowing revenue, gas expense, advertising expense, depreciation expense (equipment), supplies expense, and salaries expense. Common expense categories to include in your expense policy include:

Minimum wage a wage expense has to at. Salary expense is an important component of financial statements because it provides insight into a company’s ability to pay its employees and manage its. Impact on the financial statements:

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). The income statement is the most common financial statement and shows a company's revenues and total expenses, including noncash accounting, such as. Adjusting your financial statements is one of the most important steps.

Salaries do not appear directly on a balance sheet, because the balance sheet only covers the current assets, liabilities and owners equity of the company. The week’s worth of unpaid salaries and wages is actually a liability that you will have to pay in the future even though you haven’t yet spent the cash. Ebitda is the most common metric used for valuing businesses with more than $5 million in annual revenue.

A wage expense is listed on the income statement while the wages payable account is a liability on the balance sheet. Is the drawing account a capital account?. Salaries and wages of a company's employees working in nonmanufacturing functions (e.g.