Nice Tips About Preliminary Expenses Treatment In Cash Flow Statement

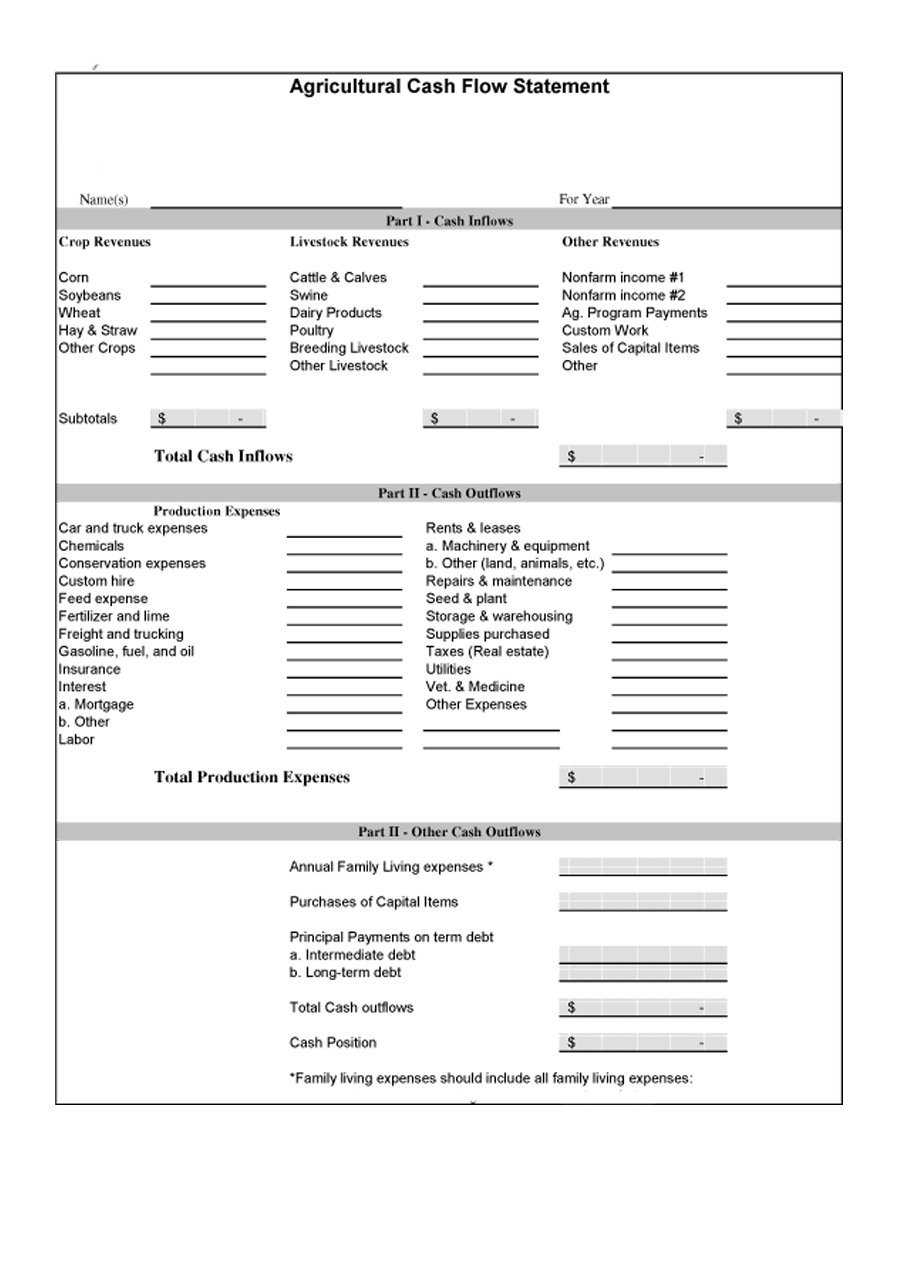

Using the indirect method, operating net cash.

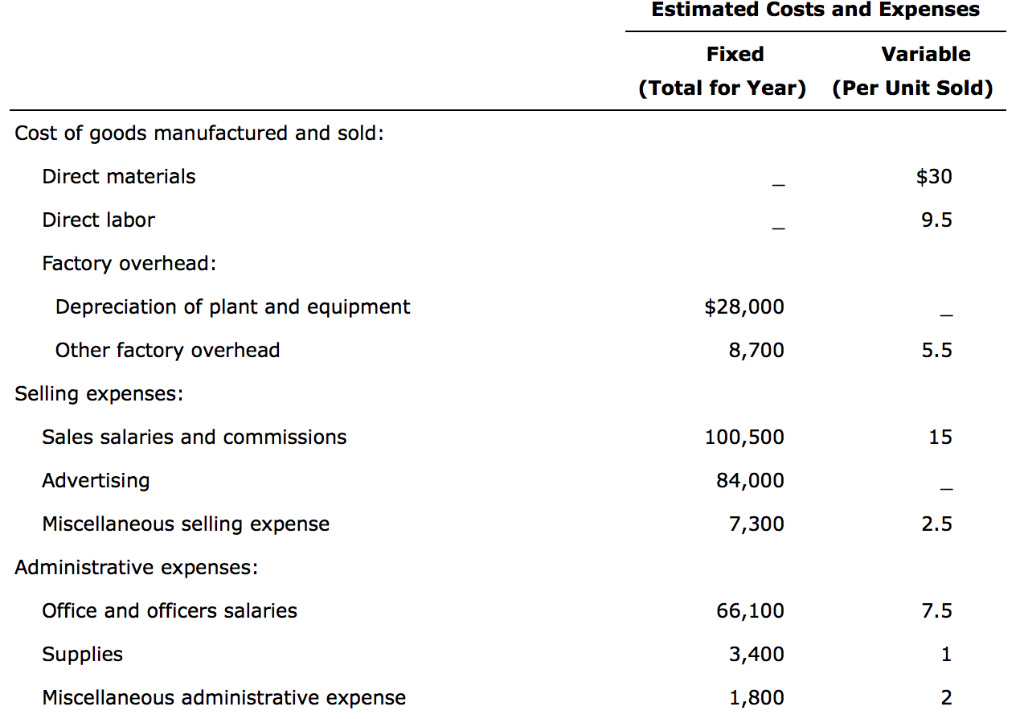

Preliminary expenses treatment in cash flow statement. The treatment of provision in the cash flow statement occurs through cash flows from operating activities. Taxes paid are generally classified as operating cash flows. Depreciation expense on cash flow statement example.

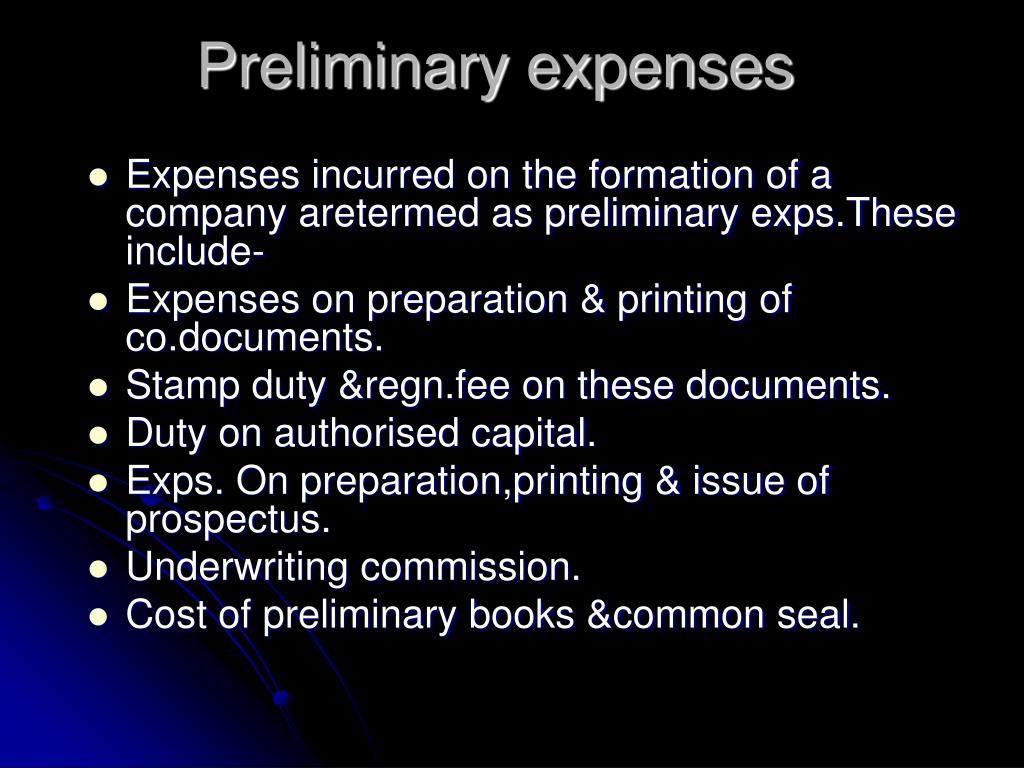

The preliminary expenses if given in the question are added to determine profit before. Accounting treatment of preliminary expenses in cash flow statement. Taxes paid should be classified within operating cash flows unless specific identification with a financing or investing.

This article considers the statement of cash flows of which it assumes no prior knowledge. We'll tell you what this is, break it down the key elements, why you should care, and how to make money from it. Determine net cash flows from operating activities.

Increase in prepaid expenses on cash flow statement. As we have seen above, an increase in prepaid expenses has a negative effect on cash flow as there is a cash. Items placed under the operating expenses section of a cash flow statement are things that reduce current assets, such as a decrease in inventory or.

It is relevant to the fa (financial accounting) and fr. The statement of cash flows is prepared by following these steps: Pensions and other employee benefits.

So, after paying all these expenses, we treat all these preliminary expenses with following ways : As mentioned above, the first part includes removing the expense. These expenses are already incurred and paid for during the.

The cash flow statement indirect method is used by most corporations, begins with a net income total and adjusts the total to reflect only cash received from operating activities. For example, we have a $5,000 depreciation expense charged to the income statement during the accounting period. This method is called the direct method because it calculates the net cash flows from operations in a much more straightforward fashion than the indirect.

These expenses are termed as. The preliminary expenses written off report of the total income is documented and retained in the financial analysis, in addition to the amount that. When company repays preliminary expenses preliminary expenses.

It is also useful in checking the accuracy of past. On the other hand, the direct method involves adding all cash revenues and subtracting all cash outlays to determine the cash flow from operating operations.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)