Formidable Tips About Nol Deduction Statement 1041

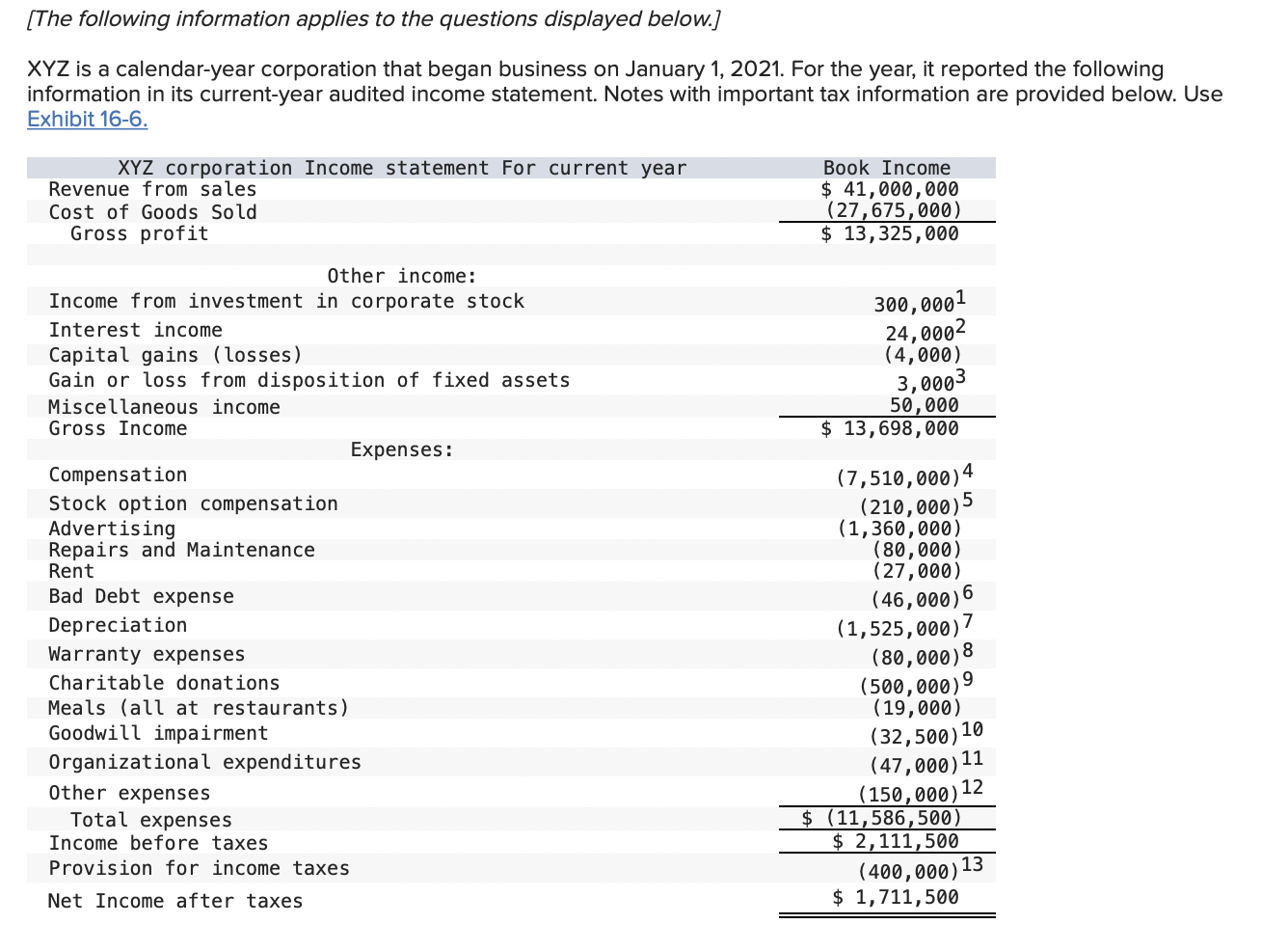

Publication 536 covers nols for individuals, estates and trusts:.

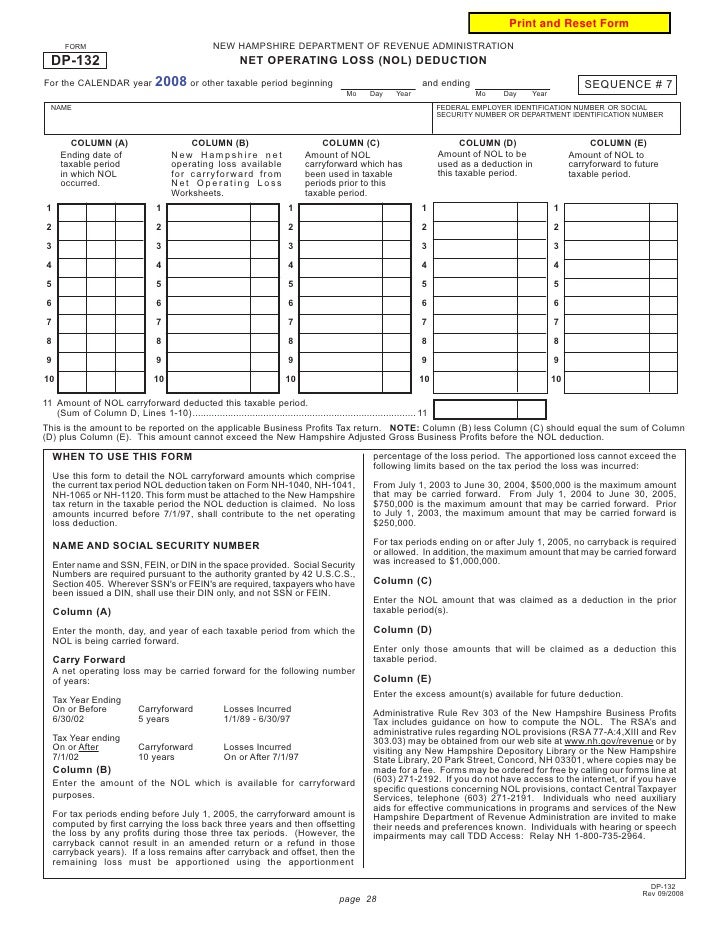

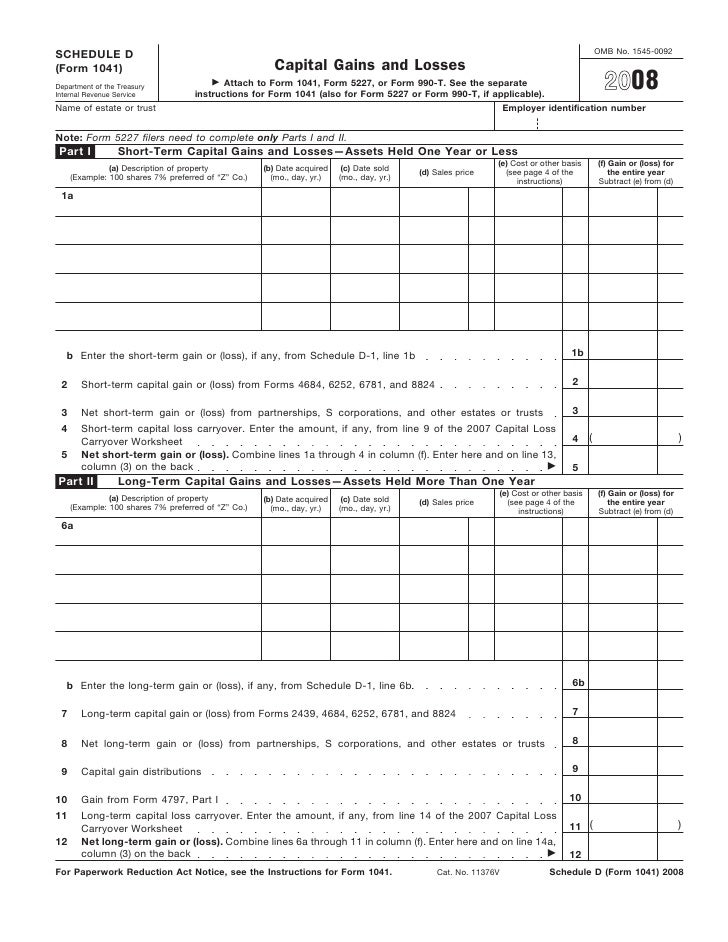

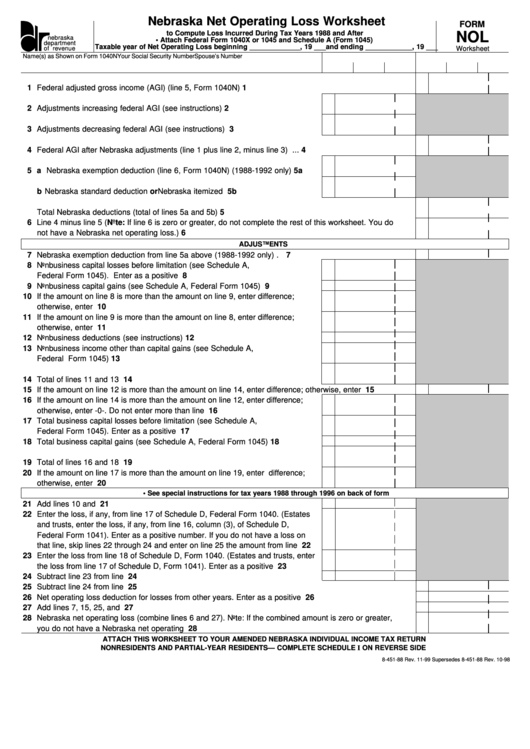

Nol deduction statement 1041. Upon termination of a trust or estate, a beneficiary succeeding to the property of the entity may deduct any net operating loss (nol) if the carryover would be allowable to the. The deduction of business and nonbusiness capital losses is limited to the amount of. Enter as a positive number your nol deduction for the nol year entered above from line 21 (form 1040 or form 1040nr) or line 15a (form 1041) 2.

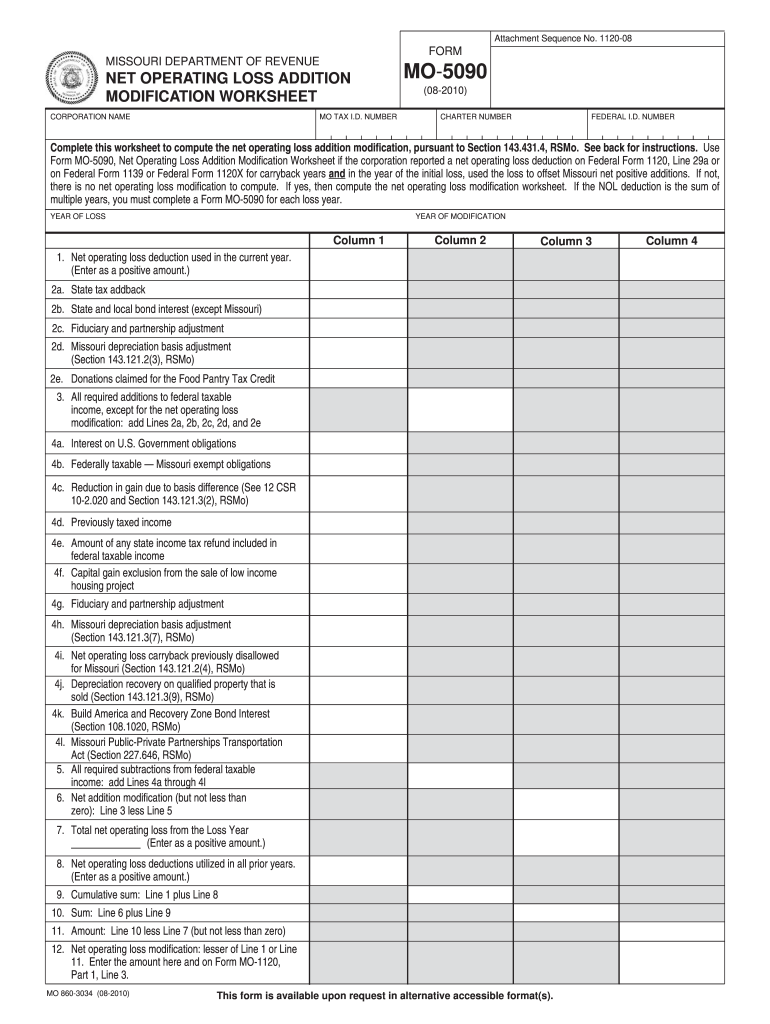

You must attach a statement that shows all the important facts about the nol. Here's how irs publication 536 describes an nol: (1) the nols carried to the year from tax years beginning before.

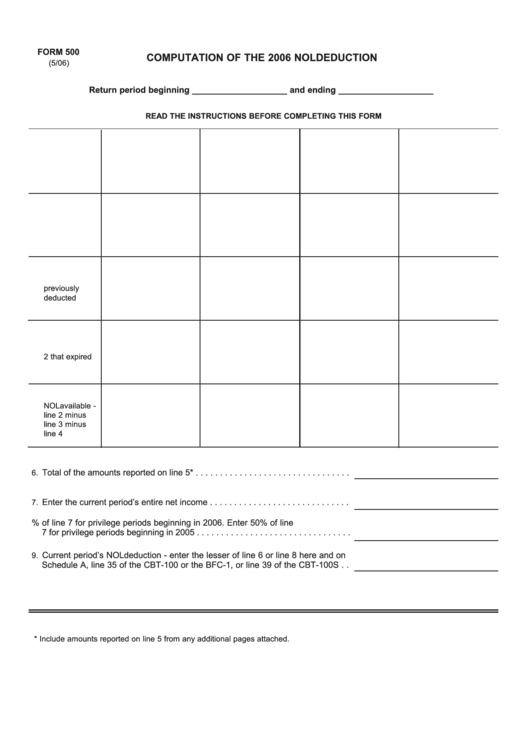

If your deductions for the year are more than your income for the year, you may have a net operating loss (nol). Your statement should include a computation showing how you figured the nol deduction. Before 2017, nols were fully deductible and could be carried.

Generally, an nol can only be carried forward to subsequent years and cannot be. What is a net operating loss? You must attach a statement that shows all the important facts about the nol.

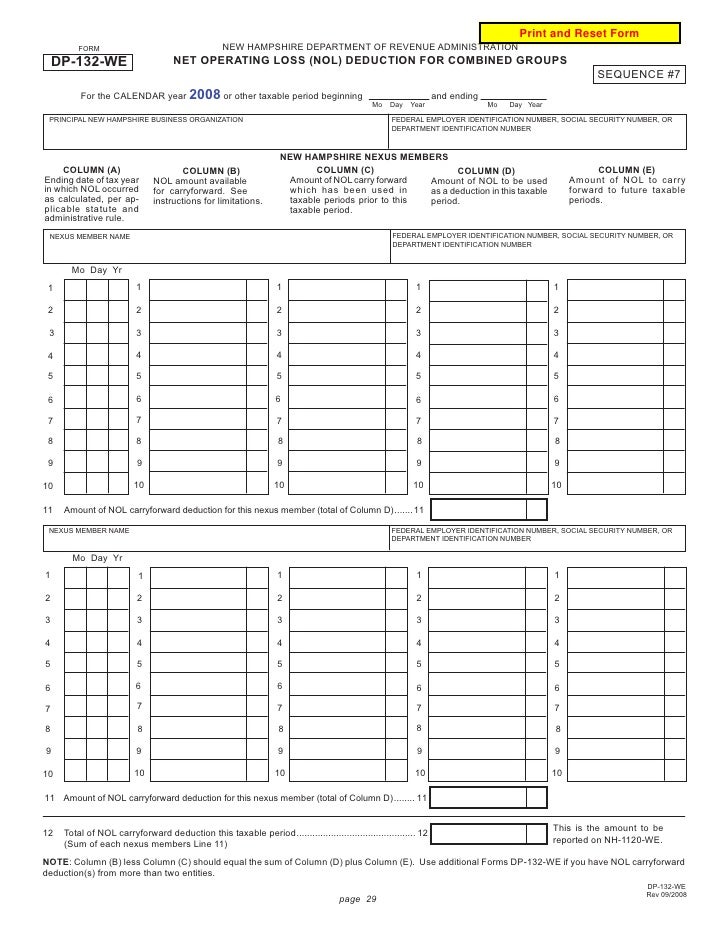

Nol deduction statement (elf only) if filing electronically, you are required to enter an explanation detailing how the net operating loss occurred. If you deduct more than one nol in the same year,. The tax cuts and jobs act (tcja) changed the rules for deducting net operating losses in 2017.

You must attach a statement that shows all the important facts about the nol. The net operating loss deduction is available to trusts and estates. Form 1041, line 15b, net operating loss deduction requires that an nol deduction statement be attached to the return.

Deducting a carryforward. Your statement should include a computation showing how you figured the nol. Skip to main content.

Upon termination of a trust or estate, a beneficiary succeeding to the property of the entity may deduct anynet operating loss (nol) if the carryover would be. Also, beneficiaries succeeding to the property of an estate or trust are allowed to claim: Estates and trusts, include an nol deduction on form 1041, line 15b, for 2023.

A net operating loss is a type of tax credit that occurs when the business tax deductions are higher than the taxable income in a year. Your statement should include a computation showing. Don't include the deductions claimed on lines 13, 18, and 21 when figuring the amount of the nol.

If your deductions for the year are more than your income for the year, you may have a net operating loss (nol). The nol deduction is disallowed for an nol carryback or carryover from another tax year. Nol deduction statement (elf only) if filing electronically, you are required to enter an explanation detailing how the net operating loss occurred.