Out Of This World Info About Formula For Comprehensive Income

There is a formula to calculate comprehensive income.

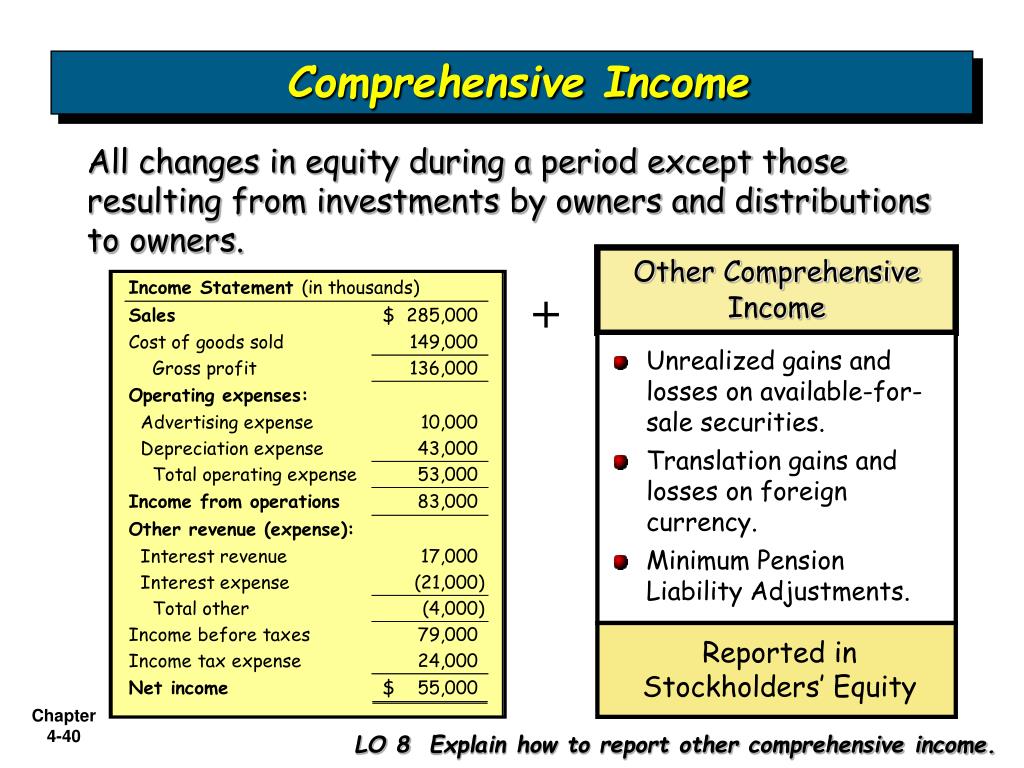

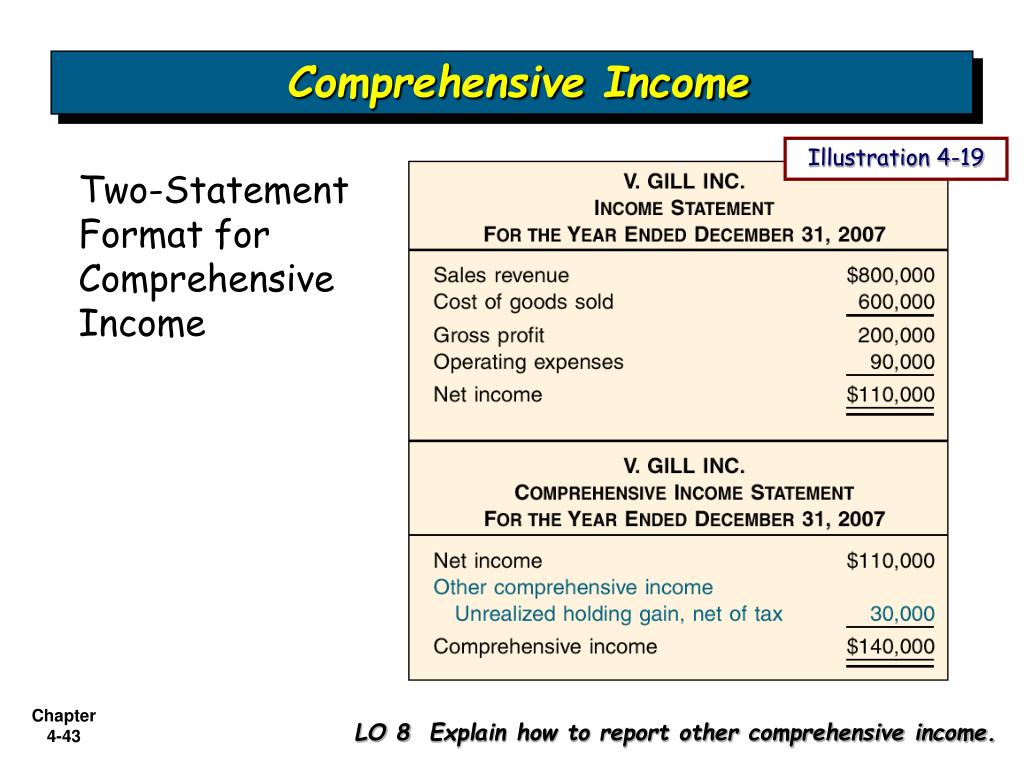

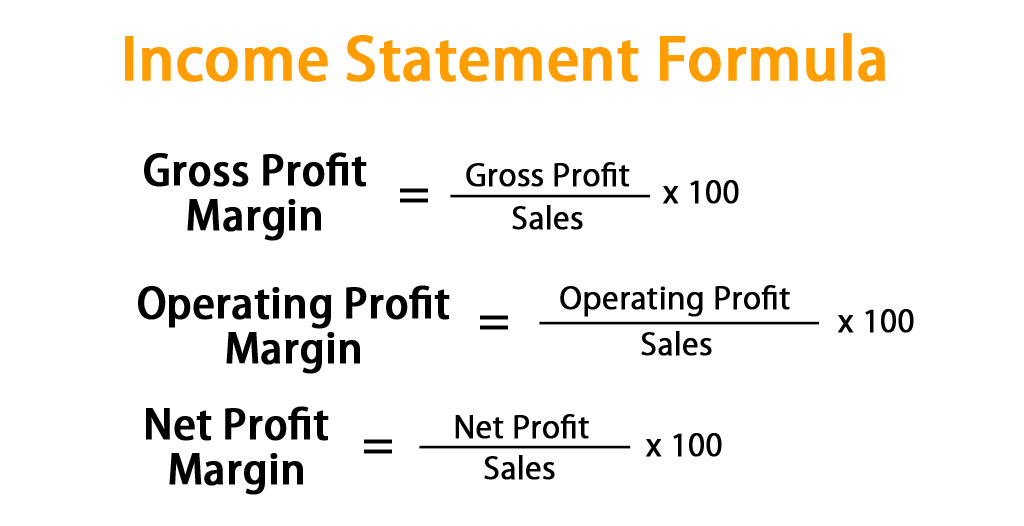

Formula for comprehensive income. Total comprehensive income is therefore equal to net income + other comprehensive income = $50 million + $25 million = $75 million. The statement of retained earnings includes two key parts: Accounting comprehensive income is generally defined as a change in a company’s net assets which can be accredited to the events which are not under the owners’ control.

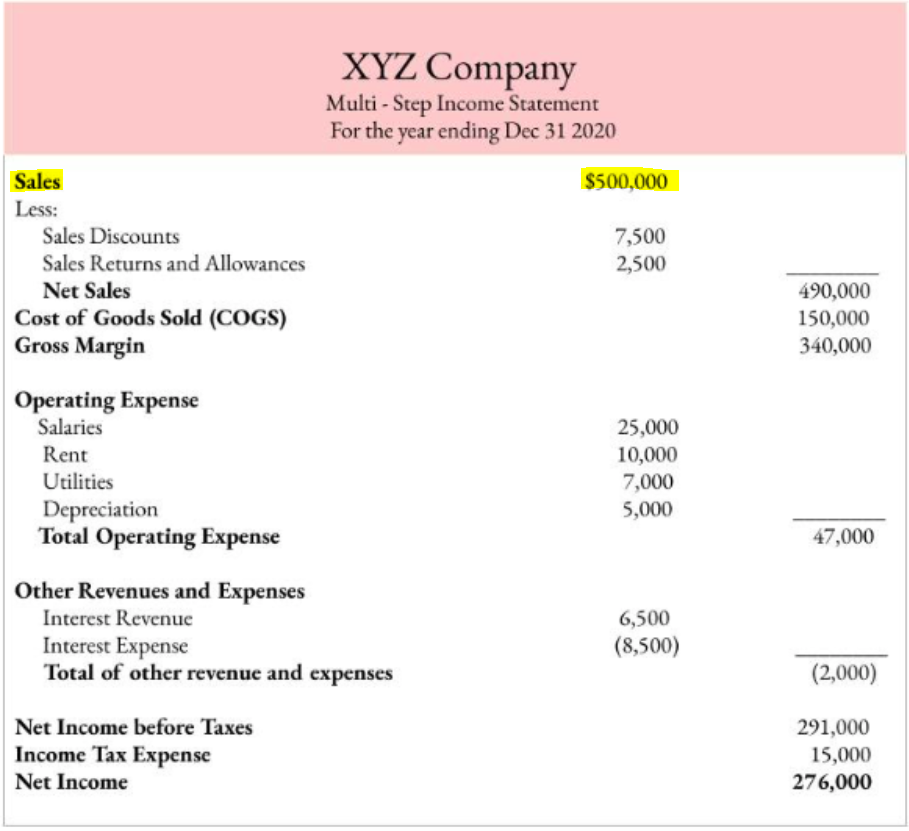

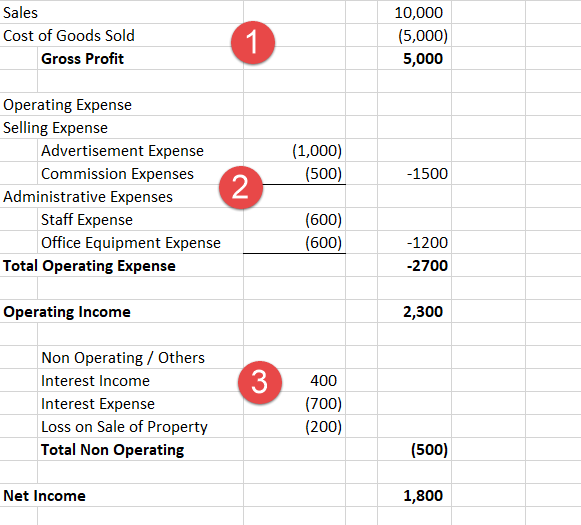

Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. Which of the following best describes comprehensive income? 220, published by the fasb and entitled comprehensive income, reads that an entity shall report comprehensive income in a single continuous.

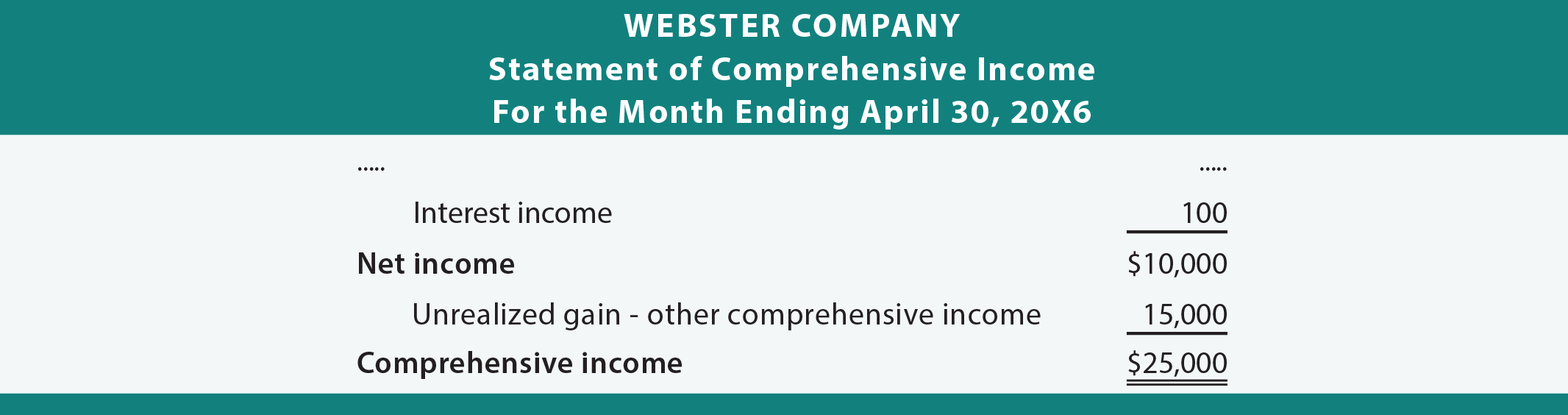

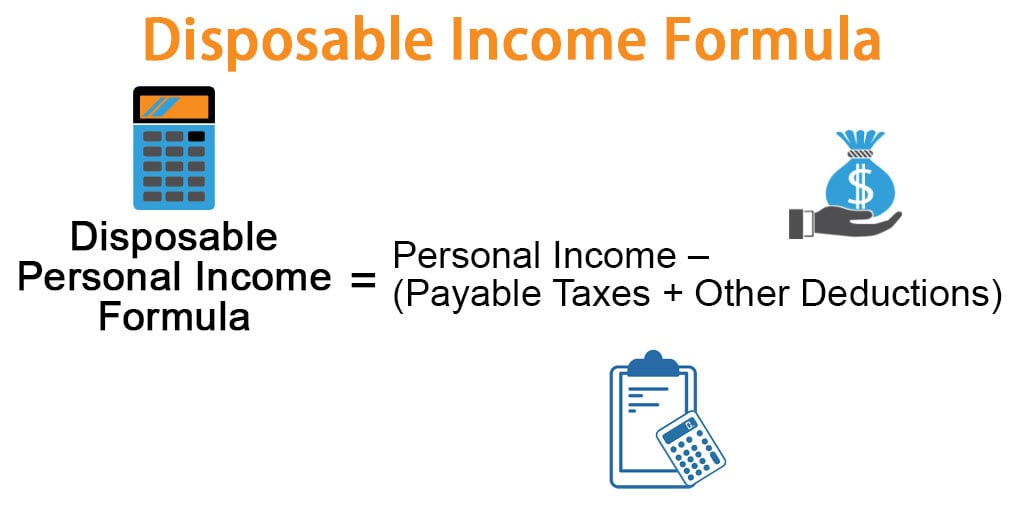

A reporting entity should disclose the income tax effect of each component of oci, including reclassification adjustments, either on the face of the statement in which those components are displayed or in the footnotes. Calculation comprehensive income = net income + other comprehensive income where: Comprehensive income formula.

Examples include money that is earned, as well as unearned income. Net income results from the usual operations of a company. Comprehensive income is the variation in the value of a company's net assets from.

The statement of financial accounting standards no. Comprehensive income = net income + other comprehensive income. Net income, and other comprehensive income, which incorporates the items excluded from the income statement.

Updated july 13, 2023 reviewed by melody bell fact checked by marcus reeves what is comprehensive income? Oci consists of revenues, expenses, gains, and losses to. Learn about the comprehensive income with the definition and formula explained in detail.

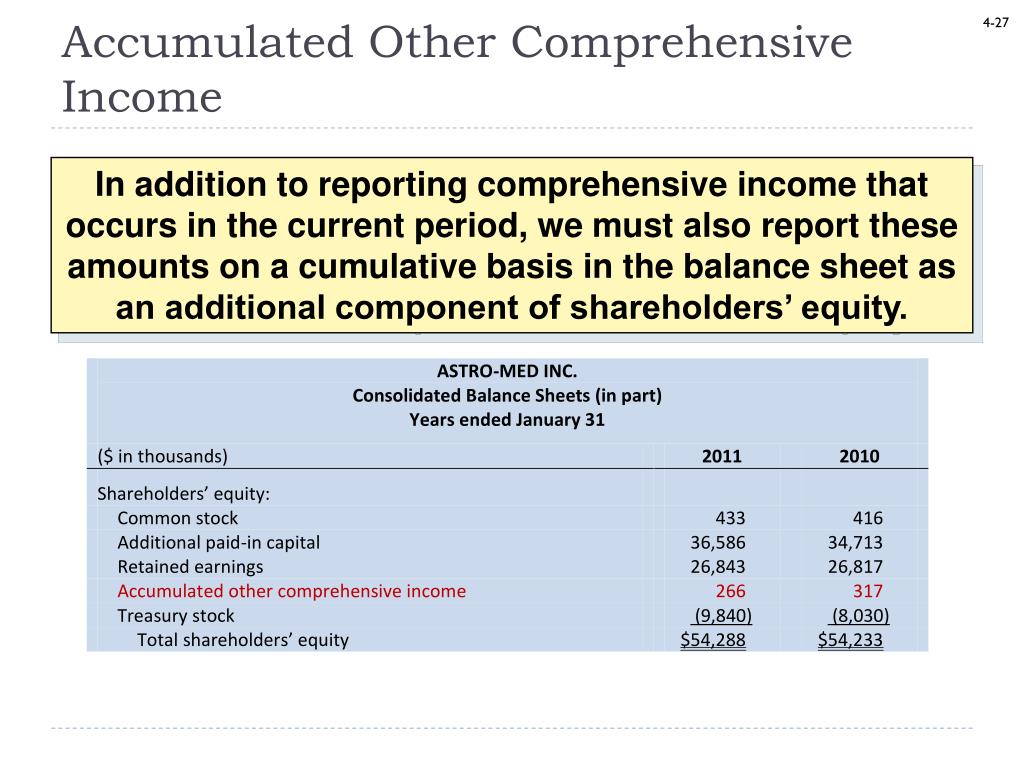

The statement of comprehensive income reports the change in net equity of a business enterprise over a given period. Other comprehensive income is shown on a company’s balance sheet. The correct answer is b.

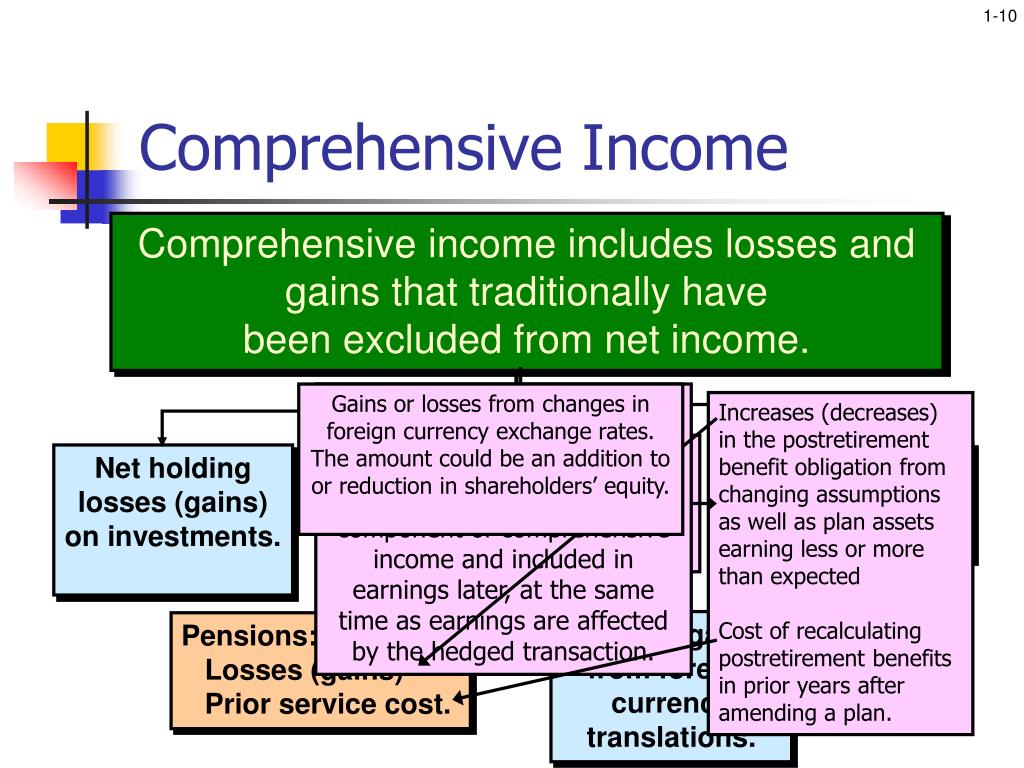

Other comprehensive income (oci) refers to any revenues, expenses, and gains / (losses) that not have yet been realized. The formula for comprehensive income is: Realized gains and losses are reported in the income statement and are reflected in net income.

It is similar to retained earnings, which is impacted by net income, except it includes those items that are excluded from net income. Comprehensive income is another term for revenue. This would include the statement of comprehensive income and statement of income (if presented as two separate statements).

Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement. Calculating comprehensive income can present a corporation with valuable info about the all round financial stability of the business. Comprehensive income includes net income and oci.