Fantastic Info About Profit And Loss Account Meaning

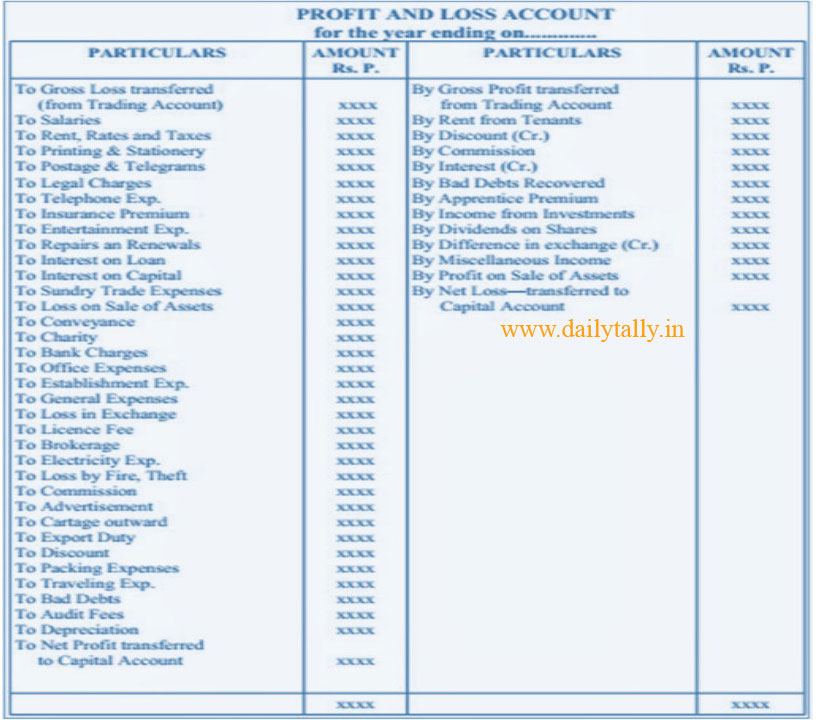

The profit and loss account shows all indirect expenses incurred and indirect revenue earned during the particular period.

Profit and loss account meaning. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. The period may be for a month, a quarter, or a year. Fy total revenues 42.95 billion baht versus 18.29 billion baht.

What is profit and loss accounting? The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The p&l statement is one of three financial.

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. The income statement, often known as the balance sheet, is a window into the heart of a corporation, presenting revenues, costs, and expenses in a comprehensive style. Understand the concept of trading account here in detail.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The profit and loss account is compiled to show the income of your business over a given period of time. As a result of this account, the company can determine whether it can grow revenue or lower costs in order to generate profit.

The result is either your final profit (if. If the revenues of an organization are more than its. The credit side (right) of a profit and loss account deals with income and gains, whereas the debit side (left) deals with expenses.

In simple terms, profit and loss account is a summary of an organization’s expenses and revenues and ultimately calculates the net figure of the business in terms of profit or loss. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. It shows your revenue, minus expenses and losses.

The income statement or profit & loss account is a financial statement that provides a summary of a company’s expenses, losses, incomes, and gains over a specific period of time. The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. The motive of preparing trading and profit and loss account is to determine the revenue earned or the.

It is prepared to determine the net profit or net loss of a trader. A p&l statement provides information about whether a company can. The profit and loss statement is an apt snapshot of a company's financial health during a specified time.

The two others are the balance sheet and the cash flow statement. Start by closely analyzing the business’s profit and loss statements. A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the.

The p&l account is a component of final accounts. Profit and loss (p&l) statements are one of the three financial statements used to assess a company’s performance and financial position. It shows company revenues, expenses, and net income over that period.

.png)

:max_bytes(150000):strip_icc()/plstatement_finalJPEG-5c89842bc9e77c0001423049.jpg)

:max_bytes(150000):strip_icc()/plstatement-5f8980ff2b264ff4a874daa9a3c06ec5.png)