Real Tips About Invested Capital Balance Sheet

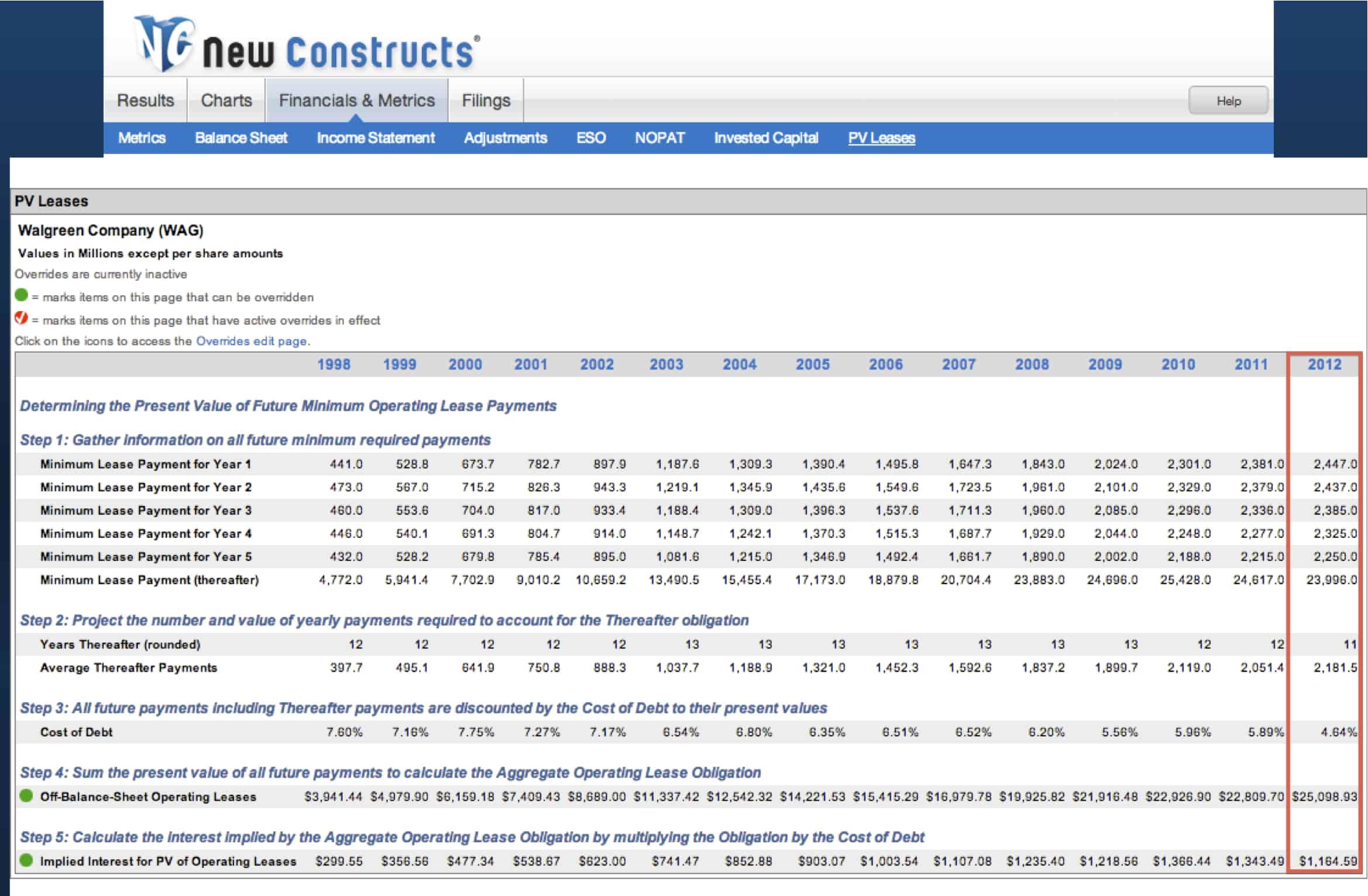

Invested capital refers to the combined value of equity and debt capital raised by a firm, inclusive of capital leases.

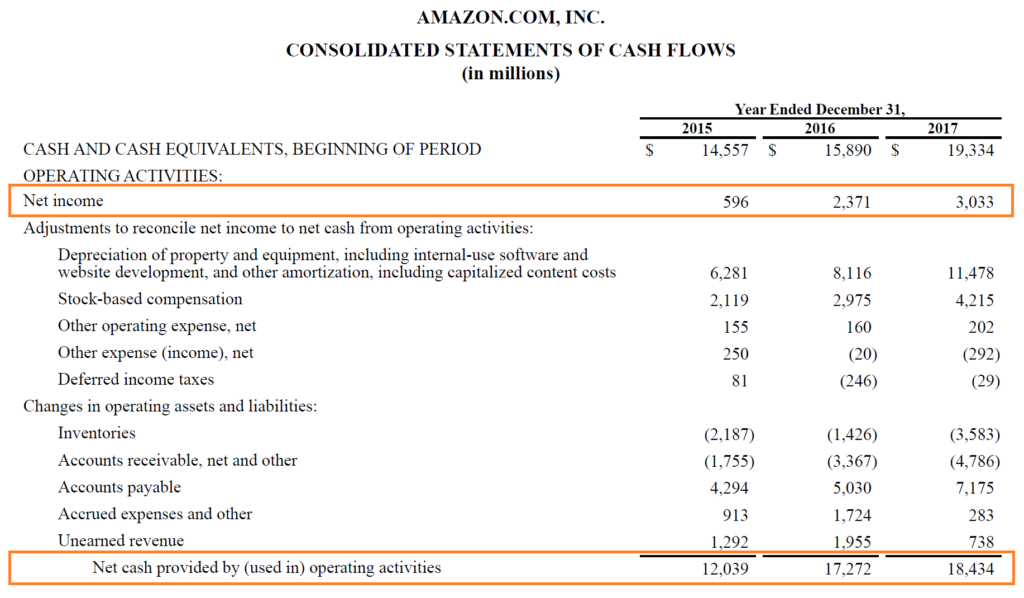

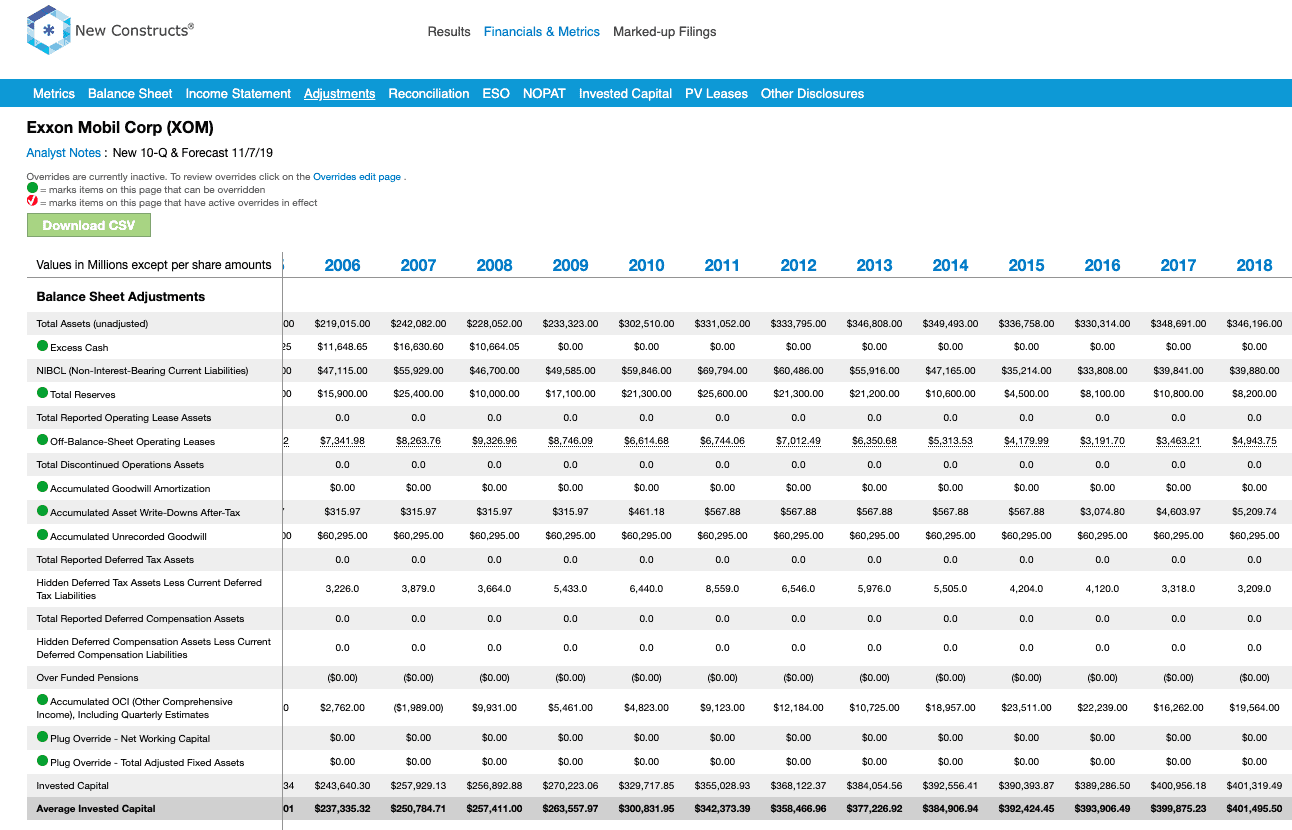

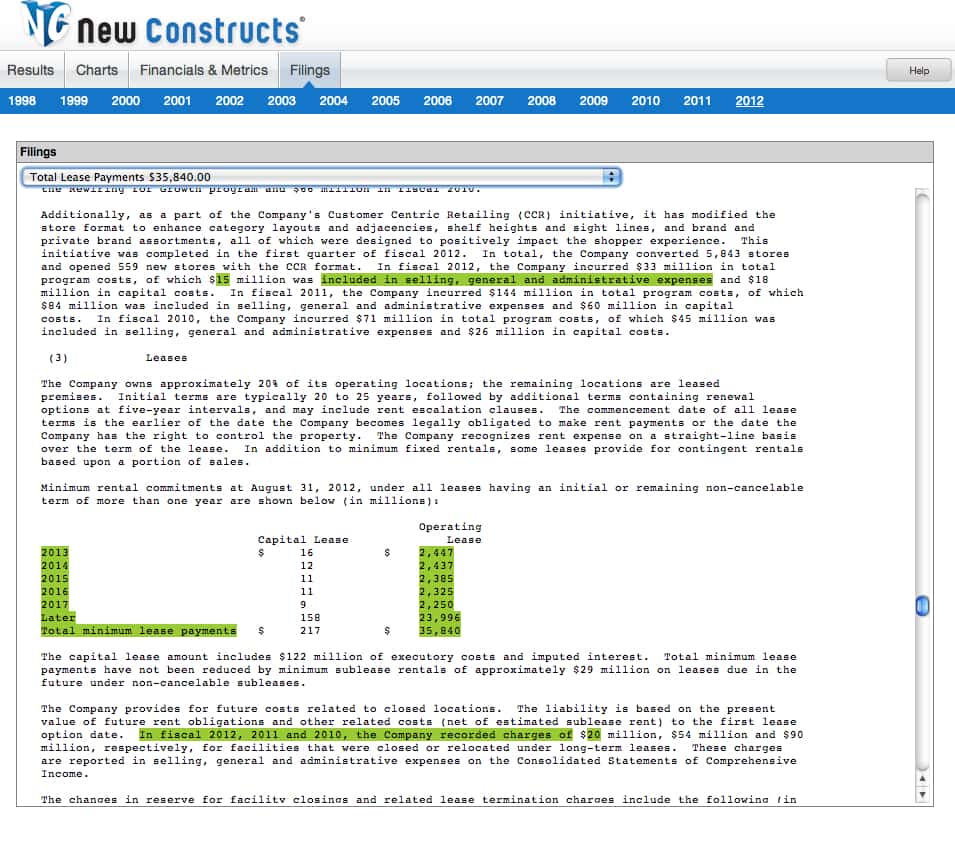

Invested capital balance sheet. Invested capital is capital invested in a company by debtholders and shareholders; Typically, investments are securities held for more than a year. Download the accompanying free excel template and test it yourself.

A company that earns a return on invested capital of 10% and wants to grow by 10% would have to reinvest 100% of every dollar they earn. If an investment will be sold sooner, it belongs under “cash” on the balance sheet, and is then called a “marketable security.” Invested capital equals the sum of all cash that has been invested in a company over its life with no regard to financing form or accounting name.

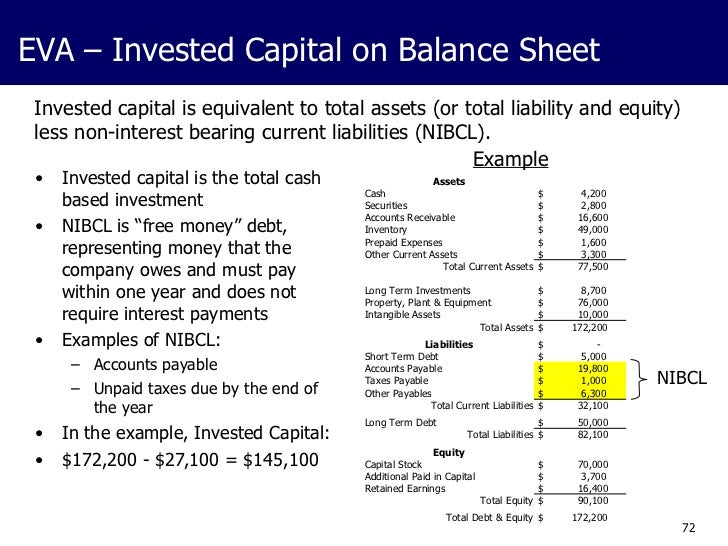

The calculation for invested capital under the financing approach is: The capital invested on a company's balance sheet is not recorded as a separate line item. It’s the total investment in the business from which operating profit is derived.

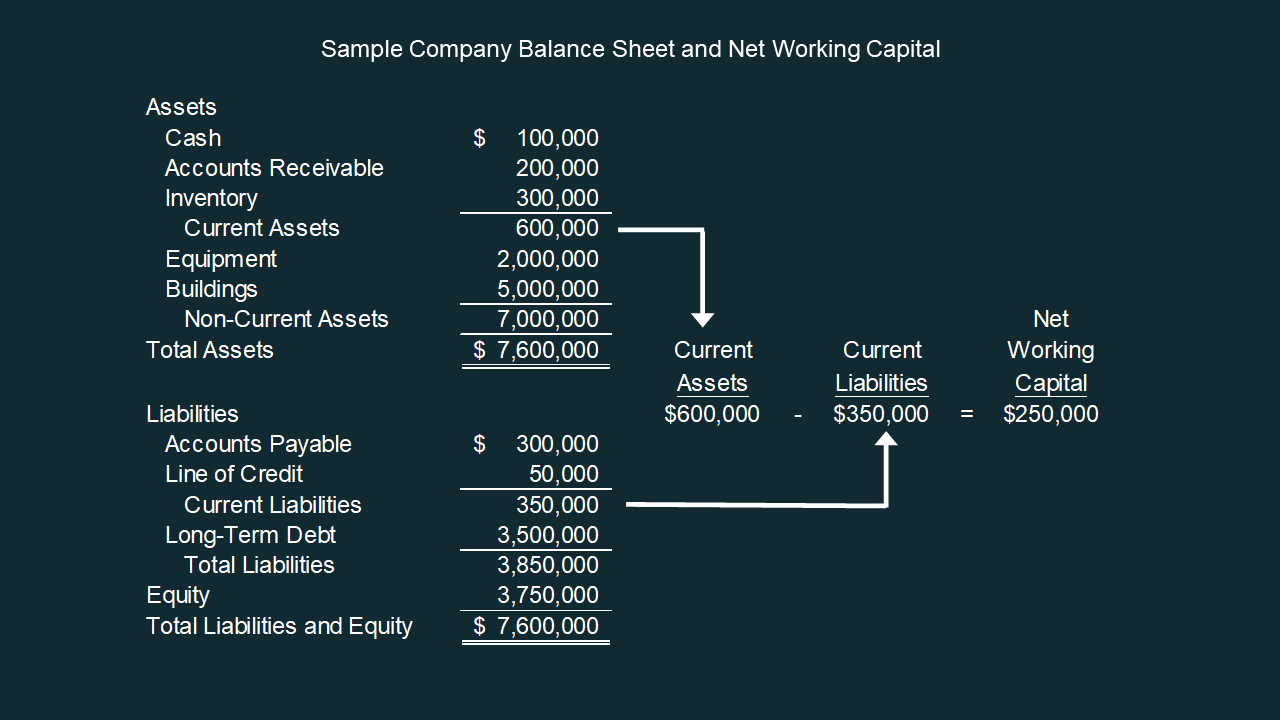

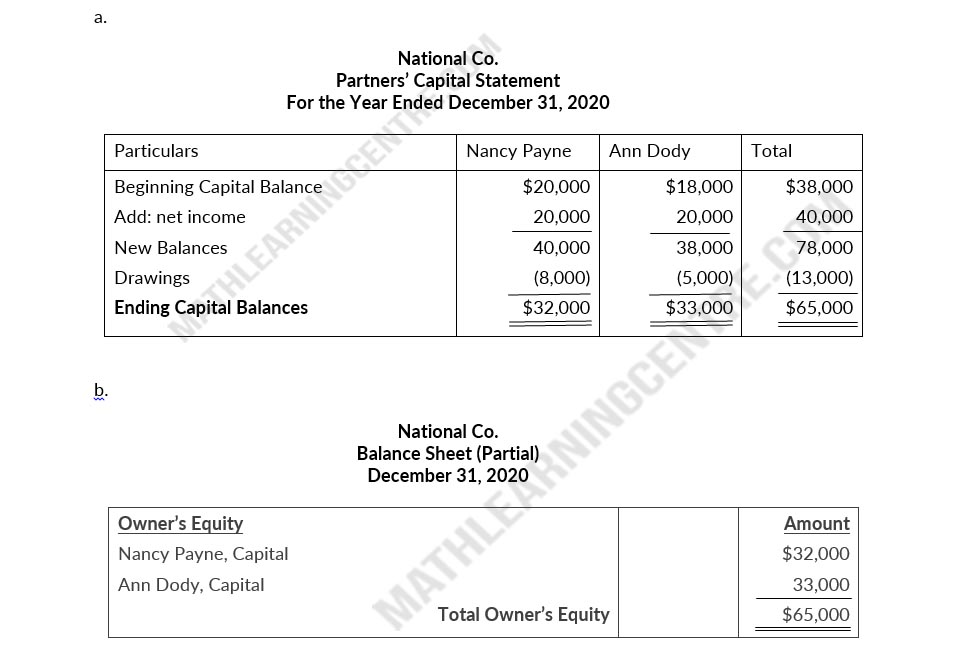

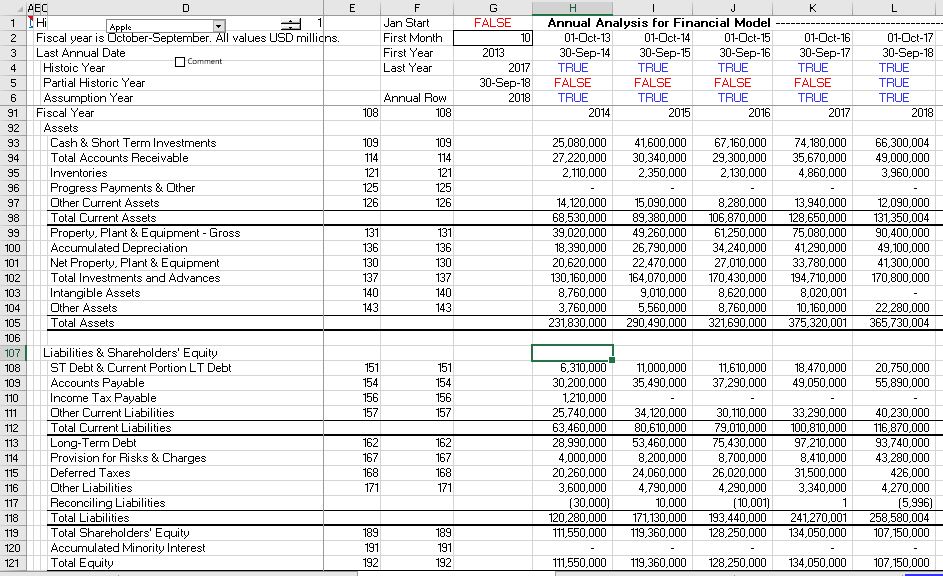

In short, the balance sheet is a financial statement that. Fixed assets are shown net of accumulated depreciation on the balance sheet. In the balance sheet, one must choose ‘separation of operations and finance’ as the layout.

For companies, invested capital is used to expand operations and further develop the company. Return on invested capital (roic) = $10 million ÷ $100 million = 10.0%. Hence, the stable reinvestment rate can simply be stated as the simple following function:

Return on invested capital (roic) is a calculation used to determine how well a company allocates its capital to profitable projects or investments. In the financing approach, investors will look mostly at the liabilities side. Invested capital (ic) invested capital (ic), 2021a = $22 million + $130 million = $152 million;

Its strong balance sheet and decent liquidity help to sustain its share repurchase. The company would post the list as an intangible asset on the balance sheet and amortize it over its estimated useful life. The book value is considered more appropriate to use for this calculation than the market value.

Where to find invested capital? Reinvestment rate = g / roic. A company’s return on invested capital can be calculated by using the following formula:

Whether it’s funded by liabilities or owners’ equity, the cash represents capital that has been invested in the business. What is return on invested capital? Instead, the amount must be inferred from other information stated in a company's accounting records.

Below is a simplified balance sheet, clearly showing the invested capital. Another way of approaching the invested capital is to look at the sources of capital more directly. The invested capital formulas: