Fantastic Tips About Difference Between P&l And Balance Sheet

What is a balance sheet of a company?

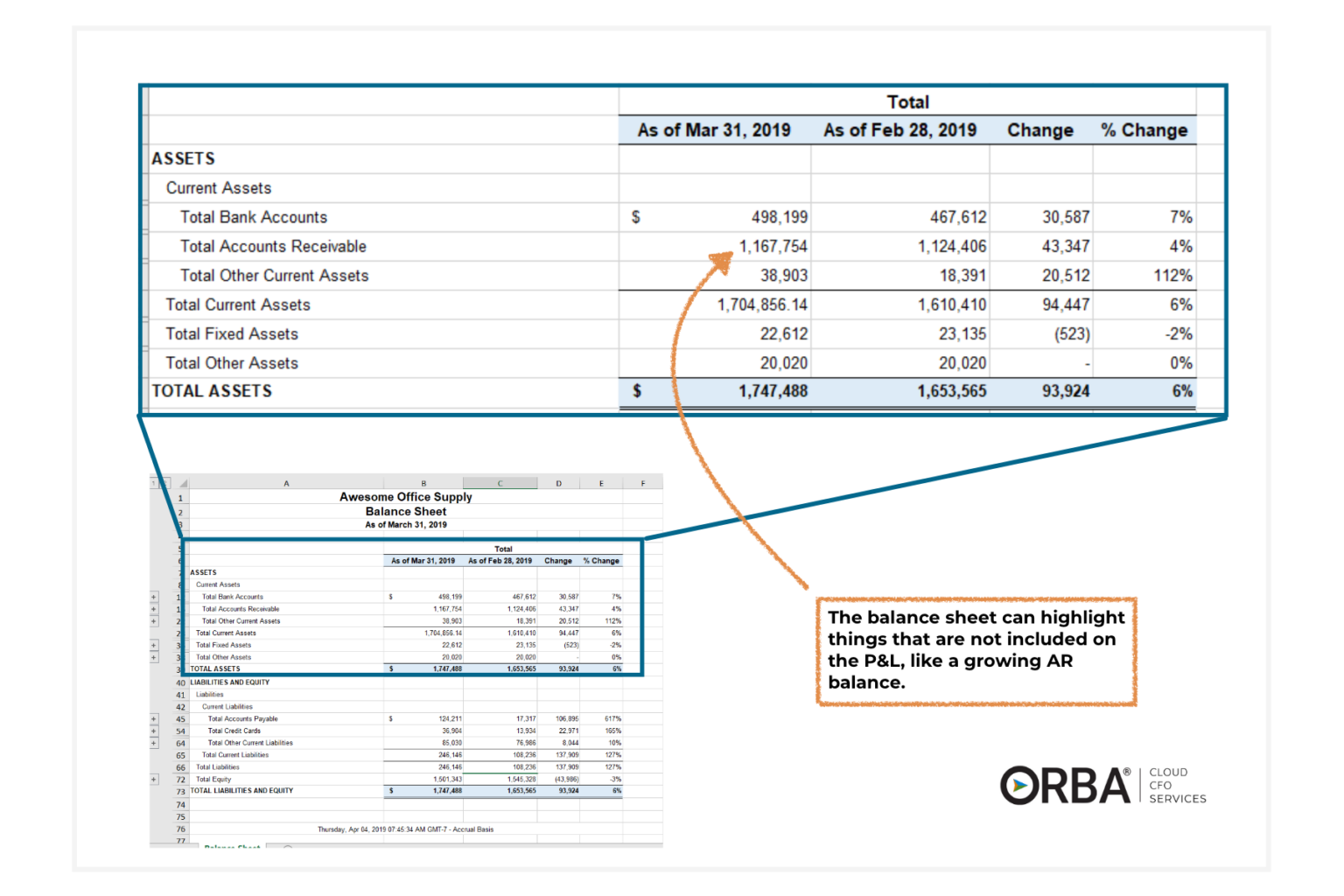

Difference between p&l and balance sheet. There are several key differences between the p&l and balance sheet, particularly the information presented and what it means. A balance sheet is a declaration that details the entity's financial situation as of a certain date. A balance sheet reports your assets/liabilities at a point in time so will never show if you've made a profit or loss.

The balance sheet vs. Both profit and loss statements and balance sheets are important for running your small business or corporation. The following details will clarify how the profit and loss account and balance sheet differ from one another:

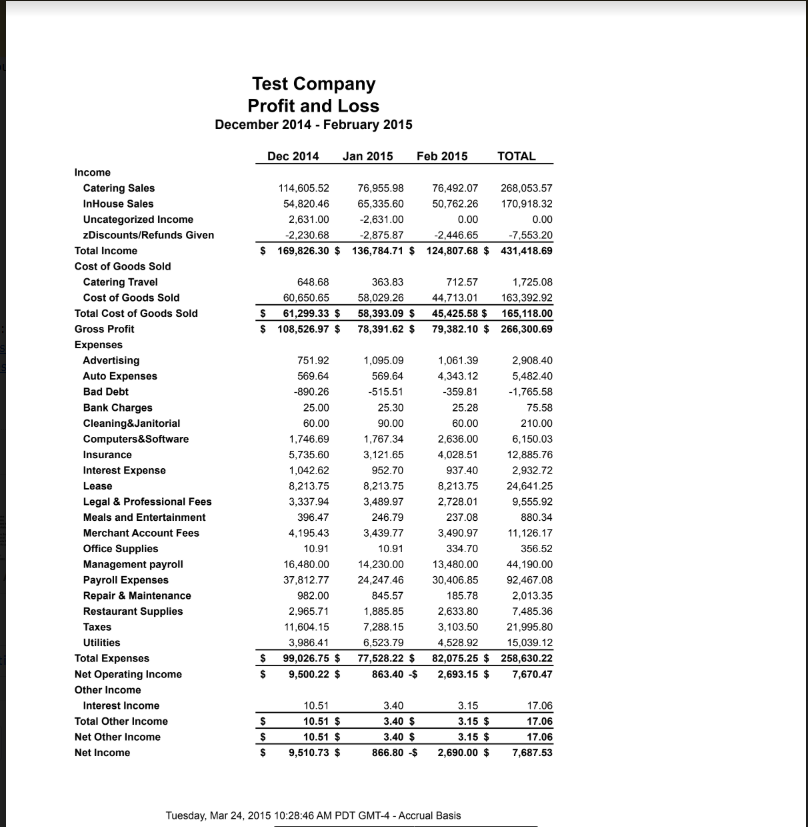

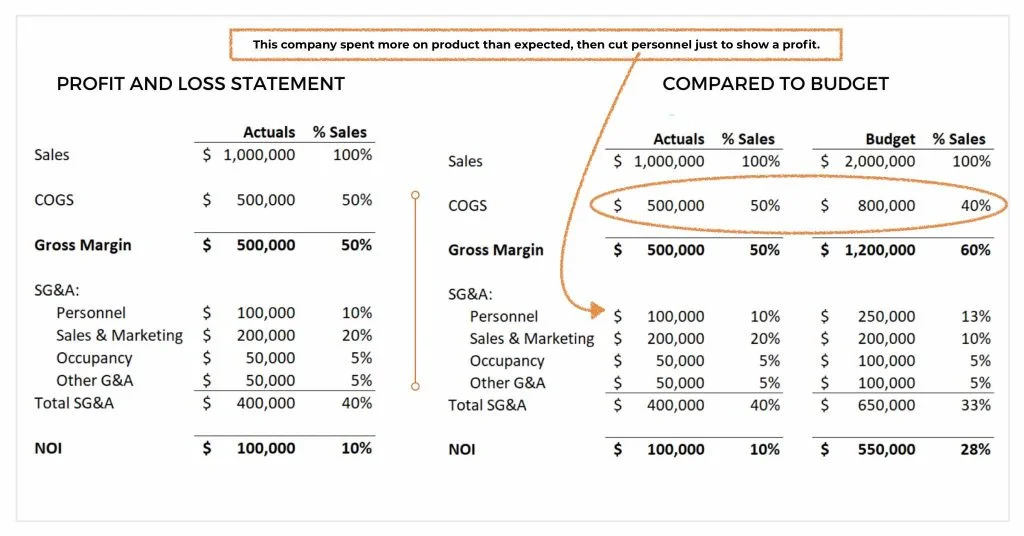

The main difference between them is that the p&l statement shows a business’s actuals for a certain period of time, like a quarter, and the balance sheet reflects everything a business owes and owns at a set point in time. Main difference the profit and loss statement and the balance sheet are two important components of financials. Updated june 24, 2022 balance sheets and profit and loss statements are both financial documents.

Managing your business profit and loss statement vs. The balance sheet captures the company’s status at the end of an accounting period, showing what it owns and owes. The balance sheet, on the.

The first shows the comprehensive income of an entity and the next shows the financial situation of the entity. Linkedin by sean ross updated apr 18, 2018 the profit and loss statement and the balance sheet are two of the three financial statements that companies issue regularly. Think of the balance sheet as a bucket and the p&l as the flow of the water.

Timing the balance sheet shows your company’s financial position on a specific date, such as december 31, 2023. The differences between profit and loss and balance sheet. The profit and loss statement focuses on the company’s financial performance over a specific period, while the balance sheet provides a snapshot of the company’s financial position at a specific point in time.

A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. The main difference is that the balance sheet yields information regarding a company’s assets, liabilities, and shareholders’ equity, while the profit and loss statement summarizes information about revenues, and expenses. Assets liabilities shareholder equity what are the 3 types of balance sheets?

Key differences between the balance sheet and profit and loss account it’s time to get to grips with the key differences between these two important financial statements: This is outlined by every enterprise, a partnership enterprise or sole proprietorship firm. The balance sheet and p&l statement hold similar financial information;

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The purpose of both are completely different from each other. Earnings statement expense statement income statement the p&l or income statement, like the cash flow statement, shows changes in accounts over a set period of time.

P&l the p&l is the report to which most business owners default; What are the main parts of a balance sheet? Companies and accountants can use these statements to assess the financial health of an organization.

.png)