Nice Info About Cost Of Goods Sold On Financial Statement

Table of contents cost of goods sold (cogs) meaning

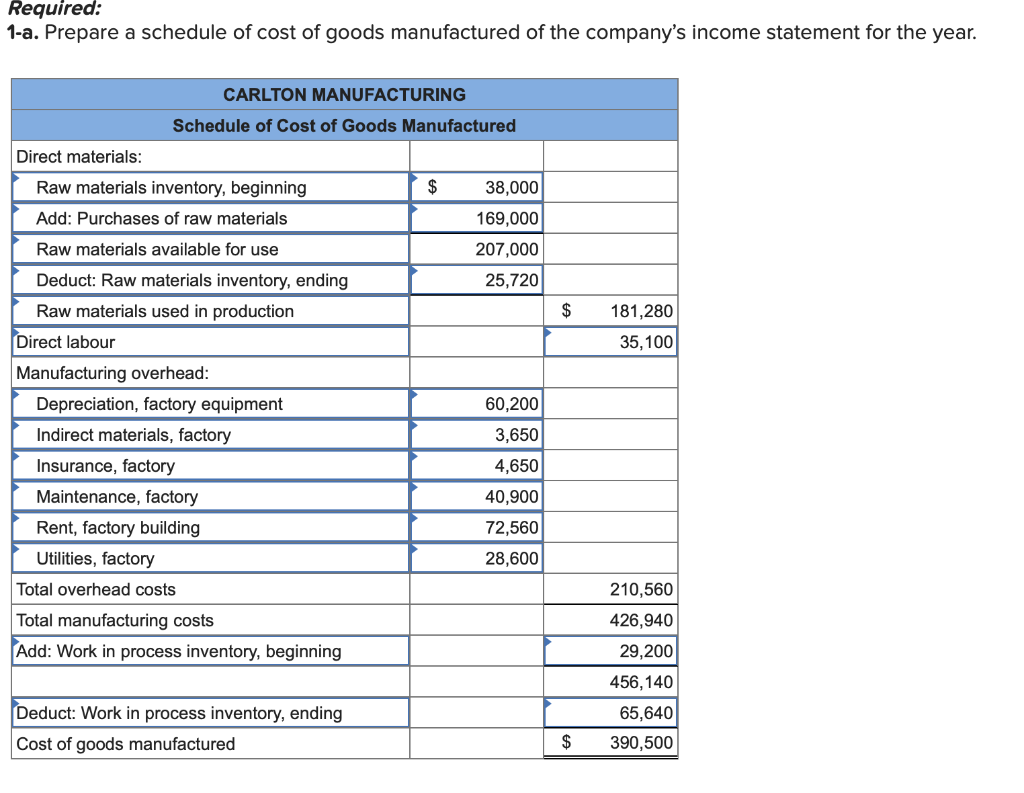

Cost of goods sold on financial statement. Cost of goods sold (cogs) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the measure are those that are directly. The cost of goods sold is the costs of goods or products sold during a specific period by the entity to its customers. This statement is not considered to be one of the main elements of the financial statements , and so is rarely found in practice.

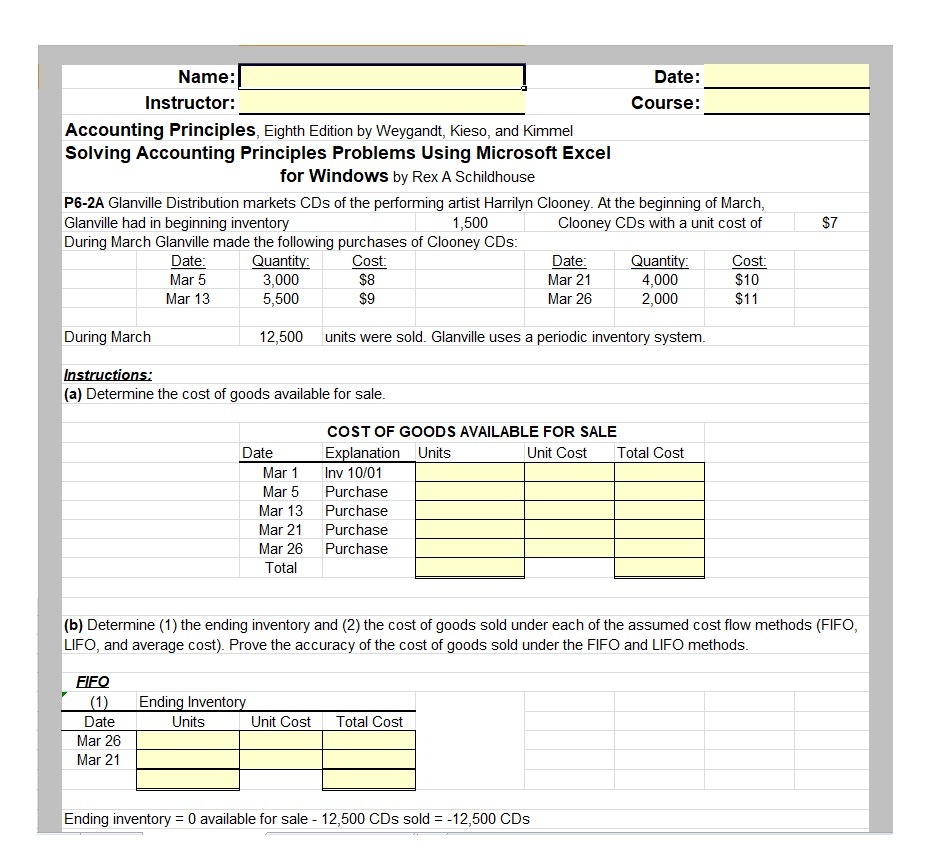

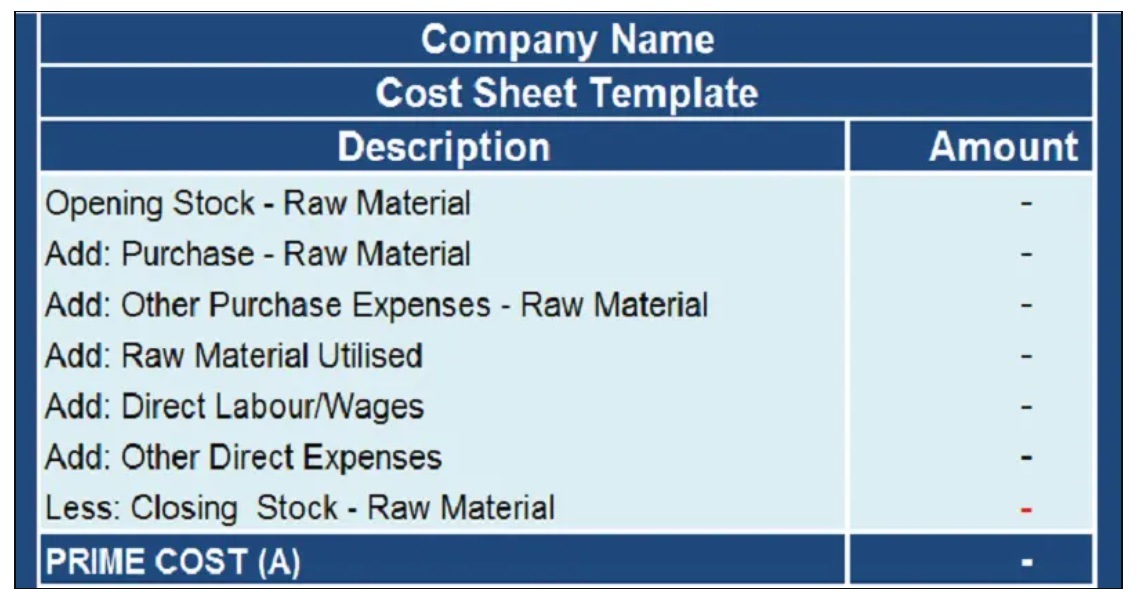

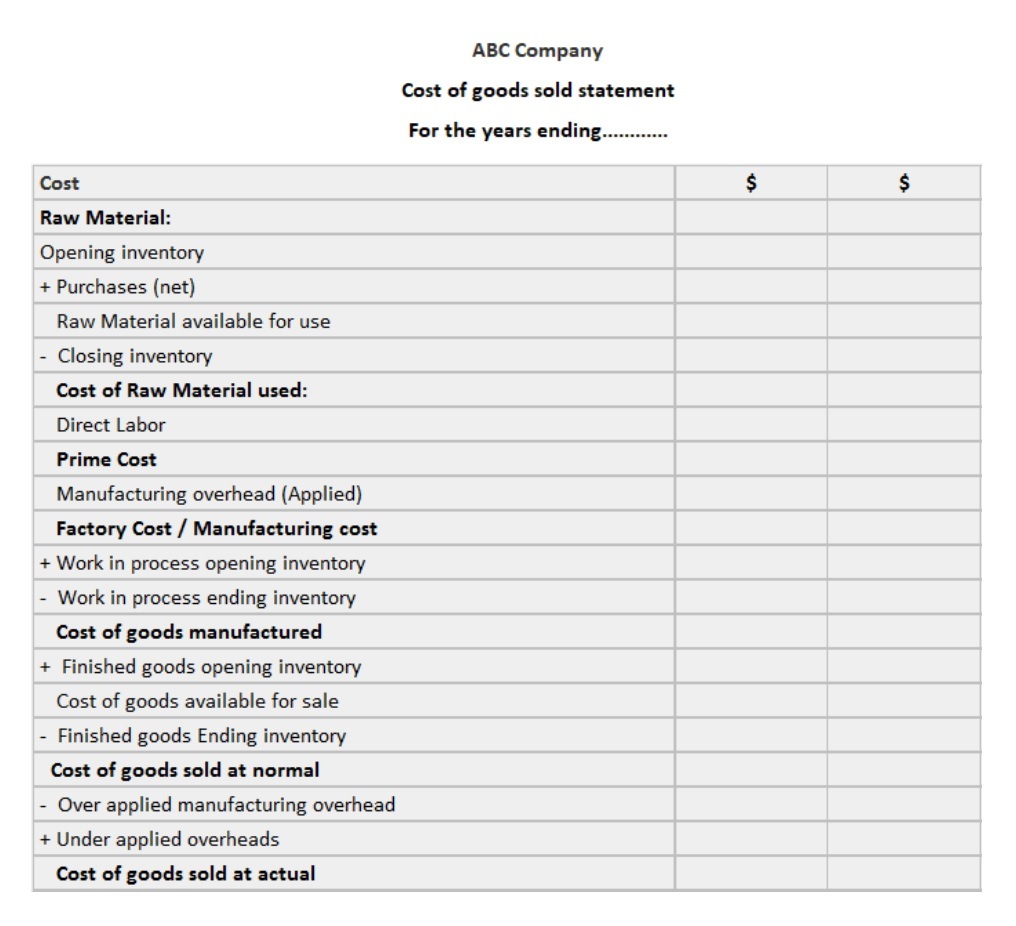

A cost of goods sold statement compiles the cost of goods sold for an accounting period in greater detail than is found on a typical income statement. Cost of goods sold refers to the direct costs involved in producing a company's goods. A cost of goods sold statement shows the cost of goods sold over a specific accounting period, typically offering more insights than are found on a normal income statement.

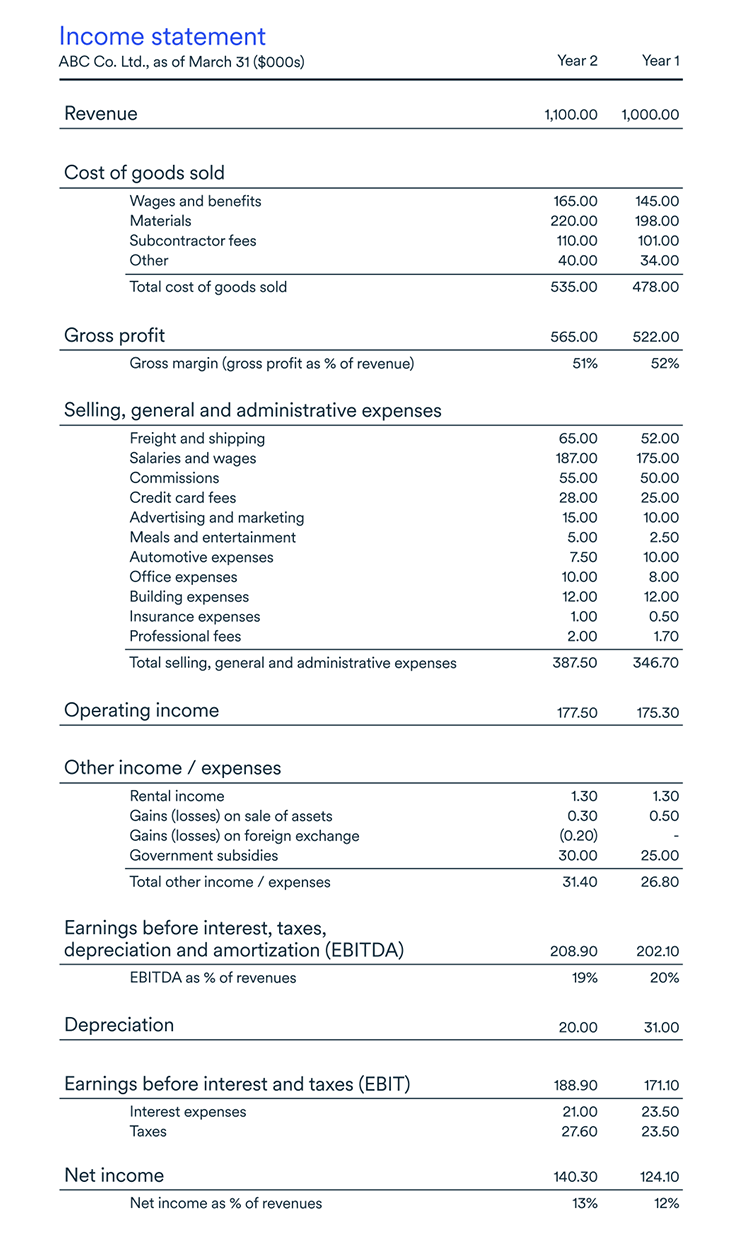

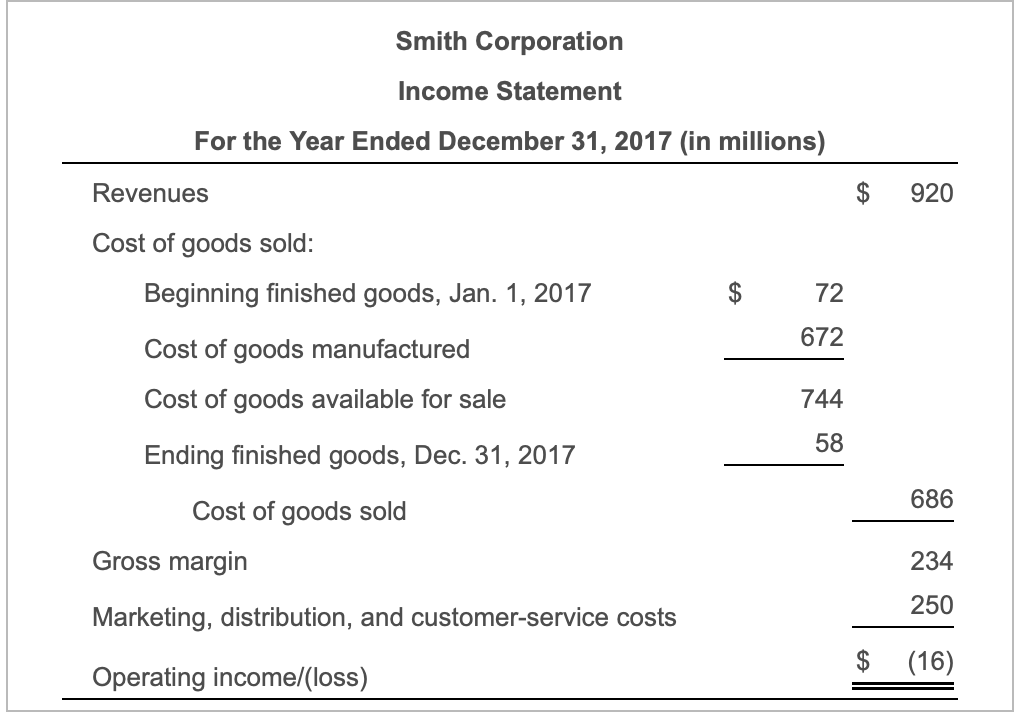

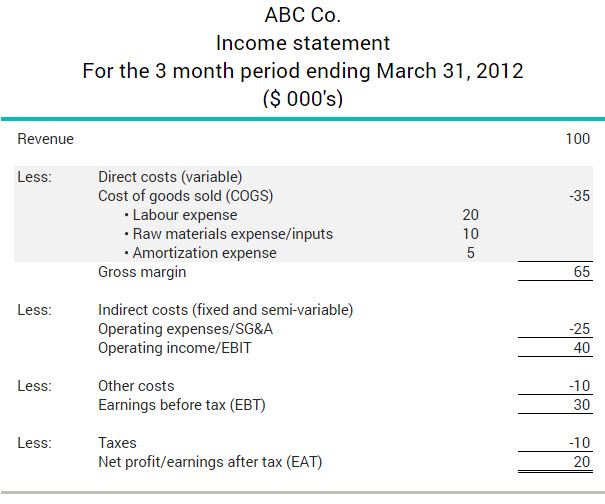

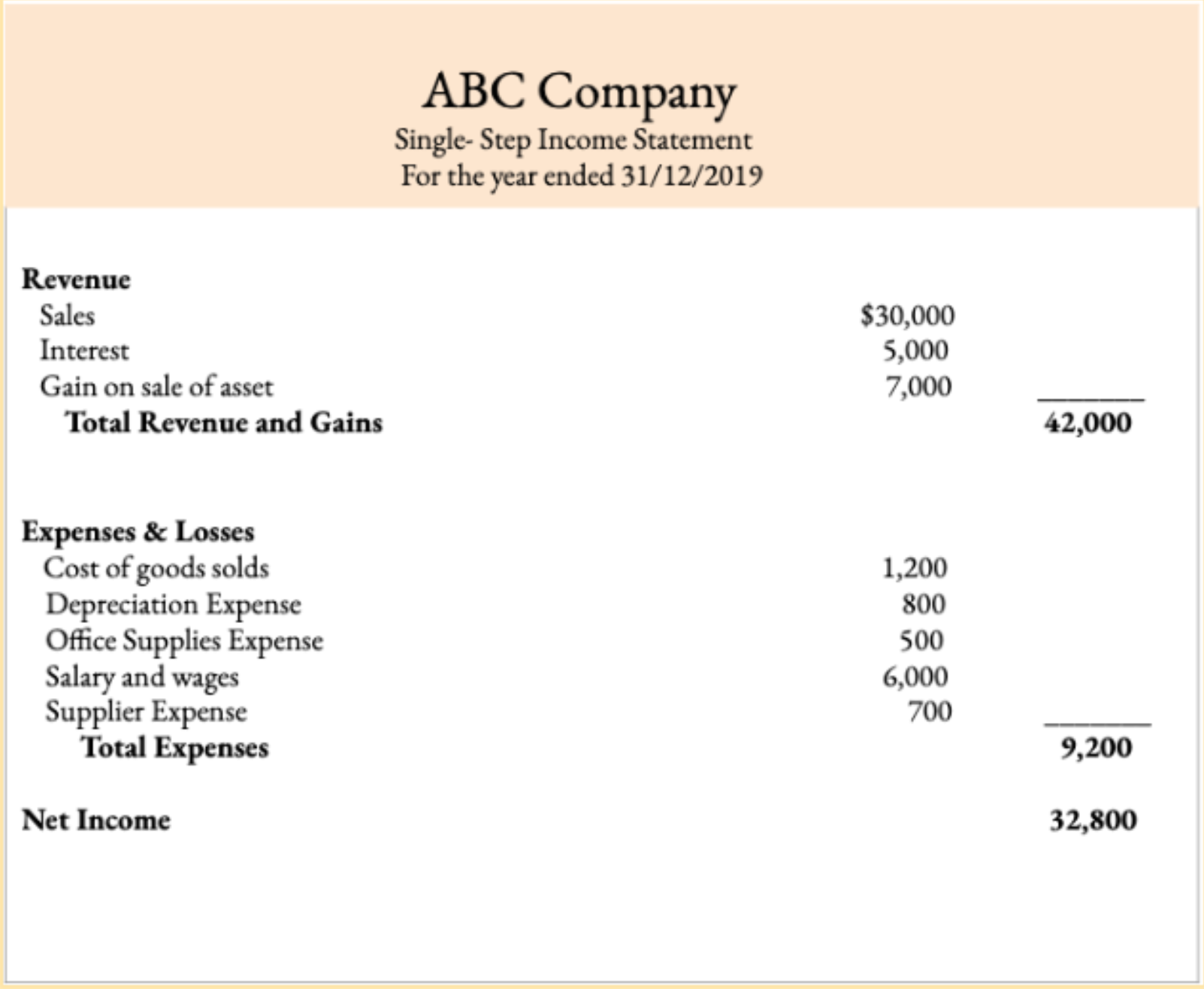

Cogs is often the second line item appearing on the income statement, coming right after sales revenue. Here are the key components typically found in. Cost of goods sold is a line item found on a company’s income statement, and it is the first item of expense after revenue, which is typically the top line item in the income statement.

Cogs includes all direct costs needed to produce a product for sale. For the year ending on december 31st, 2018, is $14,000. When a sale is made so that inventory is surrendered, the seller reports an expense that has previously been identified as “cost of goods sold” or “cost of sales.” for example, best buy reported “cost of goods sold,” for the year ended february 28, 2009, as $34.017 billion.

The cost of goods sold (cogs) also contributes to the taxable income. The cost of goods sold (cogs) statement is a financial document that breaks down the various components contributing to the cost of producing or purchasing the goods a business sells. Cost of goods sold (cogs) on an income statement represents the expenses a company has paid to manufacture, source, and ship a product or service to the end customer.

The cogs, then, is the cost of any items bought or made during the current year. Cogs refers to the direct costs of goods manufactured or purchased by a business and sold to consumers or other businesses. Tracking cogs allows companies to properly value inventory and determine gross profits.

Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. The calculation requires selecting a time period. However, it excludes all the indirect expenses incurred by the company.

For this method, inventory changes are measured to determine cogs. It does not include costs associated with marketing, sales or. Understanding the cost of goods sold (cogs) helps businesses to find out about their financial health and profitability.

To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. Typically, calculating cogs helps you. What goes into cost of goods sold

Cogs is deducted from revenue to find gross profit. Calculate cogs by adding the cost of inventory at the beginning of the year to purchases made throughout the year. Depending on your business, you may need to dress it up to include expenses such as:

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)