Smart Info About Debt To Equity Ratio From Balance Sheet

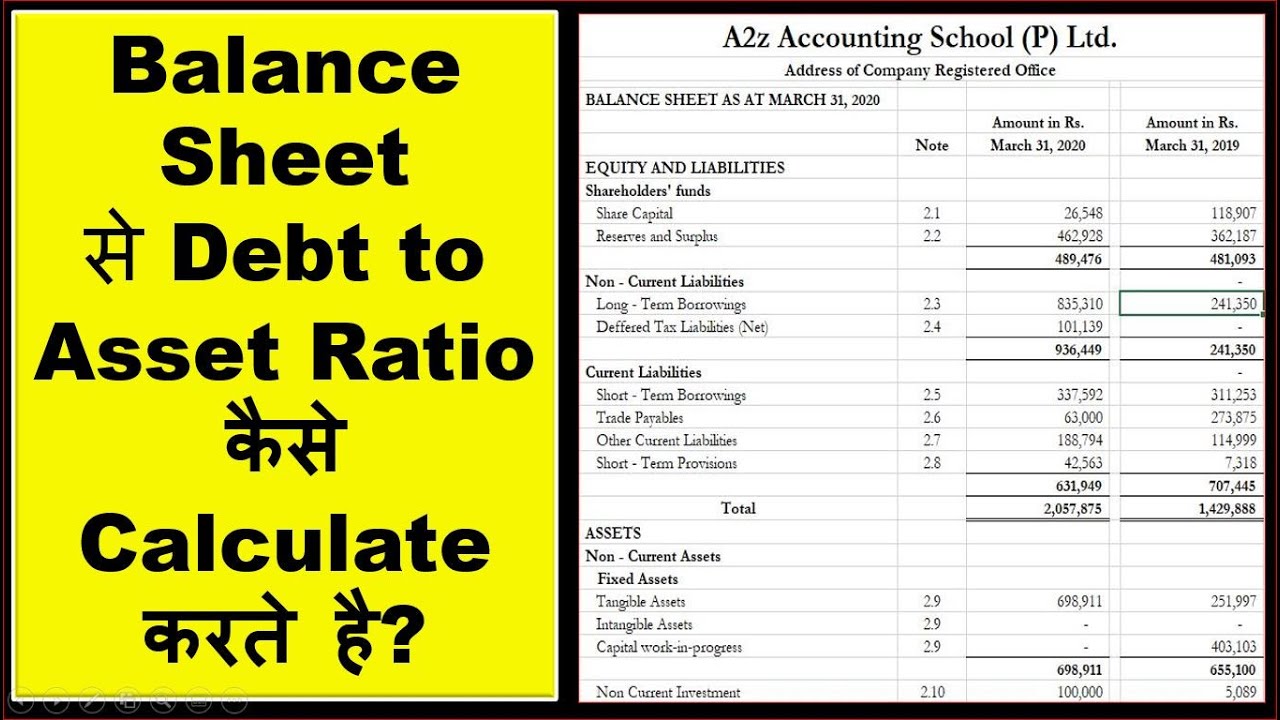

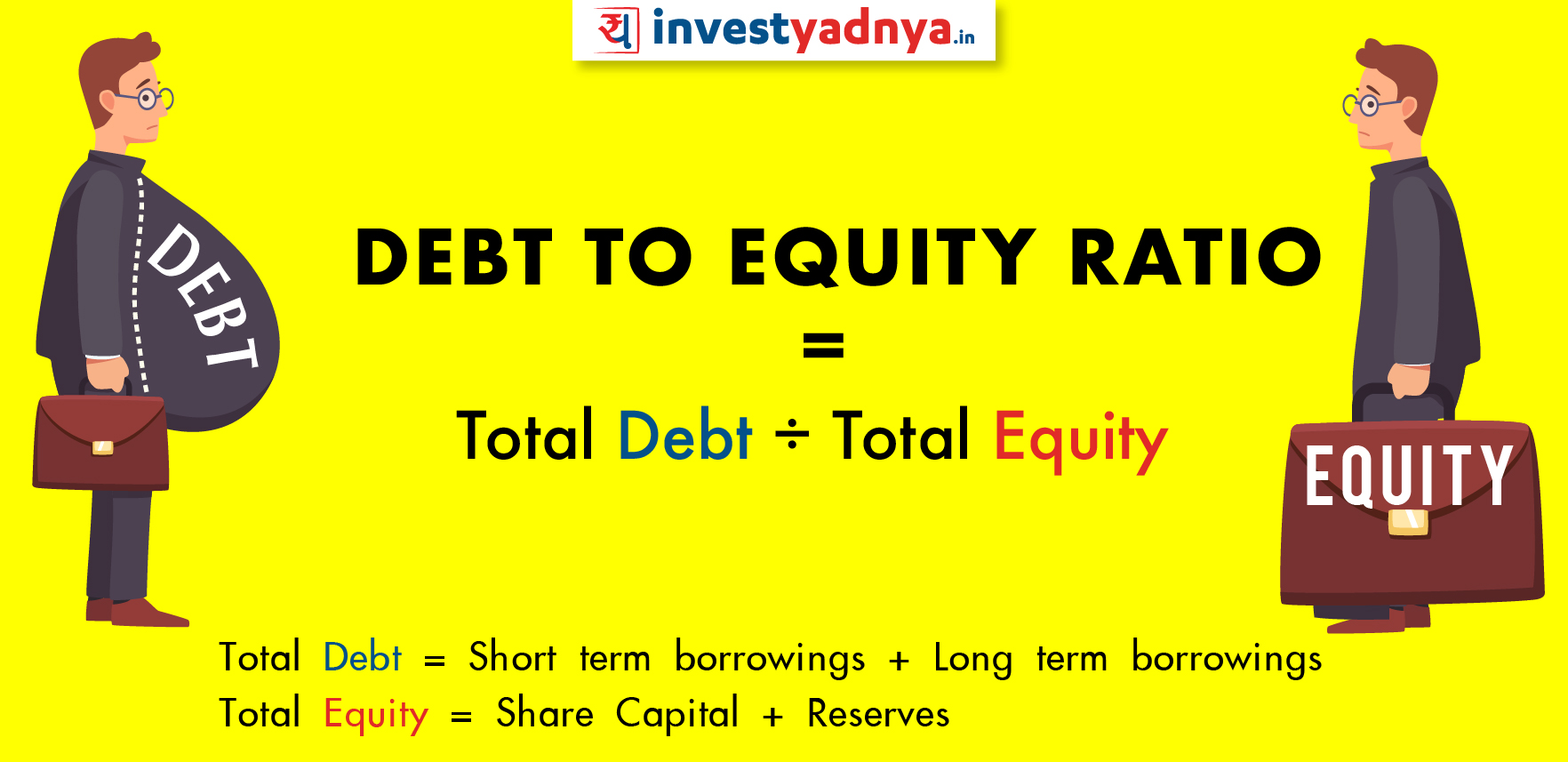

It is calculated by dividing a company's total debt by total shareholder equity.

Debt to equity ratio from balance sheet. Breaking down the d/e ratio formula. Let’s look at a couple of examples using date from their balance sheets as of the end of 2018. I will also show you how to interpret this number and.

How to calculate debt to equity ratio (d/e)? It requires a good understanding of the terms, viz. You’ll find both figures on your company’s balance sheet.

The debt to equity ratio calculates the weight of total debt and financial liabilities against shareholders’ equity: Raising capital via equity offerings allows the firm to increase net assets and thereby potentially avoid balance sheet covenant violations. Debt to equity ratio is calculated by dividing the company’s shareholder equity by the total debt, thereby reflecting the overall leverage of the company and thus its capacity to raise more debt.

This gives us a ratio of debt to equity of.47663551, or rounded to the nearest tenth, about 0.5, which could be stated as either 50% or ½. This data was taken from information provided on the morningstar site. What does the debt to equity ratio mean?

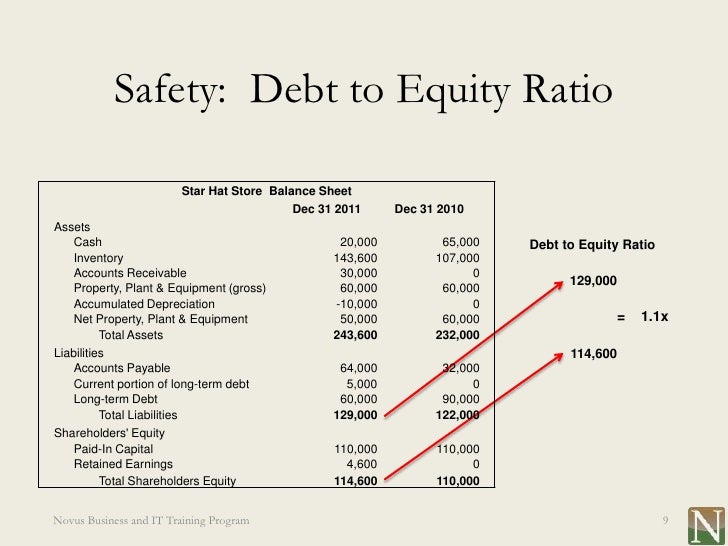

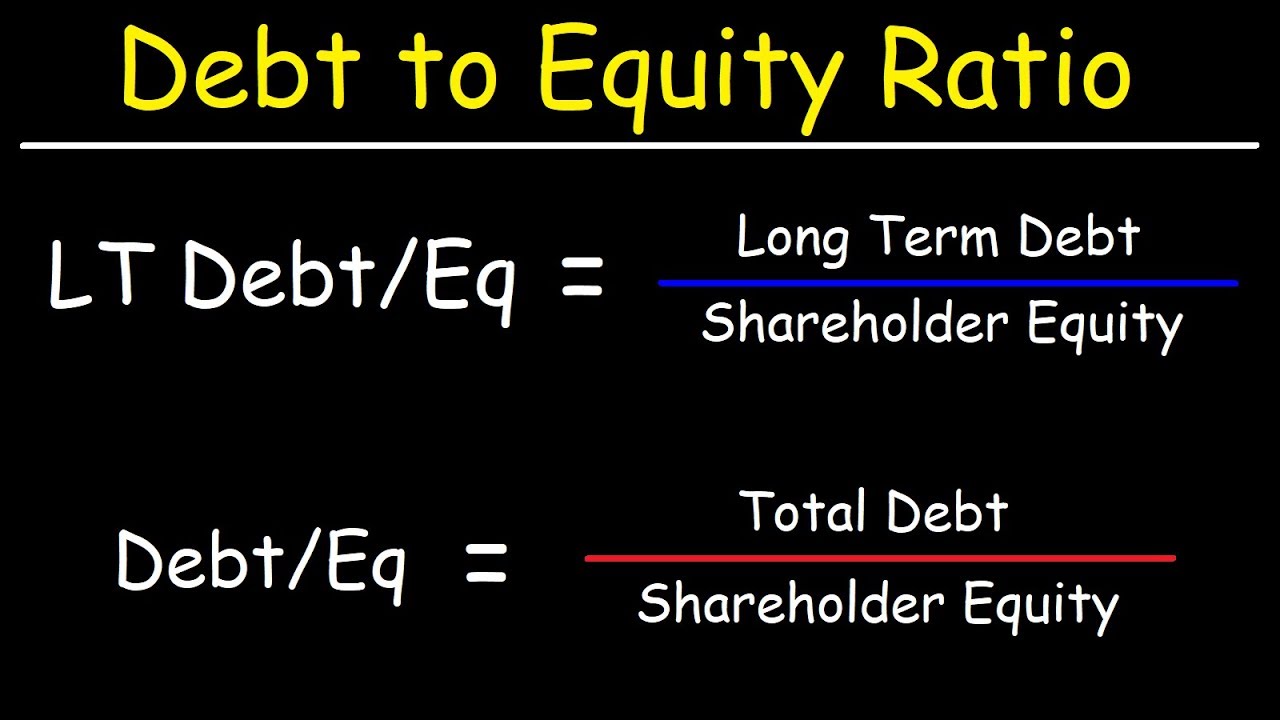

The debt to equity ratio is calculated by dividing total liabilities by total equity. In this video i will teach you how to calculate the debt to equity ratio by extracting the numbers from a comapany balance sheet. Hence, as an alternative we can use the following formula:

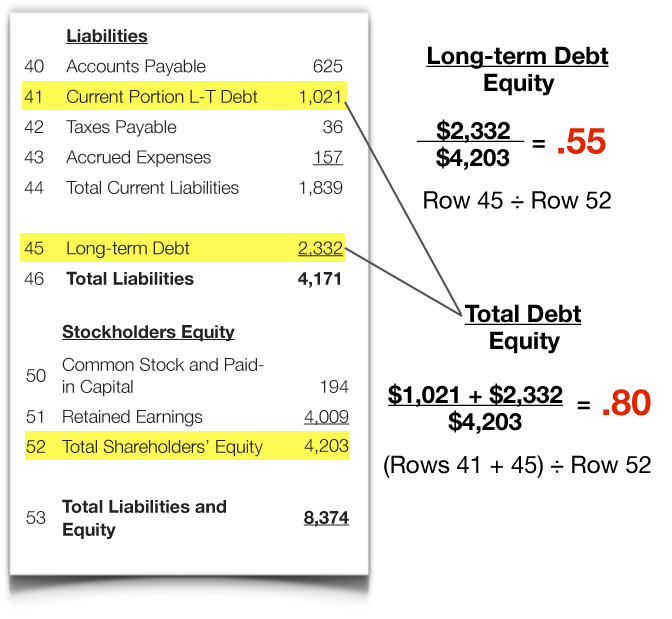

This formula provides a quick and straightforward way to assess a company’s financial leverage. Debt to equity ratio = (short term debt + long term debt + fixed payment obligations) / shareholders’ equity. Effective methods to lower your company’s liabilities.

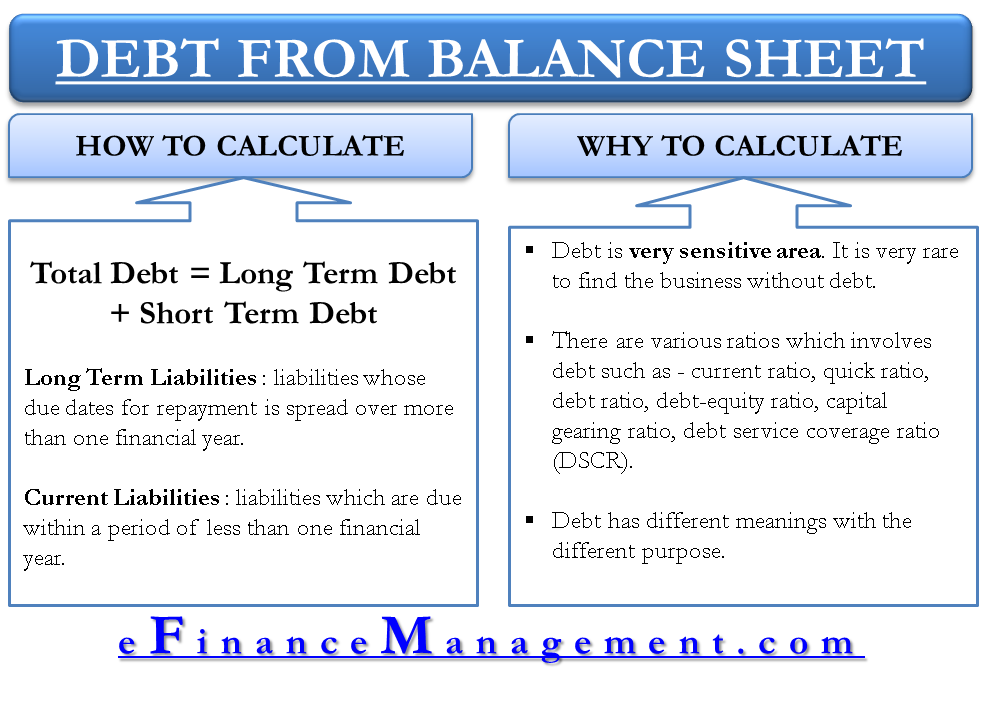

The current ratio reveals how a company can maximize its current assets on the balance sheet to satisfy its current debts and other financial obligations. Debt to equity ratio = total liabilities / shareholder’s equity. Closely related to leveraging, the ratio is also known as risk, gearing or leverage.

Profitability ratios measure a company’s ability to generate income relative to revenue, balance sheet assets, operating costs, and equity. Debt to equity ratio = total liabilities / shareholder’s equity total liabilities represent all of a company’s debt and the following items should be considered in the calculation: Without optimising its balance sheet, tm’s net debt as a proportion of earnings before interest, taxes, depreciation and amortisation (ebitda) could decline to 0.4 times by the financial year.

The amount for total liabilities can be found on the balance sheet. This study examines whether firms with debt contacts that contain more restrictive balance sheet covenants are more likely to conduct seasoned equity offerings. It equals (a) debt to equity ratio divided by (1 plus debt to equity ratio) or (b) (equity multiplier minus 1) divided by equity multiplier.

D/e ratio =total liabilities / shareholders’ equity How to create a balance sheet in 5 simple steps 2. Debt to equity ratio in practice.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

![Debt to Equity Ratio (D/E) Formula + Calculator [Excel Template]](https://media.wallstreetprep.com/wsp_template_library/Debt-to-Equity-Ratio-Calculator.jpg)