Favorite Info About Bad Debt Reserve In Balance Sheet

Bad debt reserve (also known as provision for doubtful debts) is a provision made by any organization regarding those customers to.

Bad debt reserve in balance sheet. Luis rivero, cpa. Analysts keep track of changes in bad debt reserves, which can uncover. Bad debt is the term used for any loans or outstanding balances that a business deems uncollectible.

Definition of bad debt reserve. For businesses that provide loans and credit to. Bad debt expense is a critical aspect of accounting that affects a business's balance sheet and income statement.

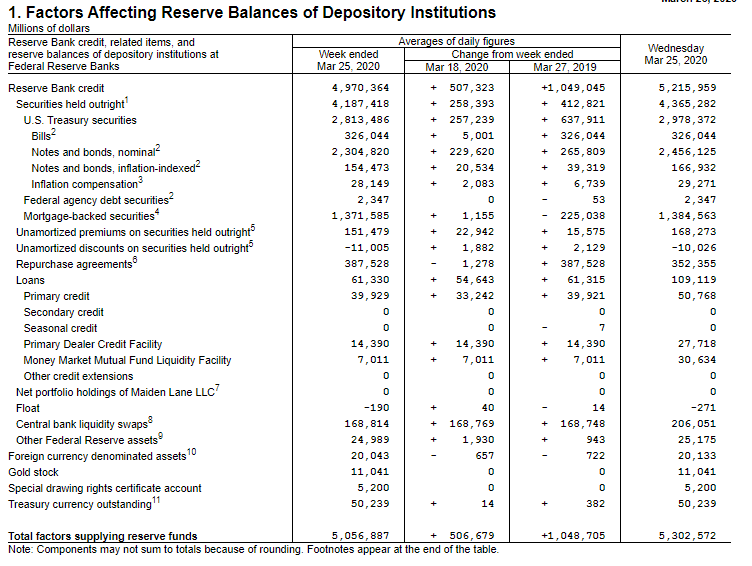

Z as uncollectible with a balance of usd. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data. The bad debt reserve you track bad debts on the balance sheet as well, using the bad debt reserve account, also known as an allowance for bad debt.

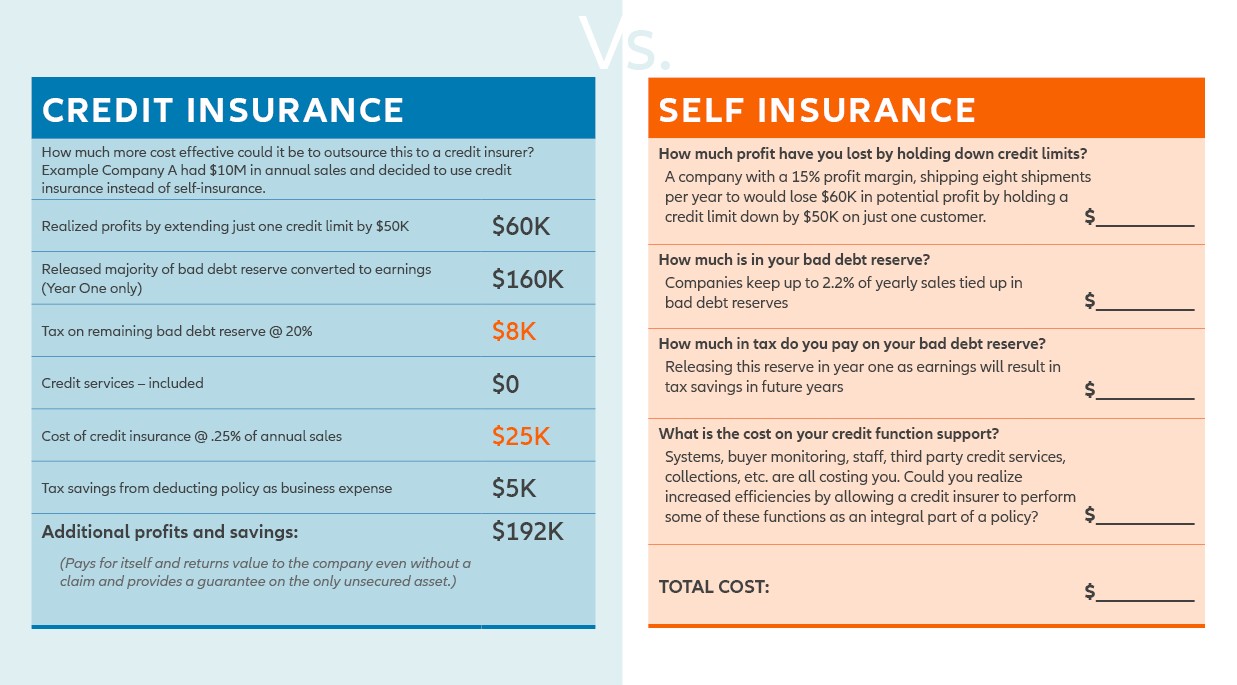

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. If the balance in the reserve is. The bad debt reserve is the amount of.

Balance sheet reserves refer to the amount expressed as a liability on the insurance company's balance sheet for benefits owed to policy owners. For example, company xyz ltd. Most companies and banks keep a bad debt reserve because some percentage of customers will fail to pay.

Bad debt is basically an expense for the company, recorded under the heading of sales and general administrative expenses. Fed minutes suggest officials are seeking smallest balance sheet possible. The bad debt reserve account will reduce the accounts receivable a/c by $ 50, and the net accounts receivable to be presented in the books of accounts will be $ 4950.

Decides to write off one of its customers, mr. This study examines whether firms with debt contacts that contain more restrictive balance sheet covenants are more likely to conduct seasoned equity. Recognizing bad debts leads to an offsetting reduction to accounts receivable on the balance sheet—though businesses retain the right to collect funds should the.

The bad debt reserve is designed to be an offset to the trade receivables account, with which it is paired on the balance sheet. The allowance for doubtful accounts (or the “bad debt” reserve) appears on the balance sheet to anticipate credit sales where the customer cannot fulfill their. Assets have declined by about $1.3 trillion since june 2022.

Also called doubtful debts, bad debt expenses are. The sharp deterioration took place in the last year after delinquent commercial property debt for the six big banks nearly tripled to $9.3bn. By establishing a reserve, companies.

A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect. Bad debt reserves are shown on a company's balance sheet as a line item underneath account receivables, the account it offsets or acts as a contra account to.

:max_bytes(150000):strip_icc()/baddebtreserve.asp_final-2e6562d79b874ef39946ab765138946a.png)