Beautiful Tips About Unrealized Gain Income Statement

Investing realized vs.

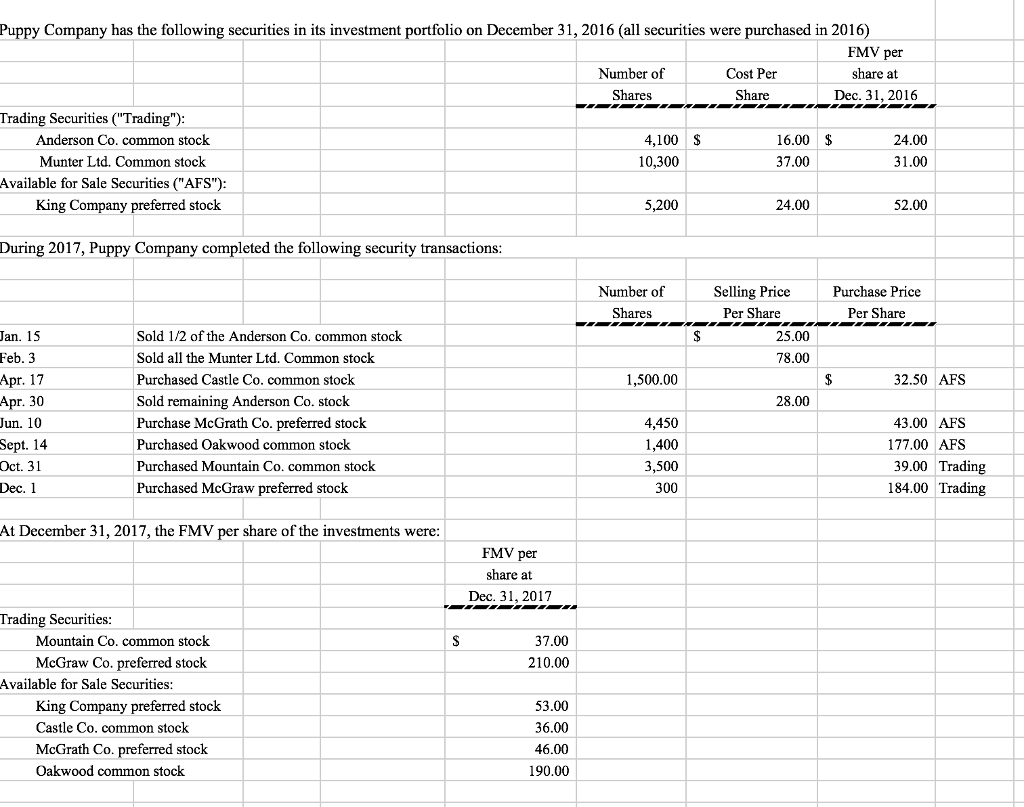

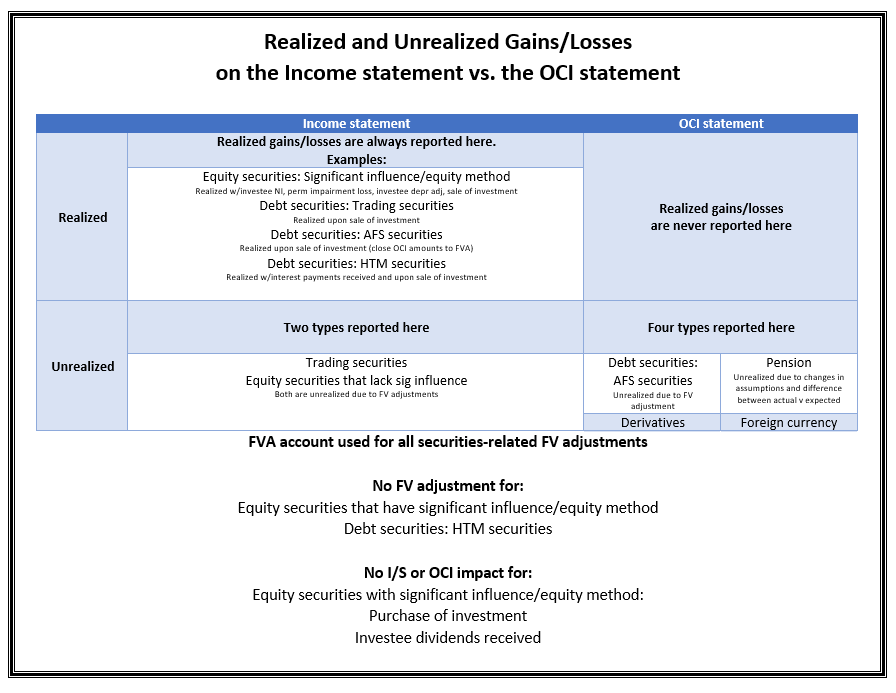

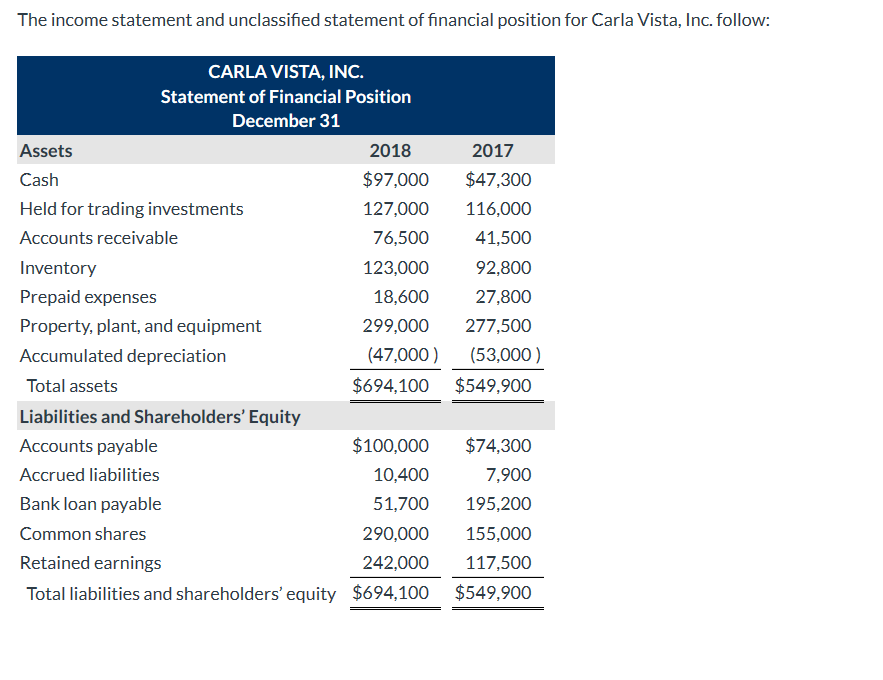

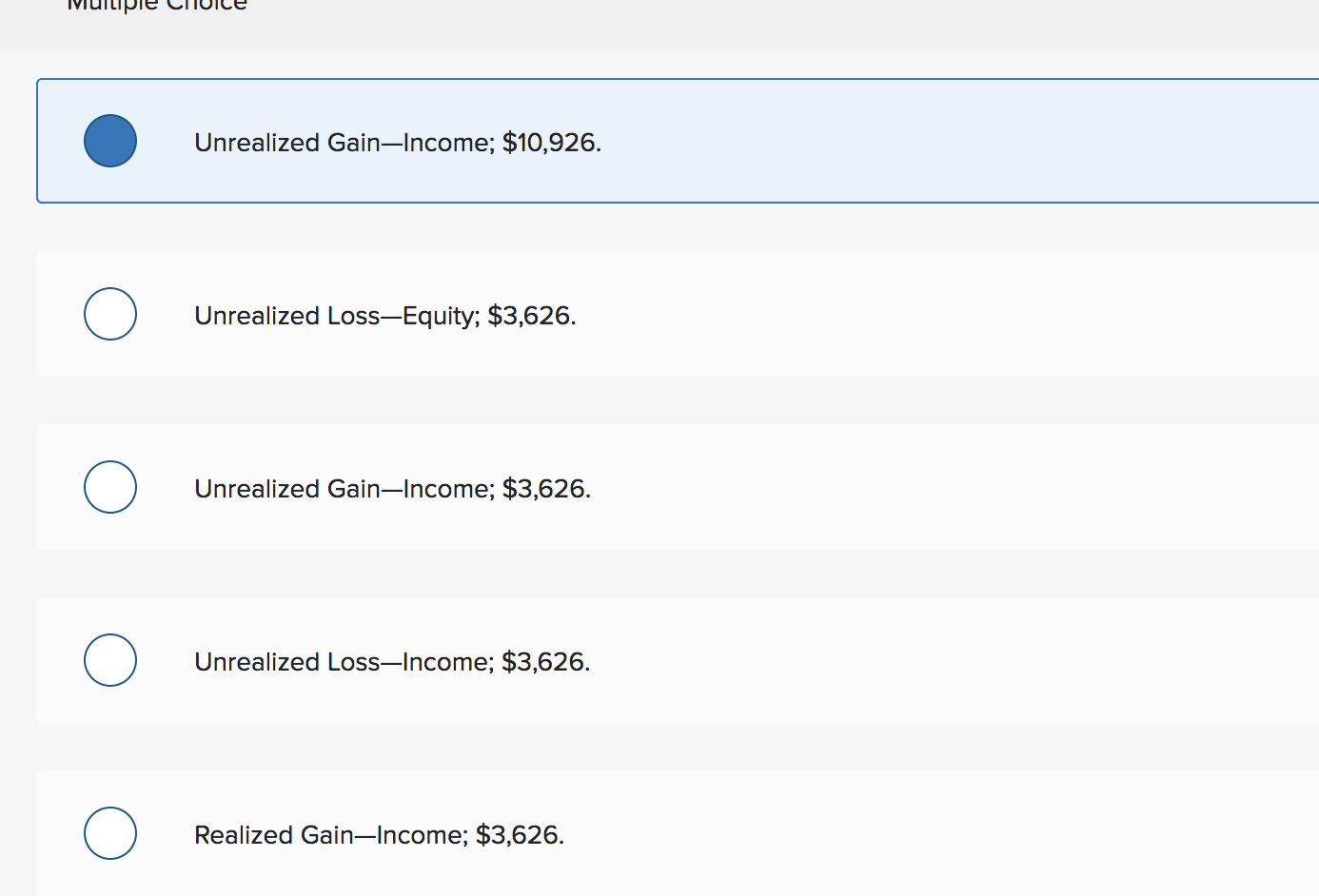

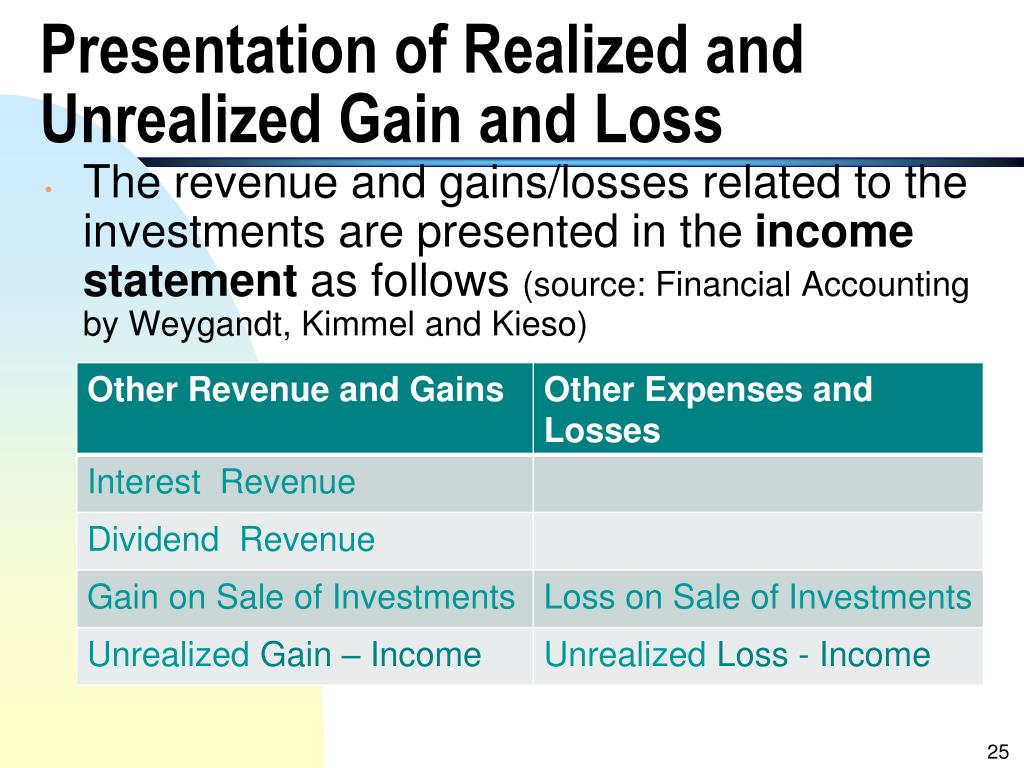

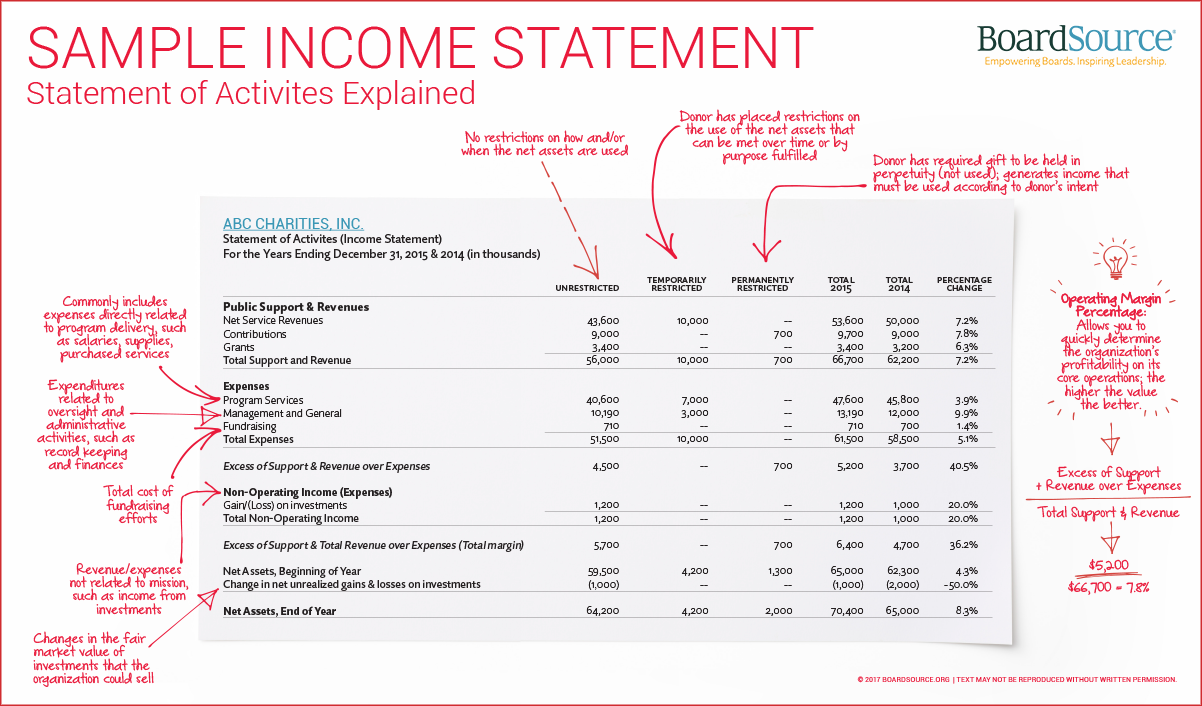

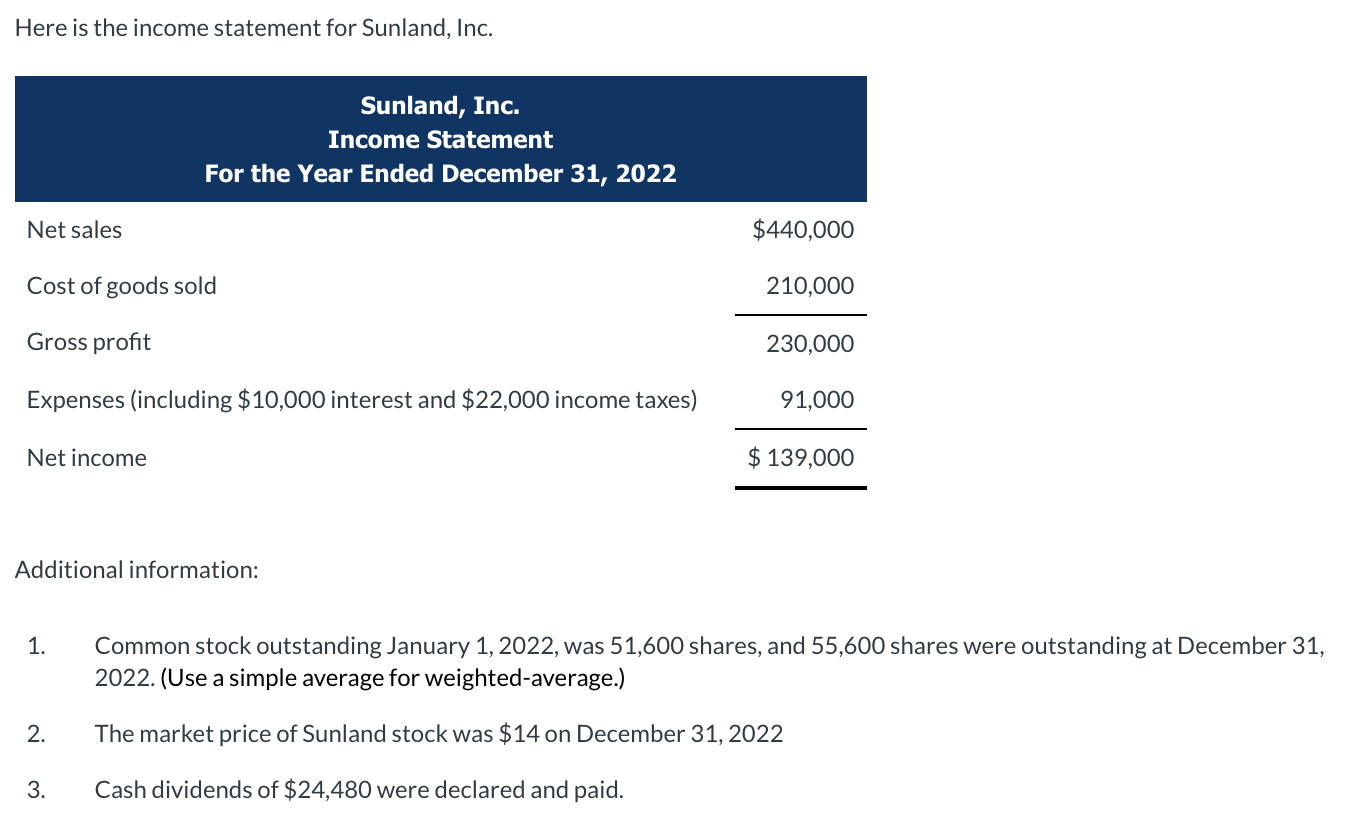

Unrealized gain income statement. The gains and losses you see in your portfolio are. Realized and unrealized gains or losses from foreign. Gains and losses are reported on the income statement.

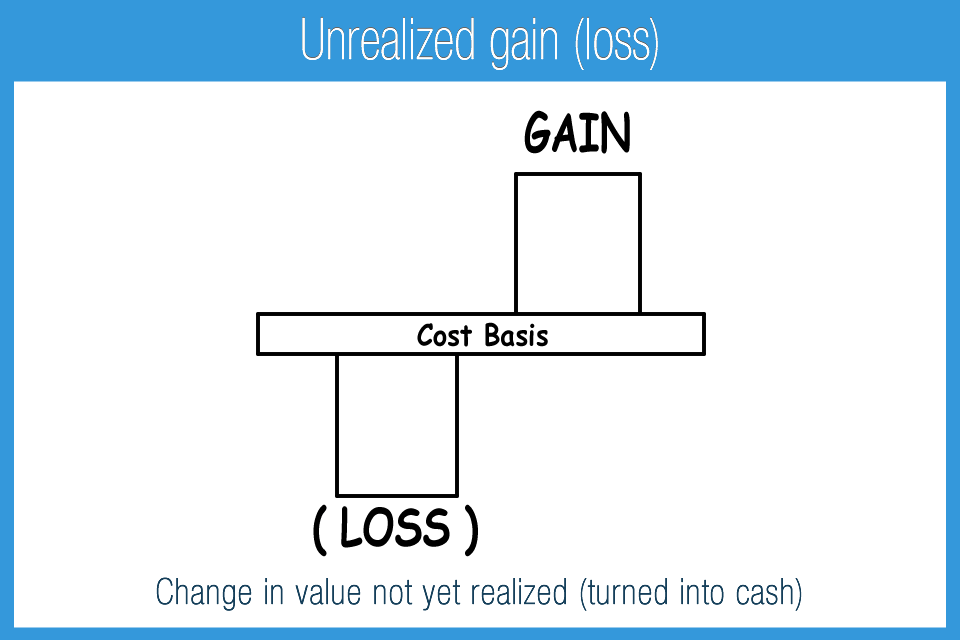

Think of it as money on paper rather than cash. Unrealized gains or losses refer to the increase or decrease in the value of different company assets that have not been sold yet. A taxpayer has two assets:

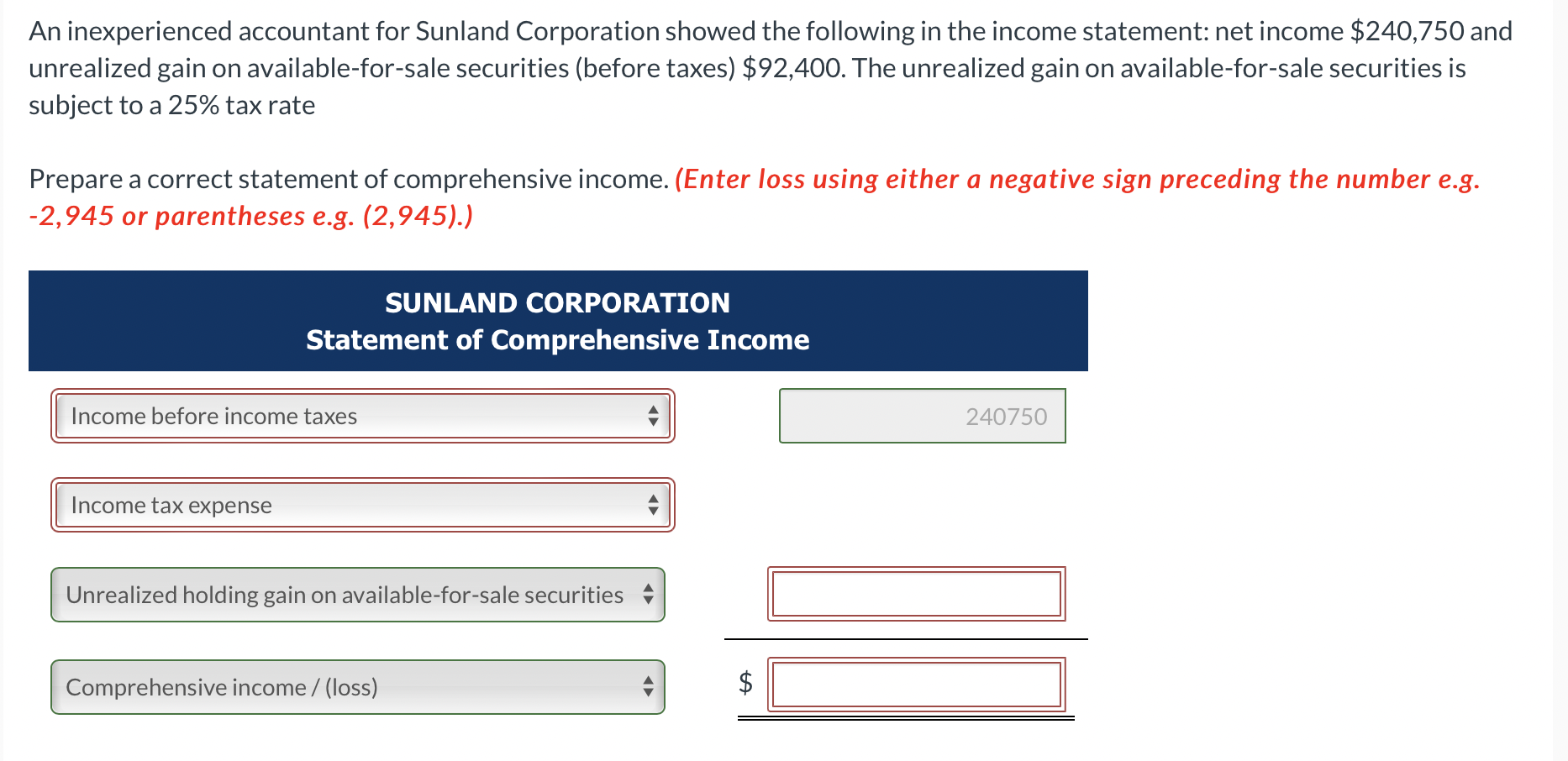

However, if the hedging instrument offsets changes in fair value or cash. Unrealized gains or losses are the gains or losses that the seller expects to earn when the invoice is settled, but the customer has failed to pay the invoice by the close of the. Updated april 26, 2022 reviewed by charlene rhinehart fact checked by kirsten rohrs schmitt what is a realized gain?

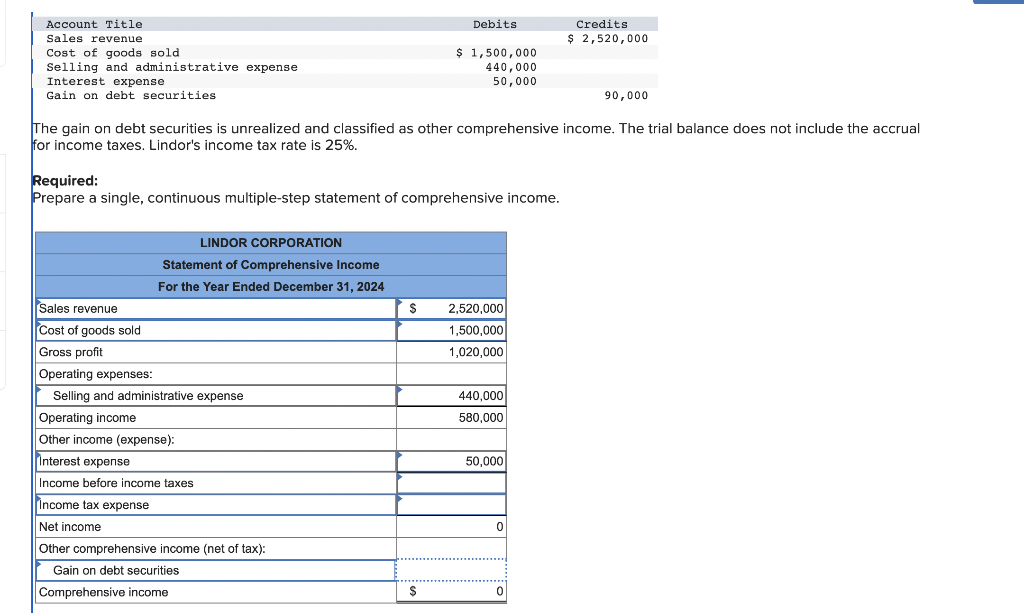

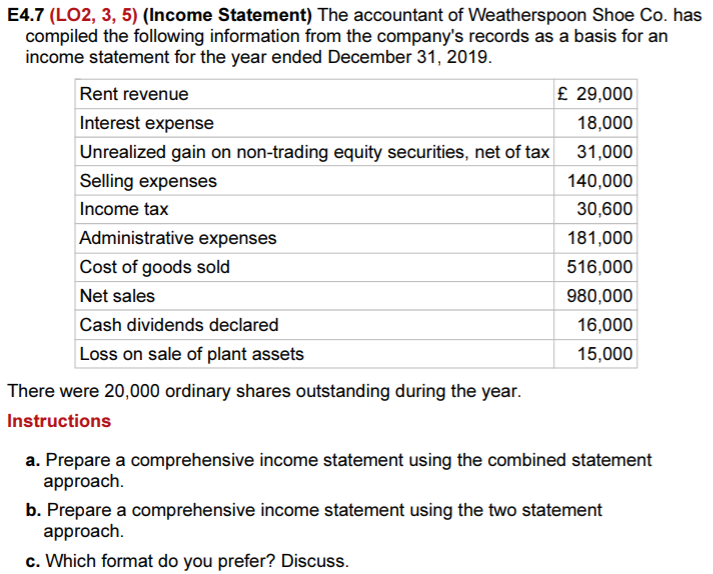

The accounting treatment depends on whether the securities are classified into three types, which are given below. Splitting gains and losses into more than one income statement line item is generally not appropriate. January 30, 2021 what we’ll cover:

Income statement net income (section vii) $ 309 $ 221 $ 723 $ 159 adjustments to reconcile net income to income available. Recording of unrealized gains and losses. Losses are similar to gains in that both are recognized on the income statement only when an asset is sold and a loss is taken.

Currency exchange rate revaluations and monetary. Asc 815 requires the change in the fair value of a derivative designated in a fair value or cash flow hedge to be presented in the same income statement line item as the hedged. That is why the gain is considered unrealized.

Unrealized gain is an income statement category reserved for investment income that a company expects to receive in the future. You can also call an unrealized gain or loss a paper profit or paper loss, because it is recorded on paper but has not actually been realized. It is never actually recorded in the accounting system.

An unrealized gain is the potential profit you could realize by cashing in the investment. Like gains, there can also be unrealized. An unrealized gain takes place before a transaction has actually occurred.

On january 1, 20x4, fsp corp acquires a debt security for $1,000 (at par) with a fixed interest rate of 4.5% per year and a maturity at december 31, 20x8. Once they are sold the gain or. You are free to use this image o your.

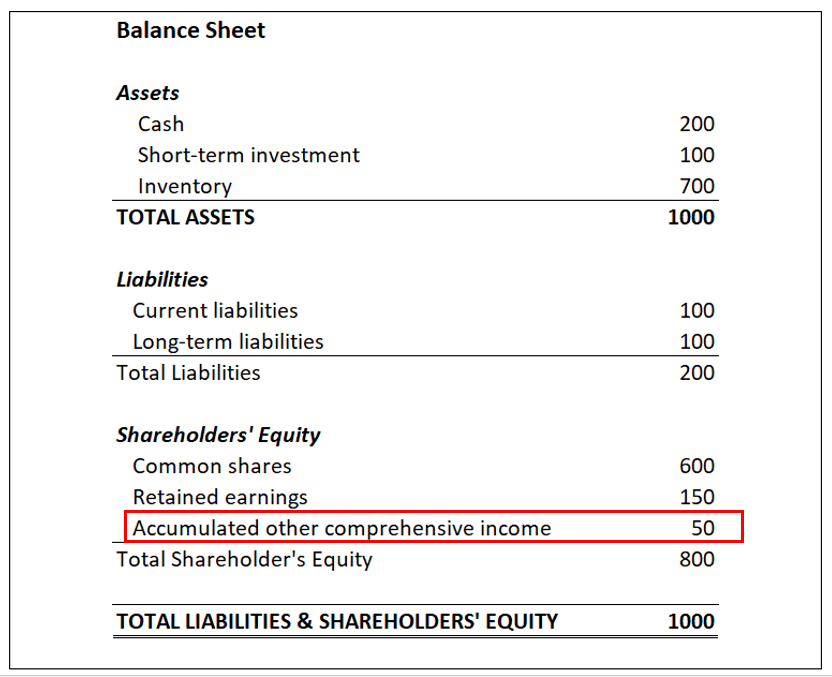

Statement of comprehensive income unlike realized gains and losses that are reported on the income statement, unrealized transactions are usually reported in. However, because you have not cashed in the investment, the gain is. But if there’s a large unrealized gain or loss embedded in the assets or liabilities of a company, it could affect the future viability of the company drastically.