Favorite Info About Gross Profit Accounting

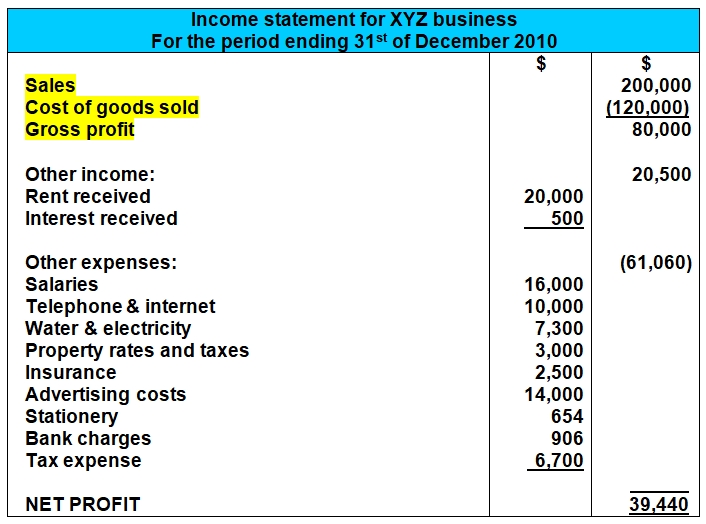

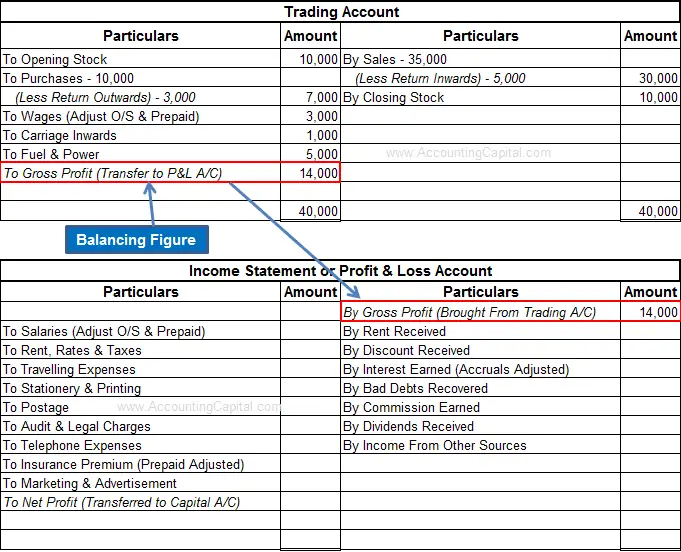

The value of net sales is calculated as the sales minus returns inwards.

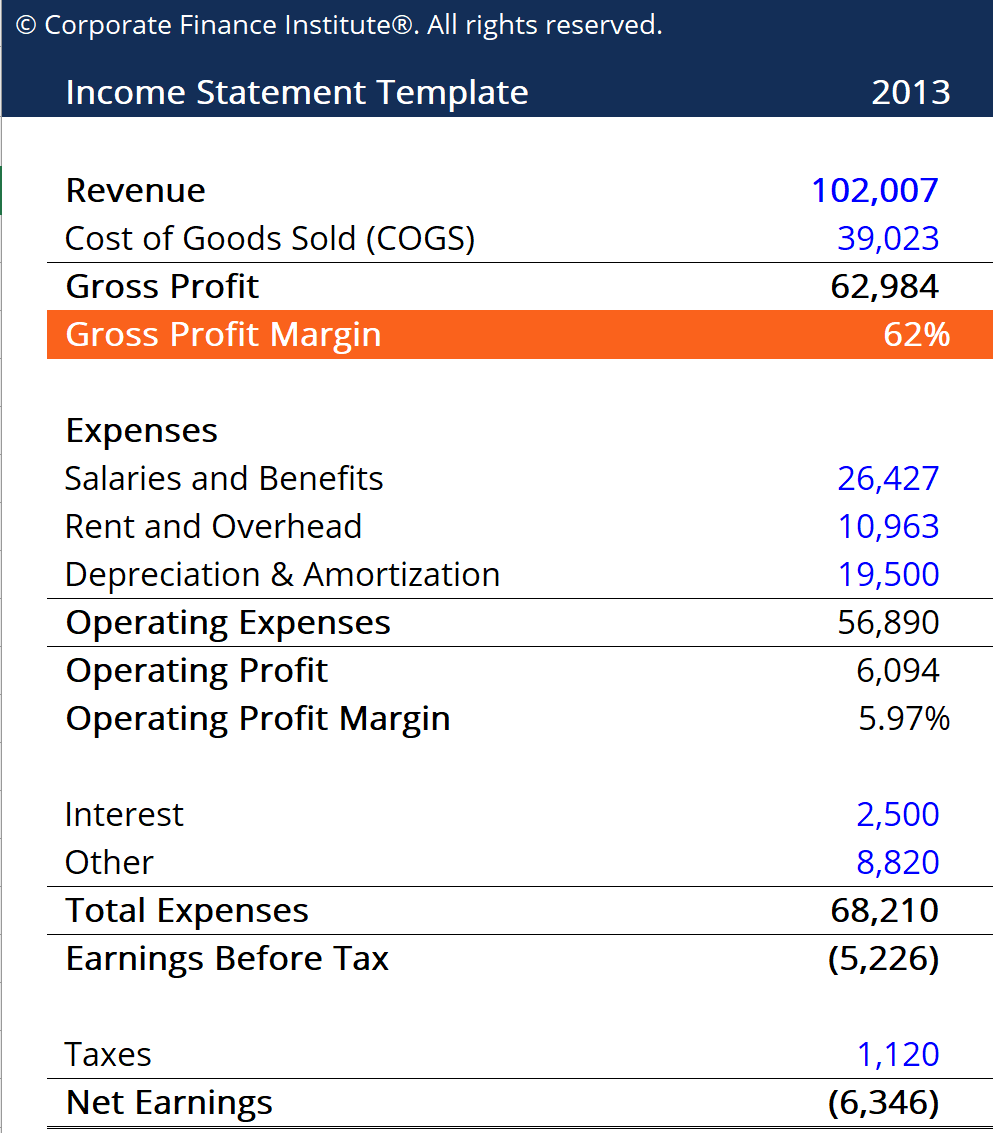

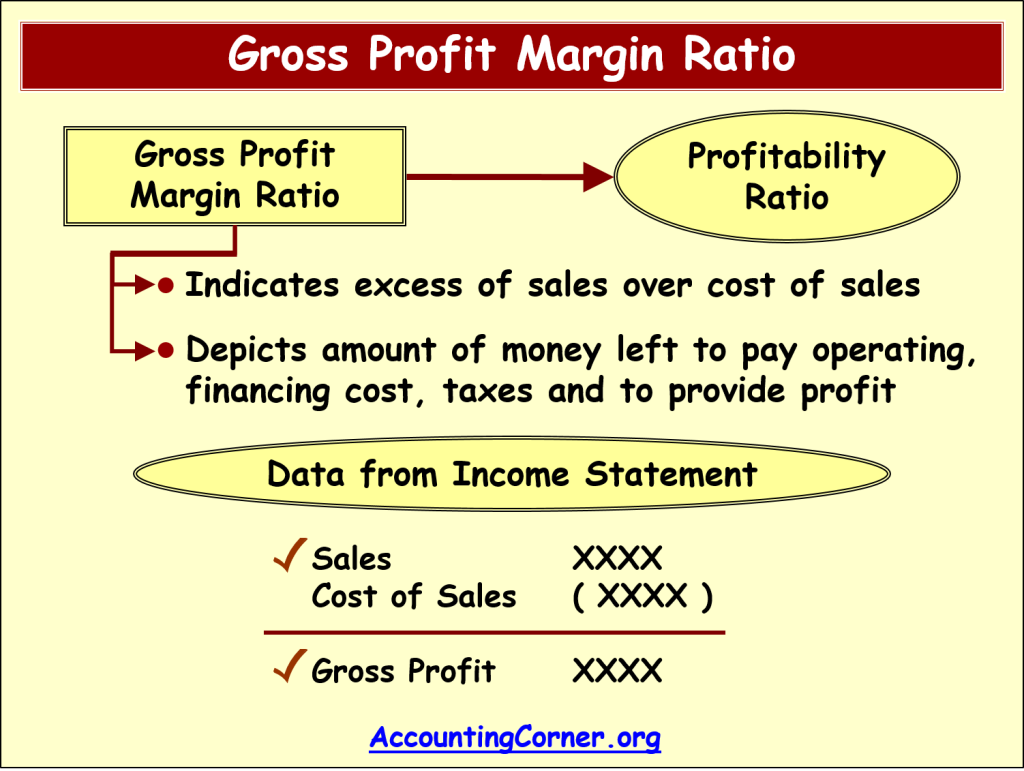

Gross profit accounting. Gross profit margin is an analytical metric expressed as a company's net sales minus the cost of goods sold. India’s market regulator has found a hole of more than $240 million in the accounts of zee entertainment enterprises ltd., dealing another blow. The difference between direct expenses and direct revenues of business gives rise to gross profit and gross loss.

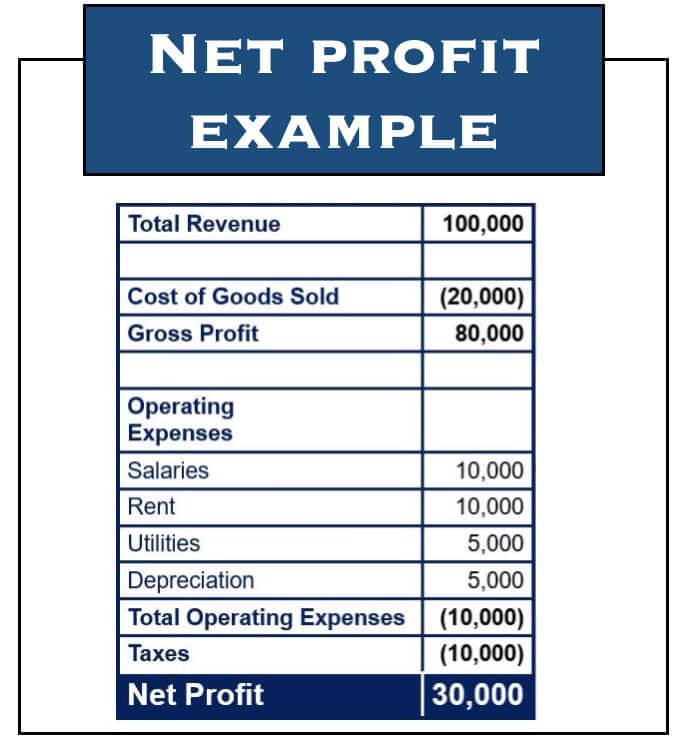

Revenue equals the total sales, and the cost of goods sold includes all of the costs needed to make the product you’re selling. Hsbc’s earnings sink on $3 billion impairment on chinese bank. You’ll also read about strategies to reduce costs and increase company profits.

For example, a company has revenue of $500 million and cost of goods sold of $400 million; The gross profit margin for year 1 and year 2 are computed as follows: Gross profit is a great tool to manage both sales and the cost of goods sold.

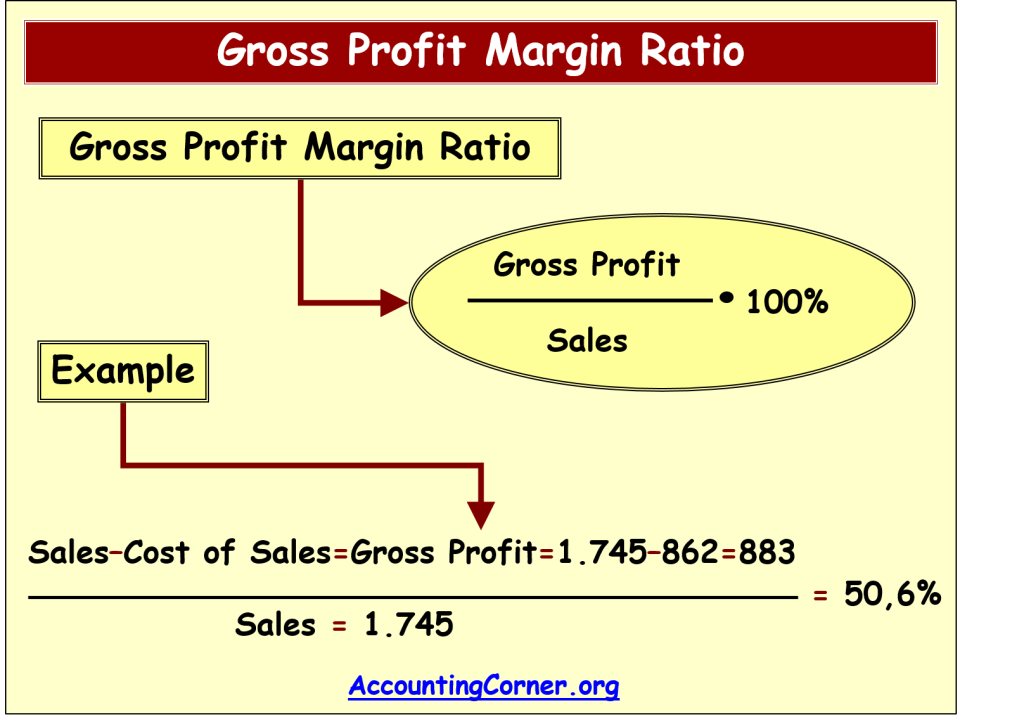

This discussion defines gross profit, calculates gross profit using an example, and explains components of the formula. Gross profit margin is often shown as the gross profit as a percentage of net. Profit (£75,000) × the number of days in the transition part (188) ÷ the number of days in the accounting period.

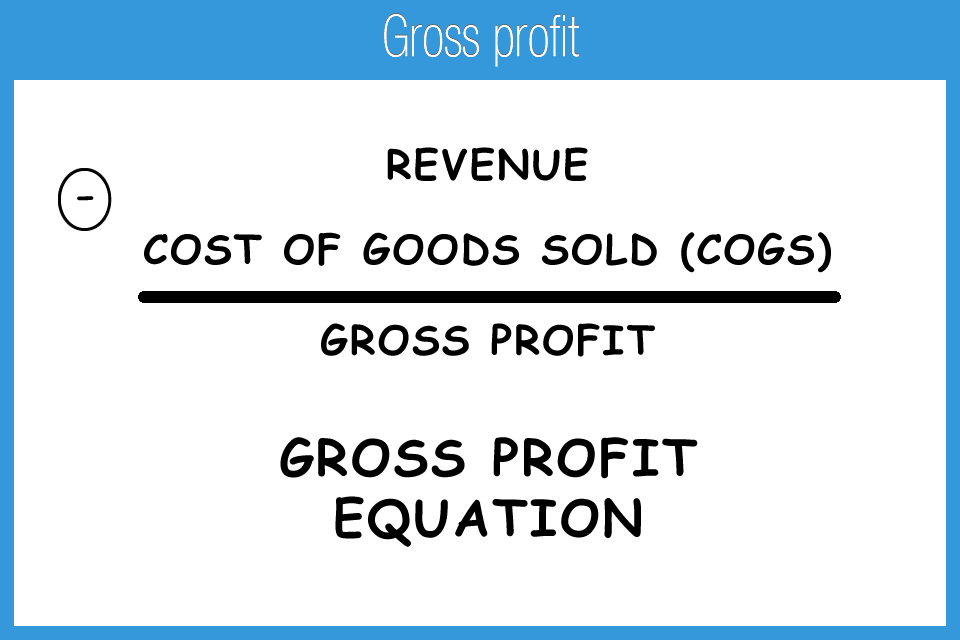

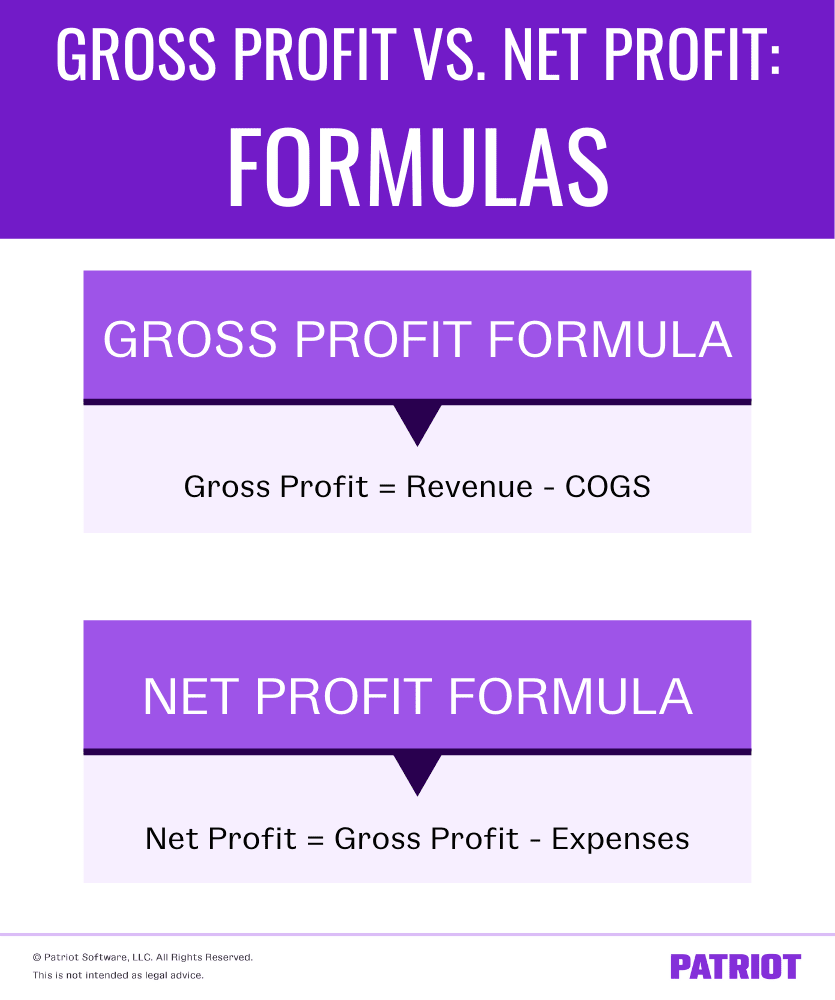

Gross profit gross profit is the value that remains after the cost of sales, or cost of goods sold (cogs), has been deducted from sales revenue. February 20, 2024 at 10:30 am pst. The gross profit formula in accounting is the profit after the deduction of the cost of goods sold.

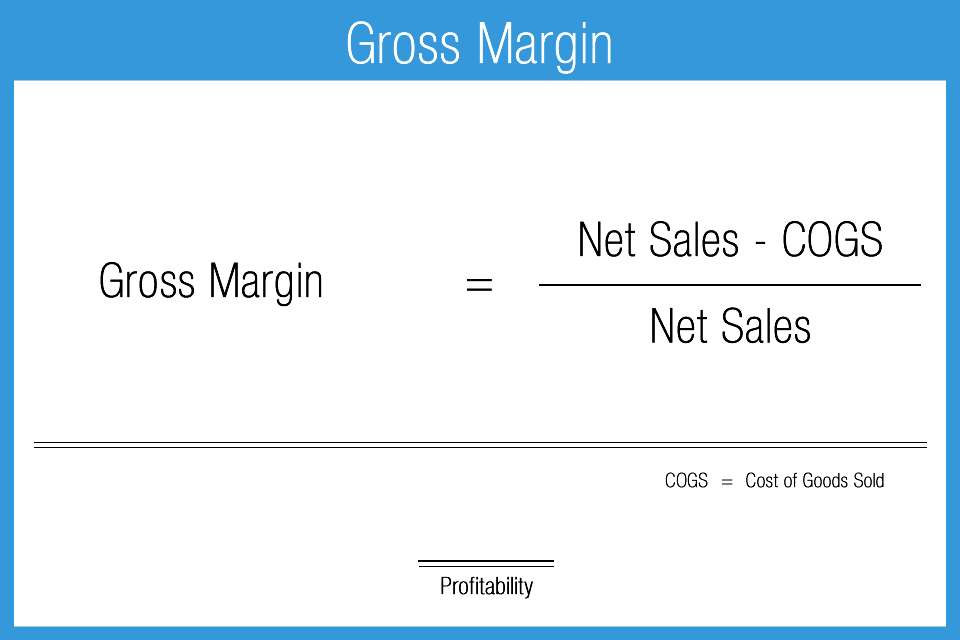

The gross profit margin is 40% (gross profit of $51,000 divided by net sales of $128,000). Gross margin = gross profit / total revenue x 100. Net profit increased 13% from a year earlier.

Cogs are any costs that are directly involved in the production of goods and services. Notice that in terms of dollar amount, gross profit is higher in year 2. From gross profit, operating profit or operating income is the residual income after accounting for all expenses plus cogs.

The formula for calculating gross margin is: Gross profit is defined as net sales minus the cost of goods sold. Gross profit commonly includes variable costs and not fixed costs.

Cost of goods sold = cost of raw material + cost of labor. Gross margin is expressed as a percentage. The formula to calculate gross profit subtracts a company’s cost of goods sold (cogs) from its net revenue.

Find the percentage of gross profit. In its noun form, the word “gross” means an […] Gross profit is defined as the difference between the net sales and the cost of goods sold (i.e., the direct cost of sales).

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)