Stunning Info About Making Financial Projections

This article will show you how to make financial projections for a startup business plan or an existing business.

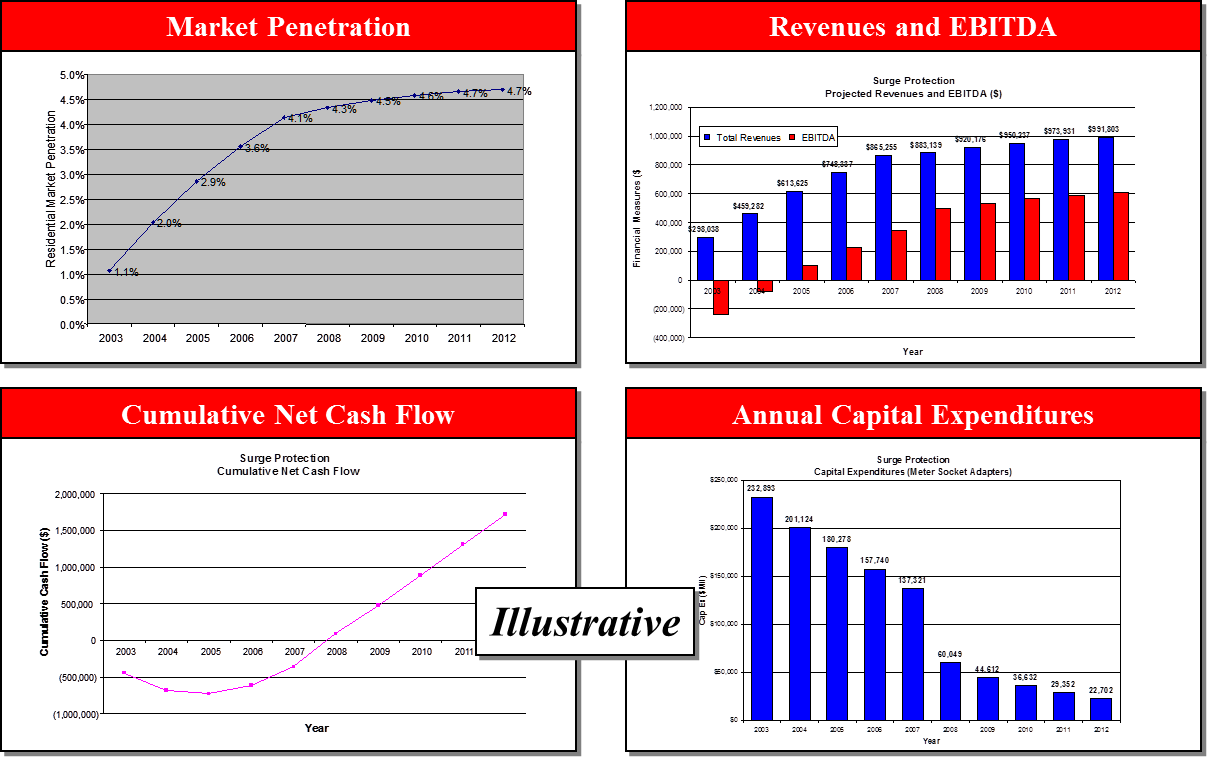

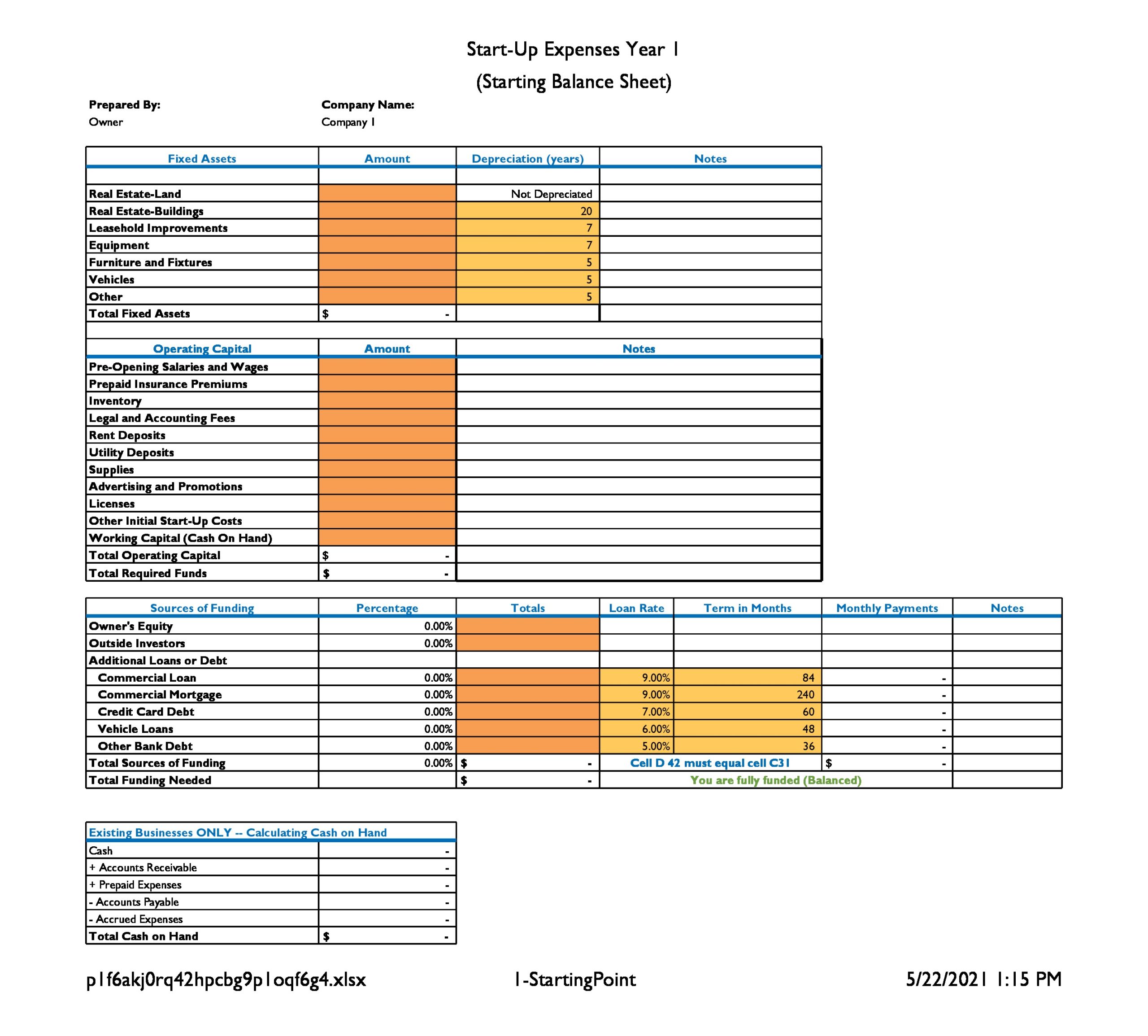

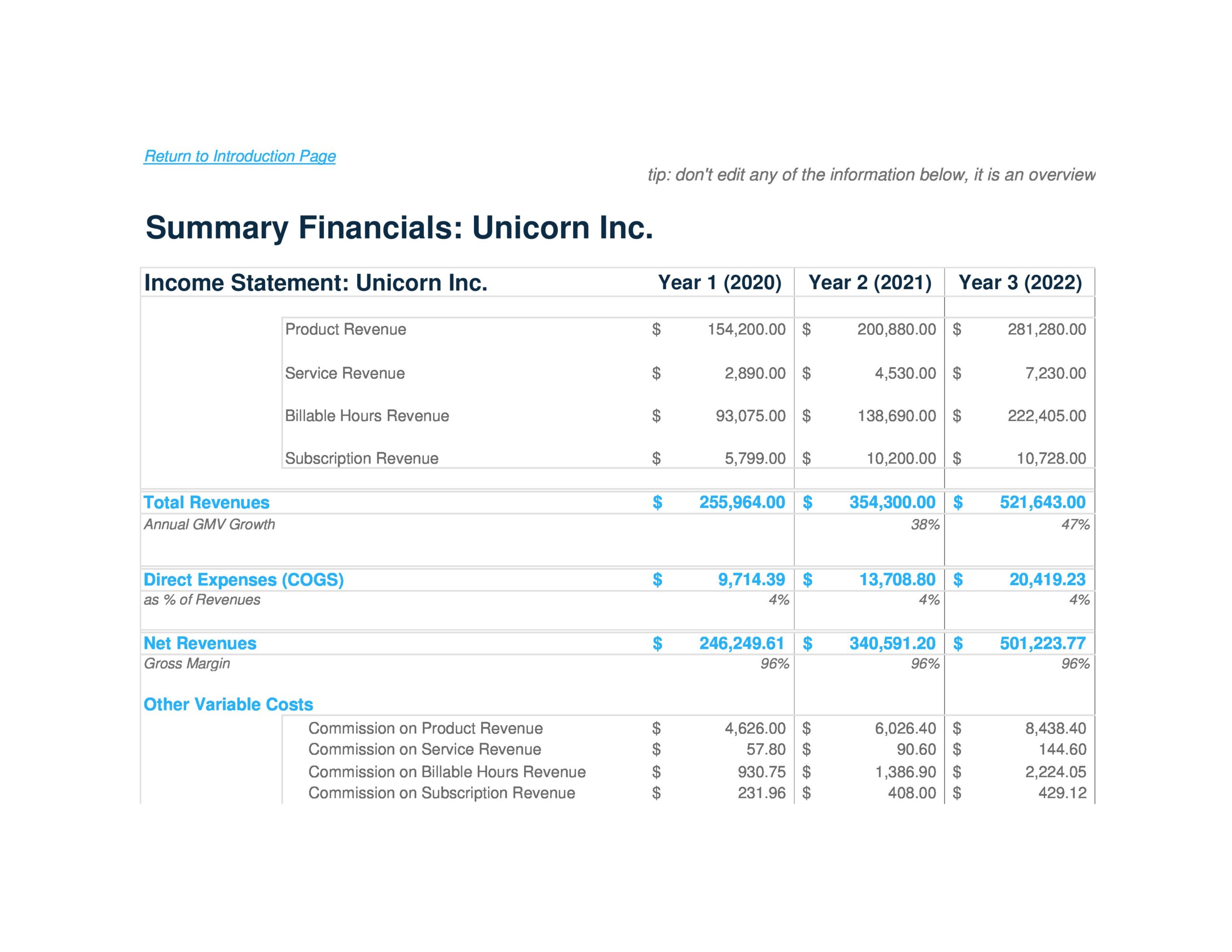

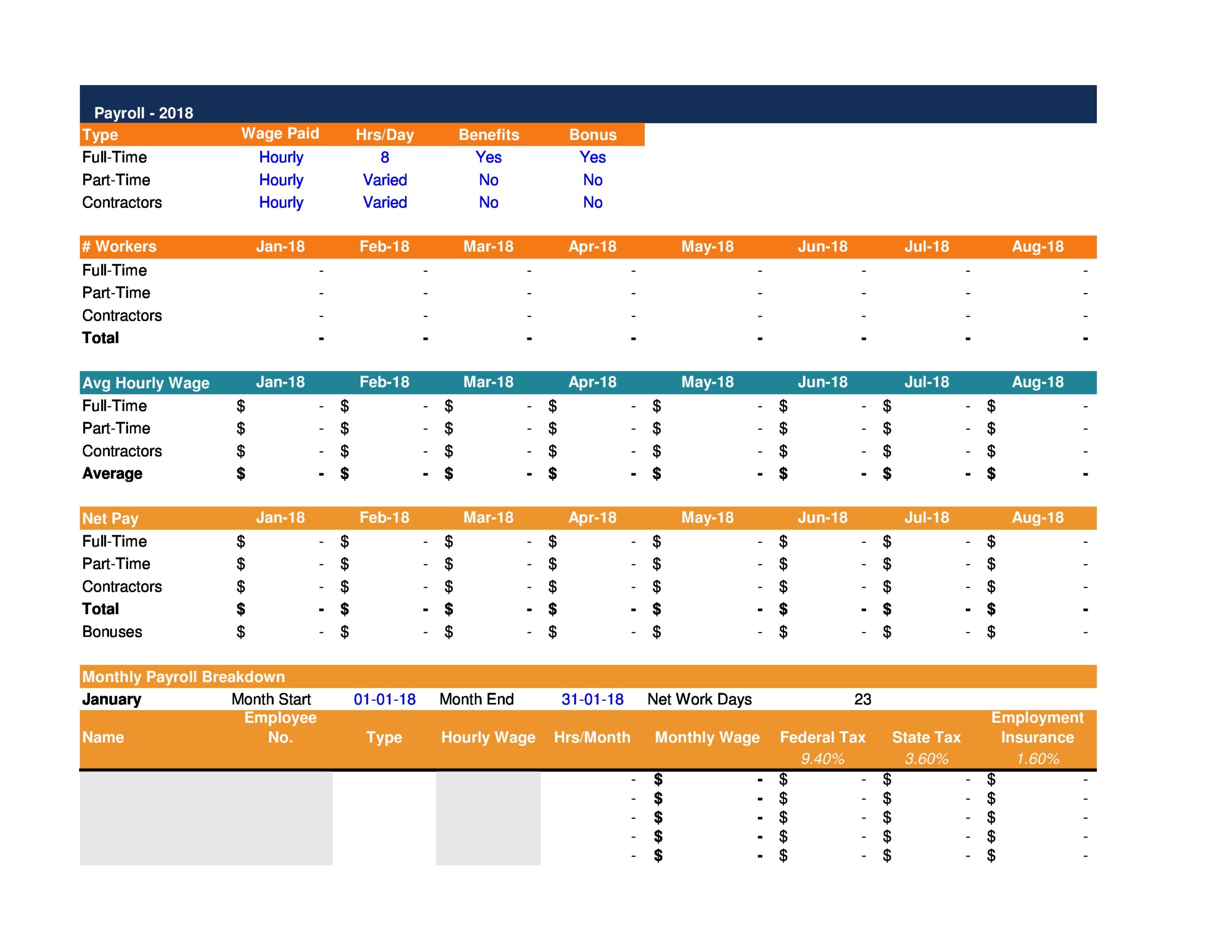

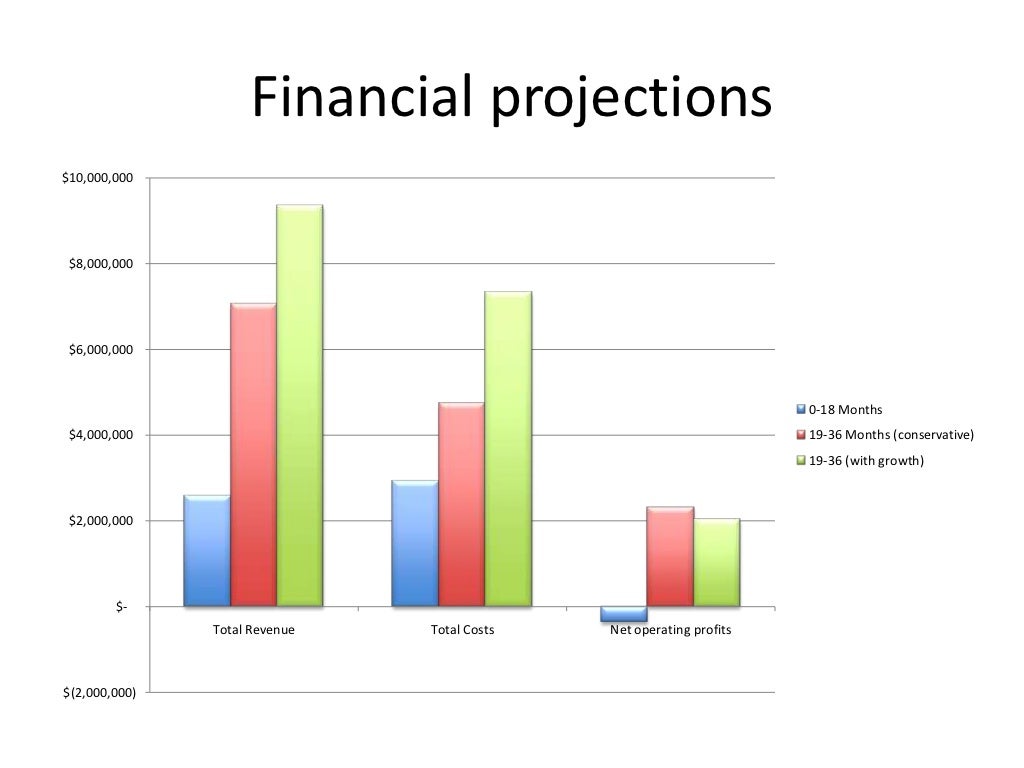

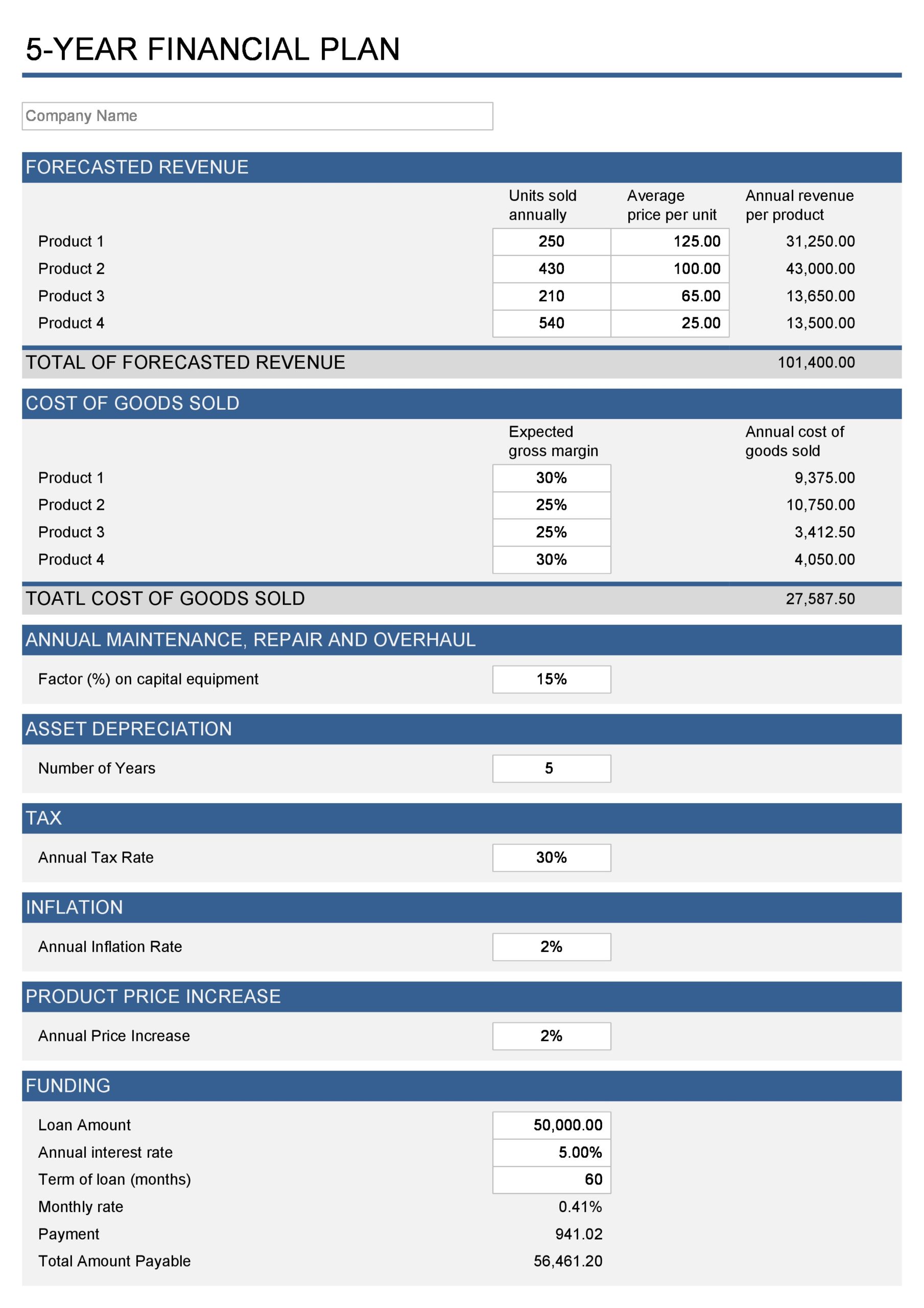

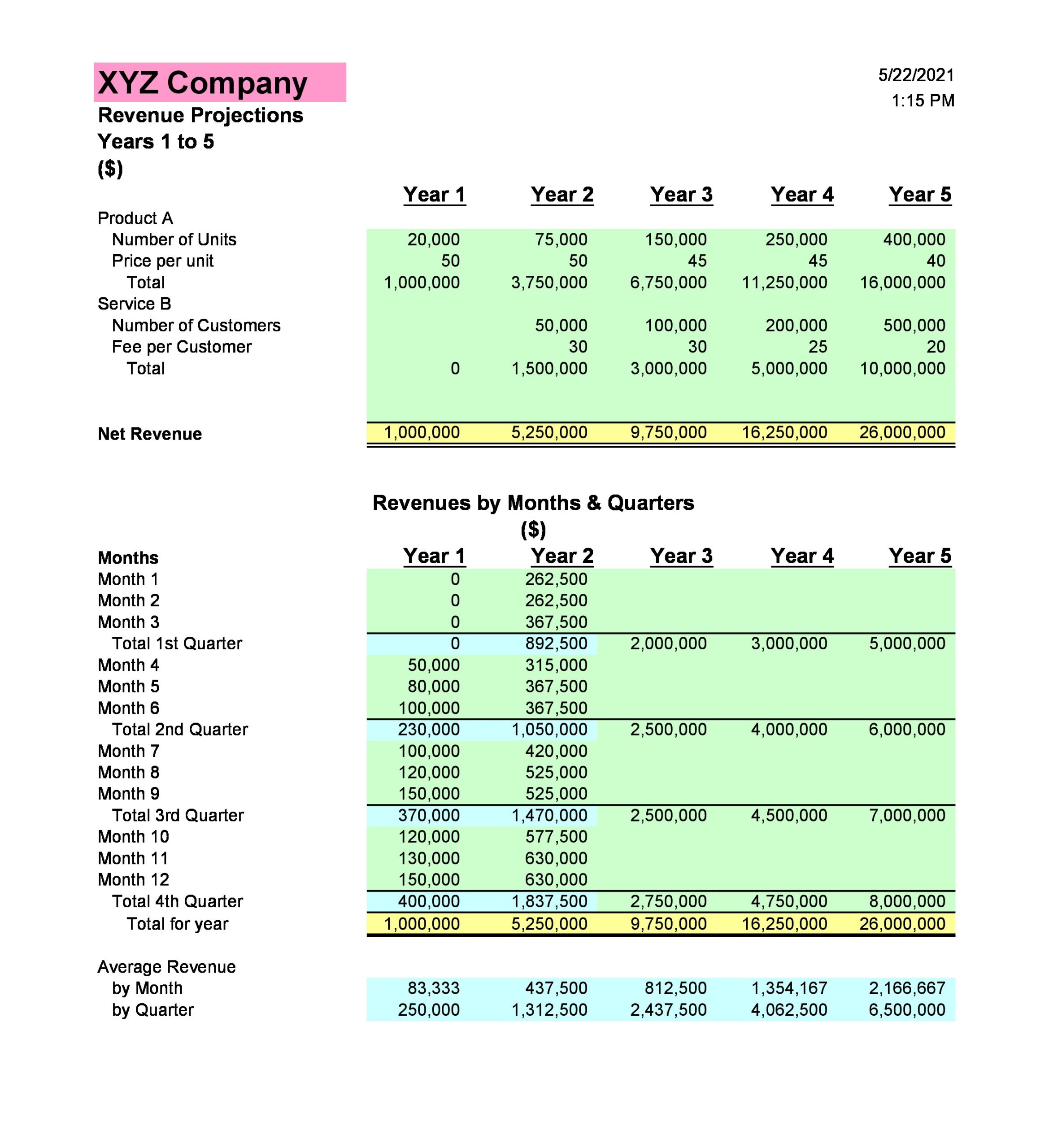

Making financial projections. Start with a sales projection. Financial projections forecast a company’s expected financial performance and position by presenting expected metrics such as projected revenue, expenses, capital expenditures, cash flows, etc. For the second year, you can make quarterly or yearly projections.

Sales projections play a significant role in determining forecasts relating to revenue and profit. What does the financial future of your business look like? If you’re creating a sales forecast for an existing business, you’ll have past performance records to project your next period.

Your financial projection should answer these three questions: Record quarterly revenue of $22.1 billion, up 22% from q3, up 265% from year ago. Simulate, tweak, and improve your projected outcomes over and over again until you come up with a winning.

They are typically used for planning, budgeting, and assessing the financial feasibility or potential profitability of new business ventures. Record quarterly data center revenue of $18.4 billion, up 27% from q3, up 409% from year ago. The first step for a financial forecast starts with projecting your business’s sales, which are typically derived from past revenue as well as industry research.

Companies also use financial projections to forecast the potential success of. Nvidia announces financial results for fourth quarter and fiscal 2024. Financial projections are important for a number of reasons.

This can help you secure the funding you need to get your business off the ground. There's an 85% chance the us economy will enter a recession in 2024, the economist david rosenberg says. For starters, you’ll need to project how much your business will make in sales.

These templates enable business owners, cfos, accountants, and financial analysts to plan future growth, manage cash flow, attract investors, and make informed decisions. Ai revolutionizes financial forecasting and budgeting across sectors, enhancing accuracy and efficiency. Companies often use these as the basis for making decisions about how to invest or manage their budgets and operating plans.

It automates data sourcing and analysis, improves risk. This way, you can complete and secure your short term objectives very well. Financial projections are estimates or forecasts of a business’s revenue, expenses, and capital costs over a specific period in the future.

A financial projection is a forecast of how much revenue you expect to generate and what your expenses will be, broken down month by month. By using a financial model to make projections, you can see if, when and whether your business will make a profit with its initial business model, what could happen if it added new Here are the steps for creating accurate financial projections for your business.

To meet the goal of reducing emissions in the european union (eu) by at least 55% in 2030 compared with 1990 levels, governments have started implementing different sets of measures. How much cash will flow in and out of your business? Financial projections help you map out the business's potential growth and create financial budgets that enable the business to grow and thrive in the near future.