Fun Tips About Financing Cash Flow Meaning

The cash flow from financing activities (cff) is part of a company’s cash flow statement.

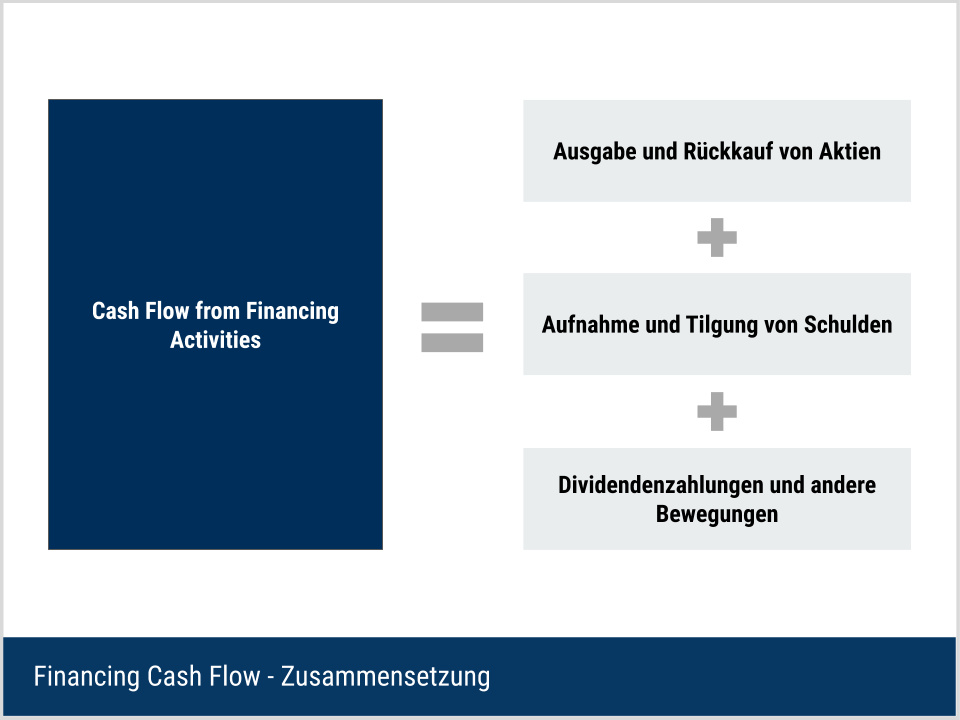

Financing cash flow meaning. Cash flow from financing activities is cash earned or spent in the course of financing your company with loans, lines of credit, or owner’s equity. Finance activities include the issuance and repayment of equity,. Cash flow is a measure of the money moving in and out of a business.

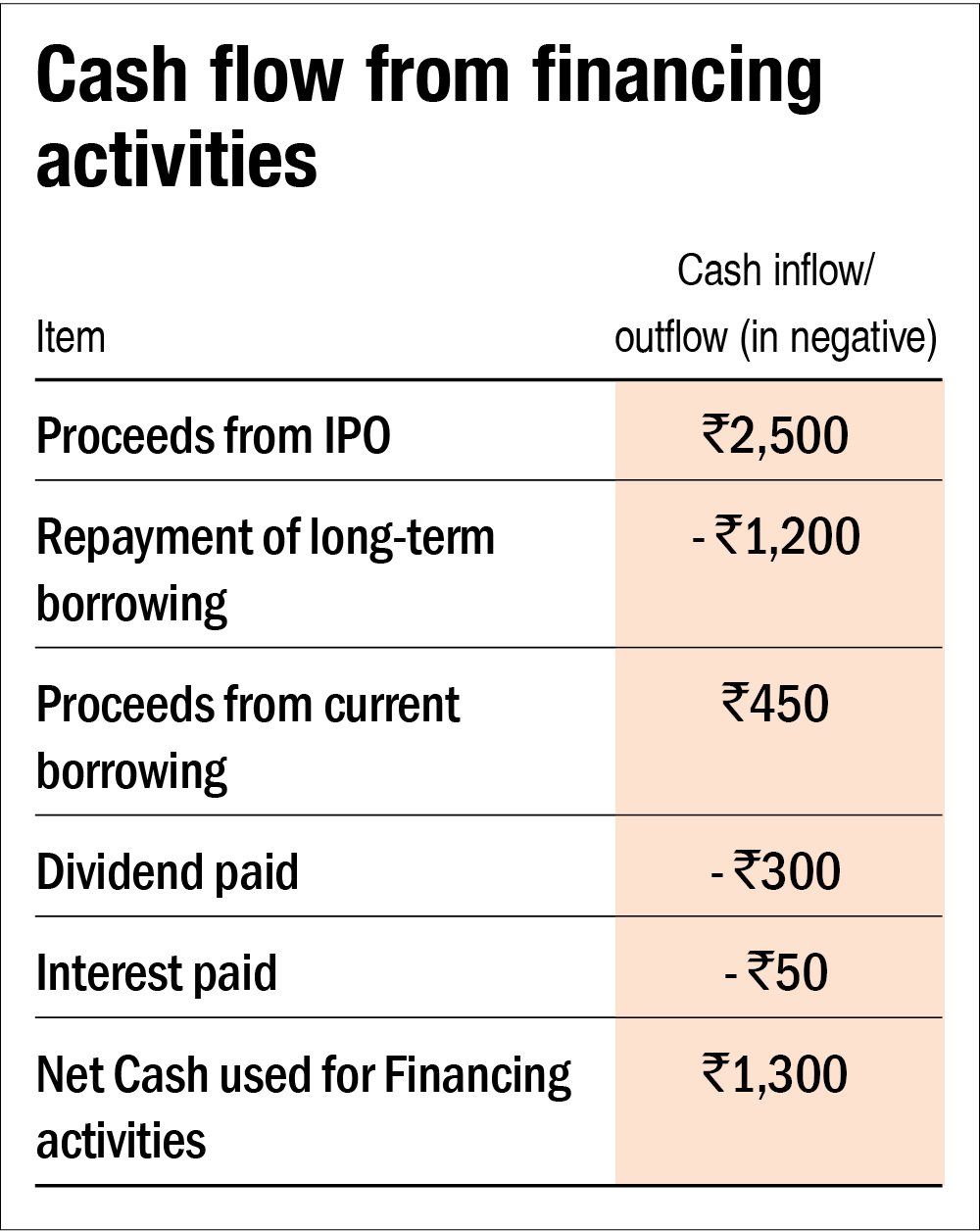

Cash flow represents revenue received — or inflows — and expenses spent, or outflows. A positive financing cash flow indicates that the company has been successful in raising capital, while a negative financing cash flow may suggest that the company is. Cash flow from financing activities refers to the inflow and the outflow of cash from the financing activities of the company like.

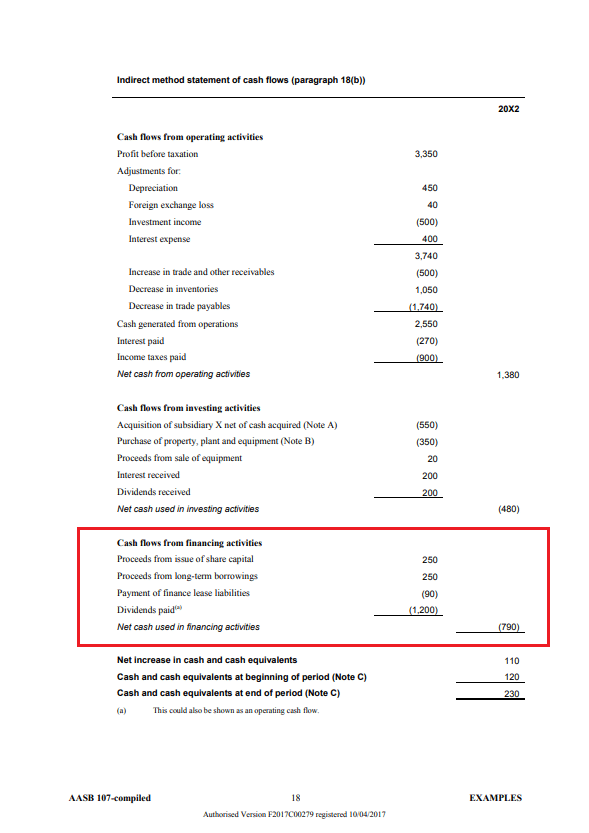

Cash flow from financing activities (cff): Financing activities detail cash flow from both debt and equity financing. Cash flow statement in brief.

In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period. Fcf is the cash from normal business operations after subtracting any money spent on capital expenditures (capex). Cash flow financing is a type of corporate financing in which future cash flows are deposited with the lender as collateral instead of physical assets.

What is cash flow from financing activities? Cash flow from financing (cff) is the cash that a company generates from its financing activities. Cash flow financing is a form of financing in which a loan made to a company is backed by the company's expected cash flows.

The net cash impact of raising capital from equity/debt issuances, net of cash used for share buybacks, and debt. The cash flow from financing activities is an essential subsection of a company's cash flow statement, providing insights into the company's financial. Cash flow from financing activities provides investors.

Based on the cash flow statement, you can see how much cash different types of. Cash flow from financing (cff) cash flow from financing (cff) refers to the cash that is used or generated from financing activities. Financing activities include transactions involving debt, equity, and dividends.

The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating,. This includes issuing new equity, taking out loans, and repaying. What is cash flow from financing activities (cff)?

Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a. Cash flow from financing activities measures how much cash is coming into a company from things like issuing new equity, taking out loans, or repaying existing debt. There are many types of cf, with various important.

Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Cash flow from financing activities is the net amount of funding a company generates in a given time period.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/Term-Definitions_CFF-Final-V2-59b1197815114baf8e44d14286edbf6e.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)