Can’t-Miss Takeaways Of Tips About Debt Repayment Income Statement

However, that change in location has costs (e.g., rent) that must be financed by a commercial loan.

Debt repayment income statement. Three years later, fasb issued. Accounts payable vs. No, only the interest portion of a debt payment impacts the income statement.

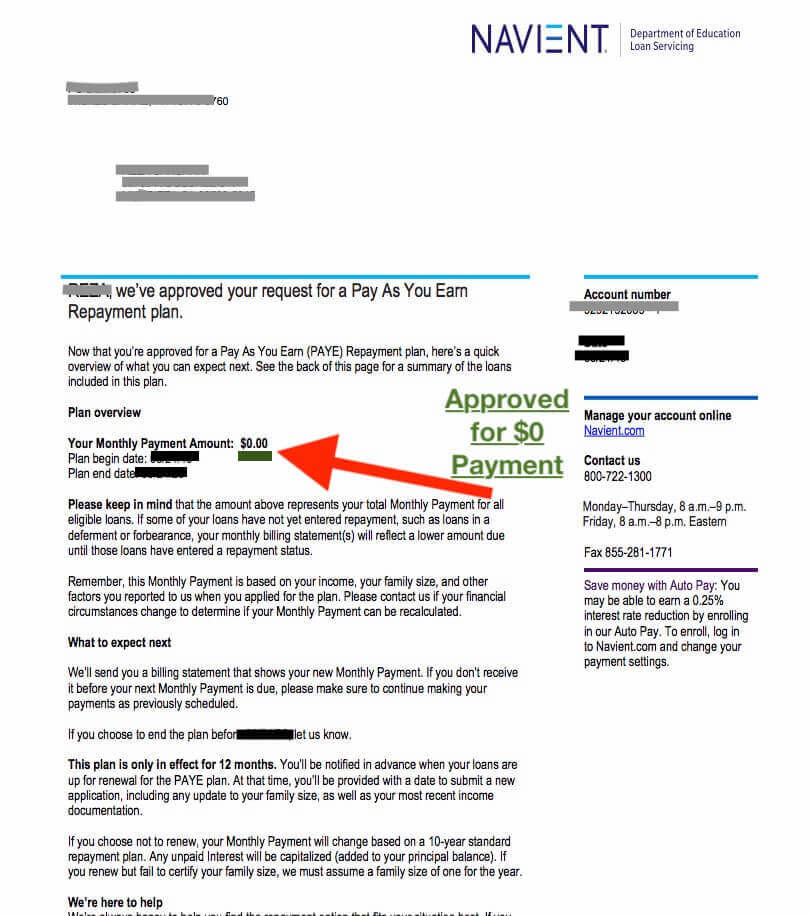

Carrying amount immediately prior to waiver is. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. Company d has a loan from a bank with the following key terms as at their 30 june 2021 reporting date:

It is typically used by businesses to construct a cash flow analysis. As part of the loan agreement, the borrower must repay the full debt principal (i.e. Obtain more debt) or repay as.

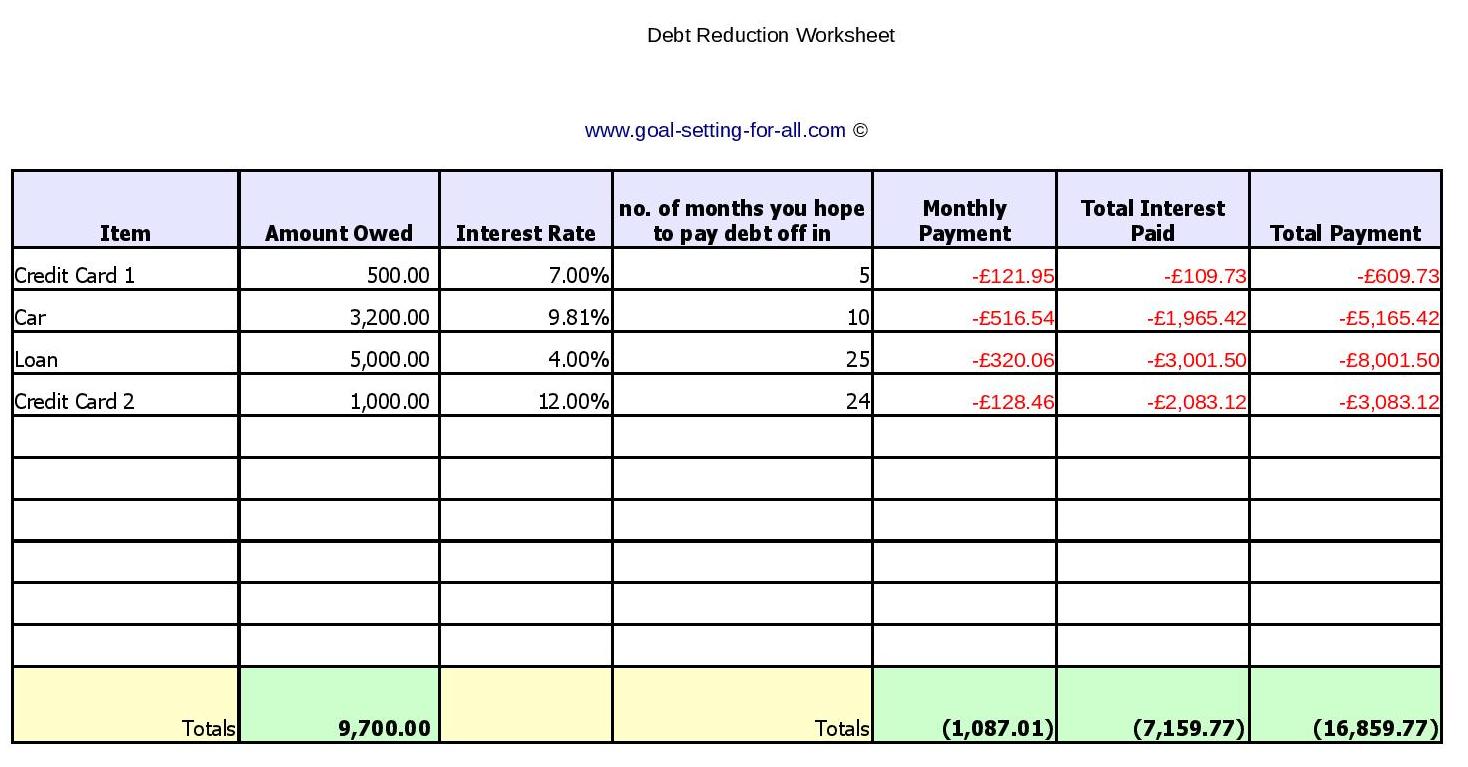

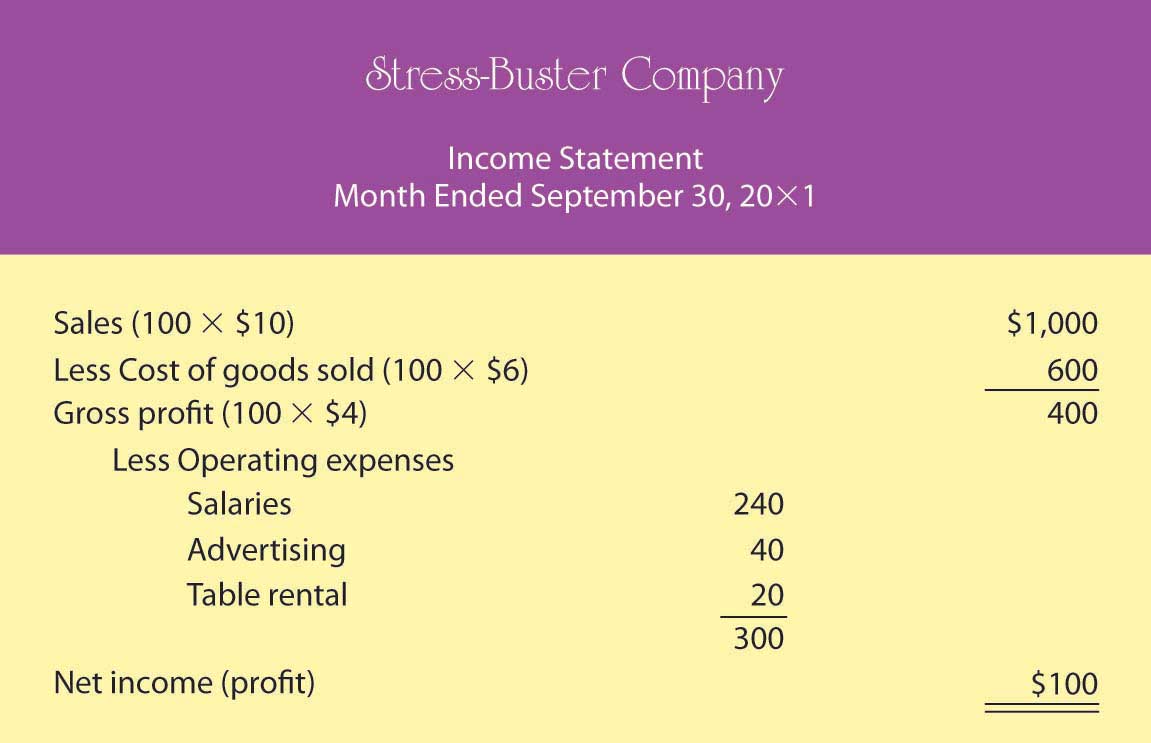

We can also assume that the company is making regular payments of $1,000 per month, $60 which goes towards interest and $940 in principle. Debt repayment is a cash outflow. 3 financial statements treatment mnmpersona gorilla 580 ib subscribe this got me slightly confused to be honest friends.

Financial obligations that have a repayment period of greater than one year are. The debt relief is the latest push from the white house to address the nation's $1.77 trillion in student debt after the supreme court last year invalidated the biden. The new treatment called for all extinguishment gains and losses to be recognized in income and identified as a separate item.

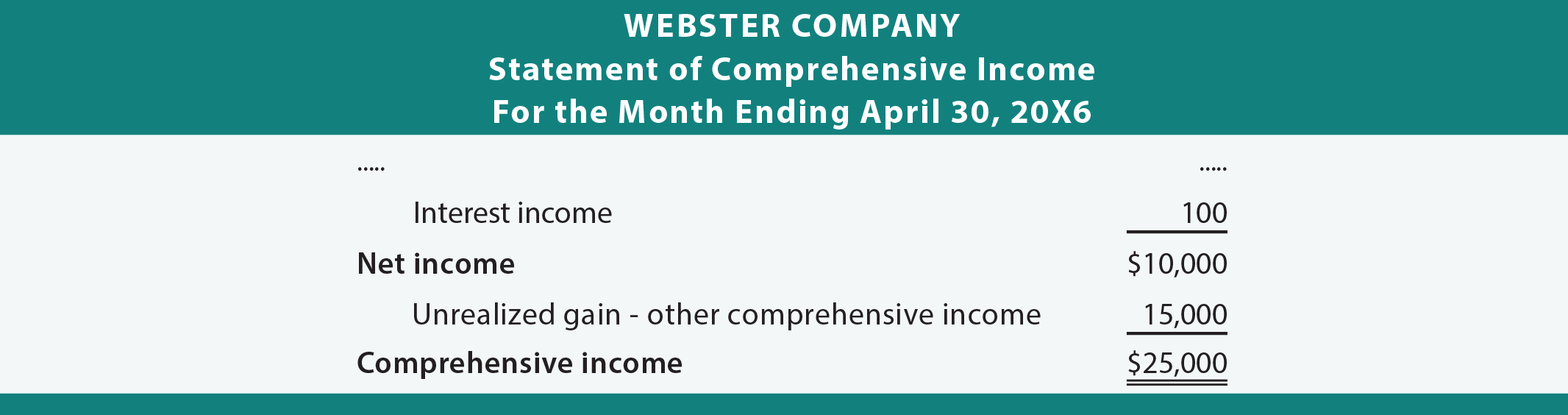

A debt schedule uses a company’s cash flow projections to estimate how much debt principal the company can repay and how its interest expense. Leases (asc 842) loans and impairment (pre asc 326) The interest expenses come in the income statement, which is the starting line item of the cash flow statement.

Settlement lowers your debt. If an individual is taking out a mortgage or. So, in one of the guides it.

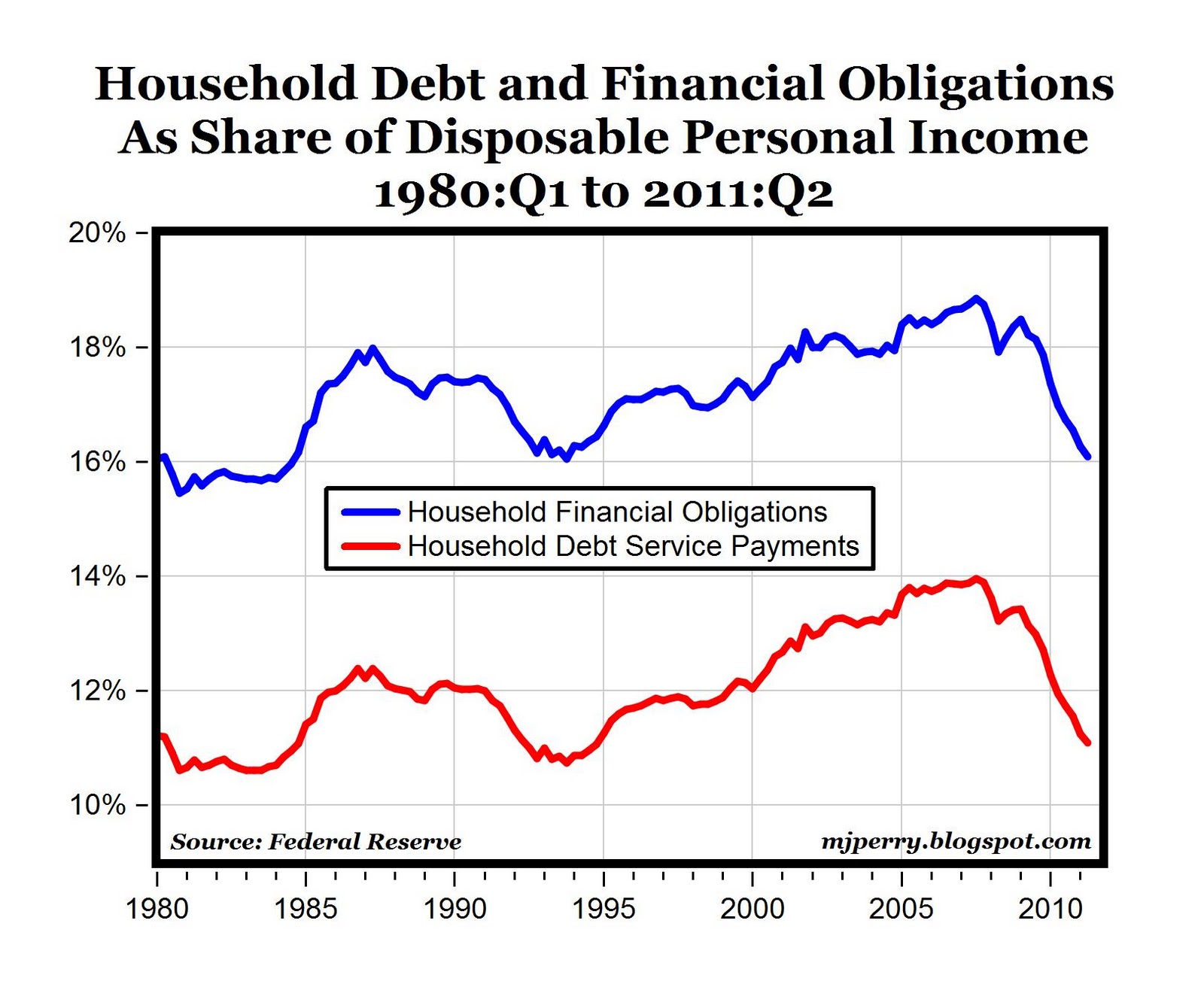

As shown in the graphic below, interest expense in the debt schedule flows into the income statement, the. A firm must ensure that a financial statement sent to a lender on behalf of a customer: I'm trying to get a final monthly net profit figure, one that already.

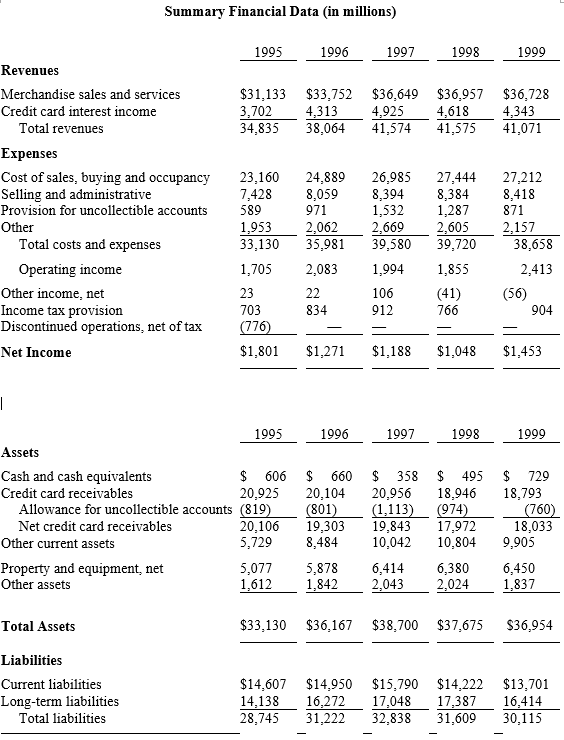

Forecasting the capital structure of a company impacts both the balance sheet and the income statement through different items, including dividends and interest expense. Debit of $60 to interest expense (an income statement account) debit of $940 to loans payable (a balance sheet account) credit of $1,000 to cash (a balance sheet account) notice that only the interest expense of $60 will be included on the income statement. The principal portion of a debt payment only impacts the balance sheet.

For those enrolled in the save plan, monthly payments are calculated based on income and family size instead. Mandatory debt amortization is the contractually required repayment of the original principal by a borrower throughout the lending term. The original amount) on the date of maturity;