Wonderful Tips About Purchase Of Equipment Cash Flow Statement

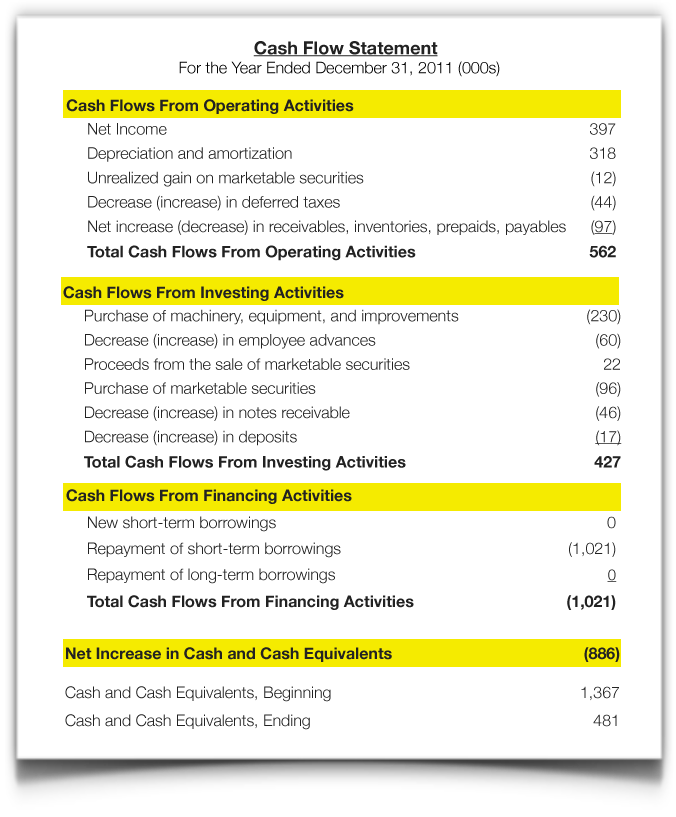

Cash flow from investing activities refers to cash inflow and outflow of cash from investing in assets (including intangibles), purchasing of assets like property, plant and equipment, shares, debt, and from sale proceeds of assets or disposal of shares/debt or redemption of investments like a collection from loans advanced or debt issued.

Purchase of equipment cash flow statement. On may 31 good deal purchases office equipment (a new computer and printer) that will be used exclusively in the business. The purchase of equipment appears as a cash outflow under cash flow from investing activities. Once completed, these activities are then reported on a company’s cash flow statement.

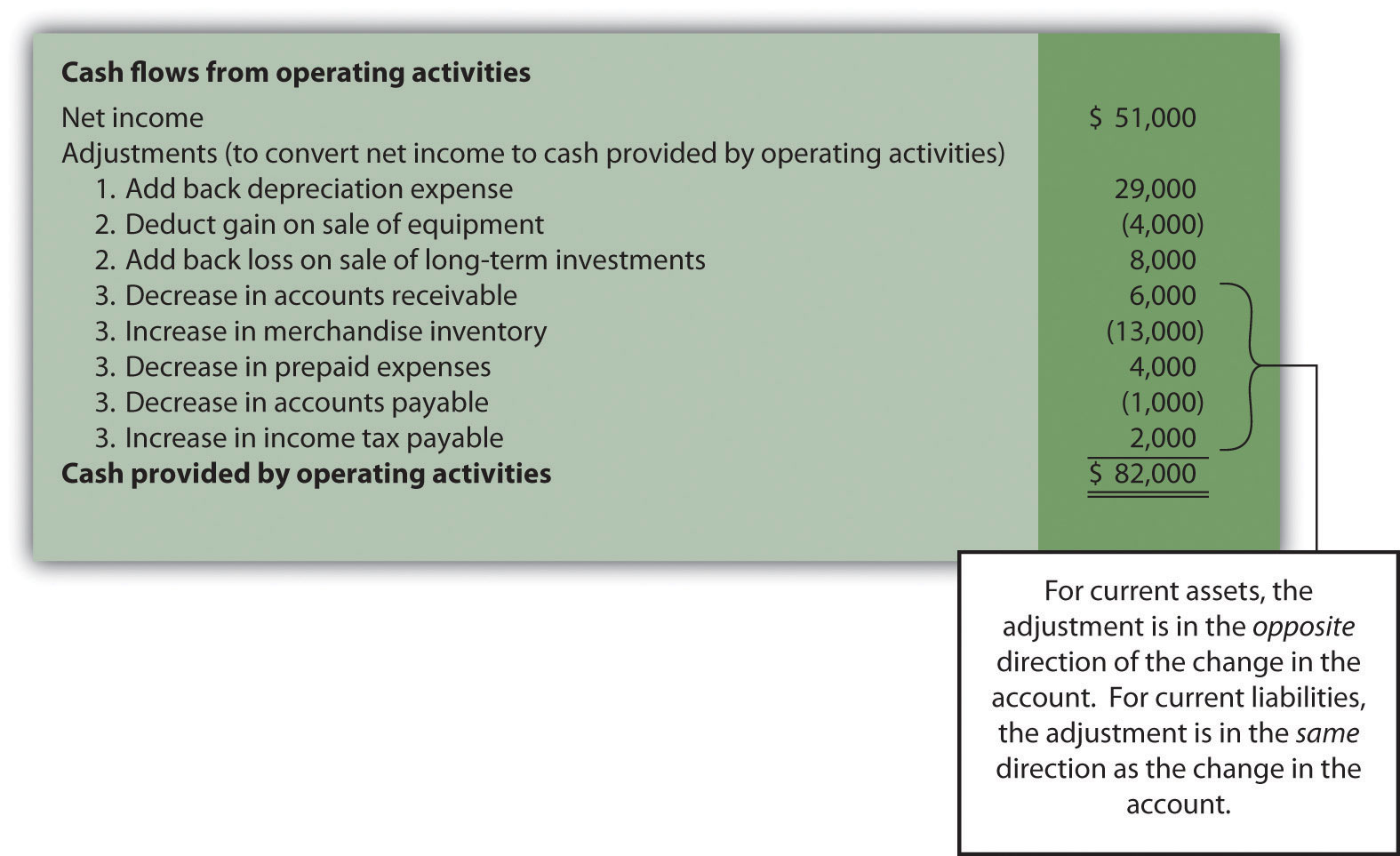

For this purpose cash flows are classified into three key activities: After calculating cash flows from operating activities, you need to calculate cash flows from investing activities.

Purchase of property plant, and equipment (pp&e), also known as capital expenditures proceeds from the sale of pp&e acquisitions of other businesses or companies proceeds from the sale of other businesses (divestitures) purchases of marketable securities (i.e., stocks, bonds, etc.) proceeds from the sale of marketable securities The cash paid for the purchase of equipment during the year is $27,000, and the proceeds from the sale of equipment during the year are $16,750 (= $9,500 cost + $7,250 gain). Cash flow from investing activities is cash earned or spent from investments your company makes, such as purchasing equipment or investing in other companies.

Instead, record an asset purchase entry on your business balance sheet and cash flow statement. The noncash activities may be included on the same page as the statement of cash flows, in a separate footnote, or in other footnotes, as appropriate. A balance sheet comparing may 31 amounts to april 30 amounts and the resulting differences or changes is shown here:

The cfs measures how well a. The first section of the statement of cash flows is described as cash flows from operating activities or shortened to operating activities. There were no other transactions in may.

The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities. Operating activities are also referred to as company operations. On december 20, 20x1, fsp corp purchases and takes title to equipment costing $100, and accordingly debits property, plant, and equipment and credits accounts payable.

Operating activities are the business activities other than the investing and financial activities. Pensions and other employee benefits. This can include the purchase of a building, the sale of equipment, or investing in stocks.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The purpose of this statement is to provide a means to assess the enterprise’s capacity to generate cash and to enable stakeholders to compare cash flows of different entities (cpa canada, 2016). The essentials—cash flow statements.

Investors with information about cash inflows and outflows and the resulting change in cash and cash equivalents. Cash flow from investing activities: Cash flow from financing activities is cash earned or spent in the course of financing your company with loans, lines of credit, or owner’s equity.

Rather, the equipment's cost will be reported in the general ledger account equipment, which is reported on the balance sheet. The purchase of equipment falls under the category of cash flows from investing activities on the cash flow statement. Cash flow types what is cash flow?

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)