Inspirating Info About Increase In Inventory Cash Flow

Since the purchase of additional inventory requires the use of cash, it means there was an additional outflow of cash.

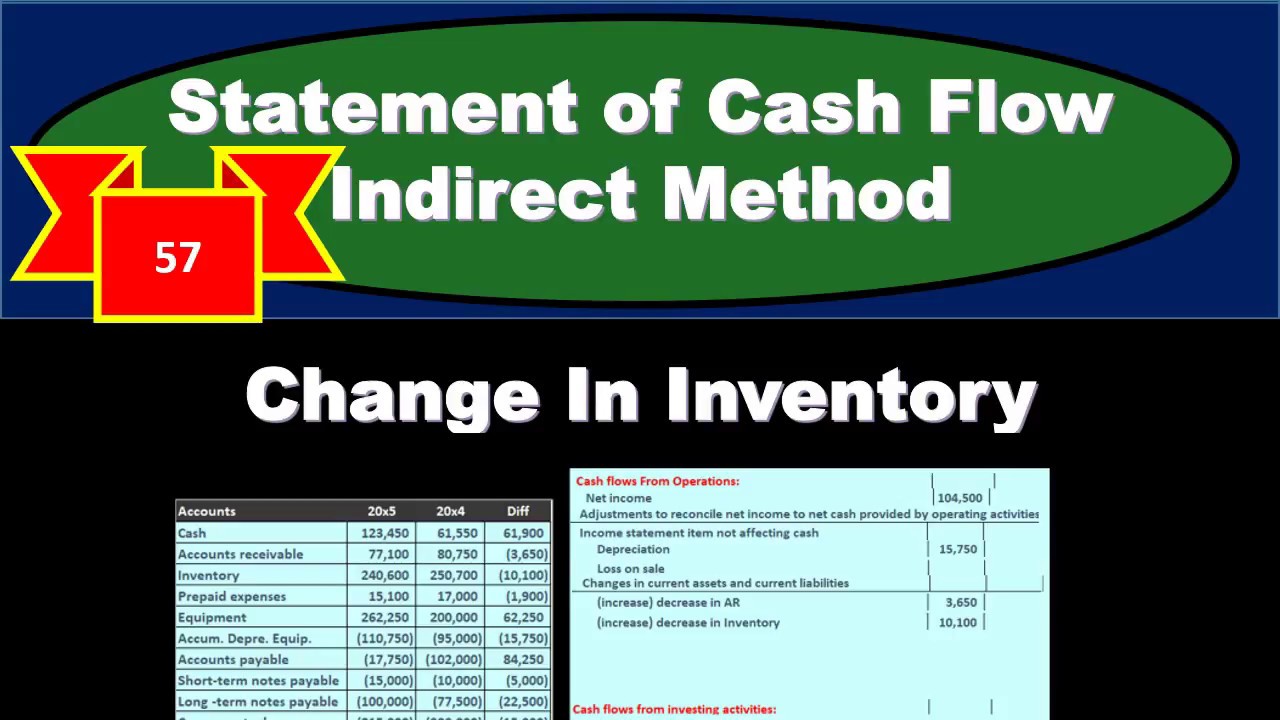

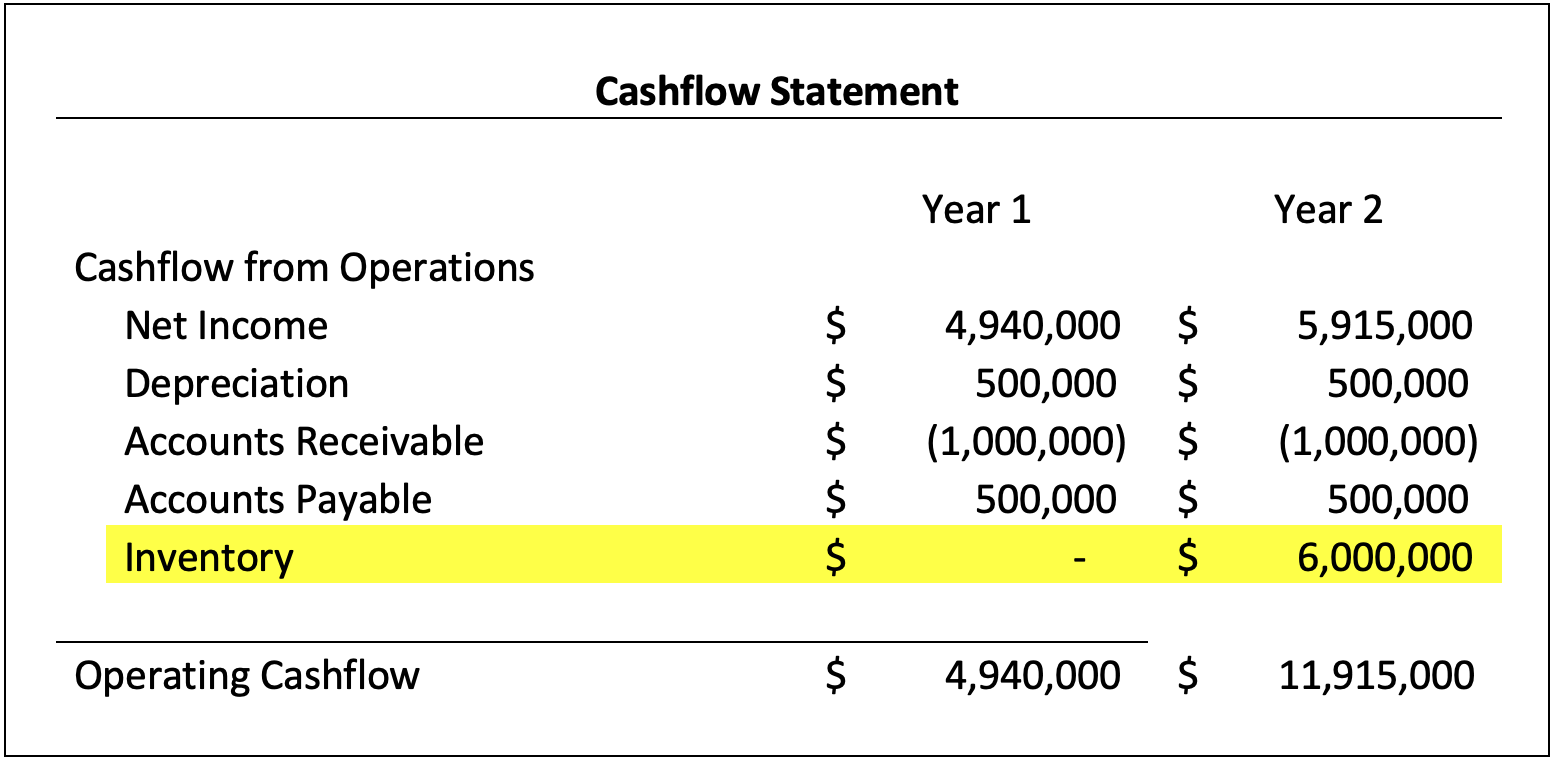

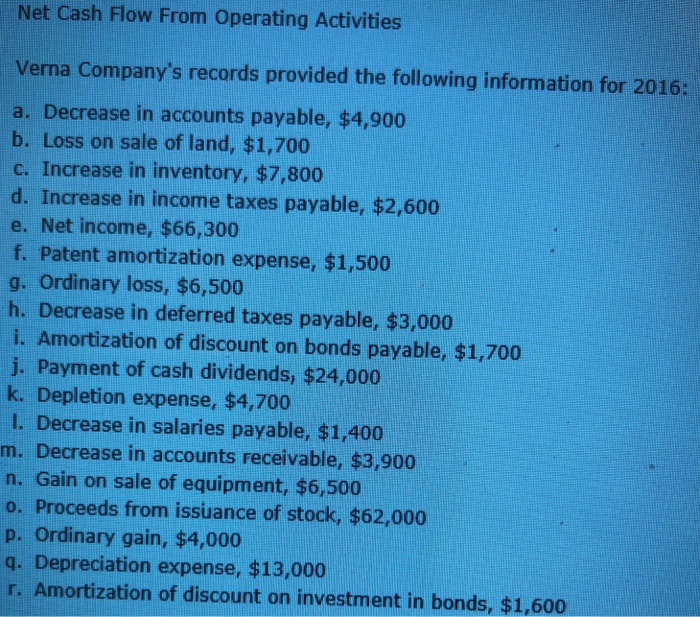

Increase in inventory cash flow. An increase in a company's inventory indicates that the company has purchased more goods than it has sold. Increase in inventory => cash outflow (negative cash outflow) decrease in inventory => cash inflow (positive cash inflow) no movement in inventory => no cash movement; The cash flow statement is annually prepared and is audited along with the income statement and statement of financial position.

Motive of statement of cash flow: Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. There are two key methods of preparing the statement:

This information will give you insight into the optimal inventory to buy to avoid running out or keeping too much in stock, giving you an ideal inventory level. If you maintain safety stock, it is important to actually analyse whether or. It shows the cash inflow and outflow of the company for a specific time period.

Any changes in the inventory balance would be reflected in the operating section of the cash flow statement. To get all the required formula components,. The inventory balance decrease when items are sold, and the company recognizes the sale and costs of good sold.

Invest in an inventory management system. When the company purchases inventory related items, that increases the inventory balance and represents a cash outflow. You can use current demand forecasting and historical data to determine how much you can expect to sell monthly.

An outflow of cash has a negative or unfavorable effect on the company's cash balance. Inventory management systems like unleashed offer solutions that cater for. We come up with the following rule:

Despite that, the most common method used by far in general practice is the indirect method. In this article, we are going to talk about how changes in inventory affect the statement of cash flow. In case inventory is purchased on credit and/or sold on credit, there is no impact on the company’s cash flow.

This formula can help you calculate the total cost of goods sold. A cash flow statement tells you how much cash is entering and leaving your business in a given period. Revisit your levels of safety stock.

Inventory optimization will help you maximize your company’s cash flow. Fasb (financial accounting standards board) favors the direct method. Inventory increase => cash outflow (negative) inventory decrease => cash inflow (positive) what if we purchase inventory on credit, so there is no cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)