Best Of The Best Info About Depreciation In Profit And Loss Statement

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

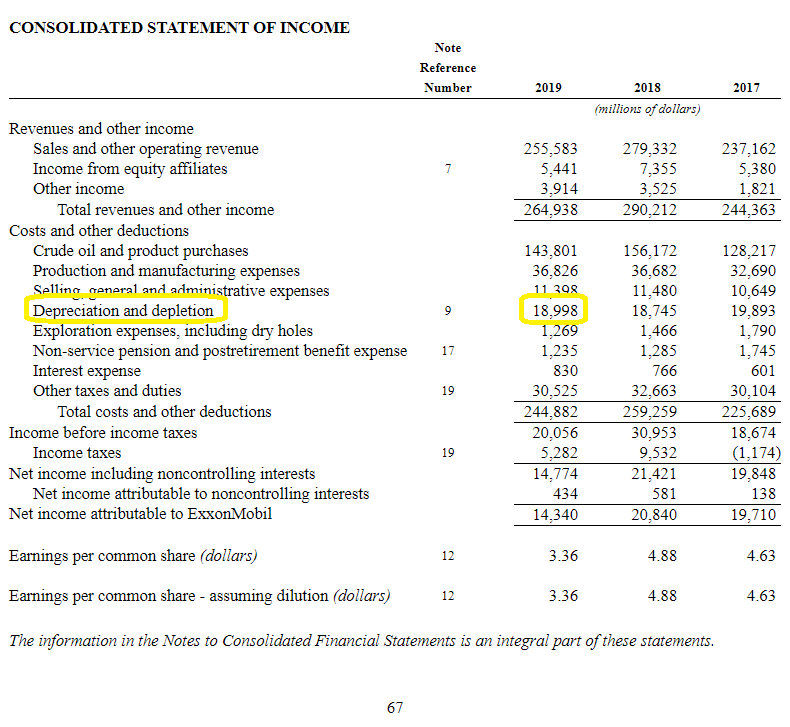

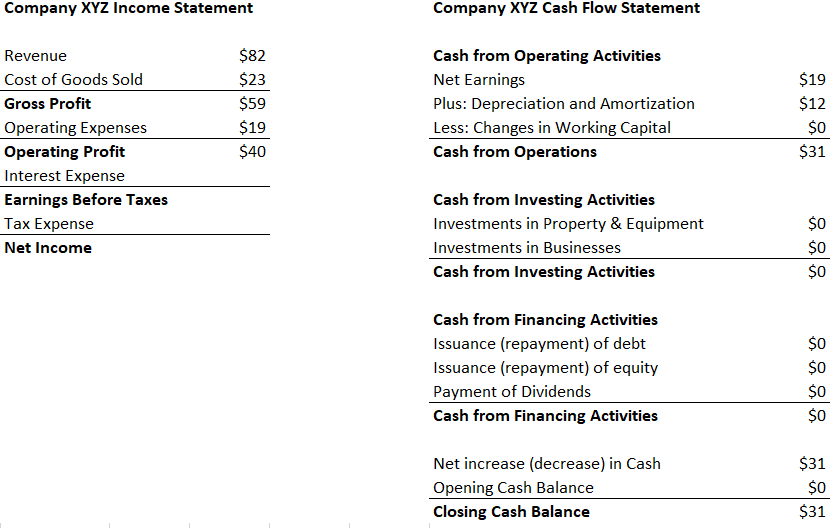

Depreciation expense is an income statement item.

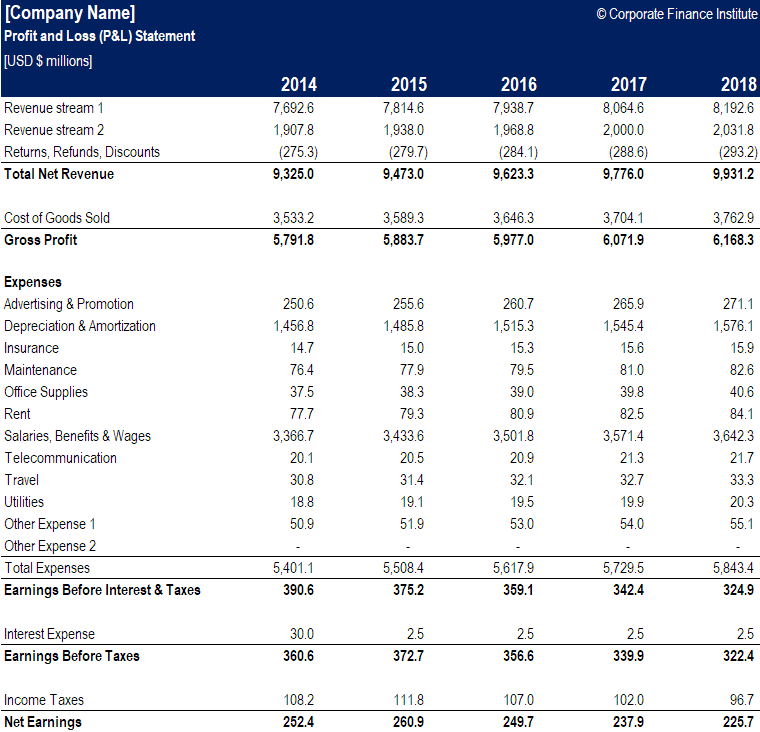

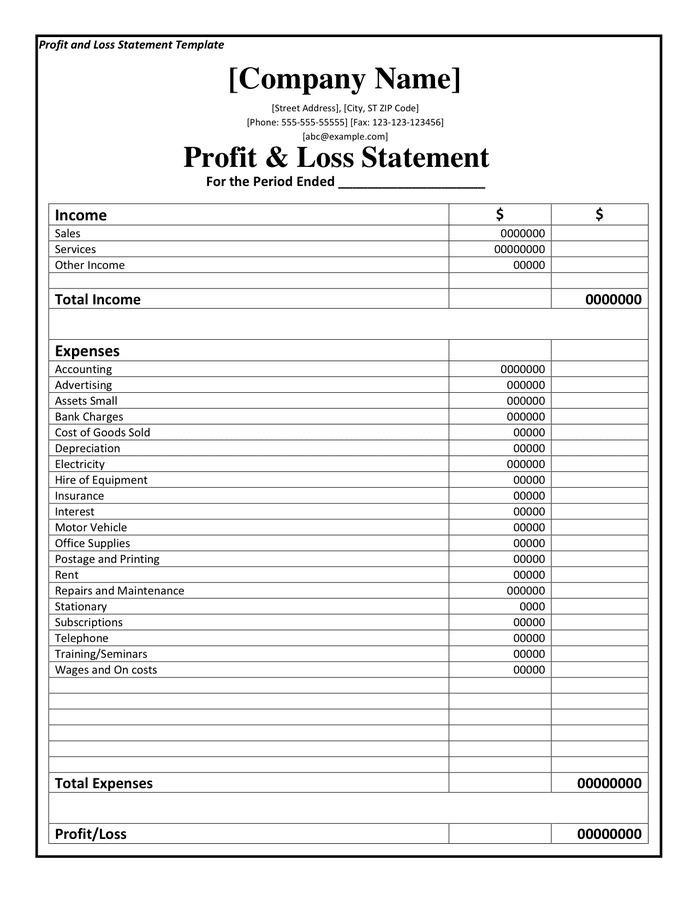

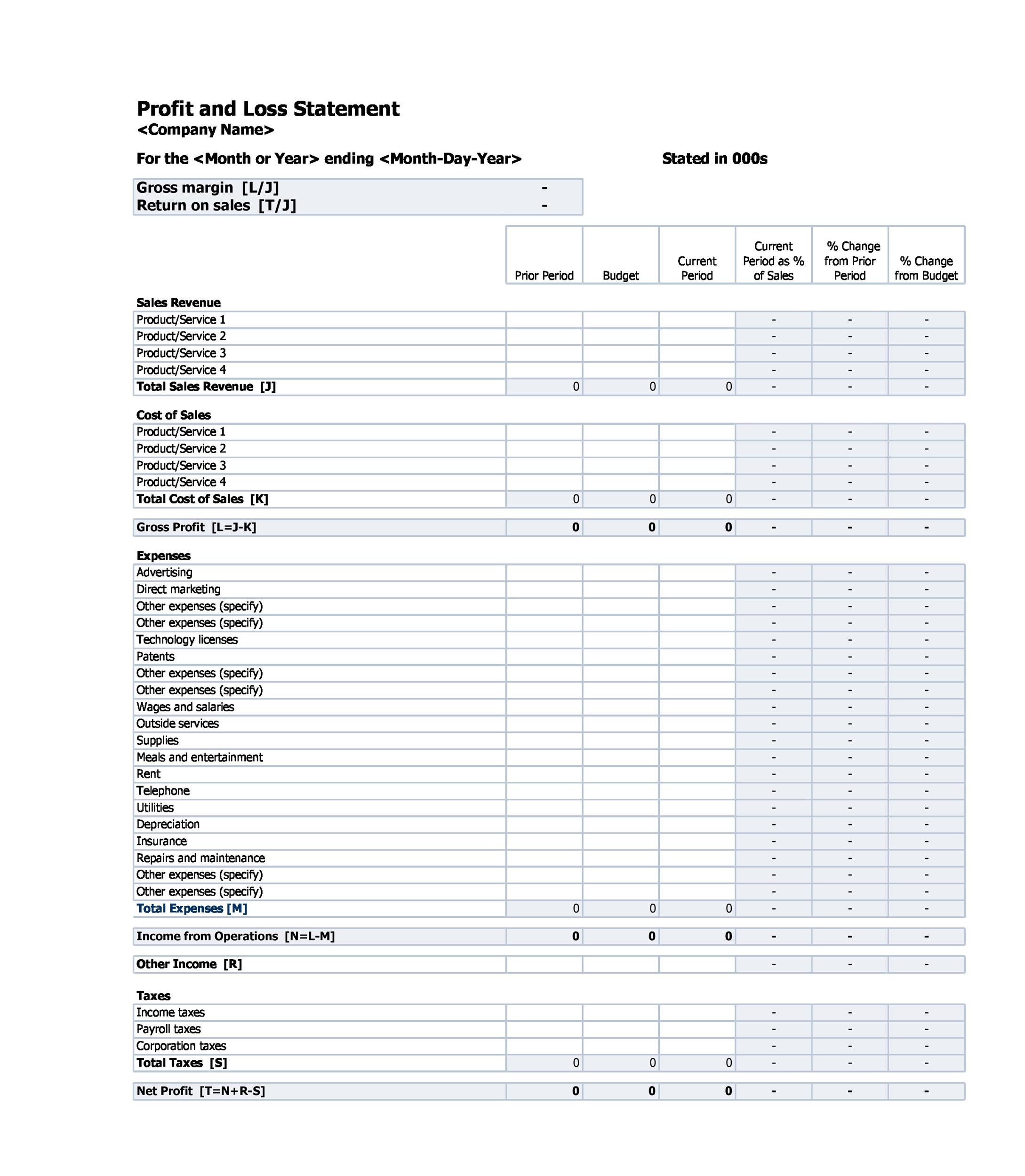

Depreciation in profit and loss statement. Depreciation may be defined as the decrease in the asset’s value due to wear and tear over time. Physical assets, such as machines, equipment, or vehicles, degrade. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

The result is either your final profit (if. Explain its effect on profit and loss account as well as balance sheet. Depreciation is an accounting concept that applies to a business’ fixed assets, such as buildings, furniture and equipment.

It spreads the cost of acquisition over the useful life of the asset. It shows your revenue, minus expenses and losses. The hand that writes the invoice rules the world.

Trading, profit and loss account are mainly prepared by traders. It is accounted for when companies record the loss in value of their fixed assets through depreciation. Depreciation and other amounts written off assets:

A p&l statement shows investors and other interested parties the amount of a company's profit or loss. Elucidate the factors that affect depreciation. The final figure will show the financial performance and show if the business has made a profit or loss.

Depreciable assets mainly fixed assets. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

Basic income statements contain the following elements: What is a profit and loss statement? Depreciation, and irrecoverable debts and allowances for receivables.

Examples are plant and machinery, motor van, furniture and fittings, land and building, etc. So, investors should be wary of overstated life. Then, it subtracts the costs of making those goods or providing those services, like.

It shows all the company’s income and expenses incurred over a given period. Depreciation is an amount that reflects the loss in value of a company's fixed asset. Murphy updated july 23, 2021 reviewed by margaret james fact checked by suzanne kvilhaug.

Download chapter pdf 23.1 introduction in this chapter we consider the effect of taxation, in so far as it influences. Corporate finance accounting are depreciation and amortization included in gross profit? In this article, we will define depreciation and explain depreciation in regards to your income statement.