Unbelievable Tips About Accounting For Interest Expense

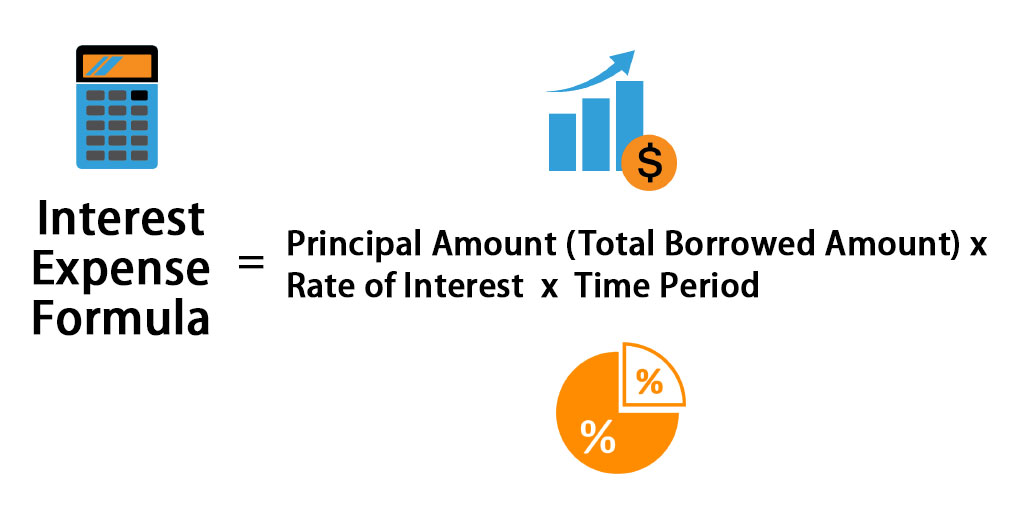

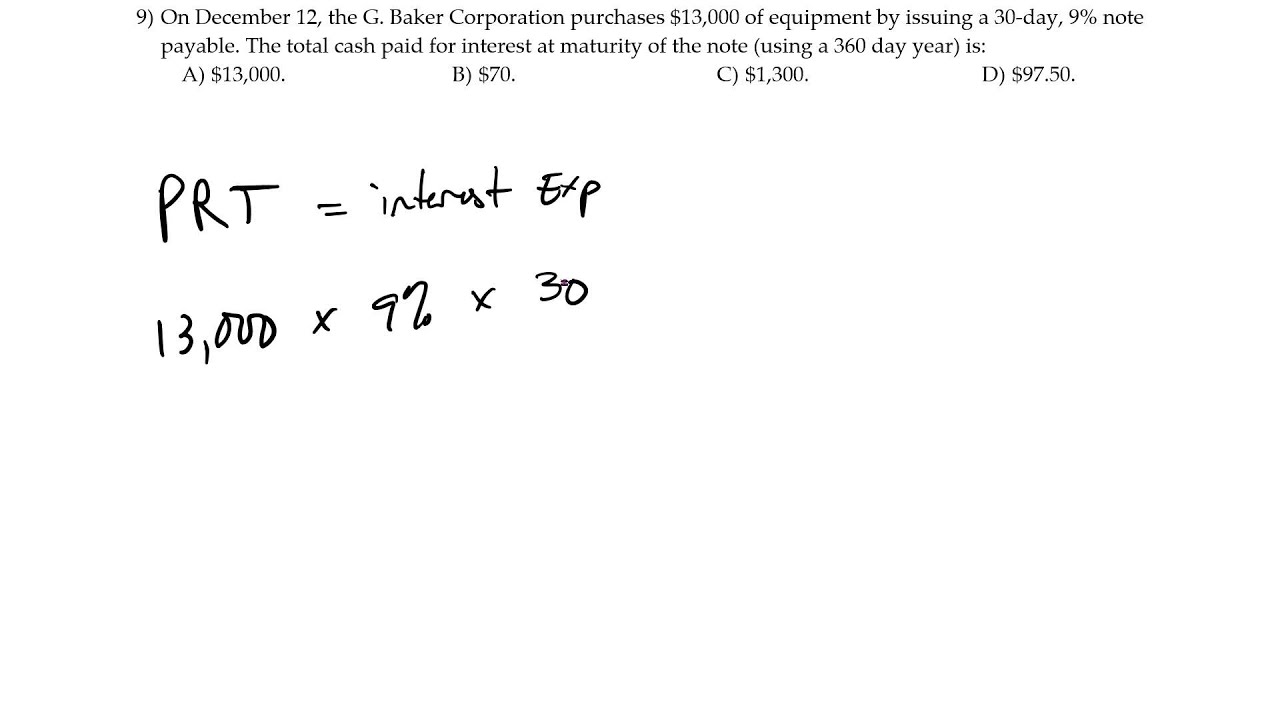

Use the interest formula to arrive at the interest expense.

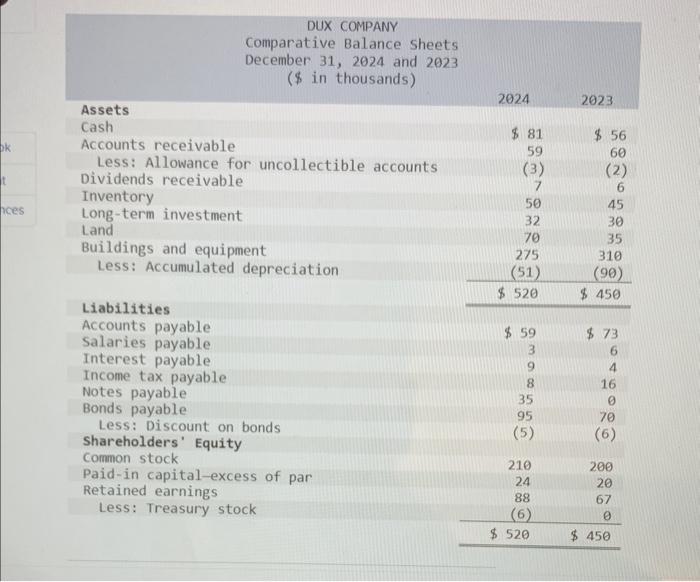

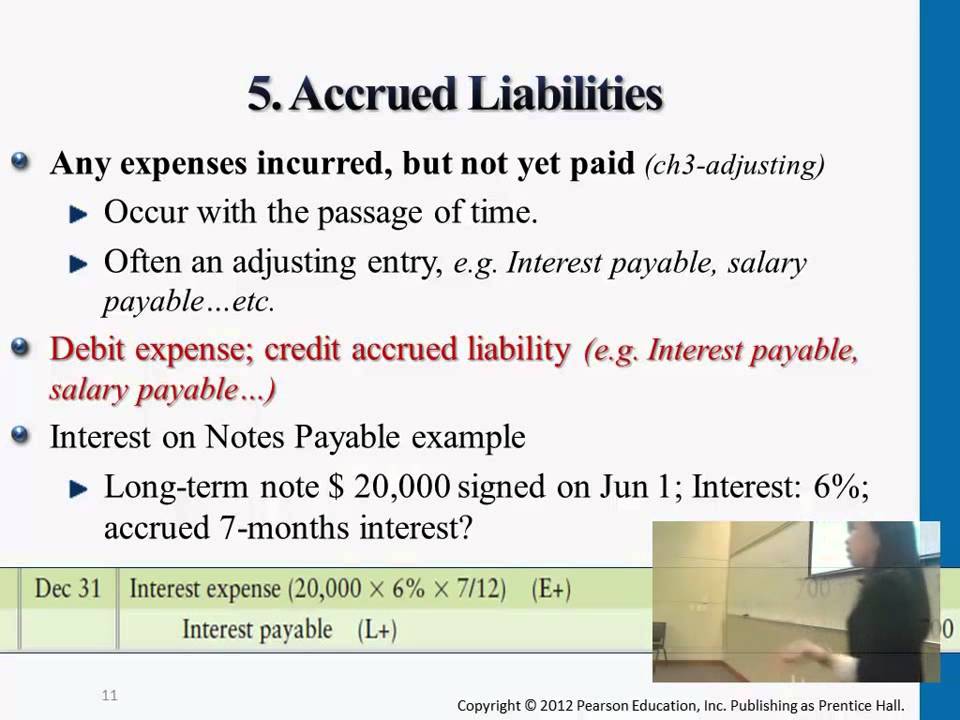

Accounting for interest expense. This tool helps you automate your accounting process, and if you run. The potential influence on a. This journal entry of the $2,500 accrued interest is necessary at the end of our accounting period of 2021.

Interest expense formula, and how it’s calculated (calculation guide) by volha belakurska 9 minute read as a. Payments are due on january 1 of each year; If this journal entry is.

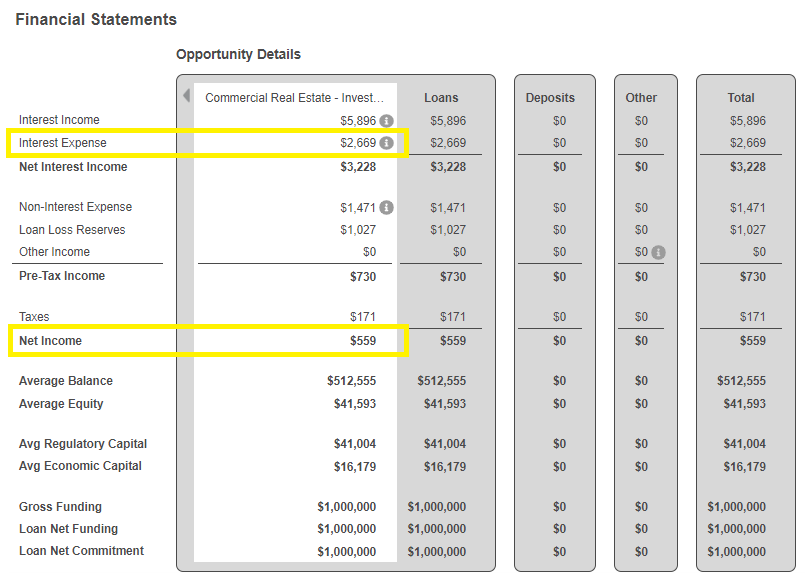

Interest expense is the cost of using monitory facilities or. Interest expense is the amount of interest incurred by a company during a certain period of time. Cash flow hedges allow companies to manage their risks by locking in or eliminating the variability of the interest rate in their debt, changing variable interest.

Example of how to calculate. Determine the time period over which the interest expense is being calculated. Interest expense is occurring daily, but the interest is likely to.

November 23, 2023 how to calculate interest expense: Interest expense is a type of expense that accumulates with the passage of time. The accounting treatment of interest income is prescribed in as 9 revenue recognition and that of interest expense depends on the nature of interest.

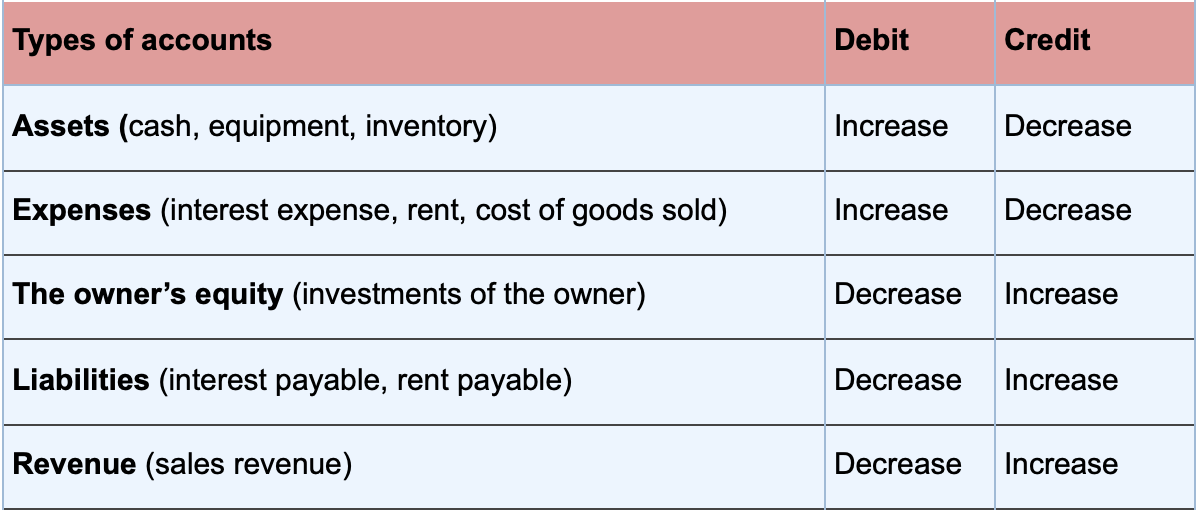

Accrued interest is listed as an expense on the borrower's income statement. Interest expense is charged against the company’s earnings and reduces its. When accounting standards codification topic 606 (asc 606), revenue from contracts with customers, took effect in 2019 for private companies, many government.

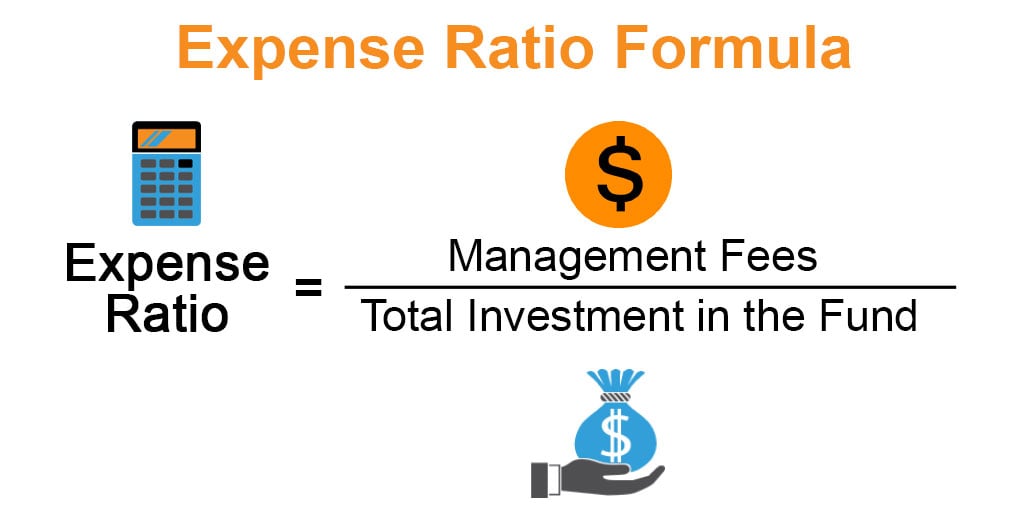

Principal x interest rate x time period = interest expense. Interest costs frequently receive a favorable tax treatment. The interest expenditure is calculated by multiplying the payable bond account by the interest rate.

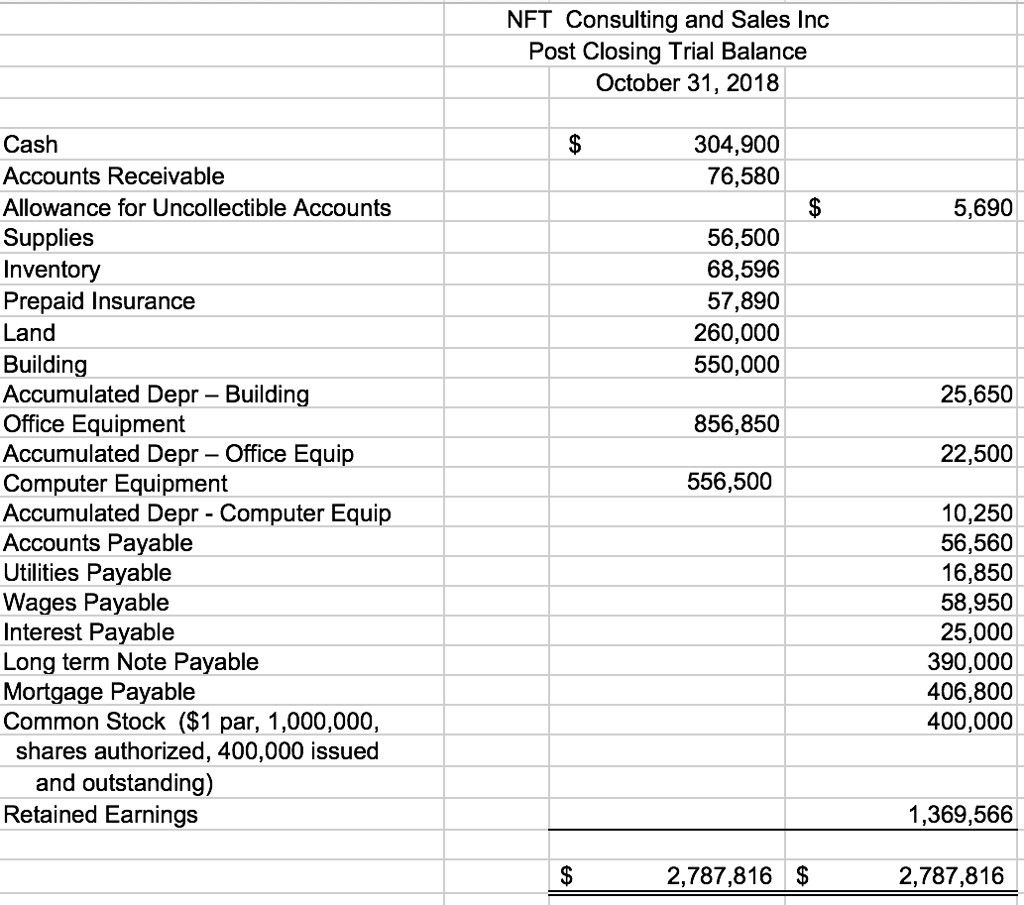

Interest payable is a liability account, shown on a company’s balance sheet, which represents the amount of interest expense that has accrued to date but has not been. An accounting item called an interest expense is incurred as a result of repaying debt. The formula for accrued interest expense is similar to the regular interest expense formula:

Accrued interest expense on december 31, 2021: Definition of interest expense. Interest expense is the cost of borrowing money during a specified period of time.

Firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the beginning balance. Likewise, the company needs to account for interest expense by making journal. In order to understand the accounting for interest payable, we first need to understand what interest expense is.