Have A Info About Cash Flow Statement In Business Plan

68% of business owners review business expenses.

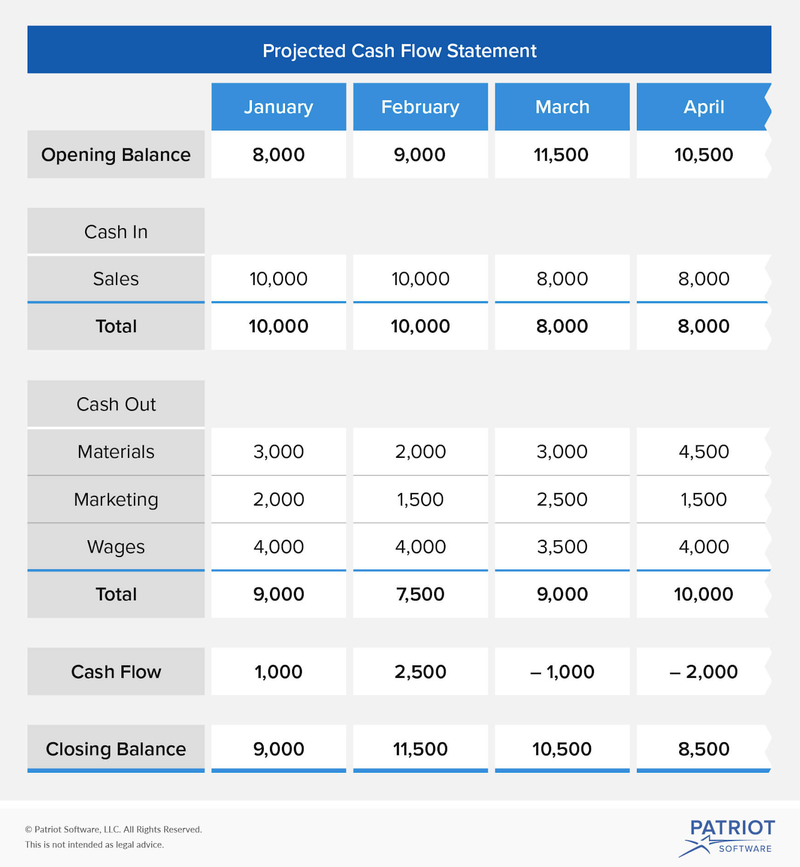

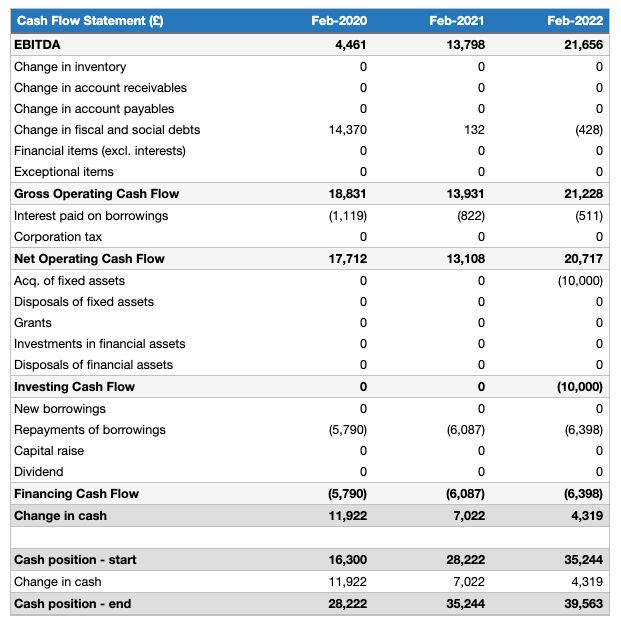

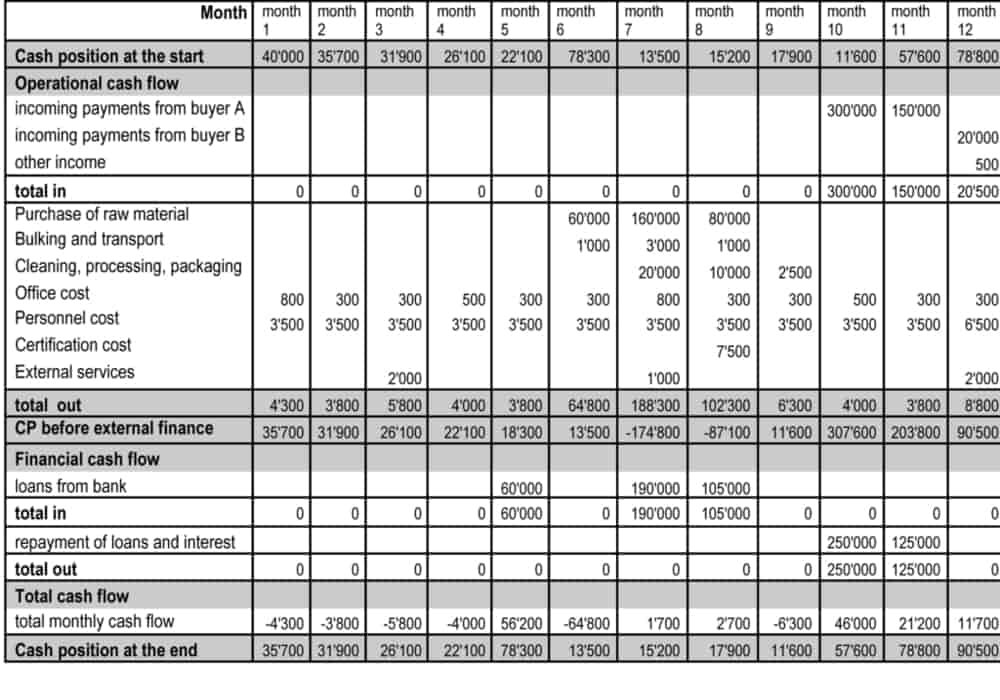

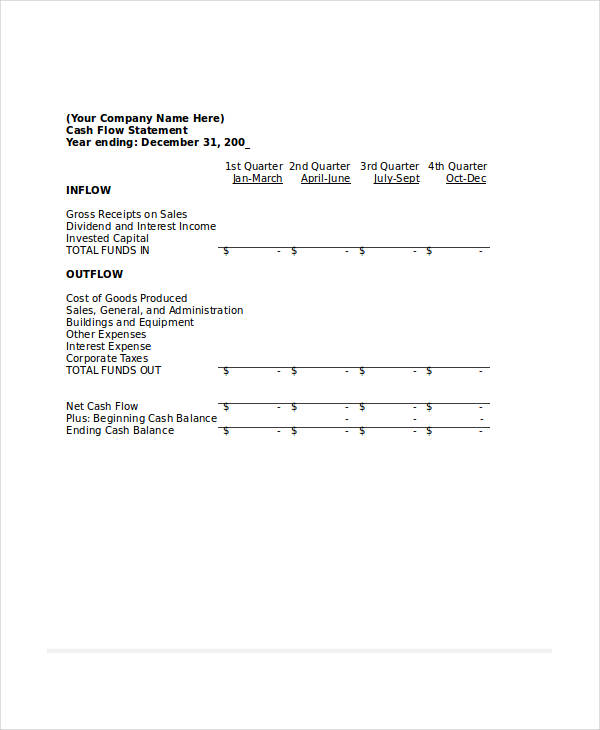

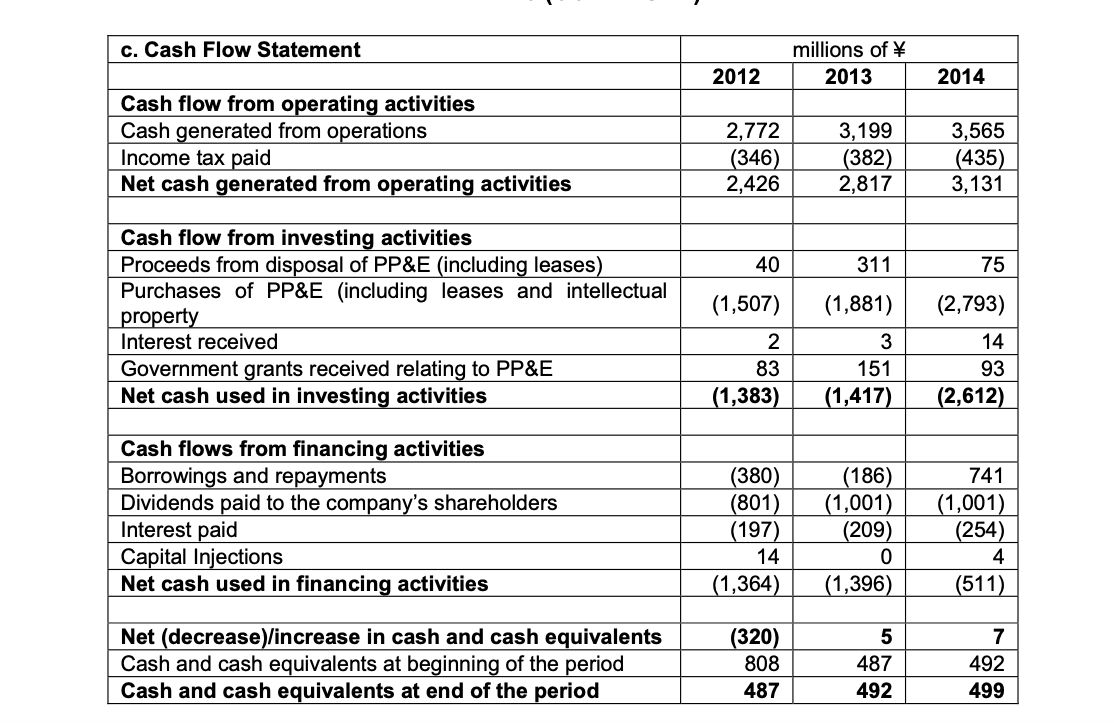

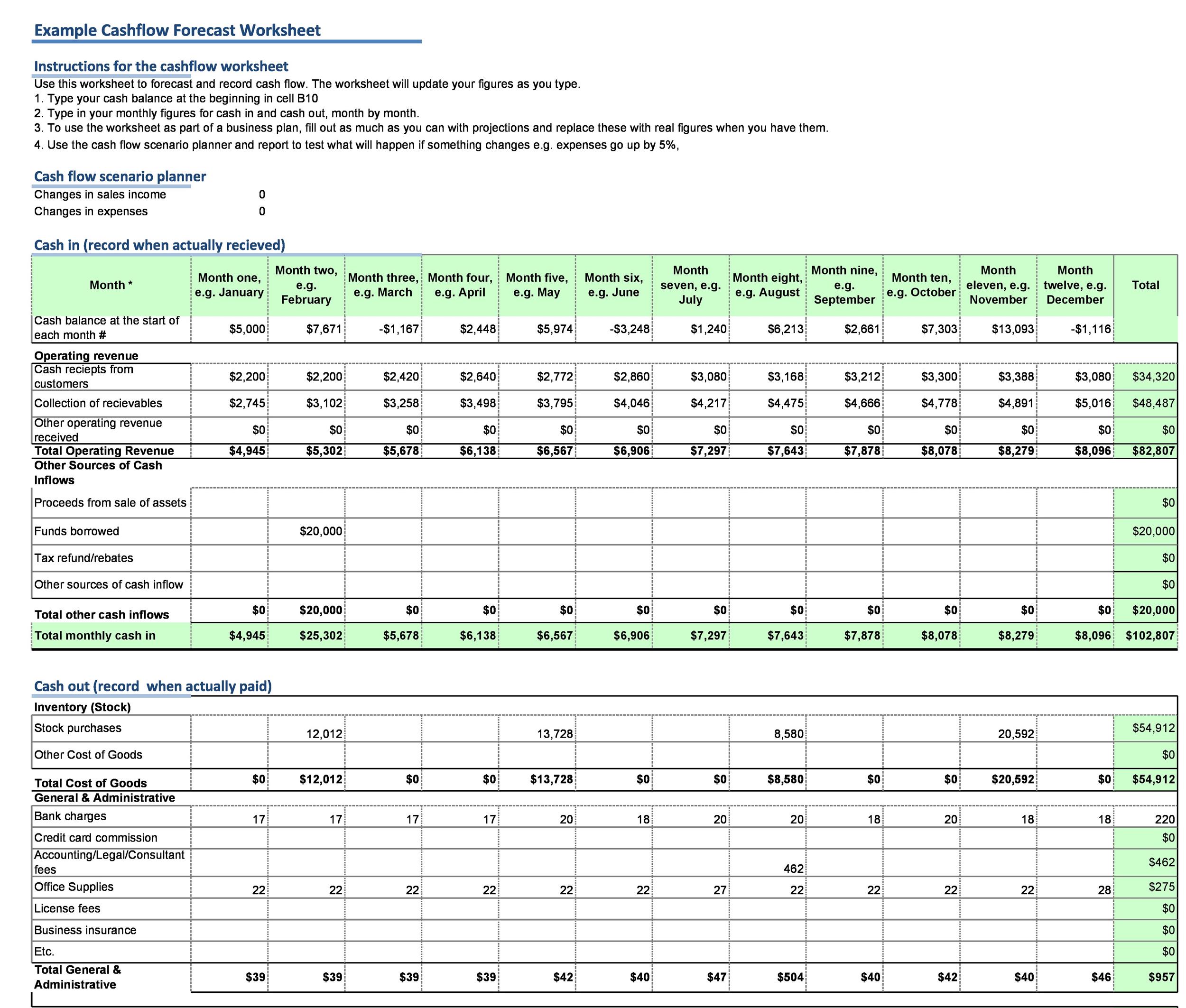

Cash flow statement in business plan. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. The cash flow statement details all cash movements over a given financial year, distinguishing between cash flows from operating, investing and financing processes. There are several ways to do a cash flow plan.

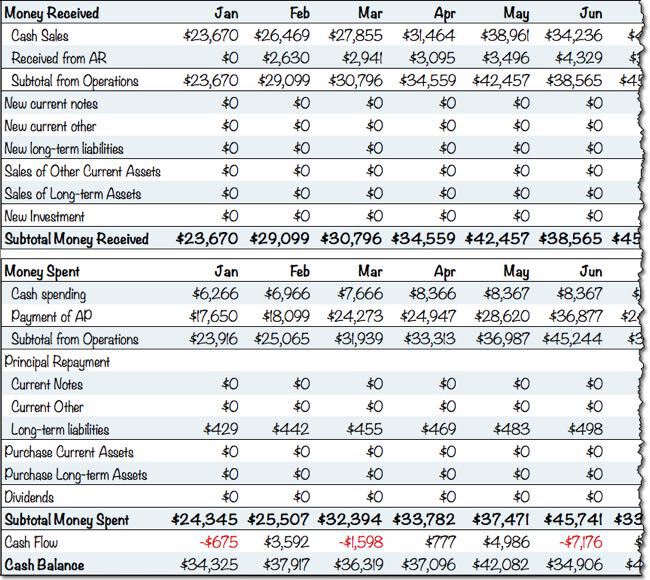

Typically, you create a cash flow document every month, quarter, or year. Find payment cycles and seasonal trends; The cash flow completes the system.

It’s a snapshot of the amount of cash entering and leaving your business, enabling you to evaluate its financial health. This figure reflects the growing popularity of coffee culture and the increasing demand for. Finally, the ending cash is calculated for the month.

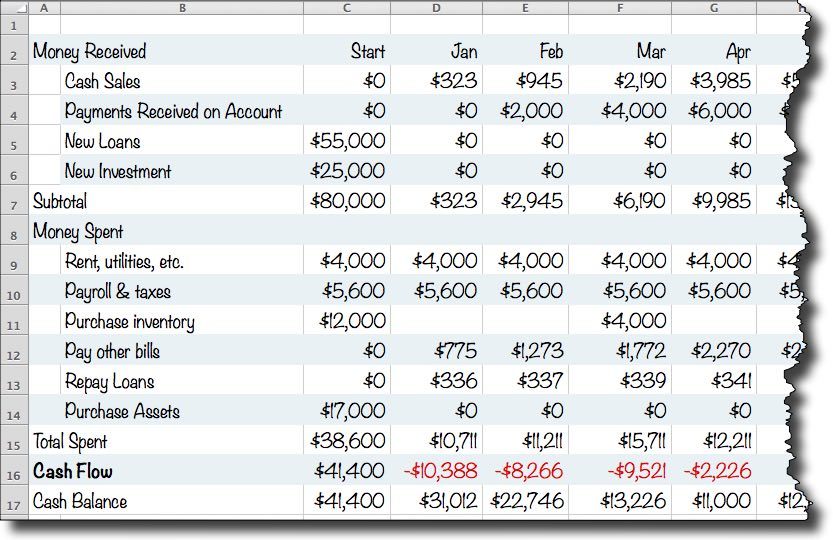

It helps management prioritize essential activities. Many small business owners focus on revenue and profit but lack a clear understanding of the importance of cash flow to the. A cash flow statement shows if you're earning more money than you're spending.

Let’s look at what each section is showing. The statement of cash flow starts by looking at the beginning cash and then makes adjustments for things that happen during the period, which impact cash. This financial plan projections template comes as a set of pro forma templates designed to help startups.

A cash flow statement is one of the three main types of financial statements, alongside a balance sheet and an income statement. It’s essential because it mirrors your financial health and is the lifeblood that sustains your operations. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out.

Financing may 19, 2023 as a business owner or manager, it’s essential to understand the concept of cash flow. Forecast your future business finances; The best ways to manage cash flow 7.

Make sure to cover here _ profit and loss _ cash flow statement _ balance sheet _ use of funds What is a cash flow statement? The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

65% of business owners review revenue. If you bring in $1 million and send out $900,000, your net change in cash is $100,000. 82% of all businesses fail due to poor cash flow management or poor understanding of cash flow itself.

The consulting firm industry in the united states, currently valued at over $250 billion, exhibits a robust demand across various sectors, including healthcare, technology, and finance. Plan ahead to make sure you always have money to cover payments. Just subtract the amount of cash you plan on spending in a month from the amount of cash you plan on receiving.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)